Democrats Drew Line in Sand for IRA Provisions but Left IRS Out - Doug Sword, Tax Notes ($):

Republican lawmakers keep finding ways to cut into the Inflation Reduction Act and its $79.6 billion funding injection for the IRS, with Democrats failing to hold the line on the first two attempts.

...

For those keeping count, the totals so far are $21.4 billion in successful clawbacks from the IRS and $67 billion in proposed clawbacks. Cuts to annual appropriations — including the proposed fiscal 2024 cut — amount to 11 percent, which would lower the agency’s annual budget to below what it was in fiscal 2009. That fiscal 2009 budget was $11.5 billion, 3 percent higher than the $11.2 billion House Republicans want for the agency’s fiscal 2024 budget, even though inflation totaled more than 40 percent during that 15-year period.

IRS Urged To Ax Limit On Transferred Clean Energy Credits - David van den Berg, Law360 Tax Authority ($):

IRS regulations on the transferability of clean energy credits should be modified so that transferred credits aren't subject to passive activity rules restricting the ability to deduct losses from businesses that taxpayers don't meaningfully participate in, representatives of tax credit firms said Wednesday.

...

Under the proposed rules for Section 6418, recipients of transferred credits subject to Section 469 wouldn't be considered to have materially participated in the business and would have to treat transferred credits as passive activity credits to the extent the specified credit portion exceeded passive tax liability.

Energy Industry Requests Easing of Credit Transfer Rules - Mary Katherine Browne, Tax Notes ($):

Members of the clean energy sector asked the government to consider relaxing restrictions and providing taxpayers with more flexibility when finalizing regulations for the transfer of specific energy credits under section 6418.

...

Congress enacted in the Inflation Reduction Act the section 6418 transferability provision allowing taxpayers not using direct pay to transfer all or a portion of any applicable credits to a third party in exchange for cash. Transferability is available for all energy generation and carbon capture credits, clean vehicle credits, some manufacturing credits, and some clean fuel credits.

Ease Sellable Green Tax Credit Restrictions, Companies Tell IRS - Erin Slowey, Bloomberg ($):

Companies looking to take advantage of those options want to be able to choose whether or not the bonus tax credits can be separately transferred in a transaction—an option the proposed rules don’t allow.

...

The bonus credits give an additional boost to taxpayers who source domestically or have a project in a low-income community or an area that was impacted by coal plant closures.

IRS Backdating Court Order Spotlights Culture, Attorneys Say - Caleb Harshberger, Bloomberg ($):

An unusual Tax Court order requiring the IRS to report what it knew and when about misstatements in a conservation easement case, as well as mounting claims of backdating forms at the agency, are highlighting what some tax attorneys said are festering IRS cultural problems, years in the making.

...

Tax attorneys say it’s the latest chapter highlighting festering issues of IRS culture being taken over by adversarial us-versus-them attitudes at the agency.

Over 3,100 Charged With Pandemic Relief Fraud, Justice Dept. Says - Madeline Ngo, New York Times:

One case detailed by the department involved 30 individuals — all alleged to be members or affiliates of a Milwaukee street gang known as the Wild 100s — who were charged for their role in a scheme involving millions in fraudulently obtained pandemic unemployment insurance benefits. The funds were allegedly used to solicit a murder for hire and to purchase firearms, controlled substances, jewelry, clothing and vacations. Some defendants were also accused of transferring firearms knowing they would be used to commit violent crimes or traffic drugs.

Justice Dept. brings wave of cases over $836 million in alleged covid fraud - Tony Romm, Washington Post:

To save an economy in free fall, congressional Democrats and Republicans starting in 2020 adopted a series of coronavirus aid packages totaling roughly $5 trillion. The money aimed to ease the strain on the hospitals and doctors, save cash-starved small businesses from financial ruin and support millions of Americans suddenly without a job.

But the speed at which Washington tried to dole out the funds — combined with decades of state and federal mismanagement — ultimately opened the door for waste, fraud and abuse that law enforcement officials are now beginning to identify.

Spend in haste, repent at leisure.

