Key Takeaways

Welcome to this edition of our state and local tax roundup. Remember Eide Bailly for your state and local tax planning, compliance, and incentive needs.

State Tax Officials Weigh Solutions to Growing Auditor Shortage - Danielle Muoio Dunn, Bloomberg ($):

Government officials have long struggled to attract and retain talent while the private sector offers much higher salaries, but the issue has intensified in recent years. Many state and local governments are bracing for a “silver tsunami” as older workers retire, said Emily Brock, director of the federal liaison center at the Government Finance Officers Association, which represents more than 20,000 federal, state, and local finance officials. According to a September 2022 report by the association, nearly a third of state and local public finance workers will reach retirement age within the next decade.

The retirement surge also arrives as more people are seeking jobs with generous remote-work policies that don’t always align with public-sector priorities, the number of people pursuing accounting majors or professional licensing drops, and influxes of federal infrastructure spending mean increased audit workloads, Brock said. State tax agencies now find themselves squeezed on multiple fronts, forcing new approaches to staffing and tough decisions about which big audits to pursue.

At some point this issue should force states to reconsider targeted tax breaks, which are labor-intensive to administer and enforce. Should, but won't. It also might force states to rely more on sales taxes for reasons noted in the next link.

Sales tax changes jump as governments search for funding - Michael Bernard, Accounting Today. "Other than economic reasons, sales taxes tend to be easier to administer and collect. In fact, over the past 60 years, in times of adverse economic cycles, sales taxes have provided a more resilient method of funding relative to income and property taxes. These circumstances all add up to the fact that rate changes and new taxes will continue to increase into 2024 and beyond."

States Fret Over Supreme Court Challenge to Foreign Income Tax - Michael Bologna, Bloomberg ($):

State tax administrators, academics, and tax practitioners have taken a keen interest in Moore v. United States , which the high court will likely hear in December. The case focuses on whether the Sixteenth Amendment authorizes the federal government to tax undistributed earnings, but the resulting precedent in Moore could have broad implications for state tax bases.

A broad ruling could restrict the federal government’s authorities to tax undistributed, or “unrealized,” earnings. Such restrictions would likely impact state tax collections as well, because most states conform to features of the Internal Revenue Code, said Greg Matson, executive director of the Multistate Tax Commission, an intergovernmental agency committed to uniform tax policy across the states.

Further reading: How the Moore Supreme Court Case Could Reshape Taxation of Unrealized Income

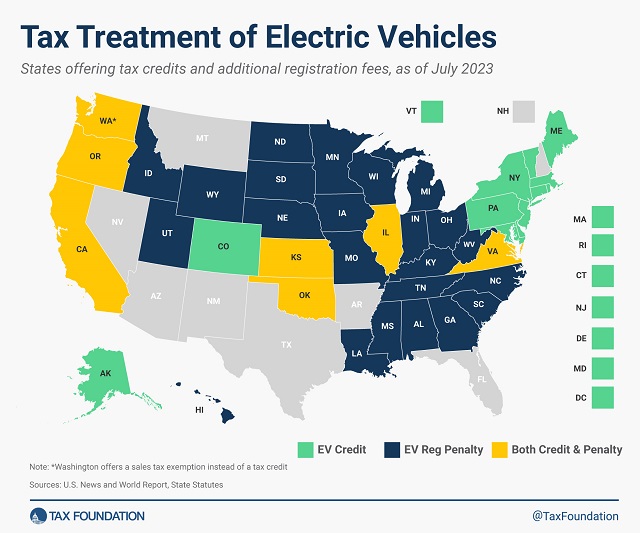

How Are Electric Vehicles Taxed in Your State? - Benjamin Jaros, Adam Hoffer, Tax Foundation. "As the market share of electric vehicles (EVs) on the road grows, however, the gas tax’s ability to fund road projects and decrease traffic congestion erodes. Both federal and state real tax revenue per vehicle mile traveled has been on a steady decline for decades, creating a fiscal gap for road expenditures even as the demand for road infrastructure improvements has grown."

