Key Takeaways

- New IRS high-income audit programs on target for 8% exam rate.

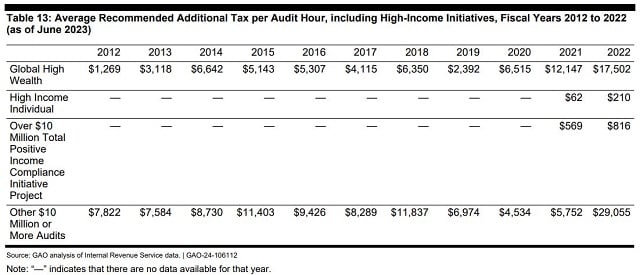

- 2022 exams of taxpayers with over $10M positive income generated $13K per audit hour.

- SALT deduction cap lift may be too heavy.

- Slow start to tax filings.

- Direct file and return-free taxes - it's hard.

- Where's your refund?

- Yes, wait for that K-1 before filing.

- Embrace E-filing

- IRS criminal investigation chief to retire.

- Sentences for ID thieves who raided preparer data.

- National Cheddar Day.

IRS on Track to Hit High-Income Audits Target, GAO Says - Jonathan Curry, Tax Notes ($):

The IRS appears set to meet its mandate of auditing at least 8 percent of returns filed by the wealthiest individuals, but it may have favored quantity over quality in doing so.

That’s one of several conclusions reached in a report released February 12 by the Government Accountability Office after it reviewed the IRS’s compliance with a 2020 Treasury directive that the agency audit at least 8 percent of all returns filed each year by wealthy individuals.

The report focuses on the preliminary results of a pair of special IRS initiatives designed to meet Treasury’s goal: the compliance initiative project (CIP) in the Small Business/Self-Employed Division and the high-income individual initiative (HII) in the Large Business and International Division. Combined, the two initiatives comprise about 39 percent of all audits of wealthy individuals with at least $10 million in total positive income — that is, reported income before offsets like deductions and credits are considered.

The report outlined information from meetings with 10 "discussion groups" of IRS agents examining High-income/High Worth (HI/HW) returns:

Balancing the number of audits with the scope and depth of audits (10 out of 10 groups). Auditors work on multiple audits at the same time. According to participants, heavy workloads, limited time, and the complexity of HI/HW returns sometimes lead them to close audits without fully examining all indicators of potential noncompliance. In addition, some participants said that classifiers did not always identify the most productive issues to audit. As a result, auditors need to spend more time identifying issues with the highest potential for noncompliance before they contact taxpayers to ask for information.

Finding noncompliance across many related entities (10 out of 10 groups). According to IRS procedures, as part of auditing the primary return, an auditor should determine whether to audit returns of related entities. Auditors said they need to audit related entities to track the flow of income and expenses from the taxpayer's return to these entities. However, according to group participants, HI/HW returns can be associated with dozens or hundreds of related entities. Therefore, according to participants, opening audits of many related entities is not always efficient or feasible because following the procedures to audit any one entity can take significant time, and auditors have limited time to complete an audit.

SALT Cap Slog

Two Tests for SALT Republicans in Coming Days - Samantha Handler, Bloomberg ($)

It’s a make-or-break week for opponents of the state-and-local tax deduction cap.

Long Island and Queens residents hit the polls Tuesday in a special election that has implications for both tax policy and the House majority. And on Wednesday, lawmakers are slated to have a test vote on a bill to raise the SALT cap.

See Jay Heflin's Capitol Hill Recap from last week for more.

The House has a bumpy week ahead - Jake Sherman and Mica Soellner, Punchbowl News. This article talks about the efforts made by New York Republicans to boost the cap on itemized deductions for state and local taxes, which is slated for a vote tomorrow. "But guess what? This rule is likely to fail on the floor. Womp, womp. That will be the end of that push, which wasn’t much of a push at all."

IRS Collection Culture, Slow Tax Season Start

Compassionate Collection? A Tax Man Has a Message to Quiet Critics - Jonathan Curry, Tax Notes. The article covers the career of Darren Guillot, who retired in September as head of the IRS collections team. The article has this story:

Guillot was a young revenue officer at the time, and that day he was parked across the street from the home of a car dealership owner who had fallen behind on his tax payment plan. He was there to deliver some bad news: The IRS was going to seize some of the dealership’s vehicles.

While sitting in his car in the shade preparing the paperwork, Guillot noticed someone walking toward him from across the street — barefoot, on the scorching pavement. It was the car dealer, emotionally overwhelmed, making a last-ditch plea for mercy.

“That was the first time I’d ever seen a grown man cry,” Guillot said. “He told me if I did a seizure, his employees would leave, that he’d lose his business, that his wife would leave him.”

The dealer eventually paid off his tax debt and avoided seizure. That was a much better result than when Mr Guillot left a note with a tax-delinquent attorney "looking forward to helping you resolve this." The attorney committed suicide. Far better to pay the taxes.

Related: Eide Bailly IRS Collection Issues

Early Numbers Suggest Taxpayers Are In No Hurry To File This Tax Season - Kelly Phillips Erb, Forbes ($). "My guess is that many taxpayers are waiting to file until the Senate votes on The Tax Relief for American Families and Workers Act. The legislation, which would, among other things, expand the child tax credit retroactively to the 2023 tax year, was announced in mid-January by Senate Finance Committee Chair Ron Wyden (D-Ore.) and House Ways and Means Committee Chair Jason Smith (R-Mo.). Days later, the House Ways and Means Committee acted quickly and in a bipartisan manner, voting 40-3 to advance the deal before it moved to the House where it passed with significant bipartisan support. The bill has not yet been slated for a vote in the Senate—but IRS Commissioner Danny Werner has encouraged taxpayers to file anyway, saying that the IRS will make any necessary changes."

