Key Takeaways

- Which TCJA provisions have the right stuff

- Tax deal taking the long road

- EV credits criticized, but useful

- ROI on tax crackdown

- Regs on Limited Partnerships

- Clock ticking on Roth Catch-Up

- Eye on College Athlete Collectives

- More on Moore

- SALT everything!

- Curry + Chicken = Lunch

In honor of Dr. Martin Luther King Jr. Day our offices will be closed on January 15th. We will reopen on January 16th.

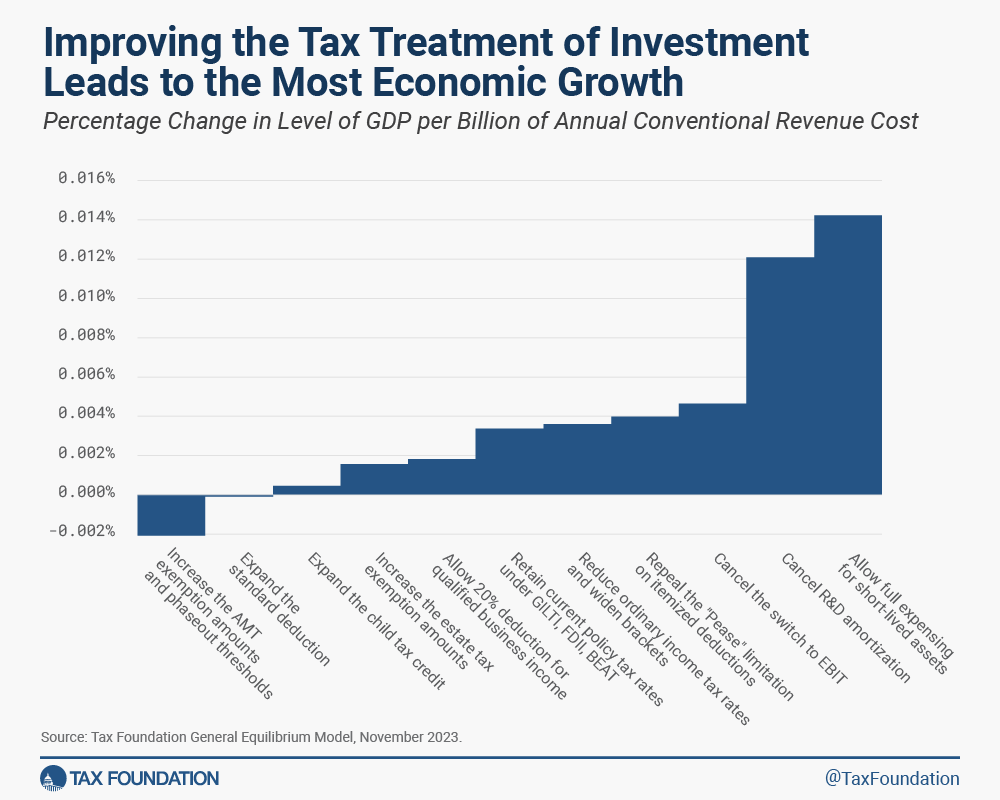

Which Provisions of the Tax Cuts and Jobs Act Should Be Made Permanent? – Erica York, Tax Foundation:

The 118th Congress returns to Washington this week with a major tax elephant in the room—most of the 2017 tax reform law will expire after the end of next year. If lawmakers allow full expiration to occur, most Americans will see their personal tax bills rise and incentives for working and investing worsen. Extending the entire tax reform, however, would come with a $3.7 trillion price tag at a time when the country’s fiscal outlook is already bleak.

Lawmakers should use the year ahead to thoroughly review and debate lasting, fundamental tax reform and prioritize policies that best boost work and investment incentives in a fiscally responsible manner.

Hearings are expected to occur this year where tax-writing lawmakers will vet TCJA provisions and debate what stays, what goes, and what gets modified. In 2025, lawmakers are expected to vote on tax legislation that will extend certain TCJA provisions and leave others behind.

The 2024 elections will be a huge factor in determining what stays and what goes:

$6 Trillion in Taxes Are at Stake in This Year’s Elections – Richard Rubin, Wall Street Journal ($):

There isn’t a dime’s worth of a difference between the political parties. The chasm is more like $6 trillion.

