IRS Guidance Coming as Employers Seek 401(k) Catch-Up Rule Delay - Austin Ramsey, Bloomberg ($):

Employers are optimistic that impending IRS guidance on new high-income, post-tax 401(k) catch-up contributions will delay enforcement long enough for them to ready their retirement plans.

Plan sponsors and lobbyists have spent the last few months prodding the IRS to delay implementing the SECURE 2.0 Act (Pub. L. No. 117-328) rule by at least a year. The regulation would effectuate a provision in the landmark retirement access law Congress passed late last year that requires high-income retirement plan catch-up contributions to be made in the form of post-tax Roth deferrals.

Further down the article:

Employer groups told Bloomberg Law they’ve been put on notice that a grab-bag of last-minute SECURE 2.0 guidance could be issued ‘this week,’ leaving them optimistic that their campaign to press pause on the program has paid off...

An IRS spokesperson said the agency has been reviewing all of the law’s provisions and plans to ‘provide the needed guidance,’ but officials wouldn’t comment on timing.

Speaking of retirement:

Baby Boomers Are Overestimating Future Social Security Income – Suzanne Woolley, Bloomberg ($):

Social Security benefits may not provide as much income as many older Americans expect — and that’s before possible cuts are needed to address a projected shortfall a decadefrom now.

Baby boomers anticipate that 47% of pre-retirement earnings will be replaced by Social Security, according to results of an annual survey from the Nationwide Retirement Institute. But the reality for someone making what the Social Security Administration considers the average wage in recent years, about $60,000, is more like 37%, according to the Committee for a Responsible Federal Budget. And the percentage drops as household income rises.

CHIPS Act Timing Questions Slow Project Financing, Industry Says - Caleb Harshberger, Bloomberg ($):

Uncertainty over the CHIPS Act tax credit refund timeline is hamstringing companies’ efforts to get private financing needed to boost semiconductor investments, tax professionals told the IRS at a public hearing Thursday.

Companies and others looking to leverage billions in promised tax credits from the CHIPS Act filed comments and spoke at the hearing on regulations for the elective payment of advanced manufacturing investment credit—calling for the language specifying how and when credits can be used and making clear when eligible filers can expect awards.

Taxpayers Seek Faster Payment on Manufacturing Investment Credit – Mary Katherine Browne, Tax Notes ($). “The majority of stakeholders recommended that the government implement a quarterly election and quarterly return system similar to mechanisms put in place for alcohol fuel, biodiesel, and alternative fuel mixture credits.”

U.S. Department of the Treasury, IRS Release Proposed Regulations on Sales and Exchanges of Digital Assets by Brokers – U.S. Treasury Department:

As part of the Biden-Harris Administration’s implementation of the bipartisan Infrastructure Investment and Jobs Act (IIJA), the U.S. Department of the Treasury (Treasury Department) and the Internal Revenue Service (IRS) today released proposed regulations on the sale and exchange of digital assets by brokers, in an effort to crack down on tax cheats while helping law-abiding taxpayers know how much they owe on the sale or exchange of digital assets. This is part of a broader effort at Treasury to close the tax gap, address the tax evasion risks posed by digital assets, and help ensure that everyone plays by the same set of rules.

The proposed regs are here.

Crypto Exchanges to Report Customer Data Under Treasury Proposal - Allyson Versprille and Erin Slowey, Bloomberg ($):

The proposed regulations from the Treasury Department and Internal Revenue Service offers clarity on reporting rules enacted in 2021 to curb crypto-related tax evasion by offering more transparency into customer trades. At the time, it was estimated the measure would raise up to $28 billion in additional revenue over 10 years, according to the Joint Committee on Taxation.

The IRS has pointed to unpaid digital asset taxes as a contributor to the tax gap—the difference between taxes owed and collected, which totals more than $500 billion per year. These proposed rules will help the IRS crack down on tax cheats and make it easier for taxpayers to know how much they owe, a Treasury official said in a background call Thursday.

U.S. Tackles Crypto Tax Mess – Richard Rubin, Wall Street Journal ($):

When they are fully implemented, the rules will require crypto exchanges such as Coinbase to deal with the Internal Revenue Service in a manner similar to brokers who handle investors’ stock and mutual-fund portfolios.

The crypto exchanges will send annual reports on Form 1099s to the IRS and to taxpayers that show the gross proceeds from transactions. That starts in 2026 for tax year 2025. Later, they will start reporting how much customers paid for the assets, known as their cost basis. Capital gains are the difference between sale price and cost basis, and investors face federal taxes of up to 23.8%.

