Inside a Sales Army Turning a Tax Break Into a Modern-Day Gold Rush - Ruth Simon and Richard Rubin, Wall Street Journal:

An antiaging consultant in Florida. A technician in North Carolina. A semiretired broker. They’re all part of a vast sales army aiming to profit from one of the biggest tax breaks Congress ever created for small businesses.

One thing that the network apparently doesn't do: evaluate whether the people who it helps claim ERC actually qualify:Members of this network—totaling more than 50,000—are talking to neighbors and cold-calling small businesses to trumpet the Employee Retention Credit, or ERC, tax break. They funnel potential clients to Bottom Line Concepts, a consulting firm that has helped clients pursue more than $6 billion in ERC tax refunds and could receive more than $1 billion in fees.

“Businesses themselves must assess whether they qualify for ERC based upon their unique facts and circumstances,” Bottom Line said. “Bottom Line has been responsible in its efforts to educate and assist small businesses who qualify, turn away those who do not.”

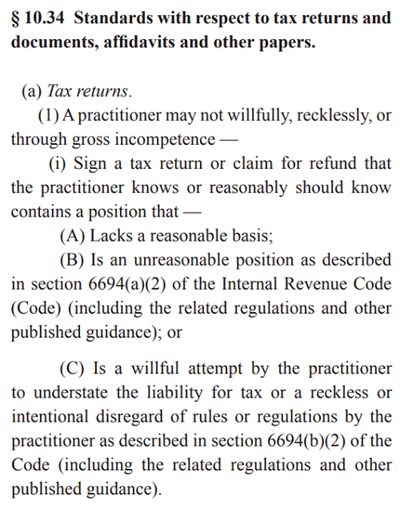

The article notes "tensions" with accountants. Those tensions arise from the standards that people who sign tax returns are held to. Sec. 10.34 of Circular 230 - the IRS standards for tax practice - provides:

But can't practitioners rely on client information? Again from Circular 230, my emphasis:

A practitioner advising a client to take a position on a tax return, document, affidavit or other paper submitted to the Internal Revenue Service, or preparing or signing a tax return as a preparer, generally may rely in good faith without verification upon information furnished by the client. The practitioner may not, however, ignore the implications of information furnished to, or actually known by, the practitioner, and must make reasonable inquiries if the information as furnished appears to be incorrect, inconsistent with an important fact or another factual assumption, or incomplete.

Nothing there says "well, it's really up to the client, so don't sweat it." Often preparers have already advised clients that they don't qualify for the ERC, or have filed claims for smaller amounts than the ERC mills say the clients qualify for. These tax pros can't just claim credits just because the clients say they qualify. ERC mills coming in saying otherwise - for a commission - give tax pros gray hairs. Maybe that's where the antiaging consultant comes in handy.

Global Tax Deal and Taiwan Top Congress’ Fall Tax To-Do List - Chris Cioffi and Samantha Handler, Bloomberg ($):

Congressional tax-writers start their trek back to Washington this week with plans to consider a Taiwan tax bill, scrutinize the global tax deal, and hash out funding for the IRS.

Lawmakers have just a few months to come together on legislation that could extend several business tax breaks and expand the child tax credit. House Republicans have been at a stalemate over whether their own package should include an adjustment to the state-and-local tax deduction cap—an argument that must be resolved to reach a tax deal given the party’s thin grip on the majority.

Shutdown, IRS Funding, Extenders on Agenda as Congress Returns - Doug Sword andCady Stanton, Tax Notes ($):

Also at stake is a tax extenders package, and it remains to be seen what form it will take — a stand-alone bill from the House Ways and Means Committee, as House Republicans insist, or a more typical add-on to a must-pass omnibus spending bill.

“If anything, I have become a little more dour on any bills getting completed before the end of the calendar year,” Rohit Kumar of PwC told Tax Notes. As the House and Senate left town for their August recess, Kumar had projected that at least some bills would pass before year-end.

Related: State of Play; Will Congress Pass a Tax Bill this Year.

U.S. deficit explodes even as economy grows - Jeff Stein, Washington Post:

After the government’s record spending in 2020 and 2021 to combat the impact of covid-19, the deficit dropped by the greatest amount ever in 2022, falling from close to $3 trillion to roughly $1 trillion. But rather than continue to fall to its pre-pandemic levels, the deficit then shot upward. Budget experts now project that it will probably rise to about $2 trillion for the fiscal year that ends Sept. 30, according to the Committee for a Responsible Federal Budget, a nonpartisan group that advocates for lower deficits. (These numbers ignore President Biden’s $400 billion student debt cancellation policy, which was struck down by the Supreme Court this year and never took effect.)

...

The higher deficit may undermine Biden’s attempts to take credit for reining in the budget ahead of the 2024 presidential election. And it could pose a challenge to Republican lawmakers, who — despite their calls for fiscal responsibility — are pushing to extend more than $3 trillion in tax cuts they approved in 2017.

GOP Tax Committee Chair Blasts Global Deal During OECD Trip - Chris Cioffi, Bloomberg ($). "Ways and Means Chair Jason Smith (R-Mo.) criticized the global tax deal during a meeting with OECD Secretary-General Mathias Cormann, expressing concerns that some countries could abuse the system and provisions such as the 15% global minimum tax."

GOP Reps. Tell OECD Min. Tax May Prompt US Retaliation - Dylan Moroses, Law360 Tax Authority ($). "Smith said if countries choose to implement the backstop component of Pillar Two known as the undertaxed profits rule, or UTPR, House Republicans would 'continue to pursue aggressive tax and trade countermeasures.'"

