Tax-Cutting States Face a Reckoning as Revenues Start Faltering - Michael Bologna, Bloomberg ($):

The snapshot data shows total state tax revenues dropped 9.4% in real terms for June 2023 compared to June 2022. The June data marked the 11th consecutive month in which state tax revenues declined based on an inflation adjusted analysis.

The more alarming numbers, however, come from the period of July 2022 through June 2023, which reflects the 2023 fiscal year in 46 states. Urban’s principal research associate, Lucy Dadayan, reports total revenues slid 10.7% when compared to the previous fiscal year. In terms of dollars and cents, the states banked $1.23 trillion for fiscal 2023 versus $1.37 trillion for the previous year.

Tax Pros See Pillar 2 Issues, Digital Tax Suits On SALT Horizon - Paul Williams, Law360 Tax Authority ($):

The effects of the 15% minimum tax deal known as Pillar Two that more than 50 foreign jurisdictions have taken steps to implement, with some slated to start next year, will flow down to states as businesses determine how the tax affects their federal taxable income, said Joe Huddleston, a managing director at EY.

...

Huddleston later elaborated on his comments to Law360, saying the minimum tax raises several questions that could alter state tax liabilities, including whether the structure will affect state taxes on foreign dividends. Even if it doesn't, any changes to how U.S.-based multinational corporations are taxed at the federal level would in turn adjust state taxes that use federal taxable income as the starting point for their calculations, he said.

State-By-State Roundup

Arkansas

Arkansas Governor Quickly Signs Tax Cuts Bill After Passage - Angélica Serrano-Román, Bloomberg ($):

The state House’s 82-8 vote came two days after the state Senate voted 27-3 to decrease Arkansas’ top personal income tax rate to 4.4% from 4.7% and its corporate tax rate to 4.8% from 5.1%.

The new laws (HB1007/SB8) also introduce a nonrefundable income tax credit for the tax year 2023, providing up to $150 for individuals and $300 for joint filers. Additionally, in line with Sanders’ request, the legislation establishes a $710 million fund to eliminate the state’s income tax over time.

California

Three Tax Increase Threshold Questions Go to California Ballot - Laura Mahoney, Bloomberg ($):

One of the proposed amendments (A.C.A. 13) passed by state lawmakers in the final hours of the the 2023 session is headed for the March 2024 ballot. It asks voters to change the state constitution so that if other ballot measures seek to increase the threshold for voters to approve state or local initiatives—including tax increases—they would need to meet that same threshold to pass.

The measure, backed by Democrats, is designed to thwart a November 2024 ballot measure to require two-thirds approval from voters for all local tax increases.

Calif. Lawmakers OK Tax Installment Agreement Expansion - Jared Serre, Law360 Tax Authority ($). "A.B. 1765, which passed the state Assembly on Thursday by unanimous vote, would expand the eligibility requirements for entering installment agreements, thereby increasing the amount of eligible taxpayers. Starting in 2024, according to the bill, the Franchise Tax Board will be required to enter into agreements up to five years in length for taxpayers with personal income tax liabilities up to $25,000."

California Legislature Approves New Use Tax Reporting Rule - Paul Jones, Tax Notes ($). "A.B. 1097 would change the threshold at which a business is responsible for registering to pay use tax on its purchases from remote sellers. The legislation was approved by the Assembly 76 to 0 on May 25, and by the Senate 39 to 0 on September 12. It now heads to Gov. Gavin Newsom (D)."

California Lawmakers OK Several Bills, Including New Tax on Guns, Ammo - Paul Jones, Tax Notes ($). "One of the more controversial bills is A.B. 28, which seeks to establish an 11 percent tax on sales of guns, gun parts, and ammunition by California firearms dealers. The State Senate passed that bill September 9 on a 27–9 vote, with the State Assembly concurring with Senate changes the same day on a 57–17 vote."

Georgia

DOR Announces Tax Relief for 28 Counties Impacted by Idalia - Georgia Department of Revenue. "Affected taxpayers who had a valid extension until October 16, 2023, to file their 2022 return will now have until February 15, 2024, to file their return. Because tax payments related to these 2022 returns were due on April 18, 2023, however, those overdue payments are not eligible for this relief."

Idaho

Report Urges Idaho to Increase Oversight on Tax Breaks - Emily Hollingsworth, Tax Notes ($):

Idaho's tax expenditures cost the state billions in revenue, but the state lacks an oversight process to ensure the tax breaks are working as intended, according to a recent report.