These programs can now also be used to pay principal and interest on an employee's qualified education loans. Payments made directly to the lender, as well as those made to the employee, qualify.

By law, tax-free benefits under an educational assistance program are limited to $5,250 per employee per year. Normally, assistance provided above that level is taxable as wages.

GOP Presidential Candidates Tout Merits of TCJA, Blast IRS – Alexander Rifaat, Tax Notes ($). "In the first debate of the 2024 election season, Republican presidential candidates sought to solidify their conservative credentials by vowing to extend the tax provisions in the Tax Cuts and Jobs Act and criticizing the IRS."

Extending the TCJA will be an extremely heavy lift no matter who runs Washington.

Tax Cut Extensions Cost Over $3.3 Trillion – Committee for a Responsible Federal Budget:

Some parts of the 2017 Tax Cuts and Jobs Act (TCJA) have recently expired or changed, and large portions of the TCJA will expire by the end of calendar year 2025. Extending these provisions without offsets would dramatically worsen the fiscal situation. Based largely on recent projections from the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) this piece shows:

- Extending the TCJA in full would cost over $3.3 trillion through 2033, or $3.8 trillion with interest.

- Extensions would boost debt to 125 percent of GDP by 2033, from 115 percent under current law.

- Extensions would boost deficits above 8 percent of GDP in 2033, from 6.8 percent under current law.

- Extending individual provisions that expire at the end of 2025 would cost $3.4 trillion through 2035.

Given the mind-blowing cost estimate, if TCJA extensions occur they will likely be short term, say one or two years. We're basically looking at the entire individual federal tax code becoming one huge extender package.

McConnell concedes farm bill will be late; Stabenow eyes year-end – Ellyn Ferguson, Roll Call:

Congress will still deliver a farm bill but it won’t be in September, Senate Minority Leader Mitch McConnell told the Kentucky Farm Bureau on Thursday, voicing what was already looking inevitable as Congress runs out of legislative days left before the Sept. 30 expiration of the current law…

The current bill expires on Sept. 30, but the new deadline for a 2023 farm bill appears to be Dec. 31. On Jan. 1, 2024, some farm policy would revert to controls on production and costly price supports adopted in the 1940s.

What does this have to do with tax policy?

The best chance for Congress to pass a tax bill that includes R&D expensing, an expansion of the 163(j) interest deduction, and upping Bonus Depreciation to 100% is expected to be at the end of the year. If lawmakers are busy moving a farm bill, they will not have the time or attention span to move a tax bill. Lawmakers repeatedly say that they ‘can walk and chew gum at the same time,’ but they can’t.

Rural America is experiencing a strong recovery thanks to Biden administration investments – Deputy Treasury Secretary Wally Adeyemo, Fox Business News (opinion piece):

Rural communities are the backbone of the American economy in ways ranging from food to culture to natural resources. Take agriculture for example: agriculture, food, and related industries make up over 5 percent of our whole economy, and farming itself accounts for 2.6 million jobs. The work of U.S. farmers helps Americans to expend a smaller share of their spending on food than any of G7 country.

Despite our reliance on our rural communities, too often they are hit the hardest when economic crisis strikes. In previous recessions, rural communities rarely received the full support they needed.

Tax legislation approved by the House Ways and Means Committee in June includes a provision that would create rural Opportunity Zones. The legislation is here. The House has yet to vote on this bill and it is not clear when it will.

Justice Department Lauds Criminal Charges Tied To Over $836 Million In Alleged Fraud - Kelly Phillips Erb, Forbes:

It’s been just over three and a half years since Alex M. Azar II, Secretary of Health and Human Services, declared that Covid-19 constituted a public health emergency. In the months that followed, government officials scrambled to find a way to ease economic shortfalls related to the pandemic through a series of tax breaks, forgivable loans, and other resources. And it didn’t take long after that for criminals to seize the opportunity to engage in tax-related scams and steal funds intended for those who were impacted by Covid-19…

This month, the Justice Department announced the results of a coordinated, nationwide enforcement action to do just that. Those efforts included 718 enforcement actions resulting in federal criminal charges against 371 defendants for offenses related to over $836 million in alleged Covid-19 related fraud.

Texas Port’s $55 Million Municipal Bonds Ruled Taxable by IRS - Martin Braun, Bloomberg ($):

The U.S. Internal Revenue Service has concluded that interest on $55 million of municipal bonds issued by a Texas port in 2017 is taxable because the issuer was too slow to spend money it raised, according to a securities filing.

