Key Takeaways

- Senate moves slow on tax bill

- House tax chief pushes for action

- He said, She said

- IRS, tax bill, and tax season

- IRA cost skyrocket

- IRS chief to testify

- DATA leaks

- Upping SALT-caps and the rich

- The Super Bowl's dark side

Taking the Hill

Senate GOP Push For Tax Bill Changes Could Slow Progress – Asha Glover, Law360 Tax Authority ($):

Senate Republicans' desire to add their own priorities to the tax bill recently passed by the House, along with a jam-packed Senate agenda, could delay the proposal in its journey to President Joe Biden's desk…

The bill faces several potential paths forward. It can go through the Senate Finance Committee, where lawmakers would be able to attach their own priorities to the proposal during a markup. Alternatively, it could go straight to the floor either as a standalone bill or attached to must-pass legislation, such as the funding bills lawmakers will need to address to prevent a government shutdown in March.

Senate Finance Committee Republicans are pushing for the first option, especially because it would give them an opportunity to make changes to the bill, including its child tax credit proposals. Under Smith and Wyden's deal, the maximum refundable amount of the child tax credit would increase from $1,600 per child to $1,800 in 2023, $1,900 in 2024 and $2,000 in 2025, according to a section-by-section summary.

Some Senators have proposed curbing the business tax relief in the bill in exchange for limiting the Child Tax Credit. Some also want to strike from the bill language modifying the Employee Retention Tax Credit. The original goal of enacting this bill before the start of tax season now seems comical.

How slow is the Senate GOP slow walk? – Bernie Becker, Politico:

At this point, it sure seems like a good number of Senate Republicans are trying to slow walk the bipartisan tax bill that sailed through the House late in January.

The big question, then, and one that doesn’t seem to have an answer yet, is just how committed Sen. Mike Crapo of Idaho, the top Republican on the Senate Finance Committee, and other GOP skeptics are to throwing the brakes on this tax plan.

That also doesn’t look like a question that will get answered anytime soon, given the Senate’s current focus on a foreign aid bill and a looming recess for the chamber.

Plus the Senate is scheduled to be on recess for two-weeks after they contend with the foreign aid issue.

Also, the tax bill has entered the “He said, She said” phase, which is not common on Capitol Hill. To be sure, lawmakers take pot-shots at each other, but rarely do they make private conversations public to do it.

Smith Combats Claims Senate Republicans Weren’t in Tax Talks – Cady Stanton, Tax Notes ($):

He said:

Senate Republicans were part of discussions on the tax deal “the whole time,” according to House Ways and Means Committee Chair Jason Smith, R-Mo., dispelling claims that the chamber’s taxwriters weren’t privy to negotiations on the package… As part of Senate Finance Committee Republicans’ participation in talks, ranking member Mike Crapo, R-Idaho — who is among panel members advocating for a committee markup of the bill to allow for changes — requested that the child tax credit income lookback period in the deal apply only for 2024 and 2025, not 2023, according to Smith. That change is part of the bill as it currently stands.

She said:

Amanda Critchfield, a spokesperson for Crapo, disputed Smith’s characterization of the negotiations and said that Crapo has maintained a practice of keeping “internal conversations confidential so that staff can explore all options.”

“To be clear, any narrative that Senator Crapo or his staff signed off on, including the lookback provision, is factually inaccurate — staff requested that it be removed entirely,” Critchfield said in a statement to Tax Notes. “Simply put, Senator Crapo did not sign off on the deal because his concerns were not resolved.”

Smith is selling his tax deal — to a fractured Senate - Laura Weiss and Andrew Desiderio, Punchbowl News ($):

Rep. Jason Smith (R-Mo.) is working overtime….

Smith is talking through what’s in his bill and setting the record straight on certain details that have drawn scrutiny on the right, according to a source familiar with the push.

Smith is not making a specific ask, but instead letting senators know he supports whatever it takes to get the bill over the finish line.

Translation: If the bill needs amending, so be it. Just pass the thing. But House efforts to get Senate support for the bill could be lacking:

Ways and Means staff presented Thursday at a Senate GOP chiefs meeting. The House staff addressed questions on the business and child tax credit policies in the package, the Senate process and the politics of the effort... But it wasn’t all sunshine. Multiple Republican chiefs stood up at the end of the presentation to slam the bill... There are strong forces working against the deal, particularly with a handful of Finance Committee members critiquing it publicly.

