Key Takeaways

- GOP Senate Finance head tries to solve for tax votes.

- Werfel quizzed on IRS penalty backdating.

- Spokane wildfires trigger June 17 deadline.

- IRS enhances "Where's My Refund" for this season.

- Computing the stakes for the March 1 optional farmer filing date.

- Tax Basics - a policy primer.

- National Toast Day.

GOP senators say they’re exploring path to yes on tax bill - Laura Weiss and Brendan Pedersen, Punchbowl News:

The top Senate GOP tax writer says he has a mission. He’s working to pin down exactly what would swing the majority of his conference to back the Wyden-Smith tax deal.

Sen. Mike Crapo (R-Idaho), the Finance panel’s ranking member, huddled with committee members on Wednesday evening to check in on where they stand after a nearly two-week recess and define potential GOP demands.

The Wyden-Smith deal, passed overwhelmingly by the House of Representatives, would restore full deductibility for domestic research costs retroactively to 2022. It would also restore 100% bonus depreciation retroactively to 2023 and ease limits on business interests. All of these business provisions would be then set to expire after 2025.

Crapo Criticizes Attempts to Dismiss GOP Concerns on Tax Bill - Cady Stanton and Doug Sword, Tax Notes ($):

When asked how close he is to assembling majority support, Crapo said he couldn’t gauge the number. A handful of Senate Republicans, including Roger Marshall of Kansas, Kevin Cramer of North Dakota, and Markwayne Mullin of Oklahoma have come out for the bill.

“I’m working on it, the issues senators have identified — there’s a ton of them,” Crapo said. “I’m just going around to every member and trying to figure it out.”

Crapo Seeks Changes To Child Tax Credit Provisions In Bill - Asha Glover and David van den Berg, Law360 Tax Authority ($):

The top-ranking Republican on the Senate Finance Committee said Wednesday that he cannot support the bipartisan tax bill pending in the Senate as long as a provision that allows taxpayers to receive a refundable child tax credit based on their prior year's earnings is included.

Sen. Mike Crapo, R-Idaho, said he opposes provisions in the House-passed Tax Relief for American Families and Workers Act of 2024 that would allow individuals to receive a refundable child credit when they have no annual earnings as long as they made at least $2,500 in prior-year earnings. The bill would also increase the maximum refundable amount of the child tax credit from $1,600 per child to $1,800 in 2023, $1,900 in 2024 and $2,000 in 2025, according to a section-by-section summary.

IRS News

Werfel Faces Questions on IRS Penalty Document Backdating - Caitlin Mullaney, Tax Notes ($). "In a February 27 letter to IRS Commissioner Daniel Werfel, Ways and Means Committee Chair Jason Smith, R-Mo., and Oversight Subcommittee Chair David Schweikert, R-Ariz., questioned the IRS’s response to the Tax Court’s August 2023 decision in LakePoint Land II LLC v. Commissioner, T.C. Memo. 2023-111, which imposed sanctions on IRS counsel for their failure to alert the court that it had submitted a backdated penalty approval form."

The Internal Revenue Service announced today tax relief for individuals and businesses in parts of Washington state affected by wildfires that began on Aug. 18, 2023.

These taxpayers now have until June 17, 2024, to file various federal individual and business tax returns and make tax payments.

The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA). Currently, this includes Spokane County. Individuals and households that reside or have a business in this locality qualify for tax relief.

The relief covers partnership and S corporation returns otherwise due March 15, 1040s due September 15, estimated tax payments. Limited relief is provided for some payroll tax obligations; details are available at the IRS link.

IRS Rules Out Single-Issue Letter Rulings - Chandra Wallace, Tax Notes ($):

Recent changes to the corporate letter ruling program mean that the IRS will no longer rule on single issues within transactions, according to IRS Associate Chief Counsel (Corporate) Mark Schneider.

Referring to the practice in prior years of issuing narrower significant issue rulings, Schneider said, “That’s gone — it’s transactional rulings or nothing” now.

IRS enhances Where’s My Refund? tool for 2024 filing season - IRS:

With millions of tax refunds going out each week, the Internal Revenue Service reminded taxpayers today that recent improvements to Where's My Refund? on IRS.gov provide more information and remains the best way to check the status of a refund.

The Where’s My Refund? tool provides taxpayers with three key pieces of information: IRS confirmation of receiving a federal tax return, approval of the tax refund and issuing date of the approved tax refund. Information for returns from tax years 2023, 2022 and 2021 is available.

Blogs and Bits

Does a Farmer Have to File and Pay Taxes by March 1? - Kristine Tidgren, Ag Docket:

Example - “Penalty” is an Interest Payment

Larry is a qualified farmer who did not pay estimated taxes by January 16, 2024, for 2023 (January 15 was a holiday). He also missed the March 1 deadline to file his return and pay his taxes to avoid the underpayment penalty. For 2023, Larry had $21,000 in overall tax liability. As a qualified farmer, his estimated tax liability was 66 ⅔ percent of that amount or $14,000. The due date for this tax was January 16. He files his return and pays the tax due on April 15, 2024. Because the underpayment rate for the first quarter of 2024 is eight percent, Larry owes an eight percent underpayment penalty for the proportion of the year for which his payment was delinquent, calculated as follows:

$14,000 (estimated tax liability) x 90/365 (days delinquent / days in the year) = $3,452 x .08 (underpayment rate) = $276.

