Key Takeaways

- Hits and misses for IRS tax chief

- Tax bill kills bromance

- Deadlines postponed in Michigan

- IT progress

- ERC, you and me

- Tax code progressivity

- DST extension

- Fizzle Commission

- Grouch Day = me time

Taking the Hill

Werfel Defends Delay Of $600 Payment Reporting Rule – Asha Glover, Law360 Tax Authority ($):

Internal Revenue Commissioner Daniel Werfel defended Thursday his decision to delay implementation of a law requiring peer-to-peer payment platforms such as Venmo and PayPal to report aggregate payments of $600 or more, saying the decisionwas informed by stakeholders.

Tax industry and commercial stakeholders recommended delaying implementation of the provision, which lowered to $600 from $20,000 the threshold at which third-party payment platforms must report payments for goods and services, Werfel said during a House Ways and Means Committee hearing. The agency also decided to phase in the lower threshold, starting with a $5,000 level for 2024.

Werfel also confirmed that amended returns will not be needed if tax measures are enacted in the middle of tax season.

Capitol Hill Recap: House Puts Kibosh on SALT-Cap Increase – Jay Heflin, Eide Bailly:

House Ways and Means Chairman Jason Smith (R-Mo) started the hearing by asking Werfel if taxpayers would have to file an amended return if they had already filed their forms before the tax bill making its way through Congress is enacted into law. (Assuming it gets enacted into law, that is.)

Smith: “Can you confirm that taxpayers do not need to file amended returns to obtain the adjustments the bill makes?”

Werfel: “Yes.”

More information on the tax bill can be found here.

Werfel also took some heat during the hearing:

Mixed Reviews for Werfel on ERC, 1099-K Reporting, and More – Doug Sword and Cady Stanton, Tax Notes ($):

[H]e bore the brunt of GOP anger over what is seen by committee Republicans as an inadequate five-year sentence handed to Charles Littlejohn, the former IRS contractor who confessed to leaking the private tax information of former President Trump and tens of thousands of wealthy Americans.

After the hearing he talked ERC with reporters:

The IRS is aiming to end the moratorium on new ERC claims — announced in mid-September 2023 — by April or May, Werfel told reporters after the hearing.

This gets tricky:

Under the tax deal awaiting action in the Senate [mentioned above], which sets a January 31 cutoff date for claims, those claimants would be ineligible unless the bill is revised to give taxpayers more notice, Werfel told reporters.

How McConnell and Schumer became Ukraine-aid allies – Burgess Everett, Politico. This article is about how the budding bormance between Senate leaders will likely fade when tax legislation comes into play next year.

McConnell and Schumer are still battling fiercely for the Senate majority next year, each reveling in the opposing party’s missteps. And their alignment to help steer Ukraine assistance past a Trump-juiced wall of conservative opposition is a largely temporary phenomenon, and no one should expect it to continue when the next high court seat opens or when Trump-era tax cuts expire next year.

Articles about the coming dustup was included in this recent Roundup.

Tax Agency Updates

The Internal Revenue Service today announced tax relief for individuals and businesses in parts of Michigan affected by severe storms, tornadoes and flooding that began on Aug. 24, 2023.

These taxpayers now have until June 17, 2024, to file various federal individual and business tax returns and make tax payments.

IRS Improving Security For Info Technology, TIGTA Says – Jared Serre, Law360 Tax Authority ($):

The Internal Revenue Service is making ample progress remedying security concerns in information technology program areas, the Treasury Inspector General for Tax Administration said in a report published Thursday.

By properly incorporating the agency's incident response procedures, the IRS effectively mitigated one ransomware attack during the 2023 fiscal year, according to the report. The agency also hit its 97% completion mark for employee training on protecting taxpayer information.

Covid Corner

IRS Using ‘Information Sessions’ to Claw Back Improper ERC Claims – Lauren Loricchio and Nathan Richman, Tax Notes ($):

CI’s Darrell Waldon told Tax Notes on February 15 that the division sent out 218 invitations to tax businesses doing significant ERC filings. The 56 percent response rate led to 216 individuals signing up for the information sessions, which are being held at IRS field offices in 34 cities across the country.

While most of the sessions were scheduled for February 12-16, a few offices had to delay them because of inclement weather, Waldon said. The goal is to finish the sessions before March, he added.

Many Covid-19 relief recipients are getting requests from the IRS — and a potential way out - Andy Medici, The Playbook, The Business Journals. This article is about the IRS seeking information from small business owners about their Employee Retention Credit claims.