The winners of November’s presidential and congressional elections will quickly face decisions on extending tax cuts scheduled to expire after 2025. President Biden and Republicans support starkly different tax plans.

Republicans generally want to extend all expiring tax cuts from the 2017 law former President Donald Trump signed. The price tag: $4 trillion over a decade.

Biden proposed extending Trump’s tax cuts for households making under $400,000 annually but said the rest should expire. Beyond that, he would raise taxes further on top earners and corporations. That plan, including tax increases the president hasn’t fully detailed, would generate more than $2 trillion beyond current forecasts.

Tax Deal Negotiations Continue, Yet Some Are Already Unconvinced – Doug Sword and Cady Stanton, Tax Notes ($):

High-level talks on a multifaceted federal tax package continued as the congressional week neared its end, but skepticism abounded over support for a deal…

The meetings were held to discuss an as-yet-unannounced $70 billion collection of tax proposals centered around an expansion of the child tax credit and rollbacks of the Tax Cuts and Jobs Act’s tightenings of research and development expensing, bonus depreciation, and net interest expensing…

Among Ways and Means Committee members, there’s little agreement over whether a tax bill can get done and passed by tax season kickoff January 29. Rep. Gregory F. Murphy, R-N.C., said Wyden and Smith’s negotiations are getting “closer and closer” but told Tax Notes that passage by the end of January “may still be a little bit optimistic.”

Since this week began other publications have also reported that progress is not good for quick passage of tax legislation.

Capitol Hill Recap: Tax Bill in the Pipeline – Jay Heflin, Eide Bailly:

Recent press reports are not painting a pretty picture for how behind-closed-doors tax discussions are going with lawmakers.

Negotiations over the package remain fluid…and tax writers were struggling Wednesday to nail down an agreement amongst themselves.

Senate GOP pessimism… House Democrats iffy…

Any effort to pass the tax package would likely start in the House. But between the pressure from the right on Speaker Mike Johnson and government funding deadlines about to hit, there’s not much room to maneuver here.

This bill is a work-in-progress:

Chief tax writers working to broaden appeal of tentative accord – Caitlin Reilly, Roll Call:

A bipartisan, bicameral $70 billion tax agreement taking shape on the Hill is drawing mixed reviews, pointing to potential challenges ahead for Senate Finance Chair Ron Wyden and Ways and Means Chairman Jason Smith…

Some Senate Finance Republicans said they were eager to reach a deal. Others took issue with the plan to end the pandemic-era employee retention tax credit early as a means to cover its costs, as well as the scope of the tentative child tax credit expansion…

On the other side of the issue, some Democrats want a package that would do more to expand the child tax credit, specifically make the full credit available as a refund to families with little or no taxable income, as was the case under the 2021 pandemic relief law.

If the bill fails to pass Congress, then it will likely be due to arguments over the Child Tax Credit. Currently, there is bipartisan, bicameral support for the business-related measures.

Manchin Takes EV Credit Gripes to Treasury, DOE in Hearing – Cady Stanton, Tax Notes ($):

Sen. Joe Manchin III, D-W.Va., put two Biden administration officials on the spot with questions over what he sees as flawed proposed rules for clean vehicle purchasing subsidies that don’t match the intentions of lawmakers.

Manchin, who has repeatedly criticized Treasury’s proposed regulations on the section 30D subsidy enacted in the Inflation Reduction Act, held the January 11 hearing as chair of the Senate Energy and Natural Resources Committee to ask questions of Treasury and Department of Energy deputies about the guidance…

“My problem is not with EVs,” Manchin said. “My problem is with this administration’s crusade to convert everyone over to an EV regardless of where the battery came from or what the law actually says.”

Energy Credit Transferability More Appealing Than Direct Pay – Alexander Rifaat, Tax Notes ($):

Transferring energy tax credits enacted as part of the Inflation Reduction Act is proving to be an attractive option for eligible entities compared with receiving direct payment from the IRS, according to tax lawyers involved in green energy projects.

Speaking at a conference hosted by the District of Columbia Bar Taxation Community, Shariff N. Barakat of Akin, Gump, Strauss, Hauer & Feld LLP said January 10 that he was witnessing a clear preference in the market for using the transferability of the energy subsidies, which seek to encourage domestic production and purchases of clean energy technologies, because of the timing of payments.