California

California Leaders Sue to Pull Tax Watchdog Measure Off Ballot - Paul Jones, Tax Notes ($):

Filed September 26 with the California Supreme Court, the state leaders' emergency petition argues that the Taxpayer Protection and Government Accountability Act (TPA) — which would impose numerous new requirements for increasing state and local taxes — is an unlawfully broad initiative that would revise, rather than amend, the state constitution and should therefore be stricken from the ballot. The measure was qualified for the ballot by initiative in February and is backed by the Howard Jarvis Taxpayers Association, the California Business Roundtable, and other tax and business interests. The groups accused the governor and lawmakers of trying to stifle voters by seeking removal of the measure.

Newsom, Calif. Lawmakers Sue To Nix Tax Ballot Measure - Maria Koklanaris, Law360 Tax Authority ($):

The lawsuit filed Tuesday is not the only attempt by Democrats, who enjoy a supermajority in both chambers of the Legislature and hold the governor's mansion, to frustrate the Taxpayer Protection Act. At the end of the legislative session on Sept. 14, lawmakers passed ACA 13. That measure, which the Legislature has the right to refer to the ballot without signatures or the governor's approval, is not specifically a tax measure but could be applied to taxation. It would require that any ballot measure seeking to raise the voter approval threshold beyond a majority of votes cast would have to pass by that proposed threshold. For example, if a ballot measure were put forward to require a two-thirds majority to pass a new tax increase, that ballot measure would need the approval of two-thirds of voters statewide.

California enacts first statewide gun and ammunition tax in the country - Sergio Robles, The Hill. "With the signing of AB 28, California will now add an 11% excise tax on the purchase of guns and ammunition, an amount that the bill’s author states is lower than the excise tax on marijuana sales."

Calif. Expands Tax Board's Installment Agreement Authority - Zak Kostro, Law360 Tax Authority ($):

A.B. 1765, which Newsom signed Friday, will allow more taxpayers the right to enter into installment agreements with the board, provided they meet certain requirements and extend the time for full payment of an agreement, according to the board's analysis of the legislation. Starting in 2024, the board will be required to enter into installment agreements of up to five years with taxpayers whose personal income tax liability is less than $25,000, according to a state Assembly analysis.

The preexisting law required the board to enter into installment agreements of up to three years with taxpayers whose personal income tax liability didn't exceed $10,000, provided they had filed all prior-year returns and remained in compliance with the agreement terms, according to the Assembly's analysis.

Iowa

2022 Pass-Through Entity Tax Form Now Available on GovConnectIowa - Iowa Department of Revenue: "The 2022 Pass-Through Entity Tax (PTET) form is now available on GovConnectIowa. Eligible partnerships and S corporations may now make an Iowa PTET election for tax year 2022 (or short tax year 2023) by filing a 2022 PTET form and making Iowa tax payments on GovConnectIowa. It is strongly recommended that a pass-through entity logs into its GovConnectIowa account to complete their 2022 PTET form. However, there is an option to Quick File the 2022 PTET form without logging in. Additional information may be found at the Department’s Pass-Through Entity Tax guidance page."

Governor announces $1.83 billion budget surplus, calls for tax cuts - Robin Opsahl, Iowa Capital Dispatch. "One component of a 2022 tax law signed by Reynolds reduced corporate taxes for the upcoming fiscal year, the governor announced earlier in September. Iowa’s corporate tax rate will fall from 8.4% to 7.1% in 2024, a reduction triggered by the state’s net corporate income tax receipts exceeding $700 million. The corporate tax rate also fell last year, reduced from 9.8% to 8.4% through the same mechanism."

Illinois

Illinois Grants Start-Up Tax Credits to Cultivated Meat Producer - Benjamin Valdez, Tax Notes ($). "Under the agreement, UPSIDE Foods will have access to nonrefundable tax credits equal to 50 percent of the income tax withholdings of new employees and 10 percent of eligible employee training costs. While typically applied against income tax liability, the credits can be applied against employer withholding taxes because the company was created within the last 10 years and has never had an Illinois income tax liability — a change that was enacted under a fiscal 2023 budget bill (S.B. 157) to allow start-ups to benefit from the program."

