Key Takeaways

- Tax-writers group-up to discuss TCJA extensions

- How much TCJA expiration will cost you

- Yellen sells clean energy credits

- New guy at the IRS

- ERC disclosure help

- Court updates

- Pillar One, Not Happy

- Paying one’s “fair share”

- Pi or Pie, loving it!

House Tax Writers Discuss Forming Working Groups Ahead of 2025 - Chris Cioffi and Samantha Handler, Bloomberg ($):

House Ways and Means Committee Republicans discussed formation of tax policy working groups Wednesday, kicking off the process for what Committee Chair Jason Smith (R-Mo.) has described as the “Super Bowl” of tax.

With many individual provisions in the 2017 GOP-led tax law expiring at the end of 2025, lawmakers on the tax-writing committee will form the groups to study key areas of the tax code. A meeting Wednesday was not to specify the exact groups that would be formed, but instead to get member input on what issues the committee members seek to focus on, several Republican Ways and Means members said after the meeting.

The committee is also expected to host hearings around the country that would involve business owners testifying about how the 2017 tax reform bill helped or hurt their bottom lines, according to committee staffers.

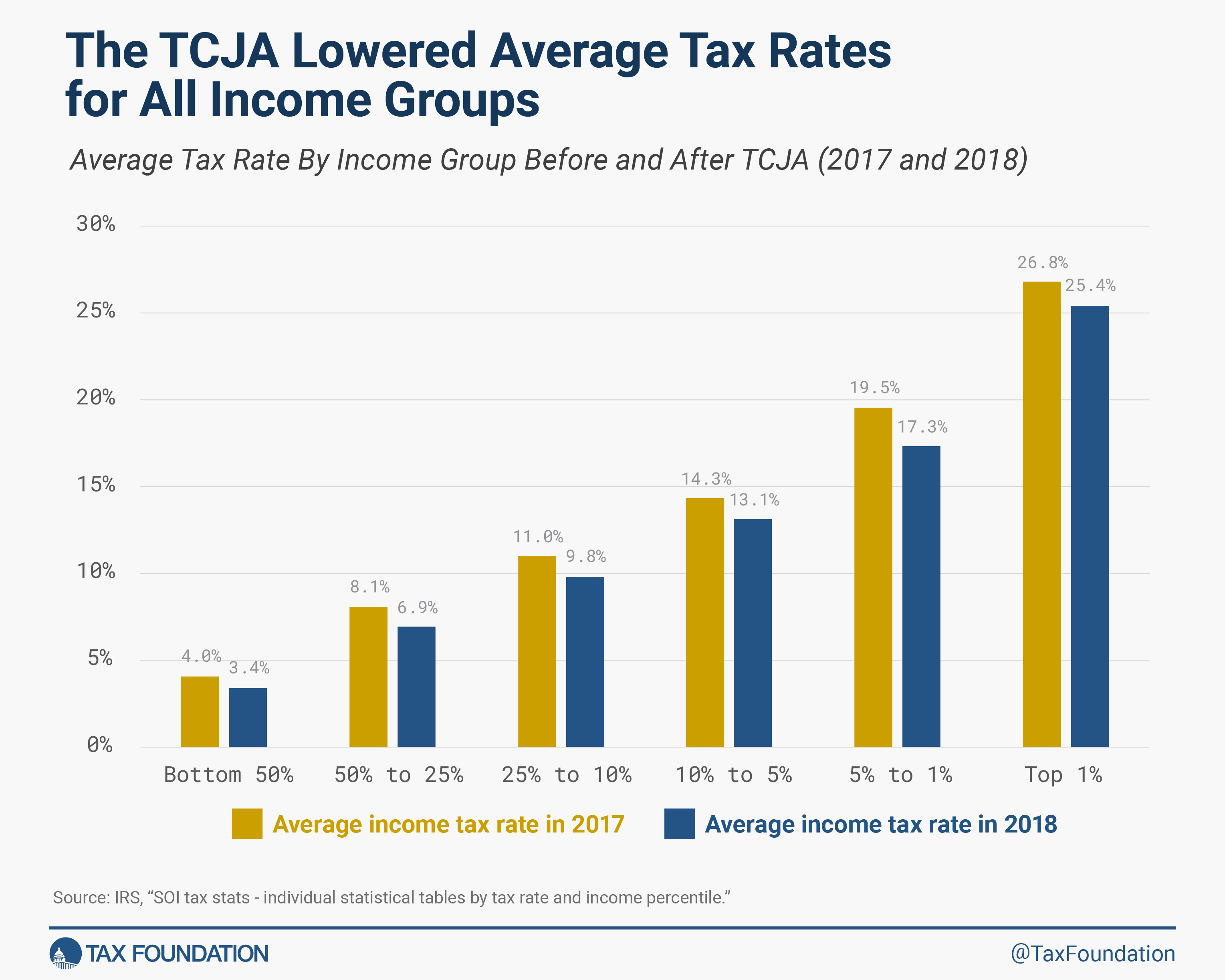

Tax Calculator: How the TCJA’s Expiration Will Affect You – Garrett Wilson and Erica York, Tax Foundation:

Congress has less than two years to prevent tax hikes on the vast majority of Americans from taking place. That’s because the Tax Cuts and Jobs Act (TCJA) of 2017, a tax reform law that simplified individual income taxes and reduced tax rates across the income spectrum, is set to expire. If Congress does nothing, most Americans will face higher taxes, worse incentives for work and investment, and a more complicated tax system starting in 2026.

Yellen to Expand Outreach to Cities on Clean Energy Subsidies – Alexander Riffaat, Tax Notes ($):

Treasury Secretary Janet Yellen has announced the department will ramp up its consultations with local governments regarding the use of energy tax credits enacted as part of the Inflation Reduction Act.

