Key Takeaways

- Lawmakers outline tax plan, but will it pass?

- IRS reminder for Jan 31 filing deadline

- Tax agency still struggles with service

- Scam alert!

- CFC, PFIC guide

- Not too Old for the Slammer

- Oysters!

Get ready for a big day in tax policy - Laura Weiss and Brendan Pedersen, Punchbowl News ($) (scroll down):

Today’s schedule is packed with meetings that could determine the fate of a highly-anticipated bipartisan tax deal.

But even as top tax writers are on the verge of a deal, they’ll need to navigate a deeply skeptical Washington and some notable dissent from across the Capitol.

The tax plan (I wouldn’t yet call it a “bill”) that is expected to be under discussion would allow for certain R&D costs to be expensed, expanding the 163 (j)-interest deduction, up Bonus Depreciation to maybe 100% and enlarge the Child Tax Credit but also include constraints on who can claim it. Other tax provisions will also be included.

This plan is not yet complete:

Congress Nears Business Tax Deal, With Offsets as Sticking Point - Samantha Handler, Bloomberg ($):

[Senate Finance Ranking Member Mike] Crapo cautioned that the deal isn’t put together yet, citing “a lot of demands for other issues.” He also declined to go into specifics about the negotiations but said offsets are one of the points still being negotiated.

“We have to put together a bipartisan, bicameral agreement that will be able to not only survive the filibuster but survive the dynamics in the House,” Crapo said.

The cost of this plan could be "offset" by modifications to the Employee Retention Tax Credit. How this credit would be modified to raise money is unclear.

Congress Explores Curbing Pandemic Tax Break in Bid for Last-Ditch Deal – Richard Rubin, Wall Street Journal ($):

U.S. lawmakers are considering curbing a troubled pandemic-era tax credit as they negotiate a bipartisan deal that could include about $100 billion in tax breaks for businesses and families…

The Internal Revenue Service has been using audits, criminal investigations and a voluntary payback program to combat what officials see as fraud and ineligible claims. But taxpayers can continue claiming the credit through April 2025, and the IRS already has about one million claims it hasn’t processed that could in total exceed $240 billion, according to a Piper Sandler estimate. IRS Commissioner Danny Werfel will brief senators Wednesday on the ERC.

“There is a good argument for using some of those dollars from cleaning up the abuses,” Wyden told reporters. He wouldn’t say what ERC changes lawmakers are considering.

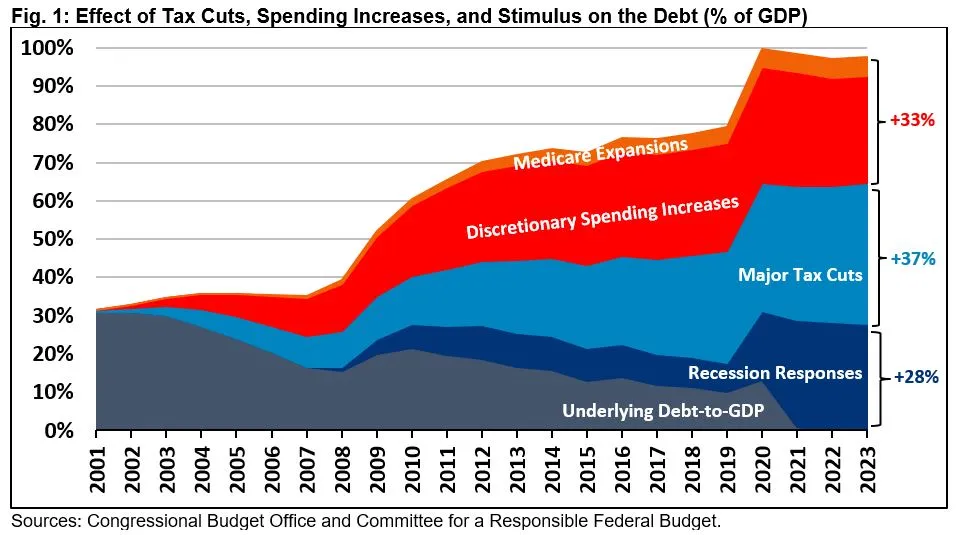

Tax measures that will offset the cost of tax cuts will be a major issue to tackle when enacting tax legislation. Tax cuts have played a role in adding red ink to federal coffers, according to a well-respected DC think tank:

From Riches to Rags: Causes of Fiscal Deterioration Since 2001 - Committee for a Responsible Federal Budget:

In 2001, the U.S. federal government ran a $128 billion budget surplus and was on course to pay off the national debt by 2009. Since then, the government has borrowed an additional $23 trillion, bringing the national debt held by the public to a near-record 98 percent of GDP and transforming that surplus into a $1.7 trillion deficit.

Some have claimed this fiscal deterioration was entirely caused by tax cuts or was completely due to spending growth. In reality, both spending increases and revenue reductions can explain the growth in deficits and debt.

The text that is bolded was not added by Eide Bailly. The think tank bolded it to make a point.

The hope is for these provisions to be include in a bill and enacted before tax filing season starts on January 29th.

Lawmakers will discuss this plan later today, according to Punchbowl News ($) (same article as above):

The agenda: Senate Finance Committee Democrats plan to meet this morning, while House Ways and Means Committee Republicans are set to huddle over lunch. Ways and Means Democrats will gather at 2 p.m. to talk through the potential deal.