In a report released August 3, the Idaho Center for Fiscal Policy found that of the 146 personal and corporate tax breaks offered by the state, only 61 have verifiable data to estimate their costs. For fiscal 2023, “these 61 tax expenditures represent over $3.7 billion that is not collected compared to a total General Fund budget of nearly $5.2 billion,” the center says, adding that the cost of those expenditures could increase to $3.8 billion in fiscal 2024. It also notes that the state gave $800 million more in tax breaks in fiscal 2023 than it allocated to education, which received $2.9 billion under the fiscal 2023 budget.

Illinois

IDOR to Abate Late Estimated Payment Penalties for PTE Tax - Ashley Aiken, Illinois Tax School Blog. "The Illinois Department of Revenue (IDOR) will abate late fourth quarter estimated tax penalties for the 2022 PTE tax if the entity paid their entire required fourth quarter payment on or before January 17, 2023. The department is assessing penalties on unpaid fourth-quarter amounts starting on January 18, 2023. IDOR announced this in a bulletin released in August 2023."

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround.

Delaware Company Facing Illinois Tax Bill on Gulfstream Jet - Perry Cooper, Bloomberg ($). "About 30% of the trips TCRG SN057 LLC’s 2006 Gulfstream Aerospace G405 made from March to December 2016 took off from or landed in Illinois, and the plane was managed by someone based in Chicago, Administrative Law Judge Brian F. Barov found. “Under any benchmark, the facts here show that TCRG used its Aircraft more than occasionally, sporadically or incidentally in Illinois,” he wrote, rejecting the company’s argument that the tax violates the commerce clause."

Missouri

Mo. Rule Would Clarify Entertainer Withholding Tax Exemption - Zak Kostro, Law360 Tax Authority ($):

The Missouri Department of Revenue proposed regulatory amendments to clarify an exception to a tax withholding requirement for paying compensation to a nonresident entertainer when the person making the payment is exempt from taxation under certain charitable, religious and other exemptions in the Internal Revenue Code.

...

Missouri requires people or entities that pay nonresident entertainers to withhold state income taxes as a prepayment of tax equal to 2% of total compensation paid to an entertainer for in-state performances, according to the existing regulation text.

New Jersey

New Jersey Working Quickly on Rules Overhauling Corporate Taxes - Michael Bologna, Bloomberg ($). "The tax overhaul, signed by Gov. Phil Murphy (D) on July 3, updates several features of the corporate business tax by addressing the way earnings are apportioned to New Jersey. In response to complaints from multinational businesses, the new law slashes the state’s authority to tax the earnings of foreign subsidiaries of global corporations. At the same time, it expands the revenue base by imposing taxes on out-of-state businesses that make more than 200 transactions into New Jersey or derive more than $100,000 in sales there—the so-called 'bright-line economic nexus standard.'"

New and Revised Guidance on GILTI, FDII Available in New Jersey- Emily Hollingsworth, Tax Notes ($).

The new bulletin (TB-110) was released September 12, as were the department's revisions to two existing bulletins, TB-92(R) and TB-88(R).

...

GILTI is now treated as a dividend subject to the state's 95 percent exclusion rule, and 100 percent of a combined group's FDII is now subject to the corporation business tax in New Jersey.

New York

ALJ Upholds Allocation of Deferred Compensation to New York - Andrea Muse, Tax Notes ($). "Two partners’ shares of deferred management and performance fees were properly allocated to New York using the business allocation percentage (BAP) for the years the fees were earned and not for the year in which they were recognized, according to a New York administrative law judge."

Link: DTA NOS. 830479 AND 830481

Oklahoma

Oklahoma Gov. Kevin Stitt calls lawmakers back for another special session - Logan Layden, KOSU:

Stitt is asking for three things this go-around, including a tax cut that puts Oklahoma on a path toward zero state income taxes and a measure to increase budget transparency.

The final request is sure to cause more friction between his administration and tribal nations. Stitt wants a trigger law mandating if a state or federal court finds that because of an individual’s race, heritage, or political classification, that person doesn’t have to pay a state tax, then no Oklahoman will have to pay that tax.

Oklahoma Governor Wants 'Trigger' Law On State Taxes - Ali Sullivan, Law360 Tax Authority ($).

Oklahoma Gov. Kevin Stitt wants state lawmakers to pass a "trigger law" that would eliminate any state tax that a state or federal court rules does not apply to tribal citizens."

...

