Welcome to this edition of our state and local tax roundup. State Tax News & Views will run biweekly for awhile in honor of the wind-down of the state legislative season. Remember Eide Bailly for your state and local tax planning, compliance, and incentive needs.

With most state legislatures on break, the nation's state tax administrators got together last week in Texas to talk shop. Their discussions give us a window on the hot issues in the state tax world, so we will lead with stories coming out of the Multistate Tax Commission gathering.

States’ Convenience Rules Are Constitutional, Massachusetts Official Argues - Amy Hamilton, Tax Notes ($):

Speaking on a panel featuring Edward Zelinsky — the law professor suing New York over its convenience of the employer rule — the general counsel for the Massachusetts Department of Revenue defended the constitutionality of such rules.

Michael Fatale, speaking on his own behalf and not necessarily representing the Massachusetts DOR’s position, said cases supporting the constitutionality of sourcing income to the employer’s state include South Dakota v. Wayfair Inc., International Harvester Co. v. Wisconsin Department of Taxation (1944), and Wisconsin v. J.C. Penney Co. (1940).

Fatale and Zelinsky were participating in a July 26 session featured as part of the Multistate Tax Commission’s annual meetings week, hosted in Austin, Texas, and virtually. Zelinsky, a professor at Yeshiva University's Benjamin N. Cardozo School of Law in Manhattan, is challenging New York’s application of its convenience rule during the pandemic. He argues that teaching remotely from his Connecticut home during the pandemic was not for his convenience because then-Gov. Andrew Cuomo had shut down most businesses in the state via an executive order.

MTC Panel Suggests Tax Exemptions For Digital Biz Inputs - Sanjay Talwani, Law360 Tax Authority ($). "Karl Frieden, vice president and general counsel of the Council on State Taxation, said that as broad-based sales and use taxes arose in the decades following World War I, they were initially applied to every stage of production, leading to "pyramiding" or cascading of taxes onto the final consumer. Among other distortions, such taxes incentivize companies to vertically integrate to reduce their amount of taxable transactions, Frieden said, and they can disfavor complex industries with multiple stages of production."

States Express Doubts About Tax Exemptions for Business Inputs - Michael Bologna, Bloomberg ($). "State tax officials didn’t dispute the theoretical framework presented by Frieden, but expressed concerns about the revenue implications of any blanket rule waiving taxes on business uses of digital products and services."

MTC OKs Private Group To Study Tax Rules For Trucking Cos. - Paul Williams, Law360 Tax Authority ($).

Katie Frank of the California Franchise Tax Board, who chairs the work group, said the panel's movement on the issue has fizzled and that private meetings could facilitate more robust feedback from state and industry representatives over the viability of the current regulation and ways that it could be revised.

...

Part of the impetus for revisiting the miles-based rule stemmed from court rulings in favor of UPS in Montana and New Mexico, which found that method didn't fairly represent the company's activity in those states. The work group has failed to reach a consensus on whether to stick with the miles-based approach, switch to a method Massachusetts employs that sources receipts based on where items are picked up and delivered, or use a blend of the two methods, Frank said during a presentation to the committee.

State Model Sourcing Rule on Guaranteed Payments Gets Traction - Michael Bologna, Bloomberg ($):

A state tax harmonization commission addressing the sourcing of partnership income is headed toward a model rule for sourcing “guaranteed payments”—compensation transferred by a partnership to its partners—in a manner that conflicts with the current federal approach.

... 67% favored a strategy sourcing guaranteed payments as a partner’s distributive share, rather than as compensation.

In other news:

IRS Urges States to Join Direct-File Pilot - Lauren Loricchio, Tax Notes ($). "The IRS will hold a direct-file pilot during the 2024 filing season that will allow a group of taxpayers to e-file their income tax returns directly with the agency. Officials are still figuring out exactly how an IRS-run direct-file program will sync with state tax systems."