The agreement between Senate Finance Committee Chair Ron Wyden (D-Ore.) and House Ways and Means Committee Chair Jason Smith (R-Mo.) is expected to be in the $50 billion to $80 billion range…

Rumors in Washington say the tax plan will cost $60 billion over a three-year period, 2023 thru 2025. Also, not all leaders within the tax-writing committees have signaled support for this plan. Getting rank-in-file members onboard could be a heavy lift.

Punchbowl News:

To be clear, it’s going to be extremely tough to get this passed — whether it’s attached to a government funding deal or attempted on its own — before tax filing season begins Jan. 29.

Most important: Congressional leaders have yet to express support for this tax plan. Without their support this tax plan goes nowhere, and right now leaders are focused on spending:

Short-term stopgap bill appears likely as funding talks drag – Aidan Quigley, Roll Call:

Lawmakers in both parties Tuesday acknowledged the necessity of a short-term stopgap spending bill to allow appropriators time to work through final fiscal 2024 funding measures following this weekend’s topline deal…

Speaker Mike Johnson, R-La., has vowed that the continuing resolution he put on the floor in November would be the last short-term stopgap measure.

However, despite the topline deal, finalizing full-year appropriations will take weeks of negotiation and require more time; the first four bills would need to be on the floor next week to beat the Jan. 19 deadline, a timeline which seems all but impossible to meet.

With tax season rapidly approaching, the IRS reminds employers that Jan. 31 is the deadline for submitting wage statements and forms for independent contractors with the government.

Employers must file their copies of Form W-2, Wage and Tax Statement, and Form W-3, Transmittal of Wage and Tax Statements, with the Social Security Administration by Jan. 31.

The Jan. 31 deadline also applies to Forms 1099-MISC, Miscellaneous Income, and Forms 1099-NEC, Nonemployee Compensation, that are filed with the IRS to report non-employee compensation to independent contractors. Various other due dates related to Form 1099-MISC, Form 1099-K and Form 1099-NEC, including dates due to the IRS, can be found on the forms' instructions.

Taxpayer Advocate Urges IRS to Prioritize Transparency, Service – Jonathan Curry, Tax Notes ($):

The IRS continues to face major deficiencies regarding its phone service as well as its processing of tax returns, taxpayer mail, and employee retention credit claims, a new report from the national taxpayer advocate warns.

The concerns highlighted by National Taxpayer Advocate Erin Collins’s annual report to Congress released January 10 come as the 2024 filing season is set to begin in just a few short weeks. She says that while the IRS has been eager to tout its accomplishments in 2023 and set big goals for itself this year, the agency needs to be more transparent about its progress to avoid “confusion and unrealistic expectations.”

The Internal Revenue Service and the Security Summit partners today alerted tax professionals to watch out for a new round of filing season-related email schemes where cybercriminals pose as potential clients.

Previously, the IRS observed a surge in these seasonal "new client" scams where identity thieves target accounting groups and tax preparation firms with fake emails. This year, the IRS has already observed reports of new client scams. Typically, the new client scam peaks during tax season, which runs from January through April. With the 2024 tax season quickly approaching, fraudsters are impersonating real taxpayers seeking help with their taxes, using emails to try obtaining sensitive information or gain access to tax professionals' client data.

Pa. Man Gets 33 Mos. In Prison For IRS Call Center Scheme – Asha Glover, Law360 Tax Authority ($). “A Pennsylvania man was sentenced to almost three years in prison and ordered to pay $193,000 in restitution for participating in an Internal Revenue Service impersonation fraud conspiracy involving call centers in India, the U.S. Department of Justice announced.”

A Guide to Taxing Net Investment Income of CFC and PFIC Owners – Carrie Brandon Elliot, Tax Notes ($):

Published October 6, 2023, proposed regs (REG-117614-14) provide guidance on the net investment income tax implications of reorganizations involving stock of controlled foreign corporations and passive foreign investment companies. The proposed regs mainly provide general guidance under section 367 on inbound and outbound transfers of foreign corporation stock and assets in reorganizations. However, proposed regs under section 1411 also address the NII calculation when a section 367(b) exchange involves previously taxed earnings and profits (PTEP).

This article covers the general NII consequences of income inclusions and stock transfers involving CFCs and PFICs in reg. section 1.1411-10. A future article will address the operation and rationale of those NII rules, and the effect of the new proposed regs on gains from transfers of CFC and PFIC stock and assets in section 367(b) exchanges.

From the “Not Too Old For Jail” file:

71-Year-Old CPA Sentenced To 25 Years In $1.3B Tax Case – Anna Scott Farrell, Law360 Tax Authority ($):

An accountant blamed by federal prosecutors for pioneering the use of conservation easements as illegal tax shelters was sentenced to 25 years in prison Tuesday following his conviction on all counts of a $1.3 billion tax fraud scheme that drew the first criminal prosecution of its kind.

Jack Fisher, a 71-year-old certified public accountant who once worked for the Internal Revenue Service and PwC, would be 96 by the time he is released under the sentence announced by the U.S. Department of Justice. Fisher's co-conspirator, attorney James Sinnott, 52, was also sentenced Tuesday and will serve 23 years in prison, the DOJ said.

Believe it or not, in what seems like another life, I met a few people decades ago who thought that old age would be a barrier for going to jail. Oddly, they weren't even retirement age and few would have considered them too old for anything.

Happy National Oysters Rockefeller Day! Eating them raw is also a treat!

Make a habit of sustained success.