IRS Gives a Thumbs Down to TikTok-Promoted Trusts - Chandra Wallace, Tax Notes ($):

According to the memorandum, promotional materials for NICDS trusts “claim that almost none of the income generated by the trust is subject to current federal income tax” if the trustee doesn’t distribute income to the beneficiaries but instead treats the income as an addition to the principal assets of the trust, known as the trust “corpus.”

“The legal basis for these assertions regarding federal income taxation rely on section 643,” the IRS wrote. However, the agency continued, they misapply that statute by treating it as a definition of taxable income — which it isn’t.

The IRS guidance explains how the “Non-Grantor, Irrevocable, Complex, Discretionary, Spendthrift Trust” is supposed to work:

The promotional materials claim that almost none of the income generated by the trust is subject to current federal income tax if the trustee allocates such income to corpus and refrains from making distributions to beneficiaries. The legal basis for these assertions regarding federal income taxation rely on §643 of the Code.

To support the assertion that all income from the sale or exchange of capital assets (“capital gains”) is excluded from federal income tax, the materials quote §643(a)(3), without context (emphasis in original):

“IRC Section 643(a)(3) Capital Gains and Losses — gains from the sale or exchange of capital assets shall be EXCLUDED to the extent that such gains are allocated to corpus and not (A) paid, credited, or required to be distributed to any beneficiary during the taxable year...”

Next, the materials claim that the trustee may characterize any remaining trust income as an “extraordinary dividend”, which the materials claim is not subject to current taxation so long as the trustee allocates such income to corpus.

It doesn't work that way. Income is either taxable to the trust itself, or to the beneficiaries if distributed. Trusts have a compressed rate schedule, hitting the top 37% rate at taxable income of $14,450.

International Information Return Penalties Impact a Broad Range of Taxpayers - Erin Collins, NTA Blog:

There is a misconception that IIR penalties affect primarily bad-faith, wealthy taxpayers who are experiencing consequences of their own making. Reality, however, is much different. The IIR penalty regime disproportionately affects individuals and businesses of more moderate resources, and is by no means just a rich person’s problem. Wealthy individuals and large businesses tend to have knowledgeable and well-informed representation and as a result have fewer foot faults. Immigrants, small businesses, and low-income individuals may not be as well-informed about IIR penalties and may not have return preparers with the same technical expertise on international penalties.

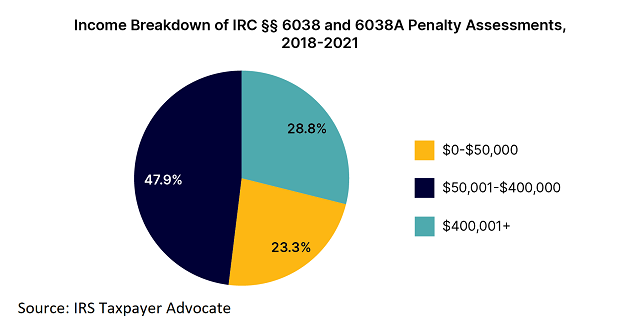

This phenomenon can be seen in the context of IRC §§ 6038 and 6038A penalties, which relate to information reporting of U.S. persons with certain interests in foreign partnerships and corporations, and 25 percent foreign-owned U.S. corporations.

These penalties start at $10,000, and the IRS assesses them automatically. As Ms. Collins, the IRS Taxpayer Advocate, notes, it's not money-laundering millionaires that get hit hardest. Almost 3/4 of these penalties hit taxpayers with income under $400,000:

From the Taxpayer Advocate's post (my emphasis):

The disproportionate nature of IIR penalties is particularly apparent when viewed in the context of IRC § 6039F penalties relating to foreign gift and inheritance reporting. This penalty is imposed against U.S. persons who receive gifts from foreign persons (including trusts and other entities) and fail to file a Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, in any year in which those gifts meet the dollar threshold. Noncompliance with this filing requirement can be devastating, as the penalties involved can reach up to 25 percent of the value of the gift. When a gift is received from a foreign person there may be no U.S. tax implication. In other words, the recipient can be penalized even though there is no tax due – no underreported income.

...

The IRC § 6039F penalties have an especially heavy impact on individual taxpayers: 92 percent were assessed against individuals. Additionally, a startling number of these penalties against individuals – 89 percent – are assessed against lower- and middle-income taxpayers.

The penalties are brutal and often unjust. Yet there they are. If you have any interest in a foreign business, or if you receive a gift or inheritance from a non-U.S. person, be sure you consult your tax pro.

Related:

Foreign Trust and Estate Compliance

IRS Violations of Taxpayers’ Rights Unaddressed, Watchdog Says - Caleb Harshberger, Bloomberg ($):

Failures at the IRS to adequately train and discipline staff have led to violations of taxpayers’ rights to representation in tax disputes, the Treasury Inspector General for Tax Administration said in a new report.

When taxpayers exercise their rights to representation, the IRS is required to go through the representatives, not the taxpayer directly—but TIGTA found a number of cases where the agency failed to follow these rules, potentially violating rights to representation in the process and frequently leaving these violations unreported.

Rules Shouldn't Prohibit Energy Credit 'Chaining,' IRS Hears - David van den Berg, Law360 Tax Authority ($):

Regulations regarding the monetization of clean energy tax credits under the Inflation Reduction Act shouldn't prevent unrelated recipients of transferred tax credits from electing to receive direct payments for those credits, a process known as chaining, lawyers and academic observers said during a hearing at IRS headquarters Monday....The IRS and Treasury released proposed rules on Sections 6417 and 6418 in June. In the Section 6417 proposed regulations — which were the focus of Monday's hearing — the agencies said they would not permit such structures. They also sought comments on limited situations in which exceptions to the proposed rule barring transferees from making elective payment elections on transferred credits might be appropriate.

