Key Takeaways

- Floor vote slated for 8 p.m. D.C. time.

- What's in, what's not.

- Senate fate uncertain.

- What it will really cost.

- Tax season news you can use.

- Blogs and bits.

- Tax Court highlights dangers of social media oversharing.

- Eat Brussel Sprouts, Hell freezes.

It appears that today will be the day that the long-awaited tax bill comes to a vote in the House of Representatives. Punchbowl News reports:

Breaking news: Speaker Mike Johnson is finally bringing the nearly $80 billion bipartisan tax bill to the floor today, ending a prolonged negotiation with angry New York Republicans.

...

The tax bill was negotiated by House Ways and Means Committee Chair Jason Smith (R-Mo.) and Senate Finance Committee Chair Ron Wyden (D-Ore.) over months of talks. It pairs business tax breaks with an expansion of the child tax credit.

If the bill moves forward as it was written by Smith and Wyden, it is expected to pass the House by a large margin. Since it’s coming up under suspension, it will need a two-thirds majority for passage.

Reports this morning say the vote is scheduled for 8 p.m. Eastern Time. What does "under suspension" mean? Wikipedia explains:

A motion to suspend the rules is in order on Mondays and Tuesdays and towards the end of a session of Congress and may only be made by the Speaker of the House or their designee, though it is customary for committee chairs to write the Speaker requesting a suspension. Once a member moves to "suspend the rules" and take some action, debate is limited to 40 minutes, no amendments can be offered to the motion or the underlying matter, and a 2/3 majority of Members present and voting is required to agree to the motion.

A suspension motion sets aside all procedural and other rules that otherwise prohibit the House from considering the measure—but the motion never mentions the specific rules that are suspended.

The bill includes a retroactive restoration of deductions for domestic research costs, 100% bonus depreciation, and the pre-2022 rules for deducting business interest. These items are paired with enhancements to the child tax credit to secure bipartisan support.

Speaker Johnson to Allow Vote on Business, Child Tax Breaks - Erik Wasson, Billy House, and Samantha Handler, Bloomberg:

House Majority Leader Steve Scalise officially announced the bill will come up for a vote on Wednesday. A two-thirds majority will be needed to pass it and prospects for its passage are good.

The decision to hold the vote came after a group of New York Republicans pressed Johnson for a separate vote on the state and local tax deduction cap. They briefly held up business in the house on Tuesday to make their case. Talks over the SALT cap went late into the evening in Johnson’s suite of offices.

Tax-Cut Loving Republicans Grumble at $78 Billion in Bipartisan Tax Cuts - Richard Rubin and Lindsay Wise, Wall Street Journal:

Some GOP lawmakers said that the proposed expansion of the child tax credit would undermine incentives to work. Others complained that immigrants who are in the country unlawfully could get some of the benefits because they can claim it if their children have Social Security numbers.

...

Even if the bill gets through the House, the Senate path isn’t clear. Republicans there have also been seeking changes.

Tax deal likely much more expensive than official estimate, experts warn - Tobias Burns, The Hill:

Adam Michel, director of tax policy studies at the libertarian leaning Cato Institute, described the official revenue scoring of the bill by the JCT as “a bit of a choose your own adventure.”

Tax season news you can use

IRS To Taxpayers: Don’t Wait For Congress To Act, File When Ready - Kelly Phillips Erb, Forbes ($). "The proposal would, among other things, phase in a refundable portion of the child tax credit and increase the maximum refundable amount per child to $1,800 for the tax year 2023—yes, that's last year— as well as $1,900 in the tax year 2024, and $2,000 in the tax year 2025. The refundable credit would allow lower-income families to qualify for it even if they did not owe any tax. It would allow for the same flexibility taxpayers had during Covid to use the current tax year or prior tax year earned income to calculate the credit."

IRS Set to Resume First Tranche of Collection Notices - Jonathan Curry, Tax Notes ($):

Taxpayers with a balance due in tax years 2020 and 2021 began receiving a new letter — designated the LT38 — late this January offering a friendly reminder that they do, in fact, need to pay up. These soft letters will be sent out on a staggered basis over the next few months to taxpayers who had received a CP500 series balance due reminder notice, Nikki Johnson, IRS director of collection, Small Business/Self-Employed Division, said during a January 30 IRS webinar.