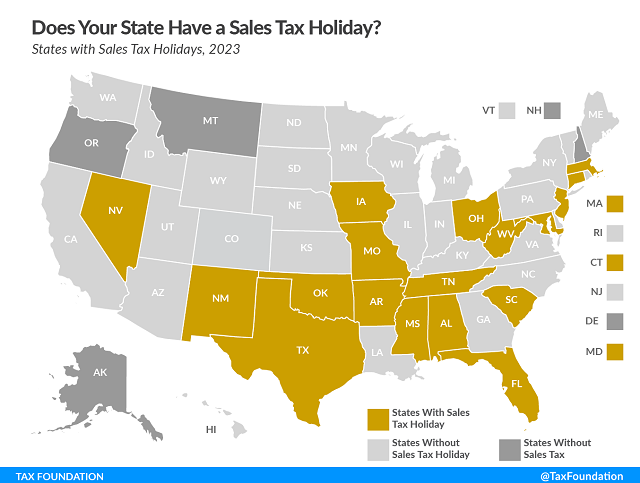

Does Your State Have a Sales Tax Holiday? - Manish Bhatt, Tax Policy Blog. "Proponents argue that sales tax holidays promote economic growth. They posit that individuals will purchase more of the exempted goods than they would have in the absence of the holiday, and that they will also increase their consumption of nonexempt goods. However, the evidence (including a 2017 study by Federal Reserve researchers) shows that, instead of increasing purchases, consumers simply shift the timing of purchases they were already going to make."

State-By-State Roundup

California

Beet Sugar Cooperative Wins California Tax Apportionment Case - Perry Cooper, Bloomberg. "The coop was allowed to deduct income deriving from business activities for or with its member shareholders, which greatly reduced its gross income and resulting net income subject to California tax. It also earned some income that didn’t qualify for the deduction because it was earned by its for-profit subsidiary Spreckels Sugar Co."

San Francisco Halts Tax Hike to Attract Businesses - Paul Jones, Tax Notes ($). "The tax provisions in the ordinance include freezing the gross receipts tax at the January 1, 2022 rates for some businesses, postponing until January 2025 the rate increases that were set to go into effect in January 2023. The rate freeze will apply to "the business activities of retail trade, certain services, manufacturing, food services, accommodations, and arts, entertainment and recreation," according to an online summary of the ordinance linked to the San Francisco Board of Supervisors' July 25 agenda."

Colorado

Colorado Launches Refundable Tax Credit Program for CHIPS Projects - Emily Hollingsworth, Tax Notes ($):

Colorado Gov. Jared Polis (D) has announced a refundable tax credits program to encourage semiconductor industry and advanced manufacturing investment in the state.

...

Administered by the Global Business Development Division of the Colorado Office of Economic Development and International Trade (OEDIT), the program allows eligible companies to claim a refund of up to 80 percent of the value of certain economic development tax credits. On their own, the performance-based economic development tax credits are nonrefundable, though they can be carried forward to offset state taxes, OEDIT Senior Communications Manager Alissa Johnson confirmed to Tax Notes July 27.

Link: Colorado press release.

Idaho

Idaho Regs Would Clarify Credit For Tax Paid To Other States - Zak Kostro, Law360 Tax Authority ($). "The proposed regulations also would clarify when an Idaho resident who is a pass-through entity shareholder, partner or member is allowed a credit for taxes paid to another state if the entity hasn't elected to be treated as an affected business entity in Idaho but pays entity-level tax in another state. Under such circumstances, the resident would be allowed to claim the credit to the extent the tax is attributable to the individual as a result of their share of the entity's taxable income in the other state, as provided in Section 63-3029(1) of the statutes, the proposed regulations said."

Illinois

Illinois Bill Clarifies Passthrough Income Tax Credit Distribution - Benjamin Valdez, Tax Notes ($). "Pritzker signed S.B. 2047 July 28. The bill provides that for tax years beginning on or after January 1, 2024, income tax credits earned by partnerships or S corporations are allowed to pass through to partners and shareholders in accordance with the determination of income rules under IRC sections 702 and 704, or based on a separate agreement between partners or shareholders that was drafted before the due date of the return."

