Welcome to this edition of our state and local tax roundup. Remember Eide Bailly for your state and local tax planning, compliance, and incentive needs.

Clock Ticking for States to Replace Dwindling Gas Taxes - Jared Brey, Governing:

As more drivers switch to electric vehicles, incentivized by provisions of the Inflation Reduction Act and other federal laws, states will see gas tax revenue continue to shrink. While many leaders have embraced the transition to electric vehicles, neither the states nor the federal government have yet figured out a perfect way to replace their gas taxes, which have traditionally been a critical source of funding for transportation infrastructure. The sooner alternatives are put in place, the better, says Jim Aloisi, a lecturer of transportation policy and planning at MIT and former secretary of transportation for Massachusetts.

“The one thing you don’t want to do is spring this on people at the very end of the process,” Aloisi says. “People need to know that a consequence of this transition is that we need to find a replacement for the one revenue source we’ve relied on since the 20th century, and that’s the gas tax.”

Further reading: Who Will Pay for the Roads?

NJ To Follow MTC's Tax Guidance On Internet Activities - Paul Williams, Law360 Tax Authority ($):

The state Division of Taxation released a bulletin Tuesday incorporating much of the MTC's guidance advising states on how to interpret the Interstate Income Act of 1959, more commonly known as P.L. 86-272, for modern internet activities. The law insulates businesses from state taxes on net income when their only connection to the state is solicitation of orders of tangible personal property or activities that are ancillary to solicitation.

...

Some tax professionals have objected to the MTC's guidance, arguing that states would exceed their authority by diminishing the federal law's protections without a change in the federal statute. MTC officials have said that they weren't engaging in a policymaking exercise but rather assisting states in determining how internet activities square with the more than 60-year-old federal statute.

John Gupta, leader of Eide Bailly's State and Local Tax practice team, says this is an important development:

This is a pretty big deal for our internet retail clients who in many cases have been the last category of taxpayers who could confidently claim PL 86-272 protection. Those who sell through traditional channels typically will have sales people physically present in the state and are much more likely to engage in “unprotected activities”.

Since the MTC guidance is not binding law, clients who sell only through internet channels should only follow it in a state if and when that state specifically adopts it. With New Jersey joining California as the second state to formally adopt the guidance more than 2 years after the MTC issued the guidance, the biggest surprise is how slow the states have been to adopt the guidance. Since the guidance has dubious legality, it is likely the “rank and file” states have taken a “wait and see” approach as to what the typical tax policy leaders (such as California and New York) would do and also potential litigation such as American Catalog Mailer’s case in FTB. If these matters resolve in favor of the states, expect more states to adopt the guidance.

Related: Is it war?

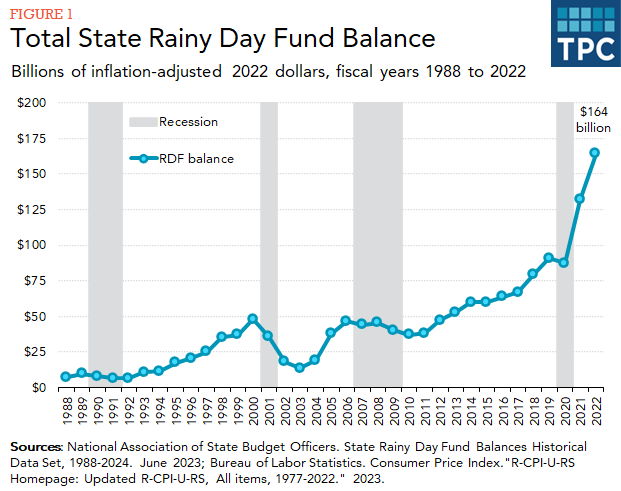

State Rainy Day Fund Balances Reached All-Time Highs Last Year - Aravind Boddupalli, TaxVox:

Every state has some type of rainy day fund, though deposit rules vary considerably and some states have more than one fund. For example, many states, including Georgia, New York, and Ohio, simply deposit a portion of their year-end surpluses into their savings account. Meanwhile, Alaska, Texas, and Wyoming require depositing and saving some funds from severance taxes (such as from oil extraction); California deposits some of its volatile capital gains tax revenues into a fund. Those relying on inherently volatile revenue sources typically have very high fund balances, including in 2022. Other states, like Idaho and Virginia, tie their deposits to revenue or economic growth, while Florida and Iowa require a minimum balance no matter the economic or fiscal circumstances.