Somewhat related:

IRS Watchdog Acting Chief Talks Hiring Efforts, Free E-file Tool – Erin Slowey, Bloomberg ($):

Heather Hill took over as acting inspector general at the Treasury Inspector General for Tax Administration in September after leaders said that longtime director J. Russell George would be out indefinitely following a medical emergency…

What do you think are the biggest challenges facing the IRS this filing season?

One of the continuing challenges that the IRS faces each year in processing tax returns is the implementation of new tax law changes as well as changes resulting from expired tax provisions.

Legislative actions generating these changes often occur late in the year, shortly before the filing season begins, and sometimes even during the filing season. For example, Congress is currently debating making changes to the Child Tax Credit and several other tax provisions.

This will require the IRS to create or revise tax forms, instructions, and publications; update computer programming to process tax returns affected by the provisions; and communicate and provide guidance to taxpayers and tax professionals on the tax law changes.

IRA News

The Cost of Biden’s Climate Tax Credits Is Soaring – Richard Rubin and Amrith Ramkumar, Wall Street Journal ($):

President Biden’s 2022 climate law is driving faster-than-expected growth in electric-vehicle purchases and clean-energy projects, doubling the projected cost to taxpayers while potentially accelerating emissions reductions.

The Congressional Budget Office this week bumped up its projection of the law’s climate tax credits through fiscal year 2033 by $428 billion, putting an official stamp on what public and private analysts had been saying for the past year. The law, known as the Inflation Reduction Act, is expected to spur up to $3 trillion in total public and private investment over the next decade.

Some in Congress want to repeal this legislation. They say it costs too much. But if the bill is popular with voters, repealing it could be hard to do.

The tax credits’ popularity and increasing cost could fuel concerns about rising government budget deficits and make the energy incentives a big target for some Republicans if they take full control of Congress and the White House next year.

But many analysts think it will be difficult for lawmakers to repeal subsidies that are popular among a swath of businesses including fossil-fuel, manufacturing and transportation companies. The subsidies are designed to increase energy security and have been boosting job creation, particularly in Republican districts.

Treasury Can Help Smooth Road to Energy Credits, Official Says - Caleb Harshberger, Bloomberg ($):

Changes in the Democrats’ 2022 tax-and-climate law suddenly opened up new green energy tax credit opportunities to nonprofits and state and local government entities, said Luke Bassett, senior adviser and director of policy and program impact in Treasury’s Inflation Reduction Act Program Office…

Bassett encouraged groups to reach out to Treasury for help, adding there are limits to what department staff can say.

He said they can’t give tax advice on specific projects, limiting how much guidance is possible for groups unsure how to know their projects will qualify for credits.

IRS Updates

Werfel to Hit House for 1099-K, Other Tax Talk - Chris Cioffi, Bloomberg ($):

IRS Commissioner Danny Werfel will face the House Ways and Means Committee Feb. 15, answering a call from Republicans to testify after the agency delayed a requirement for e-commerce platforms to send tax forms to users that exceed $600 in transactions.

Millions of users of platforms like eBay, Venmo, and CashApp had been expected to get 1099-K forms this year because a provision in Democrats’ 2021 pandemic aid law called for the threshold to be cut from $20,000 and 200 transactions to $600. The IRS twice delayed the requirement. The latest guidance issued in November keeps the $20,000 level in place for this filing season, and the IRS said it is planning a threshold of $5,000 for the 2025 filing season.

IRS, TIGTA at Odds Over Risks of Future Tax Data Leaks – Jonathan Curry, Tax Notes ($):

The IRS is contesting the conclusions reached in a new report by the Treasury Inspector General for Tax Administration that taxpayer data is still at risk in the wake of the ProPublica leaks.

In a report released February 9, TIGTA credited the agency with making significant improvements to its data security controls and processes, such as limiting access to sensitive data, deactivating inactive users, and instituting a new policy that transferring data to an external storage device requires executive-level approval. But it’s still not enough, according to the agency watchdog.

The report is here.

IRS Cracked Down on Access to Tax Data After Bezos, Musk Leaks – Richard Rubin, Wall Street Journal ($):

The Internal Revenue Service clamped down on employees’ and contractors’ access to confidential taxpayer data after a damaging 2021 leak, but some risks still remained, according to a report that provides new details on the agency’s response.

