Key Takeaways

- Californians dreaming.

- Colorado quantum incentives.

- Illinois NOL limit extension.

- Kansas tax cut veto.

- Minnesota delivery fee update.

- Remote worker issues in NY, NJ, CT, MO.

- OK tax cuts go to Governor.

- A menu of state reform proposals.

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive Needs.

State Individual Income Tax Rates and Brackets, 2024 - Andrey Yushkov, Tax Foundation:

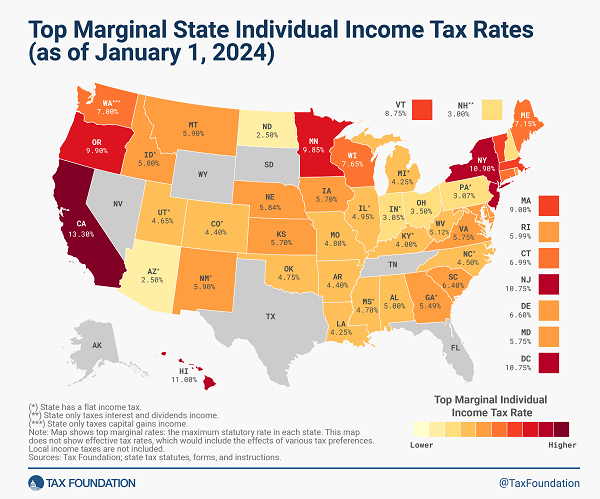

Forty-three states levy individual income taxes. Forty-one tax wage and salary income. New Hampshire exclusively taxes dividend and interest income while Washington only taxes capital gains income. Seven states levy no individual income tax at all.

Of those states taxing wages, 12 have single-rate tax structures, with one rate applying to all taxable income. Conversely, 29 states and the District of Columbia levy graduated-rate income taxes, with the number of brackets varying widely by state. Montana, for example, is one of several states with a two-bracket income tax system. At the other end of the spectrum, Hawaii has 12 brackets. Top marginal rates span from Arizona’s and North Dakota’s 2.5 percent to California’s 13.3 percent. (California also imposes a 1.1 percent payroll tax on wage income, bringing the all-in top rate to 14.4 percent as of this year.)

In some states, a large number of brackets are clustered within a narrow income band. For example, Virginia’s taxpayers reach the state’s fourth and highest bracket at $17,000 in taxable income. In other states, the top rate kicks in at a much higher level of marginal income. For example, the top rate kicks in at or above $1 million in California (when the “millionaire’s tax” surcharge is included), Massachusetts, New Jersey, New York, and the District of Columbia.

State-By-State Roundup

California

California Trial Court Won't Modify Judgment in P.L. 86-272 Guidance Suit - Christopher Jardine, Tax Notes ($). "In denying the motion to vacate or modify its decision, the court took umbrage with the FTB’s filing, stating that neither of the agency's grounds for the motion 'warrants extended discussion. The motion verges on the frivolous.'"

Californians Are Dreaming of Lower Taxes - Tyler Cowen, Bloomberg. "Researchers Joshua Rauh and Ryan Shyu, currently and formerly at Stanford business school, have studied the behavioral response to Proposition 30, which boosted California’s marginal tax rates by up to 3% for high earners for seven years, from 2012 to 2018. They found that in 2013, an additional 0.8% of the top bracket of the residential tax base left the state. That is several times higher than the tax responses usually seen in the data."

Colorado

Colorado Governor Announces Bill to Create Quantum Research Incentives - Emily Hollingsworth, Tax Notes ($). "The draft bill, which hadn’t been introduced as of press time, would create two refundable tax credit programs to cover costs associated with the development of a shared quantum research facility and to offset losses incurred by banks on loans to small- or medium-sized quantum computing businesses."