The applicability of state income tax is under consideration in the Oklahoma Supreme Court, where justices are weighing a lawsuit from Muscogee (Creek) Nation citizen Alicia Stroble, who contends that she should not have been taxed for money earned while employed at and living on the Nation's reservation. The Cherokee, Choctaw, Chickasaw, Creek and Seminole Nations have filed amicus briefs in support of Stroble.

South Carolina

SC To Push Tax Deadlines In Conjunction With IRS After Idalia - Zak Kostro, Law360 Tax Authority ($). "Affected taxpayers in the state have until Feb. 15 to file quarterly payroll and excise tax returns normally due Oct. 31 and Jan. 31 and submit quarterly estimated income tax payments normally due in September and January, the IRS said. The agency said it also would extend deadlines for calendar-year partnerships and S corporations and calendar-year tax-exempt organizations."

Virginia

Virginia Enacts Budget With Rebates, Standard Deduction Hike - Angélica Serrano-Román, Bloomberg ($). "The new spending plan allocates additional funding for education and mental health services and provides one-time rebates of $200 for individuals and $400 for joint filers. It also raises the standard deduction to $8,500 for single filers and $17,000 for joint filers."

Tax Policy Corner

State Development Incentives: Taxes, Investment, and Tullock Auctions - Michael Munger, American Institute for Economic Research:

Suppose a company wanted to auction off a $100 bill, and the bidders are state legislators. The “winner” gets to present the $100 bill to voters, with a big public ceremony and lots of news media fawning over the politician who brought home the Benjamin. How much would a legislator pay for such an opportunity to lock down votes?

It’s tempting to say that the bidding would quickly approach the full value of what is being “sold,” in this case, $100. But that’s wrong; there’s nothing to limit the bidding to that level. Remember, the “bids” are money taken from taxpayers, from the entire state. The legislator values the new project at $100, but her district is only going to pay a small fraction of that amount (North Carolina has 120 districts, so the benefit is $100 and the cost to one legislator is $100/120, or $0.83. Would you pay $0.83 to bring in $100? I would!) The legislator would be happy for the state to bid $200, or $500—even at $500 in costs, the cost share to one district is only $4.20!!—for the $100 benefit that goes primarily to her district.

TCJA Workarounds And A Misstep In Va.: SALT In Review - David Brunori, Law360 Tax Authority ($; free on LinkedIn here):

But then some tax and political geniuses came up with an idea: Let's create a SALT deduction workaround. I wish I knew who initially came up with this idea. To date, 36 states have enacted workarounds. The basic workaround allows a pass-through entity to pay an entity-level state tax on its income. That tax is deductible for federal purposes. The state then allows partners or shareholders to claim a state tax credit. In the end, the states get their money. The partners and shareholders essentially get their SALT deduction. And the only loser is the federal government. What's not to love?

The workarounds are great for those who can use them. But you have to be in a pass-through entity. Most of us are not. And, honestly, this is a rich man's game. The people and firms taking advantage of this are certainly on the higher end of the income spectrum. Of course, allowing a full deduction for state and local taxes benefits the wealthy as well. But my problem is not that the workarounds benefit the wealthy; I am no purveyor of the politics of envy. My problem is that the benefits are not widely available. That is not good policy.

Tax History Corner

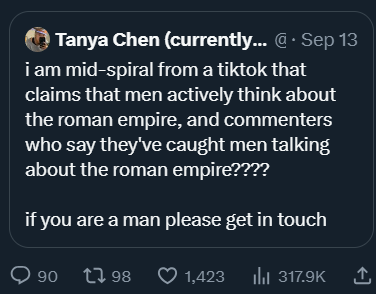

Thinking of Rome. The Roman Empire is having a mini-revival on social media:

'

'

I don't think of the Roman Empire that often, but I do think of taxes pretty much every day. Naturally, I get to wondering about taxes in the Roman world. Of course, there's a Wikipedia entry for that:

The ancient Romans had two classes of taxes: the tributa and the vectigalia. Tributa included the tributum soli (a land tax) and the tributum capitis (a poll tax). The vectigalia consisted of four kinds of tax: the portoria (poll tax), the vicesima hereditatium (inheritance tax), the vicesima liberatis (postage tax), and the centesima rerum venalium (auction sales tax).

Some of these taxes are familiar today - property taxes and inheritance taxes are commonplace. But one aspect of Roman taxes is unlikely to come back: "During the Roman Republic finances were stored inside the temple of Saturn."

Make a habit of sustained success.