Welcome to this edition of our state and local tax roundup. State Tax News & Views will run biweekly for awhile in honor of the wind-down of the state legislative season. Remember Eide Bailly for your state and local tax planning, compliance, and incentive needs.

3 Principles Should Guide MTC's Digital Products Tax Work - Charles Kearns and Jeffrey Friedman, Law360($). "The Multistate Tax Commission's sales tax on digital products work group should adopt three guiding principles as its project moves forward."

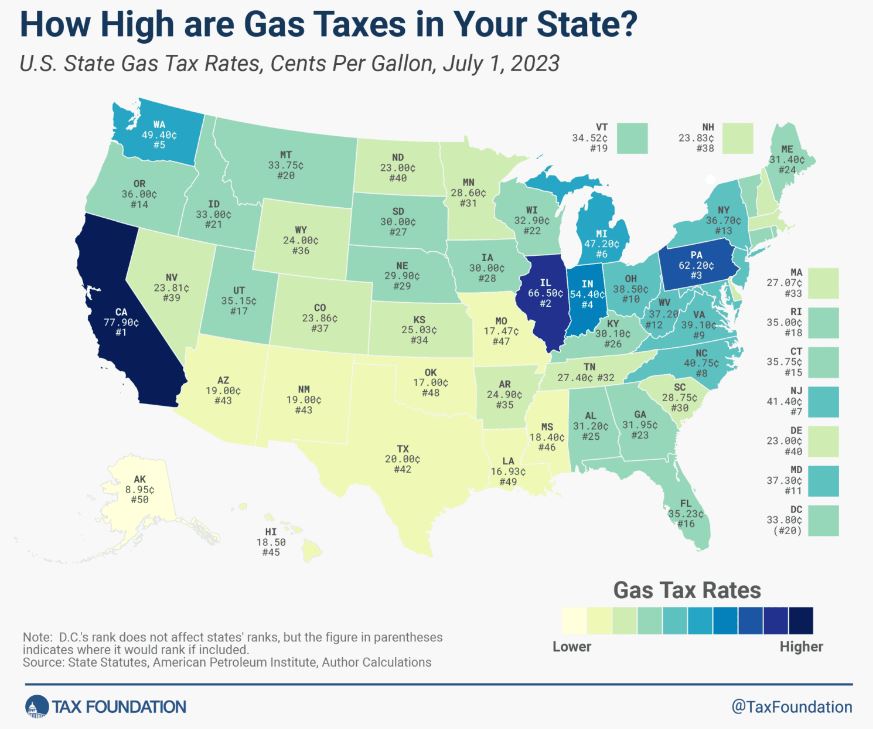

How High are Gas Taxes in Your State? - Adam Hoffer, Jessica Dobrinsky-Harris, Tax Foundation:

State-By-State Roundup

California

Couple Can't See Full IRS Memos Relating To FBAR Dispute - David Hansen, Law360($). "A Mexican couple defending themselves against allegations that they failed to report their foreign bank accounts cannot obtain redacted portions of two Internal Revenue Service memos about third-party disputes that are relevant to their case, a California federal court ruled."

Tax Treaty Doesn't Shield Man From FBAR Penalties, US Says - Anna Scott Farrell, Law360($). "A U.S.-Mexico tax treaty does not relieve a Mexican national in the U.S. on a green card of foreign bank account reporting requirements, the government told a California federal court Friday in asking for a $22,000 judgment for outstanding penalties."

Couple Seek Rehearing After Partnership Losses Reversal - Jared Serre, Law360($). "A couple have petitioned for a rehearing after the Ninth Circuit ruled that they could not offset their taxes using partnership losses claimed on unsigned returns."

Colorado

Colo. Dept. Says No Tax On Food Sales For Home Prep - Sanjay Talwani, Law360($). "Food products sold by an out-of-state company for home consumption in Colorado are not subject to state sales and use tax because the food requires additional home preparation, the state tax department said."

Illinois

Ill. To Abate Late Payment Penalties For Pass-Through Tax - Zak Kostro, Law360($). "Illinois will abate penalties for late estimated payments by partnerships and S corporations that elected to pay pass-through entity tax and had payments due in December, the state Department of Revenue said in a bulletin."