This approach is the latest attempt by the IRS to clamp down on fraud within the program. It also provides an escape hatch for business owners who, upon reviewing the documentation, realize they cannot justify the credit or are now unable to, according to one such document reviewed by The Playbook.

“If, while preparing your response to this IDR, you determine that you're not entitled to the ERC claimed, let us know if you want to withdraw your claim for ERC. We'll provide you with specific instructions on how to withdraw your claim,” the document request says.

Third-Party Payers Liable for ERC-Related Tax Underpayments – Caitlin Mullaney, Tax Notes ($):

Some third-party payers (TPPs) are liable for underpayments of employment taxes resulting from improper employee retention credit claims, the IRS concluded in a generic legal advice memorandum.

The memorandum (AM 2024-001), dated February 5 and released February 15, says the IRS will treat the ERC as it would any other improperly claimed employment tax credit, so third parties such as certified professional employer organizations, section 3504 agents, and professional employer organizations could be on the hook if they filed clients’ employment tax returns under their own employer identification numbers.

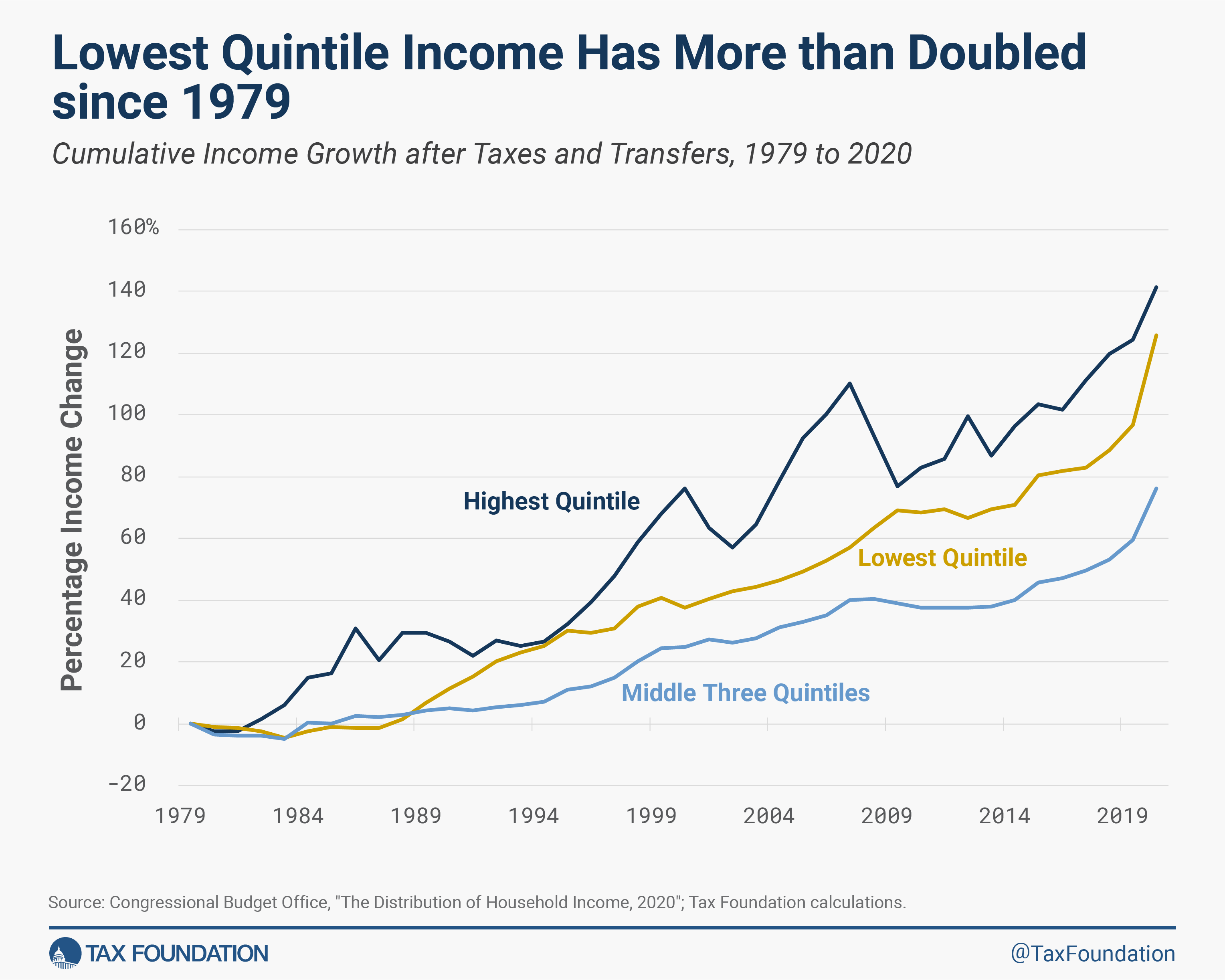

New CBO Report Shows Pandemic Response Sharply Reduced Inequality, Increased Progressivity in 2020 - Alex Durante, Tax Foundation:

