Key Takeaways

- Entity tax guidance promised in 2020 still nowhere to be seen.

- When are entity tax deductions allowed?

- How are entity-tax credit refunds taxed?

- SALT Cap lift vote slated for today.

- 2026 tax bill lobbying underway.

- Travis Kelce and energy credits.

- Separate filing - I love you, but not your tax problems.

- "The transaction before us lacks both business purpose and economic substance and is a sham."

- National Cream-Filled Chocolate Day

Long Wait for IRS Guidance on SALT Workarounds Concerns Tax Pros - Angélica Serrano-Román, Bloomberg

Practitioners, consultants, and national accounting organizations like the American Institute of CPAs have been requesting the “forthcoming proposed regulations” from the IRS, as the agency promised in a notice published in November 2020. The AICPA alone submitted letters three years in a row. But it’s still uncertain whether the agency will issue the proposed tax rules this year—or ever—especially with Congress still deliberating the fate of the deduction cap, currently set to expire at the end of 2025.

The IRS told Bloomberg Tax that, after reviewing the current year’s Priority Guidance Plan , “we do not see anything currently on additional guidance planned.” IRS spokesperson Robyn Walker said she couldn’t confirm whether the agency would issue the tax rules later in the year, because she “can only speak to what we are aware of currently.”

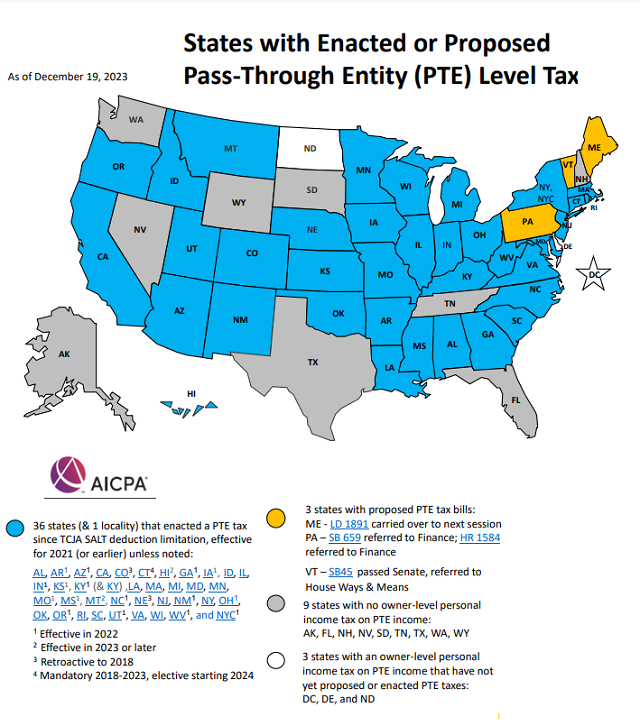

The article points out some of the uncertainty involved in deducting payments under state pass-through entity tax (PTET) systems. These systems allow partnerships and S corporations to pay taxes on income that would normally be taxed only to partners and shareholders. In most of these PTET states, the entity awards a state tax credit to the owners for an amount approximating the entity tax to prevent double taxation.

Among the uncertainties are the timing of payment deduction for both cash and accrual basis taxpayers. The treatment of tax refunds generated to partners and S corporation shareholders by PTET tax credits is also uncertain.

While the $10,000 cap for state and local tax itemized deductions is slated to expire after 2025, it might be extended. Even if it isn't, PTETs may remain in place to enable entity owners to bypass the alternative minimum tax disallowance of state and local tax deductions.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround blog 2020/9

Here is a map of states with entity level taxes, courtesy AICPA:

Here are some of the common red flags being seen on ERC claims that the IRS is focusing on:

- Too many quarters being claimed. Some promoters have urged employers to claim the ERC for all quarters that the credit was available. Qualifying for all quarters is uncommon, and this could be a sign of an incorrect claim...

- Government orders that don’t qualify. Some promoters have told employers they can claim the ERC if any government order was in place in their area, even if their operations weren’t affected or if they chose to suspend their business operations voluntarily. This is false...

- Business claiming ERC for too much of a tax period. It's possible, but uncommon, for an employer to qualify for ERC for the entire calendar quarter if their business operations were fully or partially suspended due to a government order during a portion of a calendar quarter...

- Business didn’t pay wages or didn’t exist during eligibility period...