From the Justice Department press release on the arrests (my emphasis):

Many of the cases in the enforcement action involve charges related to pandemic unemployment insurance benefit fraud and fraud against the two largest pandemic Small Business Administration programs: the Paycheck Protection Program and Economic Injury Disaster Loans. Additional matters involved pandemic healthcare billing fraud, fraud against the Emergency Rental Assistance program, and fraud committed against the IRS Employee Retention Credit program (ERC), a refundable tax credit for businesses and tax-exempt organizations that had employees and were affected during the COVID-19 pandemic.

The ERC fraud is ongoing. Consult your local radio listings.

Where’s My Refund? Has Your Tax Return Been Flagged for Possible Identity Theft (IDT) - Erin Collins, NTA Blog. "The IRS’s online tools, such as Where’s My Refund, provide taxpayers with limited information about the status of their refunds; however, this tool only tells taxpayers their tax return has been received or processed, or a refund was issued. No information is provided to taxpayers when processing of a tax return has been suspended for potential IDT. Although the IRS has agreed to make enhancements to its Where’s My Refund? tool and provide taxpayers more information about the status of their tax return, this upgrade has not been done to date."

Diving into swimming pool tax deductions - Kay Bell, Don't Mess With Taxes. "The added costs of being able to step out your back door and take a cool dip often prompts a tax question: Can I deduct my swimming pool costs?"

Lawsuits Against Google And Meta Allege Websites Are Spying On Taxpayers - Kelly Phillips Erb, Forbes. "According to the complaint, tax preparation companies like H&R Block, TaxAct, and TaxSlayer sent private tax return information to Google using Google Analytics technology. The plaintiffs allege that data may include email addresses, data on users' income, filing status, refund amounts, buttons clicked, and year of return, and was used by Google to improve its ad business and enhance its other business tools."

Seventh Circuit Blocks Basketball Team Seller's Deduction for Deferred Comp Liability - Parker Tax Pro Library. "Affirming the Tax Court, the Seventh Circuit held that a limited partnership that sold the assets of an NBA basketball team could not claim a deduction for a liability to pay deferred compensation to two players that was assumed by the buyer in the sale."

Moore Might Mean More! US Supreme Court Review of Moore & Section 965 Transition Tax - Virginia La Torre Jeker, US Tax Talk. "In recent years, one of the most hotly debated tax issues in the United States has been the imposition by Internal Revenue Code Section 965 of the 'transition tax' or 'mandatory repatriation tax', a provision of the Tax Cuts and Jobs Act (TCJA) enacted in 2017. The Supreme Court’s recent decision to review the 9th Circuit case of Moore v. United States has brought this contentious issue back into the spotlight."

Lesson From The Tax Court: Tax Protesting—A Hobby That Eats - Bryan Camp, TaxProf Blog. "That is why I call tax protestors 'hobbyists.' They simply advance stupid reasons for not paying taxes, to the point where their hobby consumes them and others, at great cost. That’s the lesson we learn in Lawrence James Saccato v. Commissioner, T.C. Memo. 2023-96 (July 25, 2023) (Judge Lauber), where the taxpayer failed to file returns for some 14 years. When caught, he persisted in protesting that he was exempt from income tax because, among other stupid reasons, he was ' a citizen of the State of Oregon' and not a 'federal citizen.' The Court’s reaction was to impose a §6673 penalty on top of a deficiency topping $200k. His hobby was eating him up."

Continuing Your Access To Procedurally Taxing - Leslie Book, Procedurally Taxing. "Great news! Procedurally Taxing will be included in your existing Tax Notes subscription for no additional cost. Once the migration to taxnotes.com is complete on September 7, you’ll be able to find the link to the Procedurally Taxing landing page under the 'Subscriptions' tab."

I have very mixed emotions. As a happy Tax Notes subscriber through Eide Bailly, I will continue to see the insightful work of the Procedurally Taxing team and guest contributors. It's a great window into the world of tax litigation and the work of low-income tax clinics, and I'm glad that Procedurally Taxing will get the benefit of Tax Analysts resources.

I am sad, though, that Procedurally Taxing will no longer be available without a subscription. Low-income tax clinics live on tight budgets, and I fear some will no longer have access to the wisdom of the Procedurally Taxing team. Pro-se Tax Court litigants, who need the wisdom of Procedurally Taxing more than anyone, will lose out.