Government Money-Market Funds Are Hot. There’s a State-Tax Catch. - Laura Saunders, Wall Street Journal:

Aside from Treasury debt, state-tax free bonds include those from agencies such as the Federal Farm Credit Banks, Federal Home Loan Banks, Sallie Mae and the Tennessee Valley Authority. Yet interest on mortgage bonds from Ginnie Mae, Fannie Mae and Freddie Mac is subject to state taxes.

Income from Treasury repurchase agreements, often called repos, is also state taxable. This is especially important because many government money-market funds have been moving into these repos the past year.

State-By-State Roundup

California

California OTA: No Refund for Colorado Company in Sourcing Dispute - Christopher Jardine, Tax Notes ($). "Janus filed a refund claim after filing the returns, seeking $1,014,327; $1,075,073; $1,055,450; and $1,096,870 for the 2013 through 2016 tax years, respectively. The company claimed that section 25137-14 did not apply and changed the source of the receipts to the locations of the mutual funds rather than the locations of the mutual funds’ shareholders."

California Excise Tax on Guns and Ammunition Goes to Governor - Laura Mahoney, Bloomberg ($). " An 11% tax would apply to the sale price of firearms, firearm parts, and ammunition, similar to a federal excise tax of 10% on pistols and revolvers and 11% on other firearms and ammunition."

Delaware

Del. Allows Personal Income Tax Deduction For Union Dues - Zak Kostro, Law360 Tax Authority ($). "Senate Substitute No. 2 for S.B. 72, which Democratic Gov. John Carney signed Thursday, will allow state residents who are active members of a labor organization to claim the deduction to cover the annual cost of maintaining their membership in the organization, according to a fiscal note."

Indiana

IN Restaurant Chain Issued Refund for Sales Tax Based on Predominant Use of Utilities - Sarah Weintraub, Eide Bailly. "A chain of restaurants in IN has been awarded its refund claim of sales tax paid on utilities consumed based on their predominant use study for the manufacturing exemption. The chain presented sufficient documentation to support its predominant use claim by providing proof of hours of operation and load factors for its fryer and grill."

Michigan

Sixth Circuit Upholds Using Sale Price, Not FMV, for Refund in Takings Case - Christopher Jardine, Tax Notes ($). "Freed owned a property in Gratiot County with an FMV of $98,800. After he fell behind about $1,100 on his property taxes, the county foreclosed on the home and sold it at a tax auction for $42,000. Rather than remitting the surplus to Freed, the county kept all the proceeds from the sale."

Minnesota

Don't toss that letter from Montana. It could be your Minnesota tax rebate. - Briana Bierschbach, Star Tribune. "The state of Minnesota worked with a vendor called Submittable Holdings, Inc. in Missoula to get the checks sent to taxpayers' homes, which has caused some confusion from people who received them in the mail."

Montana

Montana Supreme Court Says NOL Statute Is Constitutional - Cameron Browne, Tax Notes ($). "In a September 5 opinion in Tiegs v. Department of Revenue, the Montana Supreme Court reinstated a determination against a nonresident couple, finding that the district court erred in ruling that Montana’s NOL statute violated the U.S. Constitution by including out-of-state income in the formula it used to determine the tax on the couple's Montana-sourced income."

Nebraska

Nebraska DOR Issues Guidance on Passthrough Entity Tax Election - Emily Hollingsworth, Tax Notes ($):

The Nebraska Department of Revenue has issued forms and schedules for the state's new passthrough entity tax, enacted earlier this year as a workaround to the federal deduction cap on state and local taxes.

“An eligible partnership or S corporation may now file an election with the Nebraska Department of Revenue to be subject to Nebraska income tax for tax years beginning on and after January 1, 2018," the DOR said in a September 1 information update, with links to forms a passthrough must use to elect to pay tax at the entity level for tax years 2018 through 2022 and for tax years after 2022. Links are also provided for schedules to be used for determining a partner's share of the entity tax and a shareholder's share of the tax.