Nearly two years ago, the IRS decided to stop sending automated collection reminder notices after it became swamped in piles of unprocessed mail and paper tax returns from taxpayers. That resulted in taxpayers who may have already sent in a payment or response to the IRS receiving automated notices claiming otherwise, creating confusion on all sides. Last December, the IRS announced it was preparing to restart the process in early 2024.

Taxpayers might forget that they owe, but the IRS computers seldom do.

Related: Eide Bailly IRS Collection Issues.

The Internal Revenue Service announced today tax relief for individuals and businesses in parts of Rhode Island affected by severe storms, flooding and tornadoes that began on Sept. 10.

These taxpayers now have until June 17, 2024, to file various federal individual and business tax returns and make tax payments.

The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA). Currently, this includes Providence County. Individuals and households that reside or have a business in this locality qualify for tax relief.

Treacherous Terrain of Tax Preparation Requires Strongest Ethics - Josie Harris-Walton, QPWB via Bloomberg ($): "Tax professionals can jeopardize their professional standing, as well as put their clients at risk of legal problems, by bypassing due diligence in the relentless pursuit of maximizing client refunds. This choice often involves overlooking critical aspects related to tax credits, deductions, and filing statuses."

In case you wonder why we ask so many questions.

Things to remember when filing 2023 tax returns - IRS:

2. Remember to report all types of income on the tax return. This is important to avoid receiving a notice or a bill from the IRS. Don’t forget to include income from:

- Goods created and sold on online platforms.

- Investment income.

- Part-time or seasonal work.

- Self-employment or other business activities.

- Services provided through mobile apps.

Blogs and bits: When to file, Tax Court deadlines, digital currency reporting

Congressional tax law tinkering and other reasons why you should wait to file your return - Kay Bell, Don't Mess With Taxes. "I have to agree with TaxTwitter pal CPA Joe Kristan's analysis, which also applies to proposed retroactive individual tax law changes: 'I have grave doubts that the IRS will properly compute research expense, bonus depreciation, and Sec. 163(j) interest on its own. The changes in the bill would generally result in lower taxes for business. As chances for passage seem to be improving, it's hard to justify filing in a hurry with a balance due in hopes IRS will recompute taxes and issue timely refunds if passage occurs.'"

Tax Court Petition Mailed By Erroneous Due Date on Notice of Deficiency Was Timely - Parker Tax Pro Library. "The Tax Court held that a couple who filed a Tax Court petition before the deadline specified in a notice of deficiency, which was one year from the date on which the IRS mailed the notice, timely filed the petition, even though the IRS mailed a second notice one day later that purported to correct the deadline for filing a petition. The court found that the petition was timely under the last sentence of Code Sec. 6213(a), the petition was timely, and the court therefore had jurisdiction, because it was filed on or before the date specified for filing on the notice."

IRS postpones reporting of digital asset transactions, regulations coming - National Association of Tax Professionals. "The IRS has announced that it will not require businesses that receive digital assets with a fair market value (FMV) in excess of $10,000 in a transaction, or series of transactions, to file information reports until regulations are issued. The move postpones the implementation of legislation that added digital assets to the definition of cash for information reporting purposes that was to take effect Jan. 1."

But that doesn't mean digital currency transactions are somehow tax exempt.