Iowa:

Iowa DOR Issues Guidance on New Passthrough Entity Tax Election - Emily Hollingsworth, Tax Notes ($):

The DOR guidance explains that S corporations, general partnerships, limited liability companies (excluding single-member LLCs), limited liability partnerships, or limited partnerships can annually elect to pay a PTET and their owners can claim a credit against the net tax.

...

PTET elections for tax year 2022 will be due by December 31 or by the due dates of their 2022 IA 1065 or 2022 IA 1120S — including extensions — whichever comes later, the DOR said. For tax years 2023 and after, the PTET election will follow the same deadline as returns IA 1065 and IA 1120S.

Related: Iowa issues guidance on retroactive pass-through entity tax.

Iowa Proposes to Add Exclusion Guidance to Income Determination Rule - Tax Notes ($). "The Iowa Department of Revenue proposed to amend the rule regarding determination of net income by implementing legislation enacted in 2022 (H.F. 2317) which repealed one capital gain deduction, created another for farming businesses, and provided an election to deduct gains from qualifying farming business sales."

Link: Proposed Iowa guidance

Massachusetts

Massachusetts’ Proposed ‘Fee’ on Streamers Could Really Be a Tax - Angélica Serrano-Román, Bloomberg ($). "The widely supported measure (H.74) in the state House seeks to place a 5% levy on the annual gross revenue of streaming operators for entertainment services provided to people and businesses in the state. The bill would create a new framework for the use of digital infrastructure—like internet services—connected to public rights-of-way and provide a new revenue stream for community media in the commonwealth."

Michigan

Detroit Considers Shift From Property To Land Value Taxation - Aravind Boddupalli, Tax Vox. "Because typical property tax regimes apply equally to the parcel of land and any improvements on it, there is evidence the tax can discourage investment. This is because construction, repair, and maintenance all contribute to higher property values, and subsequently, higher property taxes. This may prompt some landowners to keep their land vacant or let buildings deteriorate."

Henry George, call your office.

Minnesota

Minn. May Delay NOL Deduction Cut, Tax Dept. Says - Sanjay Talwani, Law360 Tax Authority ($): "The Minnesota Department of Revenue said in a notice that the Legislature had notified the state revenue commissioner that lawmakers may delay the reduction in the NOL deduction limit from 80% to 70% of a corporation's taxable income so it applies to tax years starting after Dec. 31, 2023. Under legislation passed in May, the drop in the deduction limit applies to tax years starting after 2022."

Nebraska

Nebraska Governor Unveils Working Group on Property Valuation Reform - Emily Hollingsworth, Tax Notes ($). "Pillen chairs the working group, which also includes five state senators, members of the governor’s policy and research team, the League of Nebraska Municipalities, the Nebraska State Chamber of Commerce, the Nebraska Association of County Officials, and the Nebraska Realtors Association."

New Hampshire

New Hampshire Decouples From Federal Interest Deduction Limit - Benjamin Valdez, Tax Notes ($). "S.B. 189 will decouple the state from the limit on business interest expense deductions under IRC section 163(j) for tax years beginning January 1, 2024, allowing taxpayers to deduct the full amount of expenses in the year they are incurred. Taxpayers will be required to add back federal deductions taken for the business interest expense carryforward to their gross business profits."

New Jersey

New Jersey Enacts Convenience of the Employer Tax Rule - Matthew Pertz, Tax Notes ($):

New Jersey has enacted long-awaited legislation that imposes income tax on certain nonresidents working remotely for in-state employers, targeted at New York’s convenience of the employer rule.

...

New Jersey’s new convenience of the employer rule was designed specifically to counter New York’s rule, which taxes New Jersey residents who work remotely for New York companies. Under New Jersey's law, nonresidents who work for an in-state company but work out of state for convenience will have to pay New Jersey taxes, similar to nonresidents who commute across the border.