Iowa

Iowa Dept. Adopts Regs To Implement Child Care Tax Credit - Zak Kostro, Law360($). "Iowa explained the calculation and application process of its child care tax credit under regulations adopted by the state Economic Development Authority that implement recently enacted legislation."

Massachusetts

Should Massachusetts Tax Netflix? - Timothy Vermeer, Tax Foundation. "A bill introduced in the Massachusetts House, (H. 74) would expand funding for community media programming by imposing a new tax on the gross revenues of digital streaming service providers. The sentiment is understandable, but the proposed solution leaves much to be desired."

Minnesota

Minn. Tax Court Tosses Valuation Appeal For Lack Of Clarity - Sanjay Talwani, Law360($). "The Minnesota Tax Court dismissed the challenge of the valuation of the property for taxes due in 2021 on Monday, saying that "even accorded a generous reading," the filings did not constitute valid claims under state law because they did not provide fair notice of the theory on which the claim is based."

Montana

Montana Enacts Strong Reforms—Now, It’s Time for Sound Property Tax Relief - Manish Bhatt, Tax Foundation. "Montana is renowned for its vast natural beauty and outdoor recreation, but the state also boasts a competitive tax climate, ranking fifth in our 2023 State Business Tax Climate Index. Like many other states, its coffers are overflowing, and lawmakers have rightly prioritized tax reform to share the strong revenue position with those calling the Treasure State home. Legislators should build on these efforts and provide sustainable and sound property tax relief."

New York

NY Dept. Updates Info On Elective Pass-Through Entity Tax - Zak Kostro, Law360($). "The New York State Department of Taxation and Finance updated information regarding the optional pass-through entity tax that partnerships and S corporations may annually elect to pay on certain income, according to a bulletin."

Oklahoma

EV Maker Inks Incentives With Oklahoma, Cherokee Nation - Tom Lotshaw, Law360($). "Electric-vehicle company Canoo Inc. said Monday it has finalized workforce and economic development incentives potentially worth tens of millions of dollars with the state of Oklahoma and the Cherokee Nation for its vehicle assembly and battery module manufacturing plants planned for Oklahoma City and Pryor."

Texas

Governor Abbott Orders A Special Election Throughout The State Of Texas On November 7, 2023, gov.texas.gov/news/. "NOW, THEREFORE, I, GREG ABBOTT, Governor of the State of Texas, by the authority vested in me by the Constitution and Statutes of the State of Texas, do hereby order a special election to be held throughout the State of Texas on the FIRST TUESDAY AFTER THE FIRST MONDAY IN NOVEMBER, the same being the SEVENTH day of NOVEMBER, 2023."

Virginia

Va. Couple Told They Can't Subtract Retirement Income - Sanjay Talwani, Law360($):

Wisconsin

Wis. Bill Would Adopt Fed. Code Changes For State Taxes - Zak Kostro, Law360($). "Wisconsin would adopt recent changes to the Internal Revenue Code for state income and franchise tax purposes as part of a bill introduced in the state Senate."

Tax Topics in Pop Culture Corner

The Short Form: In Her Tax Era—The Tax Impact of Taylor Swift’s Eras Tour - Yashi Phougat Tax Foundation. "It’s no “Cruel Summer” this year if you’re a Swiftie. Taylor Swift’s Eras Tour could be the highest-grossing tour ever by the time its 131 shows are finished in 2024—potentially bringing in $1.4 billion. While ticket sales and hotel industry revivals have made headlines, what are the tax implications of the Eras Tour?"

‘Swifties,’ ‘Beyhivers’ Bring Tax Revenue Boost Wherever They Go - Laura Mahoney, Bloomberg($). "Cities hosting Taylor Swift and Beyoncé concerts can expect tax revenue boosts as ‘Swifties’ and ‘Beyhivers’ open their wallets for more than just tickets and merchandise."

Last State Roundup was Barbie, now Taylor. Taxes, Taxes Everywhere!

Make a habit of sustained success.