- Promoter says there’s nothing to lose. Businesses should be on high alert with any ERC promoter who urged them to claim ERC because they “have nothing to lose.”

If you are claiming a credit for retaining employees for a non-existent business, consider getting into the IRS program as soon as you can.

Related: IRS Launches Voluntary ERC Repayment Program with March 22, 2024 deadline.

Meanwhile in Congress

House Set for Procedural Vote on SALT Marriage Penalty Bill - Cady Stanton, Tax Notes ($):

The legislation, introduced by House SALT Caucus member Michael Lawler, R-N.Y., would raise the SALT cap — set at $10,000 in the Tax Cuts and Jobs Act — to $20,000 for joint filers with income up to $500,000. The provision would apply only to the 2023 tax year.

...

While the bill doesn’t go as far in changing the provision as other proposals — such as by raising the cap to $50,000 or $100,000 or by eliminating it altogether — it still has a hefty estimated price tag. The legislation would cost $11.7 billion for 2023, according to estimates from the Tax Foundation, and the Penn Wharton Budget Model estimated that it would reduce revenue by $12 billion over the 10-year budget window.

This bill, if passed, would apply to 2023 taxes, for which filing is already underway. Passage isn't expected.

Lawmakers Brace For Lobbying Blitz On Expiring Tax Breaks - Stephen Cooper, Law360 Tax Authority ($):

Several key provisions of the Tax Cuts and Jobs Act are set to expire at the end of 2025, including individual income tax rate cuts, the increased standard deduction for individuals and married couples, the temporary $10,000 cap on state and local tax deductions, and the expanded estate tax exemption.

House Ways and Means Committee member Rep. Judy Chu, D-Calif., told Law360 that negotiations over the fate of the expiring tax provisions from the 2017 law have already started in the House. She pointed to legislation the chamber recently passed to enhance the child tax credit and renew three business tax breaks for research and development, bonus depreciation, and expensing.

It's going to get wild.

Refunds and how they are used

Most Filers Expect Money Back From IRS—Here’s A Look At The Most Tax Refund Eager Cities - Kelly Phillips Erb, Forbes ($):

That makes some taxpayers anxious come tax time. According to LLC.org, some taxpayers are more "refund eager" than others. The company analyzed Google search volume related to tax refund status, including terms like "where's my tax refund," "IRS refund," "IRS refund schedule," and hundreds of other variations to create a ranking of where Americans are the most anxious to receive their tax refund.

Their findings? Southern states are looking the most, with more than four in ten Mississippi, Georgia, and Alabama residents performing tax refund searches during tax season.

Travis Kelce’s Debut as a Film Producer Is Also the First Movie Financed Using President Biden’s Green Energy Tax Credits (EXCLUSIVE) - Tatiana Siegel, Variety. "'My Dead Friend Zoe' used money generated by green energy entrepreneur Mike Field’s sale of surplus tax credits. (Field is also a producer on the film.)"

Related: Incentivizing the Climate Economy: How Section 48 Is Boosting Clean Energy Investments.

Blogs and Bits

Separate tax return filing considerations for married couples - Kay Bell, Don't Mess With Taxes. "Does your spouse owe Uncle Sam money? Has he or she ever been audited? When you review your joint tax return that your spouse fills out, does it look like he or she is taking some tax-filing liberties that could cause some potential problems?"

An Introduction to Tax Forms for Gig Economy Workers - Erin Collins, NTA Blog. "Form 1099-NEC, Nonemployee Compensation, is a tax document you may receive from clients who have paid you $600 or more during the tax year. Unlike traditional employees who receive Form W-2, Wage and Tax Statement, you’ll receive a Form 1099-NEC as a gig economy worker. The form provides the IRS information on the income you received as an independent contractor. If you also paid another independent contractor $600 or more during the year, you are required to file Form 1099-NEC with the IRS and provide a copy to the independent contractor no later than January 31. This is much earlier than the normal April 15 deadline for an individual income tax return so you should start working on submitting any Forms 1099-NEC as soon as the new calendar year begins."

Poor Tax Judgment Turns Junk Call Gold Into Lead - Peter Reilly, Forbes. "This case illustrates how spotty Form 1099 compliance is. The Humana people paying the bills seem to be doing everything by the book. Given that it would seem that Mr. Escano should not have been surprised that not coughing up the W-9 led to backup withholding. But he was surprised because it had not happened before in numerous settlements."