IRS’s Millionaire Crackdown Yields a Half-Billion Dollar Haul – Jonathan Curry, Tax Notes ($):

A special effort to collect tax debts owed by 1,600 high-income taxpayers has brought in $482 million so far, according to the IRS.

When that’s added to the $38 million collected from 175 similarly wealthy taxpayers in the pilot initiative that preceded this latest effort, the total revenue recovered from millionaires climbs to $520 million, the agency said in its latest quarterly update on the IRS’s Inflation Reduction Act-related initiatives, released January 11.

FACT SHEET: IRS Ramps Up New Initiatives Using Inflation Reduction Act Funding to Ensure Complex Partnerships, Large Corporations Pay Taxes Owed, Continues to Close Millionaire Tax Debt Cases – Treasury Department:

The IRS is working to ensure large corporate, large partnership and high-income individual filers pay the taxes they owe. Prior to the Inflation Reduction Act, more than a decade of budget cuts prevented the IRS from keeping pace with the increasingly complicated set of tools that the wealthiest taxpayers use to hide their income and evade paying taxes owed. The IRS is now taking swift and aggressive action to close this gap.

SECA Guidance Will Set Limits on Active Limited Partners – Kristen Parillo, Tax Notes ($):

The guidance project on the limited partner exception to self-employment tax will address the circumstances under which an “active” state law limited partner isn’t entitled to the exception, according to an IRS official.

“We've long needed guidance in this area, and it is time to provide it,” Holly Porter, IRS associate chief counsel (passthroughs and special industries), said January 11 at a conference hosted by the District of Columbia Bar Taxation Community.

Porter provided details on a project — simply titled “Guidance under section 1402(a)(13)” — included in the government’s initial 2023-2024 priority guidance plan released in September 2023. She explained that guidance is needed to clarify the statutory provision’s scope, given the volume of litigation and controversy.

IRS Provides Penalty Relief on Hot Assets Reporting – Kristen Parillo, Tax Notes ($):

The IRS won’t impose penalties on partnerships that are unable to provide complete hot asset gain reporting to affected partners by the January 31 deadline because they don’t have all data for new computational requirements.

The penalty relief, announced January 11 in Notice 2024-19, 2024-5 IRB 1, responds to tax professionals’ concerns that most partnerships will be unable to timely complete the recently revised Form 8308, “Report of a Sale or Exchange of Certain Partnership Interests.”

Consolidated Return Tax Regs May Be Paired, Officials Say – Kat Lucero, Law360 Tax Authority ($):

The U.S. Treasury Department is actively working on two consolidated return regulations — one on group continuation and the other on redetermination of unrealized gain or loss — that were recently revived and may publish them together or close to their release dates, officials said Thursday.

The department is prioritizing the pair of regulations after it reopened the projects last year under the current guidance plan, according to Colin D. Campbell Jr., an associate tax legislative counsel at the Treasury's Office of Tax Policy. He spoke at a tax conference hosted by the District of Columbia Bar in Washington, D.C., and online.

Retirement Plan Roth Catch-Up Relief Won’t Be Extended, IRS Says - Austin Ramsey, Bloomberg ($):

Recent temporary enforcement relief on swift, post-tax retirement plan catch-up contributions was a one-time respite, and sponsors should be ready by 2026, according to an IRS official speaking Thursday at the 2024 D.C. Bar Tax Conference.

Regulators took care to balance the industry’s need for more time to build record-keeping and payroll systems that can handle the new SECURE 2.0 Act (Pub. L. No. 117-328) provision with clear congressional intent to use the measure as a revenue raiser, Treasury Department Deputy Benefits Tax Counsel Helen Morrison said.

IRS Is Looking at Next Steps on College Athlete Collectives - Naomi Jagoda, Bloomberg ($):

The IRS is “considering all options” when it comes to issues around the tax-exempt status of name, image, and likeness collectives, including issuing additional guidance, an agency official said Thursday.

The agency is carefully weighing how it wants to move forward on the topic, Lynne Camillo, deputy associate chief counsel at the IRS, said at the 2024 D.C. Bar Tax Conference. She noted, however, that NIL guidance isn’t on the IRS’s most recent priority guidance plan.