The OECD and the Global South - Alex Parker, Things of Caesar. "The Organization for Economic Cooperation and Development’s 15% global minimum tax has endured withering criticism from the American right over the past few months. While it tries to withstand that barrage, there’s been a quieter but growing opposition from what’s often called the Global South–developing and emerging countries who feel their interests were neglected during this years-long process."

California Adopts New Marketplace Rules Despite Stakeholder Concerns - Paul Jones, Tax Notes ($). "The new rules make a variety of changes, but the main point of contention for taxpayers involved the definition of marketplace facilitators. According to the statement of reasons document, one of the stakeholders raising concerns — CalTax — argued that the definition in the new regs was too broad and that they captured online businesses and transactions that lawmakers hadn't intended to treat as marketplace facilitators or marketplace-facilitated sales, for example, situations in which sites are paid to list sellers’ goods for purchase but don’t actually facilitate the transactions in question."

IRS reminder: Make sure to understand recent changes when buying a clean vehicle - IRS. "Before taxpayers purchase a clean vehicle they should be sure that the vehicle was made by a qualified manufacturer. Taxpayers must also meet other requirements such as the modified adjusted gross income limits."

Roth vs. Traditional 401(k): Where to Put Your Money for Retirement? - Anne Tergesen, Wall Street Journal. "Roth accounts aren’t the best choice for everyone, and deciding how much of your money should go into Roth versus traditional entails calculating your current spending, future taxable income, life expectancy and other factors, some of which are unknowable."

Alaska, Illinois taxpayers in spring/summer disaster areas now have Oct. 31 tax deadline - Kay Bell, Don't Mess With Taxes ($).

Disastrous water levels in Alaska and Illinois also prompted the IRS to grant those communities tax relief. The Alaska floods began on May 12. Severe storms and flooding hit parts of Illinois on June 29.

Last month, the IRS announced tax relief for the affected residents, including an Oct. 31 deadline for a variety of tax responsibilities.

Many Floridians Receive Hurricane Extension Due to Idalia - Russ Fox, Taxable Talk. "The IRS announced yesterday that victims of Hurricane Idalia have their tax filing deadlines extended until February 15, 2024. As of this moment, most of central and northern Florida including the Tampa/St. Petersburg area, Orlando, and Jacksonville are eligible for this extension. This is an extension for filing, not paying your tax. But if you have a valid extension for your partnership, corporation, trust/estate, or individual return and are in this area, you have several months before you must file."

IRS Reminds Businesses That Form 8300 for Cash Transactions In Excess of $10,000 Must Generally Be Filed Electronically Beginning January 1, 2024 - Ed Zollars, Current Federal Tax Developments. "The IRS issued a news release (IR-2023-157) reminding most businesses that, starting January 1, 2024, they will be required to file Form 8300, 'Reporting Cash Payments Over $10,000,' electronically with the Financial Crimes Enforcement Network (FinCEN). This requirement comes as final regulations mandating the electronic filing of most information returns take effect."

IRS Issues Proposed Regs on Prevailing Wage and Apprenticeship Requirements for Increased Clean Energy Credit or Deduction - Parker Tax Pro Library. "The proposed regulations also address specific PWA or prevailing wage recordkeeping and reporting requirements and affect taxpayers intending to claim increased credit or deduction amounts pursuant to the IRA, including those intending to make elective payment elections for available credit amounts, and those intending to transfer increased credit amounts."

Beware TikTok Tax Advice – IRS Tanks a Trust Scheme - Virginia LaTorre Jeker, US Tax Talk. "The NGICDST is a marketed trust structure which makes a huge mistake in interpreting the US tax law – specifically, Section 643 of the US Internal Revenue Code. This convenient misinterpretation magically makes taxable income on capital gains and other investment income completely disappear! That’s right – no tax."

Ramaswamy: A Dynamic Debate Performance Paired With An Incoherent Economic Agenda - Howard Gleckman, TaxVox. "In July, Ramaswamy signed the Americans for Tax Reform’s no-tax-increase pledge, according to the group’s website. But in his 2022 book Nation of Victims, he seemed to embrace a 59 percent tax on inherited wealth he said was proposed by progressive economists Thomas Piketty and Emmanuel Saez. While it is not quite what they suggested, it is close."

Former Utah movie producer charged with tax evasion and obstructing IRS - IRS (Defendant name omitted):

According to the indictment, Defendant owned a home in Cedar Hills, Utah, and operated... a freelance film and media production company. From 1999 through 2005, Defendant allegedly did not file any federal income tax returns or pay any tax and in 2005, the IRS conducted an audit and assessed him with $703,266.96 in taxes, interest and penalties. After Defendant allegedly failed to make any payments towards his outstanding debt, a federal judge ordered that his home be sold at auction to satisfy his tax obligations. The indictment alleges that Defendant then attempted to stop the sale by filing bogus documents, including a false promissory note, with the IRS, intimidating potential purchasers or investors of the home and attempted to harass IRS personnel by filing frivolous lawsuits against them personally.

The indictment further charges that shortly before the sale closed, Defendant allegedly broke into the home and attempted to reclaim it. With the help of others, he allegedly occupied the home unlawfully for several months, fortifying it with weapons, sandbags and wooden boards tactically placed throughout the house.

Sometimes it's easier to just pay the taxes.

Welcome back to work. It's Telephone Tuesday! It's also National Be Late For Something Day, which I will observe tomorrow.

Make a habit of sustained success.