Speaking at an electric vehicle battery factory in Elizabethtown, Kentucky, March 13, Yellen said Treasury will focus outreach efforts on 150 cities with a population of at least 20,000 and a poverty rate of 20 percent or higher and that have experienced a decline in their population.

IRS Morsels

IRS names Guy Ficco new Criminal Investigation chief – IRS:

The Internal Revenue Service announced today that Guy Ficco will become the new IRS Criminal Investigation chief effective on April 1.

Ficco, the current Deputy Chief and a 29-year agency veteran, will succeed James Lee, who announced last month that he will retire at the end of March. In his new role, Ficco will oversee a worldwide staff of more than 3,200 Criminal Investigation (CI) employees, including 2,200 special agents who investigate crimes involving tax, money laundering, public corruption, human trafficking, drug trafficking, cybercrime and terrorism-financing.

IRS Ends ‘Blanket’ Letter Rulings for Post-Spin Payments – Chandra Wallace, Tax Notes ($):

The IRS will no longer issue broad letter rulings assuring taxpayers that “any payment” made after a tax-free spinoff transaction will receive nonrecognition treatment as part of the spin.

This type of ruling is “just too broad” without more detailed information from taxpayers to support it, IRS Associate Chief Counsel (Corporate) Mark Schneider told Tax Notes.

What To Know About Employee Retention Credit Disclosures – Mark Loyd, Gregory Rhodes and Helen Cooper, Law360 Tax Authority ($):

Eligible taxpayers hoping to address potentially erroneous employee retention credit claims have until midnight on March 22 to apply for the voluntary disclosure program.

The Internal Revenue Service introduced the voluntary disclosure program, or VDP, late last year as a lifeline to taxpayers that the IRS contends were hoodwinked by aggressive promoters.[1] The VDP is a settlement program that allows employers to repay 80% of the credit amount received.

In exchange for keeping 20% of the claimed credit, which will not be taxed as income, the taxpayer must cooperate with any requests for information from the IRS and sign a closing agreement.