Judge Upholds IRS Guidance On Abusive Benefit Trusts – Anna Scott Farrell, Law360 Tax Authority ($). “Guidance from the Internal Revenue Service that requires disclosure of potentially abusive benefit plans is not unlawfully vague, an Arizona federal court ruled, rejecting arguments from a recruiting firm that claimed the guidance was confusing and wrongly labeled transactions as abusive.”

Taxpayers’ Listing Notice Suit Can’t Repackage Vagueness Claim – Nathan Richman, Tax Notes ($):

Plaintiffs seeking to invalidate a 2007 transaction listing notice can’t make arguments that the IRS exceeded its authority in defense of their surviving vagueness claim, an Arizona federal court concluded.

On January 10 Judge David G. Campbell of the U.S. District Court for the District of Arizona granted the government’s summary judgment motion on the last two claims in Govig & Associates Inc. v. United States, a suit challenging the IRS’s actions promulgating and applying Notice 2007-83, 2007-45 IRB 960.

Narrow Moore Ruling Would Avoid Tax Code Shakeup, Panel Says - John Woolley, Bloomberg ($):

The US Supreme Court will likely issue a narrow ruling to resolve a high-profile dispute over a one-time tax on foreign earnings to avoid collateral damage in other parts of the US tax code, a panel of tax advisers said Thursday.

Moore v. United States asks the court to resolve whether an income tax under the 16th Amendment may target all economic gains, or only gains realized by the taxpayer. But the justices might uphold the tax at issue without reaching a conclusion about whether money must be realized to be taxed as income, said panelists speaking at the 2024 D.C. Bar Tax Conference.

Chevron Cases Unlikely To Undermine Treasury, IRS Atty Says – Kat Lucero, Law360 Tax Authority ($):

The U.S. Treasury Department's rulemaking authority is unlikely to get hamstrung by a pair of cases before the U.S. Supreme Court that aim to weaken the so-called Chevron deference that federal courts have long relied on when reviewing ambiguous regulations, an IRS attorney said Thursday.

The underlying arguments in the cases — known as Loper Bright Enterprises v. Raimondo and Relentless v. Commerce — do not challenge procedures or reasoned decision-making that might lead to changes in processes, according to James Kelly, deputy associate chief counsel, international, at the Internal Revenue Service.

New working paper: The Global Minimum Tax and the taxation of MNE profit – OECD:

The Global Minimum Tax (GMT) introduces significant changes to the international tax architecture and thereby to the taxation of large multinational enterprises (MNEs). This paper assesses the impact of the GMT using new and unique data on MNE worldwide activity building on comprehensive estimates of global low-taxed profit. The global minimum tax is estimated to reduce global low-taxed profit by about 80% - from 36% of all profit globally to about 7%. This reduction stems from both the reduction in profit shifting and the application of top-up taxes. The GMT is estimated to raise additional corporate income tax (CIT) revenues of USD 155-192 billion globally each year or between 6.5% and 8.1% of global CIT revenues. It is also estimated to reduce tax rate differentials across jurisdictions with potential impacts on the allocation of investment and MNE activity.

From the “Of Course They Do” file:

New York Republicans Want SALT Debate in Tax Bill Discussion - Samantha Handler, Bloomberg ($):

A New York Republican is trying to drum up support to allow a debate on raising the state and local tax deduction cap as bipartisan tax package negotiations leave out those proposals.

Rep. Nick LaLota (R-N.Y.) is circulating a letter asking Speaker Mike Johnson (R-La.) to move any tax package through what’s known as “regular order” so members can debate an amendment that would raise the SALT cap. The 2017 Republican tax law instituted a $10,000 limit on deductions for state and local taxes, which has drawn opposition from New York, New Jersey, and California Republicans as well as some Democrats.

Any adjustment to the SALT-cap is expected to occur in 2025, according to lawmakers on the tax-writing committees and tax staff. The best anti-SALT-cappers are expected to get is a doubling of the cap (from $10,000 to $20,000) for joint filers; the cap for single filers would remain at $10,000, according to tax staffers.

Happy National Curried Chicken Day! Curry smells wonderful. Tastes great! Lunch plans are made!

Make a habit of sustained success.