Key Takeaways

- Generous tax credits subsidize filming advertisements.

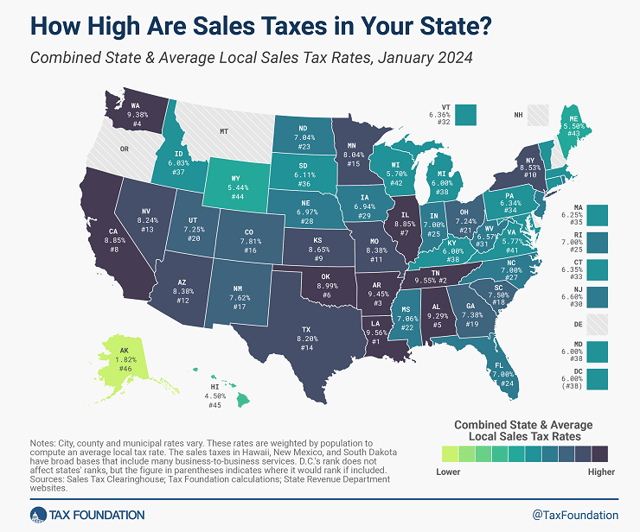

- 2024 sales tax rates by state.

- SALT deduction cap stalls out.

- Henry George, call your office.

- Valentine's Day and taxes.

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive Needs.

How a Bad Bunny Beer Ad Got Puerto Rico Tax Money to Shoot in LA - Angélica Serrano-Román, Bloomberg:

Film tax credit programs, offered in 38 states and Puerto Rico, were designed to attract movie and television series productions to places producers might not otherwise consider. States have raced to top each other as officials tout the credits as vehicles to create jobs and support independent filmmakers.

But hundreds of millions of dollars in subsidies have been provided to create advertisements for some of the world’s biggest consumer product companies, including McDonald’s Corp., Kellanova (previously Kellogg Co.), and AbbVie Inc., according to data obtained by Bloomberg Tax through public records requests. In Georgia, which claims to offer the most film tax incentives, the number of awards for commercials rose 53% from fiscal 2022 to fiscal 2023, while approvals for television and movies fell 5%.

State and Local Sales Tax Rates, 2024 - Jared Walczak, Tax Foundation:

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections). They also benefit from being more pro-growth than the other major state tax, the individual income tax, because they introduce fewer economic distortions.

Forty-five states impose state-level sales taxes, while consumers also face local sales taxes in 38 states, including Alaska, which does not impose a statewide tax. These local rates can be substantial, and some states with moderate statewide sales tax rates actually impose quite high combined state and local rates compared to other states.

Capitol Hill Recap: Hold The SALT - Jay Heflin, Eide Bailly.

On the heels of the House Rules Committee approving legislation last week that modifies the SALT-cap, the expectation was that the full House would vote on the measure this week.

...

Legislative outlook: House passage of the bill seems to be in doubt. However, if the bill were to pass the chamber, passage from the Senate is also expected not to occur. This means the bill is unlikely to become law.

State-By-State Roundup

California

California Wealth Tax Proposal Dies Again - Paul Jones, Tax Notes ($):

The legislation, A.B. 259, was introduced last year by Assembly member Alex Lee (D) but failed to advance that year. It got renewed attention in January when it was heard by the Assembly Committee on Revenue and Taxation but was then put in the suspense file, essentially ending its prospects. However, the legislation officially died last week after failing to advance out of its house of origin by January 31 of the second year of the state’s two-year session, as required by the state constitution.

...

The tax would have applied to the value of a California resident’s net wealth — including stocks and art but excluding directly held California real estate and out-of-state tangible property. The tax would have been levied at 1.5 percent on the portion of a person's wealth over $1 billion ($500 million for married persons filing separately) for tax years 2024 and 2025. In tax year 2026, the tax would have been levied at 1 percent of a resident’s worldwide net worth over $50 million ($25 million for married taxpayers filing separately), and an additional 0.5 percent tax would have been levied on a resident’s net worth over $1 billion ($500 million for married taxpayers filing separately) for a combined tax of 1.5 percent on wealth in excess of $1 billion.

San Francisco Issues Final Business Tax Reform Recommendations - Paul Jones, Tax Notes ($). "Other proposals include increasing the gross receipts tax exemption for small businesses from $2.19 million to $2.5 million, and ditching regulatory license fees, collectively worth about $10 million in revenue, that the report says are mainly paid by small businesses such as restaurants and bars."