IRS Issues Guidance on the Alternative Fuel Vehicle Refueling Property Credit - Parker Tax Pro Library. "The IRS issued a notice providing guidance on eligible census tracts for the qualified alternative fuel vehicle refueling property credit under Code Sec. 30C and announcing the intent to propose regulations for the credit."

Tax Policy Corner

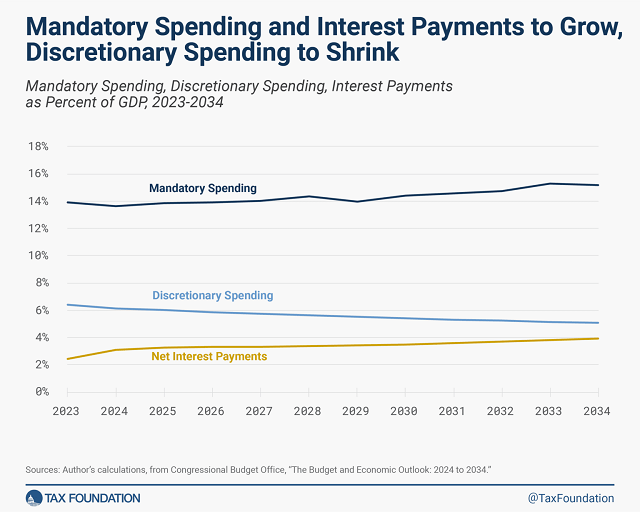

Major Takeaways from CBO’s Updated Long-Term Outlook - Alex Muresianu and William McBride, Tax Policy Blog: "Increased outlays are primarily to blame for higher deficits going forward, particularly the growth in mandatory spending programs, including Social Security and Medicare, and rising interest on the debt. From 2024 to 2034, mandatory spending will grow from 13.6 percent of GDP to 15.2 percent of GDP, while discretionary spending will decline from 6.2 percent of GDP to just 5.1 percent of GDP. The remaining increase in outlays is due to a historic increase in interest payments, which go from 3.1 percent of GDP in 2024 (exceeding the defense budget for the first time in records going back to 1940) to a new record high of 3.2 percent in 2025, before rising higher to 3.9 percent in 2034."

Taxes in the Courts, Silly Stock Department

Patent Settlements Are Taxable Income for Tech Company - Caitlin Mullaney, Tax Notes ($). "A technology licensing company is liable for over $15.5 million in deficiencies and penalties after the Tax Court found that it excluded litigation settlements from its gross income."

The tax planning here should have its own TikTok video. To avoid having the settlement income taxed, the corporation offered a discount on the payment if the defendant styled the payment as a "share purchase agreement," or SPA, of a special class of "stock" - shares that the court found had no vote and no meaningful dividend and liquidation rights. A stock purchase is not taxable to the corporation issuing the shares.

Tax Court Judge Marshall accepted the IRS valuation of these "shares" as zero. From the Tax Court opinion:

The SPAs dictate petitioner's expectation and intention that the Settlement Shares will not receive dividends, do not have liquidation preference, are not transferrable or redeemable, and have no voting rights or other means to effect a change with respect to those absent rights. Acqis has created an instrument that looks like an equity share with none of its substance. In searching for words to describe Acqis's creation, we find ourselves comparing it to a ceremonial “Key to the City”: It bears the appearance of an item we know well, but opens no doors, bestows no ownership or function, and is instead merely representational. Likewise, the Settlement Shares resemble shares in form, but in function they grant no real benefits of ownership or income. We conclude that the Settlement Shares are worthless.

It got worse from there:

In all, the record convincingly shows that the parties sought to settle the patent infringement litigation, but the transaction (as defined above) served no purpose toward that goal and had no nontax effect. Instead, the SPAs were added as a legal fiction to achieve a desired result with respect to Acqis's tax liability.

...

The SPAs were executed with the sole purpose of obtaining a tax benefit for Acqis and lacked any economic substance beyond that goal. What pretended to be a purchase of Acqis shares was really a settlement payment for patent infringement damages and a licensing fee. The transaction before us lacks both business purpose and economic substance and is a sham. Accordingly, the transaction will be disregarded.

The opinion upholds around $13 million of additional tax, plus 20% substantial understatement penalties.

The Moral? The IRS is not required to believe just anything, nor is the Tax Court.

Everyone knows it's Valentines Day. Did you know it is also National Cream-Filled Chocolate Day?

Make a habit of sustained success.