Since the news organization ProPublica began publishing confidential information about wealthy taxpayers, including Jeff Bezos and Elon Musk, the IRS masked some data that can be traced to particular taxpayers, according to the Treasury Inspector General for Tax Administration, which released its findings Friday. The IRS also increased tracking and restricted access to sensitive systems, the inspector general said.

Updates to frequently asked questions about the Premium Tax Credit – IRS:

This Fact Sheet updates frequently asked questions (FAQs) for the Premium Tax Credit.

The revisions and additions are as follows:

- Updated Eligibility FAQs: Q5, Q7, Q8, Q9

- New section: Affordability of employer coverage for employees and for family members of employees

- Updated: Q11, Q15, Q18

- Added: Q12, Q13, Q14, Q22

- Updated Reporting, Claiming and Reconciling FAQs: Q30

- Updated Unemployment Compensation 2020 and 2021 FAQs: Q45

Corrections to Revenue Procedure 2024-5, Schedule of User Fees in Appendix A – IRS:

This announcement contains corrections to Revenue Procedure 2024-5, 2024-5 IRB 1, which omitted the effective dates for certain changes to the user fees in the user fee schedule.

Revenue Procedure 2024-5, as published on January 2, 2024, (2024-5 IRB 1), omitted the effective dates for changes to the user fees that apply to certain requests for advance approvals. Rev. Proc. 2024-5 sets forth procedures for issuing determination letters on issues under the jurisdiction of the Director, Exempt Organizations Rulings and Agreements, including determination letters relating to certain advance approvals. This announcement corrects Appendix A, paragraphs (9), (10), and (11) of Rev. Proc. 2024-5.

Court Action

6th Circ. Backs Fine Against Doctor For Willful FBAR Violation – David Hansen, Law360 Tax Authority ($):

A Michigan doctor clearly met the standard for a willful failure to file reports of foreign bank accounts, the Sixth Circuit said, confirming a lower court decision resulting in a $930,000 penalty against him.

James Kelly Jr. made multiple decisions intended to hide the fact that he did not file reports of foreign bank and financial accounts, or FBARs, for his holdings in Swiss banks, the appeals court said in an order Thursday, upholding a summary judgment ruling in favor of the U.S. government.

Ninth Circuit Dismisses Appeal for Untimely Filing - Carlton Smith, Tax Notes ($). “In an unpublished opinion in Bunton v. Commissioner, No. 22-70229 (9th Cir. 2024), the Ninth Circuit dismissed an appeal for lack of jurisdiction because, while the private postmark date on the envelope sent to the Tax Court containing the notice of appeal was timely, the U.S. Postal Service affixed a second postmark that was untimely, and the USPS postmark governs for purposes of the extension to file provided in section 7502.”

International Tax Corner

Pillar 2 Shouldn't Hit 'Double Dipping' Loss Rules, CPAs Say – Natalie Olivo, Law360 Tax Authority ($):

The Pillar Two international minimum tax agreement should not impact U.S. rules that are designed to prevent companies from "double dipping" with a single economic loss, the American Institute of Certified Public Accountants recommended in a letter made public Friday.

The U.S. Treasury Department's upcoming guidance on interactions between Pillar Two and the U.S. tax system should state that the global regime doesn't impact domestic dual consolidated loss, or DCL, rules, the AICPA told the department in the letter, dated Thursday. In general, the rules are designed to restrict U.S. companies from using the same economic loss to offset both foreign and domestic income taxes.

Companies Call for Clarity on Analysis, Credit of Global Tax Rule - Lauren Vella, Bloomberg ($):

The US Treasury Department should explain how parts of the tax code are applied to determine if one of the rules that’s part of the 15% global minimum tax can be credited, an industry group said.

The National Foreign Trade Council, a group that represents companies on issues related to international tax policy, wrote in a comment letter Friday that the department should “expedite guidance” on how Sections 901 and 903 are applied to determine if one of the global minimum tax rules, known as the income inclusion rule, or IIR, would be eligible for a foreign tax credit.