Georgia

Georgia’s $1 Billion Tax Relief Bills Pass House Unanimously - Michael Bologna, Bloomberg ($). "The Georgia House of Representatives approved three tax proposals Thursday that provide significant relief to taxpayers by cutting the personal income tax rate, boosting the child tax credit, and creating a process to double the homestead tax exemption."

Links: HB 1015, HB 1019, https://www.legis.ga.gov/legislation/66268.

Idaho

Idaho Updates State Tax Code References To Federal Code - Zak Kostro, Law360 Tax Authority ($). "H.B. 385, which Republican Gov. Brad Little signed Thursday, conforms Idaho's income tax code to the Internal Revenue Code as amended and in effect on Jan. 1, 2024, including changes that affect tax year 2023, according to the bill's text and a statement of purpose."

Iowa

Iowa Bill Would Fund Phaseout of Individual Income Tax - Emily Hollingsworth, Tax Notes ($). "A Senate study bill, S.S.B. 3141, was introduced February 1 by Senate Ways and Means Committee Chair Dan Dawson (R). It would create an income tax elimination fund (ITEF) and a taxpayer relief trust fund, and would use the money to reduce the individual income tax until it is phased out using a formula proposed in the bill. Once the income tax rate reaches zero, the remaining money in both funds would be transferred to the general fund, according to the bill."

Iowa Tax Dept. OKs Updated Regs For Marketplace Sellers - Zak Kostro, Law360 Tax Authority ($). "The revised regulations explain statutory requirements for remote and marketplace sellers and clarify who must collect and remit state sales tax, the department said in a notice Wednesday. The revised regulations also clarify the proper sourcing of taxable services, tangible personal property and specified digital products by explaining how the location of a sale may determine when and where state sales or use tax applies, the department said."

Indiana

Ind. Senate Approves Sales Tax Nexus Change - Michael Nunes, Law360 Tax Authority ($):

S.B. 228, which the Senate passed Monday by a vote of 47-1, seeks to eliminate a section of the state's sales tax nexus rules that requires retailers that make 200 or more transactions in Indiana to collect and remit the state's 7% sales tax.

Only retailers with more than $100,000 in gross revenue from sales in Indiana would have to collect and remit sales tax, according to the bill's text.

Ohio

Ohio Tax Department Approves Amended Commercial Activity Tax Rule - Emily Hollingsworth, Tax Notes ($). "The rule says consolidated taxpayer groups whose taxable gross receipts won’t exceed the exclusion threshold in a calendar year can cancel their CAT accounts. "

Michigan

Mich. Gov. Whitmer Seeks $100M R&D Credit In Budget Plan - Paul Williams, Law360 Tax Authority ($). "The Democratic governor included the R&D credit proposal in her $80 billion fiscal year 2025 spending plan, which she presented to lawmakers during a joint meeting of the House and Senate Appropriations committees. Whitmer also suggested earmarking $59 million to create a tax credit to offset qualifying caregiving expenses."

Mississippi

Mississippi Governor Renews Call for Eliminating the Income Tax - Matthew Pertz, Tax Notes ($). "In his budget recommendation, Reeves said Mississippi could support reducing the income tax rate by one percentage point a year and fully eliminating the tax by calendar year 2029."

Nebraska

COST Opposes Nebraska Bills to Tax Business Inputs, Digital Ads - Emily Hollingsworth, Tax Notes ($):

Nebraska bills to impose tax on business inputs and digital advertising services would cause economic distortions, burden businesses and consumers, and raise constitutionality concerns, according to the Council On State Taxation.

In February 1 written testimony submitted to the Legislature's Revenue Committee, COST said it opposes two bills that would subject accounting services and legal services performed for businesses to the state’s 5.5 percent sales and use tax (L.B. 1308 and L.B. 1345) and a bill to remove a sales tax exemption for data centers (L.B. 1319). COST said the legislation would lead to increased taxation of business inputs and business-to-business transactions, which can obfuscate tax transparency, lower state competitiveness, and pass along higher expenses to consumers and lower wages to employees.

New Mexico

New Mexico Tax Overhaul Bill Advances to Senate for a Vote - Michael Bologna, Bloomberg ($):

The New Mexico House passed a tax plan that would cut personal income taxes and pay for a portion of the revenue losses through adjustments to the state’s corporate rate and levy on capital gains.

The omnibus bill, HB 252, heads to the Senate after winning House approval 48-21 Wednesday.

The bill would also replace the current three-factor business apportionment factor (property, payroll, and sales) with sales-only apportionment.

