Key Takeaways

- Tax deal talk resumes. Don't count on a deal just yet.

- Microcaptive arrangement fails in tax court.

- Purported insurance company a "piggy bank."

- Refunds come slower for the unbanked.

- IRS stuck with its own deadline error.

- FedEx Ground grounds Tax Court filing.

- U.S. wealth distribution after taxes and transfers

- Proposals for working families.

- Construction, tax fraud leads to prison time.

- National Bird Day.

Here’s one bipartisan deal Congress could strike in January - Theodoric Meyer and Leigh Ann Caldwell, Washington Post:

Senate Finance Committee Chairman Ron Wyden (D-Ore.) and House Ways and Means Committee Chairman Jason Smith (R-Mo.) — who are negotiating the package alongside Rep. Richie Neal (D-Mass.) and Sen. Mike Crapo (R-Idaho) — have agreed on a framework, according to two Democrats and two Republicans familiar with the discussions.

The idea is to write a $100 billion bill. Half the cost would come from restoring three tax breaks prized by Republicans and the other half from increasing the child tax credit, according to the people, although one of them cautioned that $100 billion was probably an upper bound rather than a target.

It seems like a popular day for articles on a potential tax bill:

US Business, Child Tax Break Deal Percolating on Capitol Hill - Erik Wasson, Samantha Handler, and Chris Cioffi, Bloomberg: "A potential deal between Senate Democrats and House Republicans would involve a retroactive renewal for 2023 of an expired research and development break, as well as a deduction for some kinds of interest and expanded “bonus” depreciation of investments like equipment."

Punchbowl News tells us not to expect too much: "We still think a tax agreement clearing Congress anytime soon is unlikely." They add: "Any bipartisan tax deal would be a huge development. And lead negotiators are eyeing a very ambitious deadline. They could try to attach a tax compromise to whatever government funding deal leaders cobble together later this month, just in time for the 2023 filing season."

Eide Bailly's Jay Heflin cautions, "We’re in wait-and-see mode for whether Congress will pass tax legislation this year."

Artex-Managed Microcaptive Fails to Qualify as Insurance - Chandra Wallace, Tax Notes ($):

The Tax Court rejected premium deductions for a microcaptive arrangement that it held wasn’t insurance and affirmed the taxpayers’ liability for accuracy-related penalties.

...

Microcaptives — small insurers owned by the companies they insure — are afforded favorable tax treatment under section 831(b), which provides that they don’t have to pay taxes on their premium income, even though the companies they insure can deduct those premium payments for federal income tax purposes. The arrangements have come under scrutiny from the IRS because of the potential for abuse when the relationship between a microcaptive and its owner is not a bona fide insurance relationship.

Tax Court Rejects $3.6M In Deductions For Captive Insurance - Anna Scott Farrell, Law360 Tax Authority ($):

Risk Management Strategies Inc., an S corporation that employed banks that administered special-needs trusts, took $1.2 million annually in undeserved business deductions for 2012 through 2014 for what it claimed was insurance coverage provided by the corporation's affiliated insurance company based in Anguilla and other entities, the Tax Court said in a memorandum opinion. The amounts Risk Management claimed it paid for insurance would have reduced the corporation from a profitable enterprise to one that was just breaking even, the court said, basing its analysis on Risk Management's tax returns.

The average rate on line for Risk Management's captive policies was more than 10 times greater than for average commercial insurance companies, the court said, even though there was no evidence that the corporation had any issues with its existing commercial insurance coverage. The premiums were not supported by detailed underwriting, and nothing in the shareholders' testimony explained why the corporation would pay such "exorbitant sums" for coverage, Tax Court Senior Judge L. Paige Marvel wrote for the court.

Captive Payments Not Deductible as Insurance, Tax Court Says - John Wooley, Bloomberg ($):

Risk Management Strategies Inc., an S corporation, reported $1.2 million in expenses for purported insurance coverage provided through an arrangement with its captive insurer, Risk Retention Ltd., and other entities, according to the court. The IRS determined federal income tax deficiencies and accuracy-related penalties for the RMS shareholders in 2018, saying the arrangement didn’t actually provide insurance coverage, and therefore couldn’t support deductions for the amount paid in premiums, the opinion said.

The Tax Court sided with the IRS, concluding that RMS’s premium payments didn’t qualify as either deductible insurances expenses or reserves set aside for self-insurance under IRC Sections 162 and 165, respectively. That’s because Risk Retention operated in an “unthinking” manner, and its policies “were designed only to resemble insurance policies superficially,” the opinion said.

Link: T.C. Memo 2024-2

Ben Peeler, head of Eide Bailly's Tax Controversy team, has thoughts on the case:

One of the most important components of this case compared to previous cases is that the Court heavily scrutinized the Provincial Pool arrangement. It found that the pool was run to show case claims, work as a self-insurance pool controlled by the insureds and even backdated documents to establish losses to validate the pooling arrangement.

Additionally, it found that simply adding deductible financing as a component of insurance did not create risk distribution because it simply acted as a piggy bank for holding self-insured deductibles, not any risks of the insurance which was still run through a commercial insurer. The Court found these were just more round tripping of cash accumulations for tax purposes. These issues combined with the similar issues with previous captives such as unprofessionally run, invalid policies, unreasonable premium amounts, working to premium targets around tax deduction limits, loans that round trip the premiums to the insured, account for the demise of another Artex captive.

Finally, it should be noted that the Court did not accept their reliance on their accountant and his general understanding that captives were a valid and that premiums paid to a captive were necessary and reasonable. The Court demanded actual advice about the legal requirements for a valid insurance company and found no professional opined on this. This amounts to a higher standard than required for penalties in Avrahami and a significant shift in the Court’s rulings. This highlights the importance of an independent review of the captive arrangement prior to entering into it, by a professional with understanding of the relevant legal issues.