New Mexico

New Mexico governor facing legal battle over tax bill line-item vetoes - Curtis Segarra, KRQE:

During the 2023 legislative session, Governor Michelle Lujan Grisham vetoed large portions of an omnibus tax bill passed by lawmakers. Now, a Democratic representative is asking a court to declare the governor’s actions unconstitutional.

...

But when it hit the governor’s desk, Lujan Grisham vetoed large portions, including the proposed changes to the state’s income tax brackets. In a message to the legislature, she explained her reasoning: “Although HB 547 has many laudable tax reform measures, I have grave concerns about the sustainability of this tax package as a whole. HB 547’s tax cuts will impact our ability to fund important services and programs that our citizens depend on, such as education, healthcare, public safety, and infrastructure,” she wrote.

New York

Jefferies Wins ‘Distortive’ NY Corporation Franchise Tax Case - Perry Cooper, Bloomberg ($):

Jefferies Group LLC convinced an administrative law judge that the state’s apportionment of the investment bank’s receipts to New York violated the US Constitution.

The state improperly sourced the company’s receipts based on the location of the institutional intermediaries rather than the underlying investors who are actually its customers, New York Division of Tax Appeals Administrative Law Judge Winifred M. Maloney held in an opinion released Thursday.

Ohio Board Denies Tax Break For Park Used By One Family - Sanjay Talwani, Law360 Tax Authority ($). "The board said under a special use agreement with the park district, the property was operated 'as a private preserve' for the family, one of whose members was president of the group that sold the property to the district in 2017 for $730,000."

Oklahoma

Gov.'s Remarks Could Cause Tribal Backlash, Okla. Chief Says - Crystal Owens, Law360 Tax Authority ($):

The Muscogee (Creek) Nation's principal chief said recent remarks by Oklahoma Gov. Kevin Stitt regarding his stance on the taxation of tribal motor vehicle tags are reckless and could result in "physical confrontations" against Native Americans as litigation on the issue continues in the state's Supreme Court.

Principal Chief David W. Hill, in a letter to Stitt released publicly on Tuesday, criticized part of the governor's Aug. 24 speech at a Tulsa Regional Chamber of Commerce meeting where he gave audience members his views on tribal jurisdictional issues facing the state in the wake of two major appellate court rulings.

...

"Every time you see a tribal tag, just realize the state is losing about $200 million in revenue annually," Stitt told the crowd at the event, adding, "if some people don't have to pay taxes, then no one in Oklahoma should."

Virginia

Va. Lawmakers OK Tax Rebates, Increase Standard Deduction - Michael Nunes, Law360 Tax Authority ($):

Lawmakers passed an amendment Wednesday to the state's biennial budget, H.B. 6001, that would give taxpayers an income tax rebate of $200 and increase the standard deduction to $8,500 in 2024. The legislation passed the state House of Delegates by a vote of 86-4 and the Senate by a vote of 38-0.

...

Under the proposed amendment, the state's standard deduction would remain at $8,000 for individuals and $16,000 for joint filers in 2023, but increase to $8,500 for individuals and $17,000 for joint filers in 2024 and 2025. Under the current budget, the standard would remain at $8,000 until Jan. 1, 2026.

Wisconsin

Latest Wisconsin Republican tax cut plan likely to run into roadblock: Gov. Tony Evers - Chuck Quirmbach, WUWM. "GOP leaders unveiled the proposed tax cut last week. Itwould lower the state’s third income tax bracket from 5.3% to 4.4%. That would help single filers making between about $28,000 and $300,000 per year and joint filers making between about $37,000 and $405,000."

Tax History Corner

You don't need to keep your records this long. Clients frequently ask how long they should keep their tax records. However long they hold on to them, they won't approach the life of the tax records of the Third dynasty of Ur, which thrived around 2100 BC, or more than 4,000 years ago (via Archaeology.org):

“It’s one of the most documented periods in the ancient world,” says Western Washington University Assyriologist Steven Garfinkle. “In some cases we can track a single sheep through the tax system across multiple tablets, all the way to the king’s kitchens.” The taxes the Ur III kings levied relied on the bala system, a local tax that was probably already more than 1,000 years old by that point.

Make a habit of sustained success.