New U.S. Buyback Tax Hits Companies With $3.5 Billion Burden - Jennifer Williams-Alvarez, Wall Street Journal. "At 1%, the tax isn’t altering companies’ buyback plans, but lifting the levy could prompt executives to change their strategies. President Biden in February proposed quadrupling the rate to encourage long-term investments by companies instead of rewarding shareholders and executives. A group of Senate Democrats followed up later in February with a bill similarly seeking to increase the tax on certain buybacks from 1% to 4%, a proposed hike that faces hurdles to passage in the divided Congress."

The tax only applies to public companies.

How to leverage 0% capital gains with this lesser-known tax strategy - Kate Dore, CNBC. "For 2023, you may qualify for the 0% rate with taxable income of $44,625 or less for single filers and $89,250 or less for married couples filing jointly."

Hawai'i wildfire victims granted federal tax relief, including new Feb. 15, 2024, deadline - Kay Bell, Don't Mess With Taxes. "The Internal Revenue Service has made it official. Hawaii wildfire victims in Maui and Hawaii counties have been granted tax relief, including a Feb. 15, 2024, deadline to file various federal individual and business tax returns and make tax payments."

Credit Unions Can Qualify for Employee Retention Tax Credit for 2021 Wages, But Not Those Paid in 2020 - Ed Zollars, Current Federal Tax Developments. "Given that credit unions are covered by IRC §501(c)(1) and exempt from tax under IRC §501(a), the memorandum concludes they are eligible for the credit in 2021."

Farmland Values and Thoughts on Transitioning to the Next Generation - Roger McEowen, Agricultural Law and Taxation Blog. "The current level of the applicable exclusion for federal estate tax purposes is $12.92 million. If the Congress does nothing with respect to the estate tax, that amount will adjust for inflation in 2024 and 2025. Then it will revert to $5 million in 2026 with an inflation adjustment that will likely peg it around $7-$7.5 million. So, the “average” farm doesn’t currently have an estate tax issue, but it land and other asset values continue to rise, many farms and ranches could have such a problem beginning in 2026."

Tax Court Judge Suggests Glue Factory For Retired Thoroughbred Horses - Peter Reilly, Forbes. "There is something rather tasteless in bringing up glue factories in the context of thoroughbred horses."

One-Year Anniversary Refresher on the IRA’s Tax Changes - Carrie Brandon Elliot, Tax Notes ($). "The IRA extends and modifies credits for individuals to build energy-efficient homes, or to install heat pumps and energy-efficient windows and doors. It also extends the residential clean energy credit to 2032 and increases the energy-efficient commercial building deduction."

Austin Vernon on the IRA - Tyler Cowen, Marginal Revolution. "So I think the first thing is that the law is not fiscally sustainable because the subsidies are large and uncapped. I would expect it to quickly get into the trillions over the ten year period without adjustments."

Bidenomics' Tax Conflicts - Alex Parker, Things of Caesar. "While Biden can be unsparing in his criticisms of big business, his environmental and manufacturing policies count on corporate America to be a partner. The entire premise of the Inflation Reduction Act is that companies will jump at the new lucrative incentives to invest in clean energy production."

Read to the end to learn about "Stardust the Super Wizard," who would be useful, with his "nearly unlimited technological powers," in resolving the contradictions of current tax policy.

Could Congress Actually Crack Down On Tax Exempt Political Organizations? - Howard Gleckman, TaxVox. "The good news: If Republicans are outraged by what they see as Democratic abuses and Democrats are offended by perceived GOP abuses, maybe there is a bipartisan opportunity to fix the system."

Drywall contractor sentenced to 18 months for tax evasion - IRS (Defendant name omitted):

Timothy M. O'Shea, United States Attorney for the Western District of Wisconsin, announced that Defendant, of Verona, Wisconsin, was sentenced today by U.S. District Judge William M. Conley to 18 months in prison for tax evasion. Defendant pleaded guilty to this charge on May 24, 2023.

Between 2013 and 2020, Defendant owned and operated a drywall business in Dane County. In 2015, the Internal Revenue Service (IRS) commenced a civil audit of Defendant's income tax returns for 2013 and 2014 and determined that he had significantly underreported his income for those years. Between 2015 and 2019, the IRS sent multiple notices to Defendant regarding tax deficiency assessments for the 2013 and 2014 tax years but he did not respond.

...

At the sentencing hearing, Judge Conley stated that the IRS had made "remarkable efforts" to handle Defendant's failure to pay taxes as a civil matter, but Defendant inexplicably chose to ignore the IRS's communications. Judge Conley also stated that Defendant made a bad situation with the IRS worse when he "doubled down" and used other people to create fictitious companies in an attempt to avoid the IRS's liens and levies.

Don't do that.

Don’t Like Paying Taxes? Would Free Merch Change Your Mind? - Sylvan Lebrun, Wall Street Journal:

Japan has a system that enables taxpayers to redirect some of their local taxes to towns or cities where they don’t live—and receive a gift or other token of gratitude in exchange. But what began as an effort to help rural places that were losing population has devolved into a cutthroat battle between municipalities dangling gifts to attract enough taxes to maintain public services.

...

Each year, Yoko Koizumi, a financial planner in Yokohama, uses the program to stock her larder with essentials such as meat, fish and vegetables, and with luxury items that she wouldn’t otherwise buy, including scallops, fish eggs and crab.

You know, it would be nice to get airline miles or something for paying taxes. Or even fish eggs.

It's National Tooth Fairy Day! But don't rely on the Tooth Fairy for your dental health, and don't rely on the Tax Fairy to take care of your tax obligations.

Make a habit of sustained success.