Open a bank account so IRS can direct deposit your tax refund - Kay Bell, Don't Mess With Taxes. "In order for the IRS to be able to deposit your refund, the apps must have routing and account numbers associated with them that can be entered on a tax return. Check with the mobile app provider or financial institution to confirm which numbers to use."

Taxpayer Allowed to Rely on Notice of Deficiency Statement of Last Day to FIle a Tax Court Petition Even When the Date Was More than a Year After the Notice Was Issued - Ed Zollars, Current Federal Tax Developments. "What are the implications when the Internal Revenue Service (IRS) erroneously states the filing deadline for a petition in the Tax Court to contest a notice of deficiency? In a situation where this error significantly favored the taxpayer, the Tax Court determined that the taxpayer was entitled to rely on the date specified in the initial notice, despite the IRS issuing a corrected notice the following day."

Tax Court Bounces Two Petitions Sent Via FedEx Ground - Leslie Book, Procedurally Taxing via Tax Notes. "While FedEx Ground is much cheaper than the other services, it only delays receipt by a few days. In the Nguyen case, for the 2017 and 2018 tax years, the IRS proposed $2,572,624 and $113,318, in additional tax and civil fraud penalties of $1,895,708 and $84,975. Given the outcome, this likely lands in the penny-wise, pound-foolish category."

America Spreads the Wealth — and Redistributes It, Too - Tyler Cowen, Bloomberg. "It’s also worth noting that the top marginal tax rate of 70% was never entirely binding; effective rates of taxation were lower than they looked. (I recall my father being given the use of a series of “company cars” in the 1970s largely to avoid taxable income.) More recently, in 2020, although published marginal income tax rates were lower, the top 10% of earners paid for 74% of the income tax burden, and the top quarter paid for 89%. Unlike most European nations, the US does not have a value-added tax to shift a big part of the burden back onto the middle class."

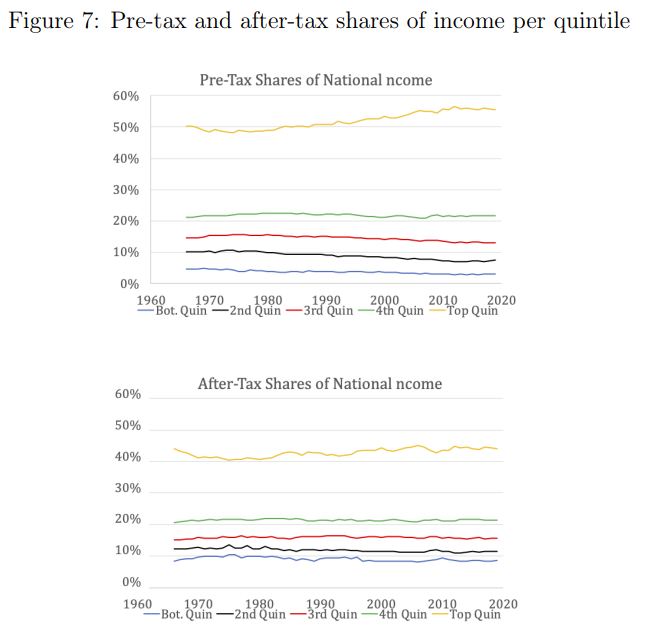

The article quotes a recent study, "How Progressive is the U.S. Tax System?" It contains these charts of income distribution in the U.S., before and after taxes and transfers:

Pro-Growth Tax Policy For Working Families - Leonard Burman, TaxVox. "I believe that wage stagnation is a significant factor behind the discontent of many American workers, even as we remain the richest country in history. Unless we can find a way to share the gains from growth more broadly, resistance to pro-growth policies will increase. History dating back at least as far as the Industrial Revolution suggests that workers will resist mechanization when it is perceived as a threat to their livelihood."

Polk County woman sentenced for role in construction-related tax fraud conspiracy - IRS (Defendant names omitted):

U.S. District Judge Virginia M. Hernandez Covington has sentenced Defendant to 12 months and one day in federal prison for conspiracy to defraud the United States and the Internal Revenue Service. The court also ordered Defendant to pay restitution to two victim insurance companies and to the Internal Revenue Service in the amount of $8,953,629.24. Defendant had pleaded guilty on October 4, 2023.

...

During the time period charged, Defendant falsely and fraudulently represented in insurance applications that her companies had a very limited payroll and a very limited number of employees who worked on construction jobsites. Defendant also caused the transmission of false and fraudulent wire communications to numerous contractors representing that her companies' employees had full worker's compensation coverage.

In reality, Defendant's companies received and cashed more than $34 million in checks from various construction contractors for these purported "employees." These payroll figures far exceeded the very limited payroll figures that Defendant had reported to her worker's compensation insurance companies. As a result, these employees—who were, in reality, the employees of other entities—performed work on jobsites without adequate insurance coverage. In addition, the insurance companies that dealt with Defendant's companies lost premiums they would have charged had they been aware of the true number of workers their policies were thus being manipulated to cover. The insurance companies sustained losses on the insurance premiums that were not paid.

As a result of these misrepresentations, Defendant's companies also disclaimed responsibility for ensuring that jobsite workers were legally authorized to work in the United States and evaded laws that required the payment of state and federal payroll taxes on behalf of these workers. Defendant's companies did not collect or remit all required payroll taxes to the United States. In addition, the contractors who actually paid these workers' wages and used their services were also able to avoid responsibility for those taxes. The amount of those unpaid payroll taxes totaled more than $8.9 million.

That $8.9 million is likely to be an ongoing problem for the defendant after she spends her year in prison. It is very difficult to get out of that, even in bankruptcy.

Fill those feeders! It's National Bird Day.

Make a habit of sustained success.