Court Side

CPA Had Unreported Income, Didn’t Substantiate Most Deductions – Tax Notes ($):

The Tax Court held that a CPA had unreported income and gross receipts as reported on an amended return, he is not entitled to deduct unsubstantiated expenses from his CPA and leasing businesses, and he is not entitled to a net operating loss, mortgage interest, or charitable contribution deduction, but he did substantiate a property tax deduction.

Ex-Super Bowl Champ Owes $15M Tax After Default, US Says – Anna Scott Farrell, Law360 Tax Authority ($):

A California federal court should issue a default judgment for $15.5 million in federal income taxes against four-time Super Bowl champion Bill Romanowski and his wife, the U.S. government argued, saying the couple has failed to participate in a collection case against them.

In a motion filed Tuesday, the government said that Romanowski earned millions of dollars playing in the NFL but that he and his wife, Julie, didn't pay their taxes from 1998 to 2007. The couple was well-aware that the government was suing them and their privately held protein powder company, Nutrition 53 Inc., to recover the debt, which includes interest and penalties, the government said. But they never filed a response to the June complaint, or a clerk's November entry of their default, making a default judgment appropriate, the government said.

Small Tax Case Dismissals Can’t Be Appealed, Second Circuit Says – Mary Katherine Browne, Tax Notes ($):

The Second Circuit determined that it lacked jurisdiction to hear the appeal of a small tax case dismissal because the tax code precludes the review of decisions in small tax cases, including dismissals.

In a March 13 opinion in Foley v. Commissioner, the Second Circuit upheld the jurisdictional dismissal of Joseph Foley’s late-filed Tax Court petition disputing his tax liabilities for tax years 2014 and 2015.

International Zone

Crapo, Smith: Biden Administration Should Negotiate a Better Global Tax Deal for America – Senate Finance Committee. “The United States stands to lose billions of revenue under the Organization for Economic Cooperation and Development’s (OECD) plan to reallocate global taxing rights—known as Pillar One—negotiated by the Biden Administration, according to an analysis by the nonpartisan Joint Committee on Taxation (JCT). JCT estimates that about 70 percent of the profits subject to reallocation under Pillar One will come from U.S.-based companies. The Biden Administration is considering committing to this agreement by the end of this month, in preparation for a formal signing ceremony in June.”

BTAX OnPoint: Computing the Primary Foreign Tax Credit Limit - Alexa Woods, Shelina Merchant and John McManus, Bloomberg ($):

The IRS and Treasury Department issued new rules to help taxpayers working on foreign tax credit calculations, both for 2023 and going forward, continuing to add options and flexibility to foreign tax credit rules it issued in early 2022 (T.D. 9959). Corporations and other taxpayers that claim foreign tax credits (FTCs) need to layer in the impact of the §904 limit when evaluating the options now available.

The §904 limit method has become a series of calculations, requiring corporations to first separate multiple types of foreign income into categories. Expenses then need to be allocated to each category of income. All of the steps need to be completed in the right order to compute the correct limit.

From the “Knock, Knock. Who’s There? Taxman” file:

Biden’s 15% Corporate Minimum Tax Hits KKR, Blackstone, Whirlpool in First Year – Richard Rubin, Wall Street Journal ($):

President Biden’s 15% corporate alternative minimum tax hit the electric utility Duke Energy, the appliance maker Whirlpool and the investment firms KKR and Blackstone in its first year, and the president now wants to expand the levy.

Congress created the tax in the 2022 law known as the Inflation Reduction Act, trying to address situations in which companies reported billions in profits to investors while using legal credits and deductions to pay little or no corporate taxes. That was a political and policy problem partly of Congress’s own making and one that Biden and Democrats attempted to solve by layering on another tax.

What Day Is It?

Happy National Pi Day! Also pie!

National Day Calendar:

National Pi Day on March 14th recognizes the mathematical constant π. Also known as pi, the first three and most recognized digits are 3.14. The day is celebrated by pi enthusiasts and pie lovers alike!

Make a habit of sustained success.