Update: Leslie Book replies: "Not to worry about tax clinic access to our posts. @TaxNotes has and continues to make access free for all LITCs. And we’ll continue to post outside paywall on topics of interest to low income taxpayers"

Tax Policy Questions That 2024 Presidential Candidates Should Address - Erica York, Tax Policy Blog. "The next occupant of the White House will have to address several critical tax policy issues, from the expiring individual and business tax changes in Tax Cuts and Jobs Act (TCJA) to escalating deficits and debt."

Democrat or Republican, Next President Faces a Fiscal Nightmare - Alexander Rifaat, Tax Notes ($):

In a report released August 23, the Committee for a Responsible Federal Budget (CRFB) said that in the next four years of the upcoming presidential term, the United States’ debt-to-GDP ratio is projected to reach 107 percent, which would break the record set in 1946, the year following the end of World War II.

As the 2024 election season takes shape, the CRFB urged presidential candidates to level with the American public, arguing that neither Democrats’ preference for tax increases nor Republicans’ focus on spending cuts are sufficient to tackle the spiraling federal deficit.

From the CRFB report:

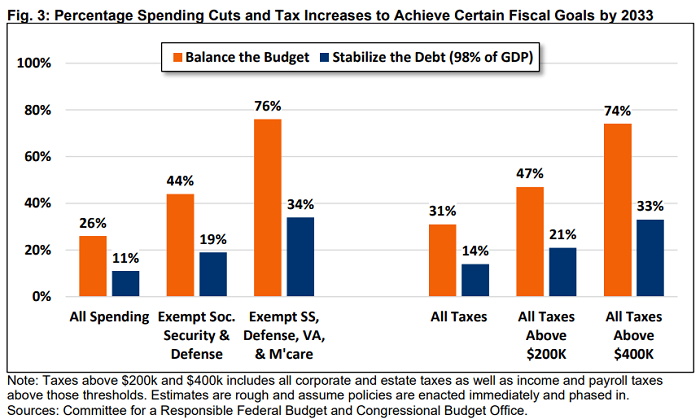

It is not realistically possible to fully address our fiscal challenges without changes to spending and to revenues. This is true both in terms of policy and politics. It is therefore irresponsible and counter-productive for candidates to promise what they will not do to fix the debt. As an example, balancing the budget by FY 2033 with spending cuts alone would require an already unrealistic 26 percent spending cut. If candidates promise to exempt spending on Social Security, Medicare, defense, and veterans as well, all other spending would have to be cut by an impossible 76 percent – the equivalent of ending Medicaid and all nondefense discretionary programs. Cuts would need to be about half as large to stabilize the debt relative to the economy.

Similarly, balancing the budget just by raising taxes would require boosting tax collection by nearly one-third, while doing so from only corporations and those making over $400,000 would require boosting tax collection by about three-fourths. This is likely impossible in practice, since it would require lifting the top tax rate well above its revenue-maximizing level, even with substantial base broadening.

(Source: CRFB)

I missed the debate last night, but I'm pretty sure I didn't miss any candidate seriously addressing these numbers.

Rhode Island attorney pleads guilty to federal wire fraud, tax evasion charges - IRS (Defendant name omitted):

In pleading guilty to charges of wire fraud and tax evasion, Defendant admitted that he forged client signatures and deposited client settlement checks into his attorney IOLTA account, using those funds to pay personal expenses and to repay earlier clients whose funds he had embezzled. To prolong his scheme, Defendant repeatedly made false representations to clients about the status of their cases, and told them that he would pay their medical expenses and other bills with settlement funds he had received.

...

Defendant also admitted that from 2014-2019, he took multiple steps to conceal his gains from the IRS, including by making false statements on IRS forms regarding his assets; making false statements to IRS Revenue officers about his ability and willingness to pay his taxes and about his withdrawal of over $540,000 of cash from his IOLTA accounts for payment of personal expenses; and by transferring money from his client account to the account of family members to make personal payments.

One of life's great mysteries is how someone with the intelligence, self-control, and motivation to get through law school, and with enough knowledge of the law to pass the bar exam, would take such illegal and foredoomed actions. But once you somehow get that far, leaving the theft off your 1040 isn't a great leap.

Celebrate those delightful built-in butter pockets! Today is National Waffle Day.

Make a habit of sustained success.