Massachusetts

Massachusetts Joint Tax Relief Plan Includes Corporate, Individual Tax Breaks - Emily Hollingsworth, Tax Notes ($):

H. 4104 was approved in the House September 27 on 155–1 vote, days after House and Senate leaders announced on September 21 that the legislature had agreed on a plan after months of negotiations that began in June. The bill goes to the Senate next.

...

The final bill also includes some provisions that were championed in one chamber or the other, but not both — for example, the House's proposal to switch Massachusetts from a three-factor apportionment formula to single-sales-factor apportionment based on a corporation’s sales tax receipts, which would take effect January 1, 2025.

Massachusetts Lawmakers Adopt $1 Billion Tax Relief Legislation - Angélica Serrano-Román, Bloomberg ($):

Among the legislation’s provisions is a requirement that married taxpayers who file joint returns with the IRS also file jointly in Massachusetts. The change addresses a loophole related to the 4% surtax on incomes over $1 million, implemented in 2022. Under current law, married couples earning over $1 million can file as singles in the state, allowing them to split their income and potentially reduce or completely avoid the surtax.

Additionally, the bill reduces the tax rate for short-term capital gains to 8.5% from 12%.

Michigan

Michigan Sales Tax Bills Aim to Restore State's SSUTA Compliance - Emily Hollingsworth, Tax Notes ($):

H.B. 4377 and H.B. 4378 were narrowly approved in the Senate on a 20 to 18 vote on September 27. Both bills had similarly squeaked through the House in a 56 to 53 vote on June 22.

...

According to Mich. Admin. Code R. 205.136, prepared food that’s sold with “eating utensils provided by the seller” is subject to sales and use taxes. However, the regulation establishes different definitions of “eating utensils provided by the seller” depending on whether 75 percent or more of a company’s sales come from prepared foods. The 75 percent rule isn’t included in M.C.L. 205.94d and M.C.L. 205.54g as currently written.

Mich. Lawmakers OK Aligning Prepared Food Tax With Pact - Paul Williams, Law360 Tax Authority ($). " The legislation would provide that sales of food for immediate consumption are generally taxable if more than 75% of a business' food sales are sales of prepared food and utensils are made available to a customer. If that threshold is crossed, sales of candy, soft drinks and bottled water would only be taxable if utensils are handed directly to a customer during the purchase."

Mississippi

Priceline, Expedia Duck Hotel Taxes at Mississippi High Court - Perry Cooper, Bloomberg ($):

The online travel companies aren’t hotels because they don’t furnish rooms and therefore aren’t subject to the 7% tax levied against the gross income of hotels, Justice Robert P. Chamberlin wrote for the 5-3 court. “The nature of the OTCs’ business is to provide an intermediary service between hotels and customers,” the court said.

...

The state sued the websites alleging they were required to collect and remit 7% state and local sales tax on the amount paid by the consumer, not the lower room rates the hotels offer the booking companies. The state argued the sites owed $10 million in hotel privilege taxes, plus interest, failure-to-file penalties, and a 300% penalty for failure to remit funds held in trust for the state.

New Jersey

New Jersey Adopts Combined Return Regulations - David Engel, Thomson Reuters:

N.J. Admin. Code § 18:7-21.2(a) provides that a unitary business is characterized by significant flows of value evidenced by factors, such as functional integration, centralization of management, and economies of scale. These factors provide evidence of whether the business activities operate as an integrated whole or exhibit substantial mutual interdependence and that if the entities meet either the “Interdependence of Functions Test” or the “Unity of Use and Management Test,” the entities are part of a unitary business.