If this farmer doesn't have his K-1s, it likely will be wiser - and cheaper, taking tax prep fees into account - to wait for the K-1 and take the $276 penalty than it would be to file a return by tomorrow and amend when the K-1 shows up.

AI-enhanced fraud detector helped Treasury recover $375 million - Kay Bell, Don't Mess With Taxes. "Treasury's Office of Payment Integrity (OPI) began using the AI process at the Oct. 1, 2022, start of that fiscal year to deal with check fraud that increased dramatically during the COVID-19 pandemic."

San Diego County Gets Extension Until June 17th - Russ Fox, Taxable Talk. "Heavy rains and flooding in San Diego caused the area to be declared a federal disaster zone. The IRS extended all tax deadlines in San Diego County from January 21, 2024 onward until June 17, 2024. This includes individual, business, and employment tax returns. California’s Franchise Tax Board granted the same relief for state taxes."

Tax Refunds Edge Higher As Tax Filing Season Rolls On - Kelly Phillips Erb, Forbes ($). "I’ve noted for weeks that many taxpayers might be waiting to file until the Senate votes on The Tax Relief for American Families and Workers Act. The legislation, which would, among other things, expand the child tax credit retroactively to the 2023 tax year, was announced in mid-January and passed the House at the end of the month. The bill has not yet been slated for a vote in the Senate. IRS Commissioner Danny Werner has encouraged taxpayers to file anyway, saying that the IRS will make any necessary changes."

Option Agreement to Purchase Shares in Family Business Was a Taxable Gift - Parker Tax Pro Library. "The Tax Court that a taxable gift occurred when a taxpayer exercised his rights assigned to him by his parents to buy stock in a company for $5 million that the IRS determined were worth $31 million."

International Terminal

B Positive - Alex Parker, Things of Caesar. "The Organization for Economic Cooperation and Development released on Monday a seemingly definitive report on “Amount B,” a crucial part of the Two-Pillar Project which aims to simplify the transfer pricing of routine baseline and distribution transactions to free up resources for both taxpayers and tax administrations."

Tax Policy Corner

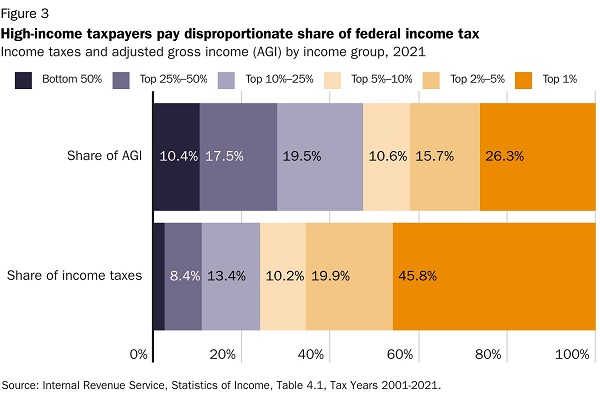

Tax Basics in 5 Charts - Adam Michel, Liberty Taxed. "Newly released data from the IRS shows that the federal tax system remains highly progressive and has become more progressive over time. The highest‐income Americans pay a disproportionate share of income taxes and face the highest average tax rates across all federal taxes. Despite high tax rates on some, the United States is a relatively low‐tax country. But with a projected $2 trillion annual gap between revenue and spending over the next decade, it is unlikely to stay that way unless Congress cuts spending."

Sustainably Reforming Social Security and Medicare Will Need More than Just Tax Hikes - Garrett Watson, Tax Policy Blog. "International experiences and budget math both show that we will need a combination of revenue and spending reforms to get entitlements on a sustainable path. Creative options including changes in Social Security benefits growth for higher earners and reforms to how Medicare compensates for health services should be on the table, along with broad-based and well-structured tax reforms. We will not make progress implementing good ideas if we are distracted by the temptation to tax that rich person behind that tree."

Section 199A Deduction: Economic Effects and Policy Issues - Gary Guenther, Congressional Research Service:

Eric Toder of the TPC has proposed two options for reforming the taxation of noncorporate business income. One option would repeal the deduction and instead tax all privately held C corporations on the same terms as pass-through entities. This would mean that all business profits except those of publicly held C corporations would be taxed at the same rates as wage income. Special rules would be needed to tax the accumulated profits of C corporations required to switch to pass-through status. The profits of publicly traded C corporations would continue to be taxed at the current corporate tax rate (21%), and their owners would continue to face a second level of tax on dividends they receive and long-term gains they realize.

Toder’s second option would tax wage income and pass-through business profits at the same rates but continue to tax privately held C corporation income at the corporate tax rate. Privately held C corporation profits would be allocated to stockholders according to their ownership shares and taxed under the individual tax, whether or not they are distributed. Such tax treatment already applies to pass-through business profits. The income tax for publicly held C corporations would operate as a withholding tax for which shareholders would claim a credit when they file their individual tax returns. A two-level income tax would still apply to the profits of publicly traded C corporations distributed to shareholders.

What Day is It?

Raise a... slice of bread? It's National Toast Day, in honor of that humble staple that comes through on those mornings when pouring a bowl of cereal is too much work.

Make a habit of sustained success.