Key Takeaways

-

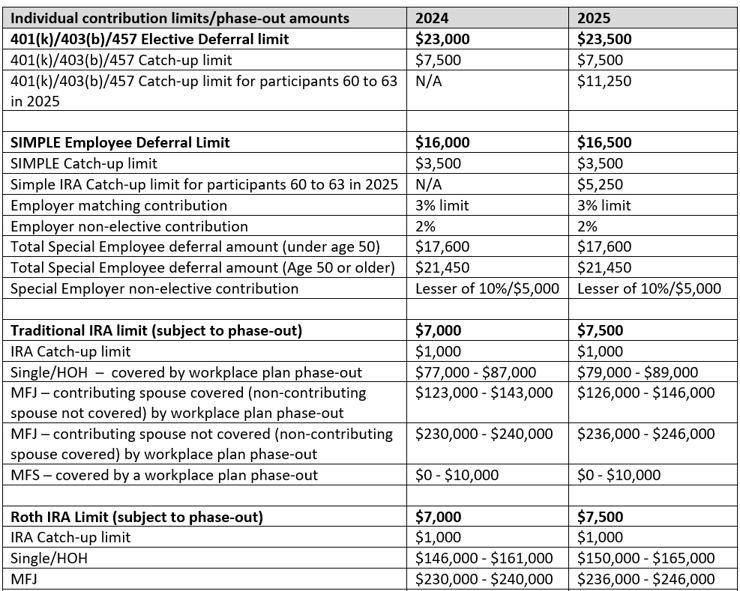

The IRS released 2025 retirement account cost-of-living adjusted limits.

-

Workers aged 60 to 63 will have the greatest savings opportunities starting next year.

-

Most deferral limits for individuals increased $500 from 2024 limits.

Older workers can make bigger retirement account contributions than ever in 2025, thanks to tax law changes made in “SECURE 2.0” legislation. The IRS recently released figures showing just how much more these workers can shelter in retirement plans starting next year. Workers aged 60 to 63 will have the greatest savings opportunities starting next year.

Specifically, there is an option for individuals aged 60 to 63, by the end of the tax year, to contribute 150% of the standard catch-up contribution limit. In 2025 the 401(k)/403(b)/457 amount is $11,250 ($7,500 * 150%) for a possible total contribution of $34,750. Simple IRA participants aged 60 to 63 are eligible for a similar additional catch-up and may contribute $5,250 for a total contribution of $21,750. Plan sponsors must adopt this change for individuals to participate in the additional catch-up.

Beginning in 2024, SECURE 2.0 allows for additional SIMPLE IRA plan contributions in certain situations. Special SIMPLE deferral amounts may be made with an employer election:

- Employers may make an additional 10% nonelective contribution, if made in a uniform manner, not exceeding the lesser of up to 10% of compensation or $5,000.

- The employee elective deferral amount is increased by 10% if the employer has no more than 25 employees. The employee elective deferral amounts is increased by 10% if the employer has 25 to 100 employees and the employer contributes either 3% compensation or 4% of an employee’s elective deferrals. In 2024 and 2025, the total amount is $17,600 for employees under age 50 and $21,450 for employees aged 50 or older.

Most deferral limits for individuals increased $500 from 2024 limits. Catch-up contribution amounts for taxpayers aged 50 or older by the end of the tax year, remained the same in 2025.

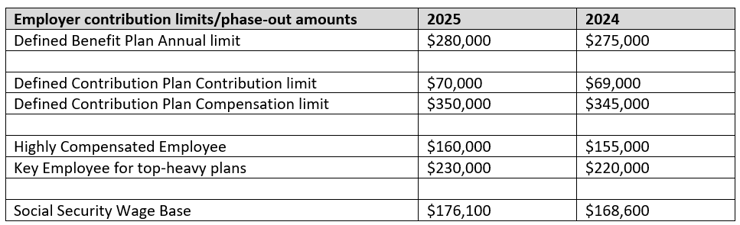

Additional retirement plan updates are provided below. Contact Eide Bailly's Compensation & Benefits Team or your Eide Bailly tax professional to learn more about employer benefit plan services or individual retirement savings.

Make a habit of sustained success.