New York

New York AG, Comptroller Back Bill To Reveal LLC Owners - Georgia Kromrei, Law360 Tax Authority ($). "The LLC Transparency Act, A-O3484, closely resembles the Corporate Transparency Act at the federal level, which was enacted in 2022 and will take effect in 2024. The federal legislation requires LLCs to report their beneficial owners to a database operated by the Treasury Department, which tax authorities and law enforcement could access."

NY Must Revisit Couples' Pass-Through Credits, Tribunal Says - Jaqueline McCool, Law360 Tax Authority ($). "The tribunal said state statute made clear that the benefit period should start based on the certification date of the subsidiary companies, not the larger company that acquired them."

Oregon

Oregon Properly Nixed Business Deductions for Residence Expenses - Perry Cooper, Bloomberg ($):

The Oregon Department of Revenue properly barred an Oregon couple that owns a home construction business from deducting numerous expenses incurred while building their private residence, the state tax court ruled.

...

The couple estimated the cost to build their 17,000 square foot home at less than $107,000, which the court called “wildly understated.” The state auditor estimated the cost of improvements at nearly $2 million based on the increase in property tax value, and allocated half of that amount to each of the tax years.

I'm no contractor, but that does seem a bit light for a 17,000 square-foot house.

Washington

Proposed Washington Capital Gains Tax Rules Cover October Filers - Laura Mahoney, Bloomberg ($):

The 7% excise tax applies as of Jan. 1, 2022, to gains over $250,000 per year, although gains from retirement account sales, real estate, and certain small businesses are excluded. The Washington Supreme Court upheld the tax as a permissible excise tax in April, rejecting arguments from business groups that it is an illegal income tax.

In response to feedback, the Department of Revenue’s proposal takes the position in a new section that the tax generally only applies to capital gain from a sale or exchange of a capital asset, and includes examples. Marked-to-market contracts under federal tax code Section 1256 are an exception, and the department said it would publish additional guidance on how to report tax from those contracts.

Link: Proposed Regulations.

Wisconsin

Wis. Joint Committee Advances GOP Tax Relief Plan - Michael Nunes, Law360 Tax Authority ($). "The bill, which passed the state Assembly on Sept. 12 by a 64-35 vote, would lower the rate for the bracket on annual taxable income above $15,000 and up to $225,000 before indexing for inflation. The state currently taxes income with rates ranging from 3.5% to 7.65%. The legislation needs to be approved by the Senate before going to Democratic Gov. Tony Evers."

Link: AB 386

Tax Policy Corner

Another Ark. Tax Cut And Chicago Transit: SALT In Review - David Brunori, Law360 Tax Authority ($; free to LinkedIn users here):

There are no details yet, but wow. Oklahoma Gov. Kevin Stitt has called for a special session of the Legislature on Oct. 3. He is demanding tax fairness for all Oklahomans. I like tax fairness, but I am pretty sure I define it differently from those who call for people to pay their fair share.

...

Eliminate the personal income tax? We are not talking about modest reductions, as in Arkansas. Eliminating the personal income tax is easier said than done. Oklahoma collects more than $4 billion a year in personal income taxes. You can't just shut it down. It is obviously possible to run your state without a personal income tax, but it takes more than a little planning. The state will have to replace $4 billion in revenue, reduce spending by that much or enact some combination of the two. Difficult, but not impossible.

Ultramarathon Accountant Corner

Lazerus Lake, founder of the Barkley Marathons, "an absurdly difficult 100-mile race through the Tennessee wilderness that only 17 people have ever finished in its nearly 30-year existence," also enjoys accounting, per this transcript of his interview with Tyler Cowen:

COWEN: What did accounting teach you about ultramarathons and running?

LAKE: Everything is numbers. I really enjoyed accounting. Your accountant knows more about you than anybody except maybe your doctor. You can look at the numbers and see what’s going on in places that you’ve never even physically been. I wasn’t really a math person who likes the pure math, but I love numbers for the information — in sports, in business, in everything. Numbers tell you everything.

I assure you, more than 17 people have completed tax season in the past 30 years.

Make a habit of sustained success.