US Grantor Trusts Need Int'l Reporting Clarity, Treasury Told - Natalie Olivo, Law360 Tax Authority ($):

The U.S. Treasury Department should clarify that domestic grantor trusts aren't required to file international information returns, the American Institute of Certified Public Accountants said in a letter made public Thursday, claiming that current uncertainty has led to redundant reporting.

Treasury should issue a notice or revenue procedure to resolve uncertainty regarding the obligation for the grantor, or creator, of domestic trusts to file international information returns, the AICPA said Monday in a letter. According to the AICPA, this category includes Form 5471, which involves U.S. stock ownership in offshore corporations, and Form 8858, an information return regarding foreign disregarded entities and foreign branches.

Related: Eide Bailly Foreign Trust & Estate Tax Compliance & Planning.

Direct File, No File

When U.S. states tried — and failed — to simplify tax filing - Julie Zauzmer Weil, Washington Post. The article discusses state efforts to provide pre-filled returns using existing information. "In 1996, Michigan launched a program to allow some taxpayers to skip filing a tax return at all. But in the first year, just 94 people chose to participate, according to a Treasury report."

The problem? Complexity:

In 1998, Congress passed a law that required the IRS to start pre-filling tax returns for “appropriate” taxpayers within a decade. But the IRS never did.

The Treasury Department published a report in 2003 on what it would take to follow that law. It noted that the United States has more complicated deductions and credits than most countries, and that Americans wouldn’t want pre-filled returns if it meant getting their refunds later in the year.

The rise of the gig economy makes return-free filing less likely than ever.

IRS takes baby steps with new direct file program - Tobias Burns, The Hill. "But the program is still in an internal testing phase, and only about 12 IRS employees from states that don’t have an income tax are filing returns with the new system so far, an IRS official said last week."

Blogs and Bits

Where is your tax refund? IRS tracking tool aims to answer annual query - Kay Bell, Don't Mess With Taxes. "You want to know, just where the heck is your federal tax refund? The IRS understands. That's why it created Where's My Refund? It's also why the agency made some improvements to the online refund tracking tool."

Your Questions on Paying Estimated Taxes, Answered - Laura Saunders, Wall Street Journal. "In general, taxpayers who are self-employed or receive income from nonemployment sources like pensions, IRA withdrawals, dividends or interest often owe quarterly estimated tax payments on this income. By contrast, filers who receive a regular salary typically have tax payments withheld from their paychecks. Our Tax Guide overview addressed the basics of both; for more information, see IRS Publication 505."

An Introduction to Tax Forms for Gig Economy Workers - Erin Collins, NTA Blog. "In recent years, there’s been a groundbreaking change in the world of college sports introducing a new dimension to the gig economy: the monetization of an athlete’s name, image, and likeness (NIL). This offers student-athletes opportunities to profit from their personal brand, opening doors to endorsements, sponsorships, and other income-generating opportunities. But just like any other income stream in the gig economy, these opportunities also come with new tax obligations."

Legislative Limbo: Deciding When to File 2023 Taxes - Kelly Golish, Tax School Blog. "So, should tax preparers wait to file returns (both business and personal) until after the legislation (possibly) passes? It depends."

Do I Really Have to Wait for that $10 K-1 to Arrive? - Russ Fox, Taxable Talk. "When you invest in a partnership or S-Corporation, you need to be aware that to file by the April deadline you will have to have that K-1. Partnerships and S-Corporations can (and these days often) obtain extensions until September 15th. If you invest in an entity that takes the extra six months, you will be extending your tax return."

Embrace E-Filing Your Tax Return - Thomas Gorczynksi, Tom Talks Taxes. "Both electronic filing and mail filing have security risks; it is not true that paper is more secure. Mail can be stolen — mail theft is rising, and USPS boxes and facilities are not always physically secure."

Crime and Punishment

IRS CI Chief to Depart Before End of Tax Season - Nathan Richman, Tax Notes ($):

IRS Criminal Investigation division Chief Jim Lee will retire on April 6, ending a term lauded by observers as both innovative and successful in rooting out tax and financial wrongdoing.

...

Lee has also developed and implemented the division’s Advance Collaboration Data Center, an attempt to apply the lessons of high-profile cyber investigations more broadly. CI plans to open the center in the spring.

Link: IRS press release.

RICO conspirators sentenced to prison for cyber intrusion, tax fraud - IRS (Defendant names omitted):

According to court documents, from 2015 through 2019, the defendants and numerous other conspirators—including a now-deceased conspirator who is referenced in the indictment as RICH4EVER4430—banded together to engage in a sophisticated cybercrime and tax fraud scheme. Defendants used the dark web to purchase server credentials for the computer servers of Certified Public Accounting (CPA) and tax preparation firms across the country. They used those server credentials to remotely and covertly commit computer intrusions and exfiltrate the tax returns of thousands of taxpayers who were clients of those CPA and tax preparation firms.

Defendant were involved with creating and operating fraudulent tax businesses to file false tax returns in the names of thousands of victims. They also registered preparer tax identification numbers with the Internal Revenue Service (IRS) using the names and information of identity theft victims to make it appear those victims were the individuals who were filing false returns in bulk.

Defendants...filed thousands of false tax returns in the names of more than 9,000 identity theft victims.

The defendant sentences range from four years to 16 years in prison, according to the IRS.

This case highlights how important it is for tax preparers to have good data security practices. Client information is a gold mine for ID thieves.

What day is it?

With or without a hamburger, it's National Cheddar Day!

Make a habit of sustained success.