The Port of Port Arthur Navigation District didn’t comply with a section of the tax code that requires municipalities to spend 85% of tax-exempt bond proceeds within three years of the bonds being issued, according to the IRS, the filing said.

FATCA Withholding-Agent Penalty Relief Extended Through 2024 - Michael Rapoport, Bloomberg ($):

Withholding agents who fail to withhold with respect to certain dividend-equivalent payments under the Foreign Account Tax Compliance Act (FATCA) will continue to have any penalties excused through 2024, the IRS said Thursday.

The extended relief, for the 2022, 2023 and 2024 calendar years, applies to withholding agents who don’t withhold by March 15 of the following year on payment of dividend equivalents made with respect to a derivative referencing a partnership.

From the "Tax Credits A-Go-Go" file:

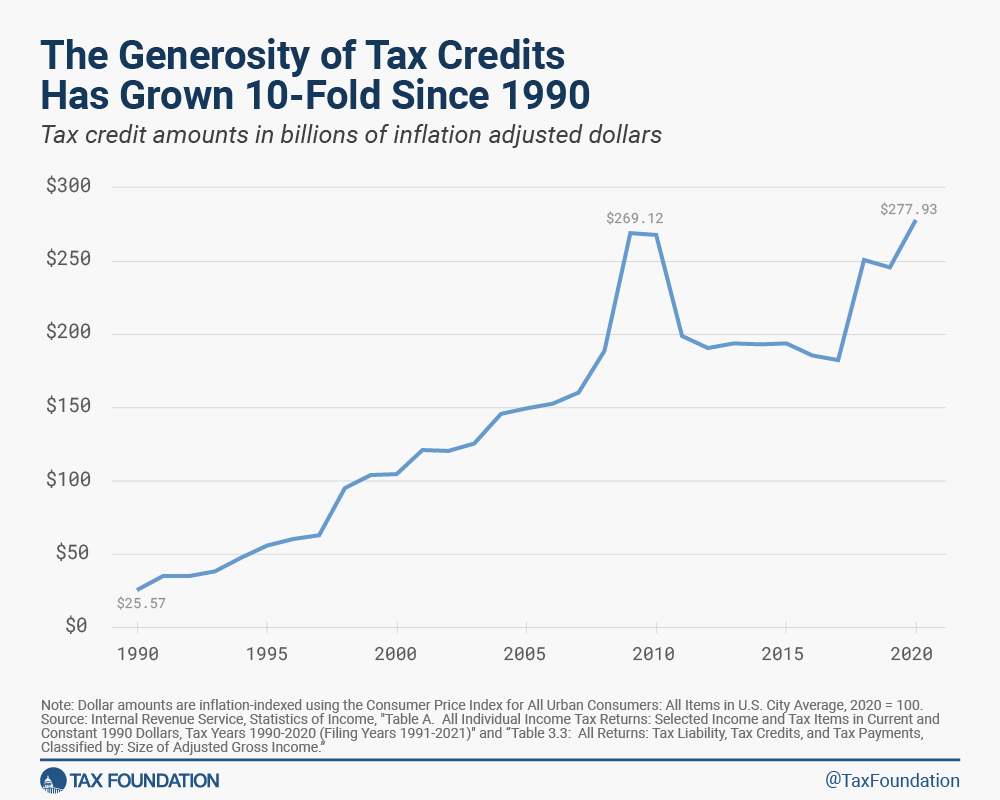

Summary of the Tax Credits Claimed on the Form 1040, Tax Year 2020 – Erica York and Taylor Cazy, Tax Foundation:

Key Findings

- In tax year 2020, taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

- Taxpayers with adjusted gross income below $50,000 claimed 54 percent ($149.6 billion) of tax credits by amount while taxpayers with adjusted gross income above $200,000 claimed 13 percent ($36.8 billion) in 2020.

- The largest tax credit by number of claims and by amount was the Child and Dependent Tax Credit, claimed on 39.3 million tax returns for a total benefit of $84.4 billion.

- From 1990 to 2020, the value of tax credits has increased nearly 10-fold after adjusting for inflation, reflecting how lawmakers have increasingly relied on the tax code to administer social benefits.

A picture is worth a thousand words:

Get your weekend started right! It’s Kiss and Make Up Day as well as National Banana Split Day and National Whiskey Sour Day. Game plan: Kiss and make up then celebrate with a banana split or whiskey sour – or both. It’s Friday. Live a little!

Make a habit of sustained success.