Key Takeaways

- Deadline Day.

- 2023 1040s, 1120s, 709s due.

- Extra time available in some places because of disasters.

- Your preparer needs to have e-file authorization in-hand.

- For paper filings, use certified mail.

- U.S. vs. Europe taxes on workers.

- 5-hour energy tax controversy.

- National Cheese Curd Day.

Happy October 15, to those who celebrate. Today is the due date for extended 2023 Individual Form 1040. It is also the extended deadline for extended 2023 corporation Form 1120 and for individual extended gift tax returns filed on Form 709.

How should you file? If you can file electronically, that's how you should file. The IRS still struggles to process paper returns. Paper returns can delay your refund by months. And despite some silly things you may have read, e-filing is more secure than trusting your return to the vagaries of the postal service. Likewise, electronic deposit of your refunds is safer than waiting for a check.

If you are having your preparer transmit your electronic filing to the IRS, be sure they have your filing authorization today. They cannot file your returns unless they have the authorization in-hand.

If you must file on paper, document your filing. Gift tax returns still are paper-file only. Certified Mail, Return Receipt Requested, is the standard. Yes, it costs $4.40, but it can more than pay for itself if the IRS asserts a late filing penalty. If you really are a last-minute filer and you get to the post office after it closes, you can use an authorized private delivery service. Be sure you use the right delivery option; for example, UPS Next Day Air qualifies, but UPS Ground does not. Save your shipping documents.

If you unfortunately have to pay today - you are supposed to be paid up when you extend - consider one of the IRS electronic payment options. You can pay individual estimated tax payments on the IRS direct pay website. This is recommended. Otherwise, you put yourself at the mercy of the postal service and the IRS mailroom.

Many taxpayers have extra time for filing extended returns as a result of natural disasters. For example, all Florida filers who extended their 1040s last April now have until May 1 of next year to file for 2023. Many other taxpayers in the Southeast U.S. also had their extended due dates moved back to May 1, 2025 as a result of Hurricane Helene.

Disaster extension deadlines also apply with different due dates in parts of Washington, Arizona, Illinois, Pennsylvania, Louisiana, Connecticut, South Dakota, and Iowa. Check the IRS Disaster Relief Page if you think you might qualify.

And congratulations to all of you hard-working preparers out there. I hope you can take tomorrow off.

Secure Digital Tax Refund System Can Solve Stolen Check Problem - Andrew Leahey, Bloomberg. "First, the IRS should offer secure digital refund cards for those without access to bank accounts in a way similar to electronic benefits transfer cards for income assistance programs. Second, it should allow taxpayers to pick up refund checks at trusted and secure locations such as post offices. Third, there should be an optional mobile app to help taxpayers track and manage their refunds."

Taxes on the Campaign Trail

Trump and Harris Both Like a Child Tax Credit, but With Different Aims - Jason DeParle, New York Times:

Ms. Harris would expand the tax cuts and add a large anti-poverty plan, sending checks to millions of parents with low pay or no jobs. That would turn a tax cut into an income guarantee, in a landmark expansion of the safety net.

Trump Proposes Tax Write-Off for Generator Purchases - Alexander Rifaat, Tax Notes ($). "In an October 11 post on Truth Social, the Republican presidential nominee said that, if elected, he will pursue a plan that would allow taxpayers in North Carolina, Georgia, Florida, Alabama, South Carolina, Tennessee, Louisiana, Texas, and other states to qualify for the incentive."

The Budget

Another Huge Federal Deficit in Fiscal Year 2024 Despite Surging Corporate and Other Tax Collections - William McBride, Tax Policy Blog:

The main reason is that TCJA not only reduced the corporate tax rate but also substantially broadened the corporate tax base. TCJA limited deductions for net interest expense, net operating losses, and fringe benefits, required R&D expenses to be amortized over 5 or 15 years, repealed the domestic production activities deduction, and reformed international taxes. In total, these offsets were estimated by the Joint Committee on Taxation (JCT) to raise more than $1 trillion over a decade, offsetting more than three-quarters of the $1.3 trillion cost of reducing the corporate tax rate.