New Mexico

NM To Revise Sourcing Methods In Digital Ad Tax Rules - Paul Williams, Law360 Tax Authority ($). "New Mexico will change the sourcing methods in its proposed digital advertising tax regulations to incorporate suggestions from an industry group that objected to the possibility of sourcing receipts to server locations, a state tax agency representative said Tuesday."

New York

Report Urges More Transparency for New York Tax Incentives - Emily Hollingsworth, Tax Notes ($). "New York's economic development department is vulnerable to corruption and needs to improve its transparency and oversight of the state's tax expenditures, according to a recent report from New York watchdog organization Reinvent Albany."

Link: Increasing the Transparency and Accountability of Empire State Development

Oklahoma

Okla. Legislature Overrides Veto On Tribal Tobacco Pacts - Caleb Symons, Law360 Tax Authority ($). "Oklahoma lawmakers have voted overwhelmingly to extend a set of agreements allowing the Sooner State to collect half of the tax revenue from tobacco sales on tribal land, overriding a veto by Gov. Kevin Stitt, who wants to renegotiate with Native American communities."

Oregon

Oregon Enacts Extended SALT Cap Workaround, New CAT Exemptions - Paul Jones, Tax Notes ($). "H.B. 2083, approved by Kotek July 27, extends until the end of 2025 the state's elective passthrough entity tax, which allows for passthroughs to pay state income tax at the entity level and for owners to claim a tax credit for their share of the taxes paid. That allows owners to benefit from a full federal deduction for the state taxes paid, avoiding the Tax Cuts and Jobs Act‘s $10,000 state and local tax deduction cap. While the SALT cap is set to expire at the end of 2025, Oregon's workaround was scheduled to sunset at the end of 2023."

Ore. Establishes Tax Credits For Affordable Housing Deals - Zak Kostro, Law360 Tax Authority ($). "H.B. 2071, which Democratic Gov. Tina Kotek signed Monday, establishes a credit for eligible individuals and businesses that sell publicly supported housing to a buyer that enters a recorded affordability restriction agreement for at least 30 years, according to a bill summary. The credit will be 2.5% of the lesser of the sale price or property appraisal amount if the taxpayer owned the property for at least five years, or 5% of the lesser of such amounts for property owned for at least 10 years, according to a revenue impact statement."

Texas

Texas Voters To Decide On Property And Franchise Tax Cuts - Michael Nunes, Law360 Tax Authority ($):

Under S.B. 2 the state would cut school tax rates on residential and business properties and increase the homestead exemption from $40,000 to $100,000. There would also be a cap on the annual appraised value increases at 20% for certain property other than residential homesteads, including second homes and investment properties worth up to $5 million, for the next three years. H.J.R. 2 enables the referendum for S.B. 2.

S.B. 3 would increase the total amount of business revenue exempt from the state's corporate franchise tax to $2.47 million, from $1.23 million. The change would exempt 67,000 businesses from the tax, according to an analysis of the bill. Passage of the bill, according to the bill analysis, is dependent on the passage of S.B. 2.

Tax Topics in Pop Culture Corner

Barbie’s Dream Lifestyle Would Be a Sales and Property Tax Boon - Lauren Suarez, Blooomberg:

Malibu, Calif., one of most well-known places Barbie has lived, is among the most expensive areas in the US. Luckily, someone loves Barbie enough that they built a life-size Barbie Dreamhouse in the city to analyze—complete with an oceanfront view and a pink slide into the pool.

The real-life Barbie Dreamhouse—which has to have room for Barbie, her little sisters and pets, and maybe Ken—boasts an online sales price of around $5.2 million. That’s less than most would think an oceanfront property would cost. If this property were bought in today’s real estate market, it would create a yearly property tax bill of $3,553 per month, or about $42,640 per year at 8.2% in Los Angeles County.

I suppose a Barbie Dreamhouse would never be built in a bucolic Iowa setting with more reasonable property taxes.

Make a habit of sustained success.