Tax Policy Corner

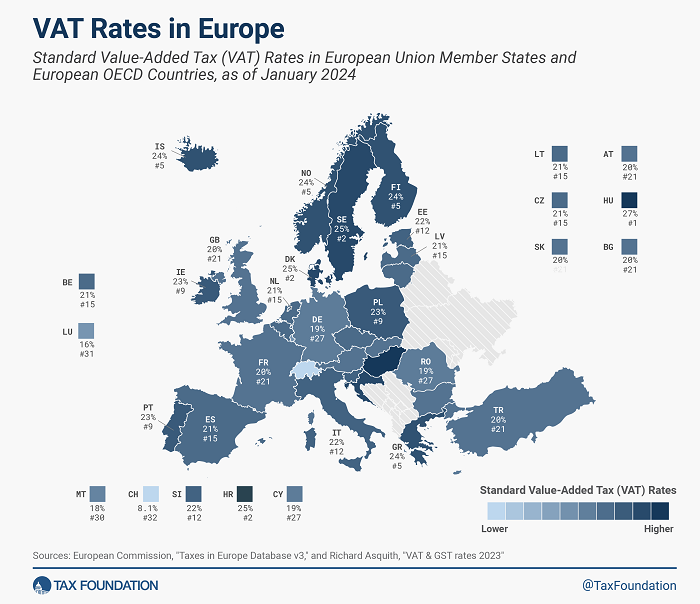

VAT Rates in Europe, 2024 - Alex Mengden, Tax Foundation:

The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 16 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent). The EU’s average standard VAT rate is 21.6 percent, more than six percentage points higher than the minimum standard VAT rate required by EU regulation.

The absence of a VAT in the U.S. is the primary reason the U.S. tax system is much more progressive than European taxpayers. The likely near-future U.S. fiscal train wreck may eventually lead to a U.S. VAT.

Tax in the courts: oversharing.

Lavish Lifestyle Leads to Taxpayer Loss in Innocent Spouse Case - Mary Katherine Browne, Tax Notes ($): A University of California, Berkeley, instructor wasn’t entitled to innocent spouse relief because she was aware of the family tax issues and enjoyed an affluent lifestyle, with expenses including a Land Rover, Dior bags, and a 5-carat diamond ring, the Tax Court held."

I wrote about this case last year in an article for Bloomberg. The taxpayer is one of the rare bloggers who has posted regularly for a long time. Among the topics covered was the death of her husband, who left behind unpaid federal income taxes. The taxpayer had filed joint returns with the deceased spouse and argued that she shouldn't be held liable for the taxes under the "innocent spouse" rules.

The Tax Court last year held that the taxpayers blog posts could be considered in determining whether the taxpayer met the requirements for innocent spouse relief. My Bloomberg piece said:

IRS guidance details factors it considers when analyzing Section 6015(f) equitable relief, including:

- Whether the spouses are still married;

- Whether the spouse requesting relief would suffer economic hardship; and

- Whether the spouse requesting relief knows or had reason to know that the taxes were being understated.

The IRS started focusing on Thomas’ blog because all facts and circumstances can include aspects of a taxpayer’s marriage and financial life, and the blog reflected some of these.

Sure enough, the blog figured into the Tax Court's decision. From yesterday's opinion (my emphasis):

Finally, Ms. Thomas's blog also provides insight into her various expenses since the unpaid tax liabilities arose. For example, Ms. Thomas blogged about purchasing a green Dior bag for her daughter's 18th birthday as well as owning several designer bags herself. She has also blogged about paying a business coach $220 an hour for private sessions. While Ms. Thomas may argue that her blog does not reflect her reality, she has not convinced us that she did not incur these expenses. And again, these expenses demonstrate how she has significantly benefited from her unpaid taxes.

To the extent Ms. Thomas might argue that this factor is neutral on account of abuse, a significant share of the lavish expenditures were made by Ms. Thomas and not Mr. Thomas, as the examples above demonstrate. And to the extent that she argues that some of these purchases were made when she thought the taxes were paid, Revenue Procedure 2013-34 draws no such distinction between expenses made before a requesting spouse knows about unpaid liabilities and those made after. In any event, the record shows that many of the lavish expenses described above, including the Land Rover, vacations, education expenses, and the green Dior bag, were incurred at times when Ms. Thomas knew about the tax problems. So even if the legal distinction she attempts to draw were accepted, her argument would be contradicted by the factual record.

This unfortunate result for the taxpayer has a lesson for the rest of us, but especially for Tax TikTok influencers: the IRS has the internet. Those folks who post videos of themselves living it up and saying everything is deductible because the have an LLC, or some such, are likely to find the IRS among their devoted followers. The IRS knows how to monetize your social media presence.

What Day is it?

It's all coming together. A bipartisan tax bill might pass the house today. It's Eat Brussel Sprouts Day. But it all makes sense, as it is also Hell is Freezing Over Day.

Make a habit of sustained success.