Illinois

Pritzker Proposes to Extend NOL Deduction Cap, Eliminate Grocery Tax - Benjamin Valdez, Tax Notes ($). "Pritzker delivered his annual State of the State and budget address February 21, unveiling a $52.7 billion budget that includes a proposal to increase the limit on corporate NOL deductions from $100,000 to $500,000 and extend the limit through tax year 2027. The change is estimated to raise an additional $526 million in corporate tax revenue and would affect less than 10 percent of corporate income taxpayers that are carrying losses. The $100,000 cap on NOL deductions was enacted in 2021 and was meant to last for three years."

Kansas

Kansas Lawmakers Fail to Override Veto of Flat Tax Bill - Emily Hollingsworth, Tax Notes ($):

Although lawmakers approved a February 20 motion to override Kelly’s veto of H.B. 2284 on a vote of 81 to 42, the vote fell short of the two-thirds majority required under the state constitution.

H.B. 2284, the Republican-led Legislature's alternative to Kelly’s tax relief plan, proposed to implement a flat income tax rate of 5.25 percent beginning in tax year 2025. The first $12,300 in income for joint filers and the first $6,150 for single and all other filers would have been exempt from the tax. Under current law, the state's income tax rates range from 3.1 percent to 5.7 percent.

Louisiana

La. Floats Rule Limiting Certain Capital Gains Deductions - Paul Williams, Law360 Tax Authority ($):

Louisiana would not allow a net capital gains deduction for sales of business assets when a certain percentage of the business's property is located outside the state, under a regulation the state Department of Revenue proposed.

The proposed rule, released Monday in the state register, would allow the capital gains deduction for sales where 75% or more of the real property or tangible assets exchanged are located inside Louisiana, provided that income from the business was subject to Louisiana income tax prior to the sale. The deduction would also not be available for transactions between related parties, according to the rule.

Minnesota

Minnesota DOR: New Retail Delivery Fee Starts July 1 - Emily Hollingsworth, Tax Notes ($):

Minnesota's controversial 50-cent fee on certain retail deliveries will take effect July 1, the Department of Revenue announced.

The DOR issued guidance on the fee February 21, noting that the fee will only apply to deliveries of tangible personal property and clothing that equal or exceed $100. The fee does not apply to food or prepared food items, drugs, baby supplies, or medical devices. Small businesses — retailers with less than $1 million in in-state sales and marketplace facilitators with less than $100,000 in in-state sales in the previous calendar year — are exempt, according to the guidance.

New York

New York’s Remote Work Tax Under Attack From Closest Neighbors - Danielle Muoio Dunn, Bloomberg ($):

Now, with more people continuing to work from home since the Covid-19 pandemic, elected leaders in Connecticut and New Jersey say that tax money belongs to them, not New York—and they’re willing to fight for it. New Jersey is offering an incentive for residents to sue New York over its taxation of telecommuters, and Connecticut said last week it plans to follow suit.

New York is one of a handful of states that has a “convenience of employer” rule, meaning workers must pay income tax to New York if their employer is based in the state, even if their job was done remotely. An exception is made for workers who were required by their job to work outside New York.

Related: Business Considerations with a Remote Workforce 2020/5

Missouri

Mo. House Panel OKs Banning St. Louis Tax On Teleworkers - Paul Williams, Law360 Tax Authority ($):

St. Louis would be barred from imposing its earnings tax on remote workers under a bill a Missouri House of Representatives committee advanced Wednesday, marking the latest development in a yearslong effort by state lawmakers to shield telecommuters from the tax.

The bill, H.B. 1516, would require the city to issue refunds to workers who paid the 1% earnings tax to St. Louis for days they worked outside the city, starting with tax returns filed on or after Jan. 1, 2025, which would apply to the 2024 tax year. The Republican-controlled Economic Development Committee approved the bill by a 12-4 vote.

Oklahoma Set to Kill State Grocery Levy, Avoid Other Tax Cuts - Angélica Serrano-Román, Bloomberg ($):

The repeal bill (HB 1955), which passed the House 88-7 last March, won 42-2 in the Senate. Republican Gov. Kevin Stitt signaled he would sign the measure. “This is a victory I’m excited to celebrate,” he said, calling the bill the “largest single year tax cut in Oklahoma history.”