What Matters in Moore - Reuven S. Avi-Yonah, Tax Notes ($) (commentary):

The obvious answer is that if the Court decides that realization is a constitutional requirement for an income tax, the holding will have significant implications for the existing income tax regime. Depending on how broad the decision is, it could enable constitutional challenges to subpart F, the global intangible low-taxed income regime, partnership and subchapter S taxation, and sections 275, 877A, 1256, and 1259, to name just a few. And even if most or all of these challenges are ultimately decided against the taxpayers (for example, because realization does not apply to corporate taxpayers, because partnership taxation is just about aggregation, because subchapter S is generally elective, and because the other sections mentioned above are excise, not income, taxes), this will take time. Meanwhile, taxpayers would rely on Moore as substantial authority and not pay tax on a lot of income.

From the “Throwing SALT on the Election” file

The Tax Angle: SALT, Housing Credits, Opportunity Zones – Stephen Cooper, Law360 Tax Authority ($):

House Democrats are determined to see former House Ways and Means Committee member Tom Suozzi defeat Republican-backed Mazi Pilip in Tuesday's special election for New York's 3rd Congressional District, said Rep. Judy Chu, D-Calif.

If Suozzi wins and Democrats go on to retake control of the House of Representatives, they can negotiate an increase in the $10,000 cap on state and local tax deductions that was enacted under the Republican Tax Cuts and Jobs Act, Chu told reporters Thursday.

"This is a big issue for New York, New Jersey and California," she said. "That's a huge amount of votes, and the path to victory in terms of taking back the House."

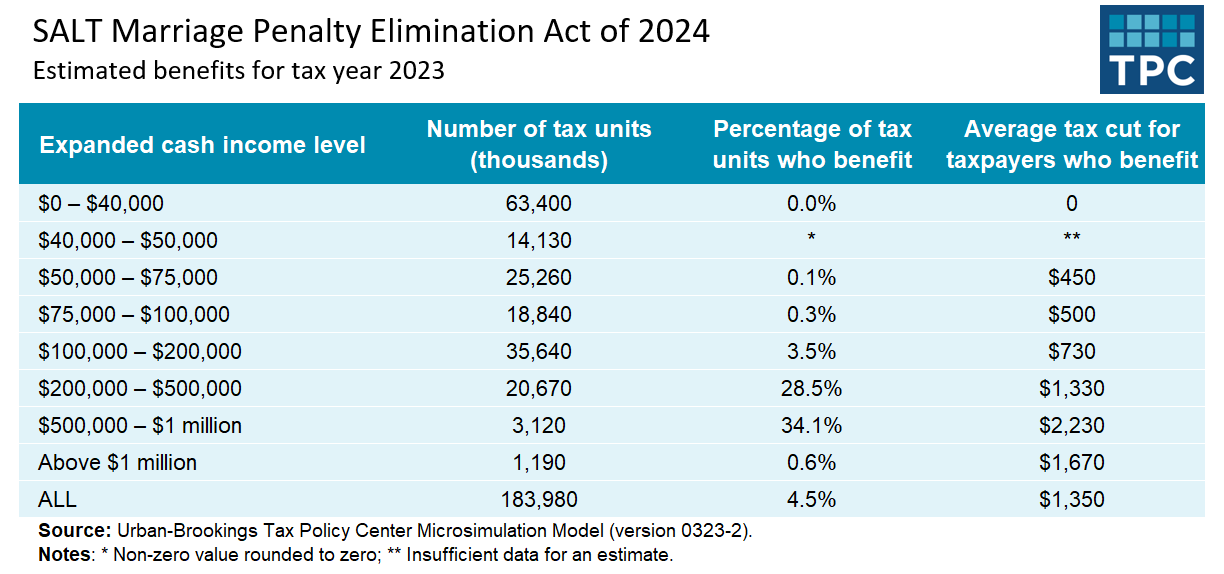

Um, legislation upping the SALT-cap for 2023 to $20,000 for joint filers earning less than $500,000 is already making its way through Congress. However, in speaking with tax staffers, the bill seems unlikely to become law. The bill helps the rich, which is politically unpopular these days:

SALT Cap Relief For Married Couples Still Favors Wealthier Households – John Buhl, Tax Policy Center:

More than 90 percent of the benefits of a House proposal to temporarily amend the $10,000 cap on state and local tax (SALT) deductions would accrue to households making between $200,000 and $1 million, according to a new TPC analysis.

What Day is it?

It’s National Football Hangover Day. I attended a Super Bowl party, but I can’t remember who won. I also have a splitting headache. It must be allergies…

Make a habit of sustained success.