The pandemic led to one of the largest fiscal responses in U.S. history, impacting households across the income distribution. A new report from the Congressional Budget Office (CBO) finds that these temporary policies, along with other fixtures of our tax and transfer system, reduced income inequality in 2020 by more than any other year since 1979 when the CBO began measuring household income. The analysis also shows that the federal tax system is markedly progressive, even when excluding the most recent pandemic policies, echoing our own research on this topic and other recent academic evidence.

Court Side

Feds Say Tax Prepper Filed Over $1M In False 2020 Returns – Ryan Harroff, Law360 Tax Authority ($):

The U.S. Department of Justice's Tax Division took an Ohio tax preparer and his two businesses to federal court alleging he has employed "at least four definable schemes to generate or inflate his customers' refunds" and cost the government $1 million in revenue for the 2020 tax year alone.

Emmanuel Antwi, the sole proprietor of Cincinnati-based businesses Manny Travel Agency & Business Services Inc. and Manny Financial Insurance & Accounting Firm LLC, knowingly filed fraudulent tax forms on behalf of his customers for years, according to the government's Wednesday complaint to the Southern District of Ohio. The suit says he did this in part by exploiting tax deductions his clients did not actually qualify for and by misrepresenting their filing status.

IRS Appeal of Tribune Media Gets Cool Reception – Kristen Parillo, Tax Notes ($):

The IRS appears to be abandoning its own regulation for measuring economic risk of loss in its appeal of a Tax Court opinion on Tribune Media Co.’s disguised sale of the Chicago Cubs, according to a Seventh Circuit judge.

The government’s position that real-world risk must be analyzed when applying its antiabuse rule to the constructive liquidation test “troubles me,” Seventh Circuit Judge Frank H. Easterbrook said February 15 during oral arguments in Tribune Media Co. v. Commissioner.

International Tax Junction

International Standards for Automatic Exchange of Information in Tax Matters – OECD (report):

Since the approval of the Standard for Automatic Exchange of Financial Account Information in Tax Matters in 2014, it has been implemented by jurisdictions and financial institutions across the globe. Taking into account the experience gained and the growing digitalisation of financial markets, a comprehensive review of the Standard was undertaken.

As a result, this publication includes the Crypto-Asset Reporting Framework (CARF) and amendments to the Common Reporting Standard (CRS), along with associated Commentaries and exchange of information frameworks, as approved by the Committee on Fiscal Affairs, which now collectively represent the International Standards for Automatic Exchange of Information in Tax Matters.

US Extends Deal On Existing Digital Taxes With 5 Countries – Natalie Olivo, Law360 Tax Authority ($). “Austria, France, Italy, Spain and the U.K. will continue applying their digital services taxes in light of the extended timeline to implement the Pillar One international profit reallocation agreement, the countries said Thursday in a joint statement with the U.S.”

U.S. Deal to Avoid Trade War Over DSTs Extended to End of June – Stephanie Soong, Tax Notes ($):

Under the deal, the five European countries will give tax credits to U.S. companies subject to their DSTs against any future income tax liabilities under pillar 1's amount A rules once they take effect. The credit amount will be the difference between a company’s DST liability during the interim period and the amount of tax due under amount A rules in the first year of their implementation. That credit will then be applied to the company’s amount A corporate income tax liability that accrued after the interim period.

In exchange, the United States, which views DSTs as discriminatory against U.S. companies, agreed to withdraw proposed retaliatory tariffs on some U.S. imports of goods from the five countries. The U.S. government also promised that it won’t take further trade action against those countries because of their DSTs until the interim period ends.

From The “I'm ah-gan it” File

Democrats, unions ramp up pressure against fiscal commission - David Lerman, Roll Call:

A proposed fiscal commission to fast-track deficit reduction measures, already under attack from the right, also faces a stepped-up assault from the left…

While anti-tax activists on the right warned the move would open the door to major tax increases, union leaders said the commission would lay the groundwork for cuts to Social Security and Medicare.

This isn’t the first fiscal commission to be created. If past is prologue, it will propose ways the Federal government can climb out of debt – which will be fully ignored on Capitol Hill.

What Day Is It?

Happy National Do A Grouch A Favor Day! Finally! Who wants my list?

Make a habit of sustained success.