New York

Connecticut Joins N.J. in Fighting New York Remote-Worker Tax - Danielle Muoio Dunn, Bloomberg:

New York requires workers to pay income taxes to the state if their job is based there, even if they work remotely outside of state lines. It’s called the “convenience of the employer” rule because workers must pay New York income taxes if they work elsewhere for their own convenience, not because their employers assign them there.

...

Connecticut wants to encourage residents to challenge “New York’s overreaching tax laws” by offering a tax credit if they’re successful in getting a refund from that state for tax years from 2020 to 2023, Beckham said in a budget briefing.

Oklahoma

Oklahoma Governor Calls for Tax Cuts, Less Government Spending - Emily Hollingsworth, Tax Notes ($). "Stitt's speech mentioned his 2023 proposal to lower the top income tax rate to 3.99 percent and the three tax-cut special sessions he called, the most recent of which was in January. However, the Legislature didn't pass his tax proposal, and the three special sessions similarly didn’t yield any tax cuts. In 2023 lawmakers increased the income threshold for the highest tax bracket for joint filers and eliminated the annual corporate franchise tax. Those bills were enacted without Stitt’s signature."

Oklahoma Governor Will ‘Sign Any Tax Cut That Comes to My Desk’ - Michael Bologna, Bloomberg ($). "Stitt, a second-term Republican, acknowledged last week’s special session yielded no cut to the state’s top rate of 4.75%, but stressed lawmakers have a fresh chance to craft a comprehensive package of tax cuts in the 2024 session."

Pennsylvania

Pennsylvania Governor Calls for Marijuana Legalization, Taxation - Angélica Serrano-Román, Bloomberg ($). "Shapiro’s budget proposal for fiscal 2024-2025 would create a 20% tax on the wholesale price of marijuana products sold within the regulated production and sales system, with sales expected to start in 2025. It also calls for a 42% tax on the daily gross gaming revenue from electronic gaming machines that involve skill and are regulated by the Pennsylvania Gaming Control Board, effective July 1."

Tennessee

Tenn. Gov. Pitches Franchise Tax Reform In Annual Address - Sanjay Talwani, Law360 Tax Authority ($):

Years of revenue growth and spending restraint have made Tennessee ready to change a longstanding piece of its corporate franchise tax, the state's governor said in his State of the State address, pitching a $400 million tax cut proposed by state lawmakers.

...

H.B. 1893, sponsored by Rep. William Lamberth, R-Portland, and S.B. 2103, sponsored by Sen. Jack Johnson, R-Franklin, would delete the provision of the franchise tax that allows an alternative minimum franchise tax amount based on the value of real and personal property owned by the taxpayer in the state. The bill would also allow taxpayers to seek refunds of that minimum tax paid in previous years.

Virginia

Virginia House Committee Advances Sales and Income Tax Bills - Matthew Pertz, Tax Notes ($). "The committee also voted to advance H.B. 464, a bill filed by Del. Chris Runion (R) on behalf of a food pantry in his district. Under the bill, the revenue threshold at which point a nonprofit is required to provide a financial audit to receive an income tax exemption would be increased from $1 million to $1.5 million."

Tax Policy Corner

Might a Georgist land tax help revive Detroit? - Tyler Cowen, Marginal Revolution:

A possible downside from land value taxation is that it discourages land speculation. Land speculators do not, I concede, have the best reputation — but speculation can be either a positive or negative, depending on whether entrepreneurs have good foresight. On the plus side, speculation can keep land from being developed prematurely, or from being locked into uses that later turn out to be too low in value.

If dormant land in Detroit is taxed at a higher rate, that might encourage property owners to develop low-quality housing or retail to lower their tax burden. A landowner might build a small house, for example, rather than holding out for a large, higher-quality apartment complex. The city might get modest growth, but lose out on the chance for a bigger economic redevelopment. Detroit has in recent times shown signs of a revival, so perhaps waiting for the right opportunity is sometimes best.

Background on Henry George and the Land Tax here.

Tax History Corner

Valentines Day looms, with its customary flood of engagements. There have been times and places where the tax law directly encouraged would-be suitors to make a move. Montana in the 1920s was such a place and time.

The state imposed a $3 annual tax on bachelors who lacked the nerve or motivation to commit. Naturally not all bachelors appreciated this, and in 1922 the Montana Supreme Court ruled the tax unconstitutional. Unattached men (women were not subject to the tax) were allowed to claim refunds.

So, Montana singles, you are on your own next week.

Make a habit of sustained success.