Stitt has repeatedly called for personal income tax cuts, citing “record-breaking savings and a strong economic outlook,” but lawmakers haven’t acted on his proposals. Senators last month opened a special session called by the governor and adjourned within minutes without taking action on income tax relief.

West Virginia

West Virginia House OKs Retirement Tax Relief - Benjamin Valdez, Tax Notes ($). "H.B. 4880, approved February 22 on a vote of 96 to 0, would phase in a personal income tax exemption for Social Security income, beginning with a 35 percent exemption retroactive to January 1. The exemption would then increase to 65 percent for tax year 2025 and to 100 percent beginning January 1, 2026."

Vermont

Vermont Taxwriters Weigh Feedback on Wealth Tax Bill - Benjamin Valdez, Tax Notes ($):

Patrick Titterton, senior fiscal analyst with the Joint Fiscal Office, told the House Ways and Means Committee during a February 21 meeting that a bill (H. 828) to impose a 3 percent surcharge on taxpayers with a federal adjusted gross income of at least $500,000 wouldn’t result in wealthy taxpayers fleeing Vermont, as some detractors have argued.

Not everyone who testified agreed:

“I’d really encourage you to stop the discussion,” said Dan Cunningham, founder of Vermont-based financial advisory firm One Day in July LLC. “Vermont is not an easy place to start and grow a business. . . . Doing this and making it harder is not the place you want to go."

“I can't tell you how many people are moving across the border to New Hampshire," Cunningham continued. "It's not a theoretical thing; we're dealing with it."

Wisconsin

Wisconsin GOP’s Tax-Cutting Bills Head to Governor’s Desk - Michael Bologna, Bloomberg ($):

Republican-backed legislation to give Wisconsin taxpayers $2.1 billion in tax relief is headed to the desk of Democratic Gov. Tony Evers, who has provided mixed signals on his enthusiasm for the proposals.

The Senate Tuesday approved four separate measures cutting personal income taxes. Republicans, who hold majorities in both chambers, provided most of the supporting votes, though a bipartisan coalition approved a bill expanding the child care tax credit. After having passed the Assembly last week, all four proposals now go to Evers, who has vetoed previous GOP-sponsored tax measures.

Tax Policy Corner

Interstate Tax Issues That Shouldn’t Be Neglected by Congress -

Joe Bishop-Henchman, National Taxpayers Union Foundation:

Now that the U.S. House of Representatives has advanced a bipartisan tax package, it goes to the Senate, where consideration will take time. Passing the bill in its current form would be the fastest way to deliver tax relief to individuals and businesses, but should the Senate decide to amend the House bill, they should evaluate some key interstate tax issues for inclusion.

Set a minimum 30-day protection for interstate remote and mobile workers, where nonresidents have to be working in a state for more than 30 days before being subject to a state’s income tax filing and withholding obligations. Currently, most states technically require filing and even withholding of income tax from workers in the state for even one day of work. With most states giving full credits for taxes paid to other states, the result is a shell game with lots of additional compliance burdens and legal risk for taxpayers.

The other reforms suggested in the post:

- Reduce compliance costs on interstate retailers by codifying and expanding minimum Wayfair protections.

- Update taxpayer protections in the “temporary” Interstate Income Act of 1959 (P.L. 86-272).

- Define uniform rules for which states get to tax digital transactions.

- Give taxpayers access to federal courts.

Tax Bill of the Week.

Iowa gets the nod again this week with HSB 716. "This bill exempts from state income tax... income received by a certified public accountant performing an audit or examination of a governmental subdivision under Code Section 11.6."

While I can think of no class of taxpayers more worthy of a tax break than my audit colleagues, it's not clear why performing audits should be favored by the tax law. Unless, of course, we tax folk get the same break.

Make a habit of sustained success.