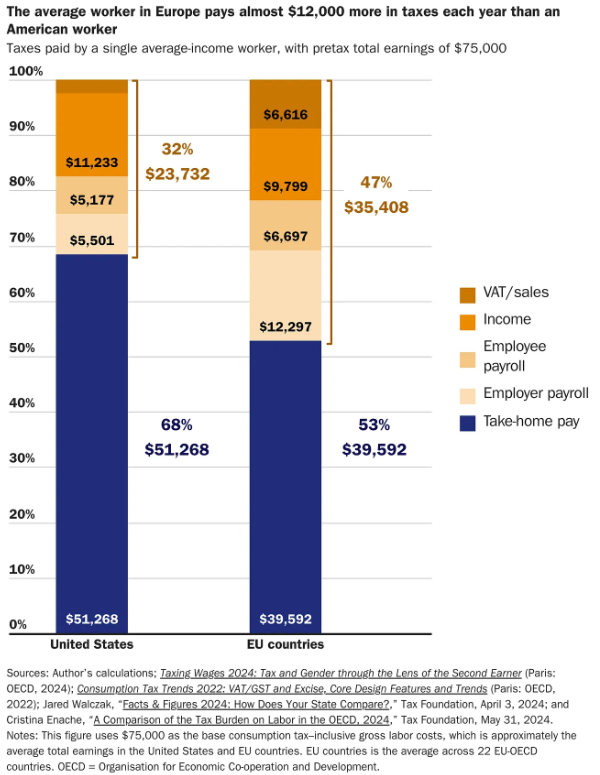

New Report: Big Government Means High Taxes on Everyone, Not Just the Rich - Adam Michel, Liberty Taxed. "Importing the European fiscal system to the United States would not only require a roughly 50 percent tax increase on lower- and middle-income American workers and families, but the higher taxes would also have broader economic costs, making society as a whole worse off."

Chart by Adam Michel

Energy

He Was a Monk, Then a Billionaire and Now an Alleged Tax Cheat - Margot Patrick, Wall Street Journal:

...

Not so fast, say U.S. tax authorities. They have another take on Bhargava’s Robin Hood moves: tax abuse.

Bhargava improperly lowered his tax bill by gifting a $624 million stake in his 5-Hour Energy partnership to charity, then buying it back with an IOU without ever giving up control of the company and its drink formula, the Internal Revenue Service alleged in civil tax court. It separately launched a criminal probe with the Justice Department into whether Bhargava used a daughter-in-law of the Indian guru, a Canadian citizen named Indu Rawat who heads his charitable giving, as a figurehead to shield additional wealth from U.S. taxes, according to people familiar with the matter and tax court filings.

Blogs and Bits

IRS processing 400,000 ERC claims worth $10 billion - Kay Bell, Don't Mess With Taxes. "The Internal Revenue Service says it has accelerated work on claims of COVID-19 pandemic tax break and is now processing around 400,000 claims. The eligible filings in that group are worth a total of nearly $10 billion."

Hurricane Milton Relief: Florida Now Has Until May 1, 2025 to File - Russ Fox, Taxable Talk. "With much of the state of Florida declared a federal disaster area, the IRS this morning announced that all residents of Florida have until May 1, 2025 to file their tax returns that are on extension. This impacts not only 2023 tax returns on extension, but the 2024 filing deadline next April."

FBAR deadlines postponed for victims of hurricanes Helene, Beryl and Debby, Tropical Storm Francine - National Association of Tax Professionals:

- Hurricane Helene victims have until May 1, 2025

- Victims of hurricanes Beryl and Debby and Tropical Storm Francine have until Feb. 3, 2025

Tax Crime on the Nature Trail

Utah outdoor retailer accused of evading $1.8m in taxes - IRS (Defendant name omitted, emphasis added):

According to court documents, Defendant of Washington City, Utah, owns and operates Outfitter, an outdoor retail and rental shop near the entrance of Zion National Park. It is alleged that, between 2018 and 2022, Defendant underreported over $5.4 million in sales. He did so by providing his tax-return preparers with profit and loss statements that underreported Outfitter’s gross receipts, falsely representing to his tax preparers that the profit and loss statements were accurate, signing and authorizing the filing of tax returns with the IRS that he knew were false, and structuring cash deposits into Outfitter’s checking account. This resulted in Defendant evading over $1.8 million in taxes.

Defendant is charged with five counts of evasion of assessment of income tax and five counts of fraud and false statements. His initial appearance on the indictment is scheduled for Oct. 28, 2024, at 10:00 a.m. before a U.S. Magistrate Judge at the St. George Courthouse.

If you hide income from your preparers, you can't blame them if the IRS comes calling.

What day is it?

It's Extension Deadline Day, of course, but it is also National Cheese Curd Day, for all you health food fans out there.

Make a habit of sustained success.