IRS expects faster refunds in 2024 for people who stop using paper - Jacob Bogage, Washington Post:

It takes the IRS a fraction of the time to process digital tax files, enabling revenue agents to swiftly — and more accurately — issue refunds. Tax officials for years have urged taxpayers to file returns electronically, hoping to avoid assigning employees the tedious task of inputting lines of data by hand into the agency’s decrepit computer system.

...

In March, the IRS obtained new scanning technology to more quickly and accurately process returns. It continues a large-scale hiring drive, planning to add roughly 20,000 employees over the next two years to fill roles in customer service and tax enforcement for high-income earners, according to Werfel’s strategic operating plan.

In the next phase, the IRS will expand the number of tax and non-tax forms that can be filed online. Taxpayers will still be able to file by paper if they wish, but their returns and correspondence will all be digitized upon receipt by 2025. A spokesperson said automated digitization of paper returns should speed tax refunds by about four weeks for those filers.

The agency also aims to digitize its massive archive of decades-old paper documents, which the IRS spends $40 million a year to store.

Crypto Rules Delay Puts Billions in Tax Revenue at Risk - Richard Rubin and Paul Kiernan, Wall Street Journal:

Last December, the Treasury Department and Internal Revenue Service said that brokers wouldn’t have to report any information until the administration issues final rules addressing questions such as the definition of a broker. More than seven months later, Treasury hasn’t taken the first formal step of issuing a proposal, which would kick off a monthslong—or yearslong—process before those final rules are done.

“Treasury is working diligently to issue these important and complex regulations soon,” said Treasury spokeswoman Kristin Lynch.

Fitch Downgrades U.S. Credit Rating - Alan Rappeport and Joe Rennison, New York Times. "Fitch lowered the U.S. long-term rating to AA+ from its top mark of AAA. The downgrade — the second in America’s history — came two months after the United States narrowly avoided defaulting on its debt. Lawmakers spent weeks negotiating over whether the United States, which ran up against a cap on its ability to borrow money on Jan. 19, should be allowed to take on more debt to pay its bills. The standoff threatened to tip the United States into default until Congress reached a last-minute agreement in May to suspend the nation’s debt ceiling, which allowed the United States to keep borrowing money."

IRS Visits to Dozens of Rich Americans Drive Malta Pension Probe - David Voreacos and Naomi Jagoda, Bloomberg. "One morning in late June, criminal agents from the Internal Revenue Service made unannounced visits to dozens of wealthy Americans. They carried summonses and wanted to ask about pension plans in Malta on the IRS “Dirty Dozen” scams list."

Feds Say NJ Man Ran $124M IRS Fraud Scheme During COVID - Celeste Bott, Law360 Tax Authority ($):

For example, Haynes aided in filing false tax returns for one unnamed person, telling them the government was giving out "free money" to people who had a business, and he told some clients the money they were getting came from a grant, according to charging documents.

More than 15 clients have now come forward to say tax forms he'd filled out on their behalf but without their knowledge were fraudulent and grossly overstate the number of employees they have and the amount of wages paid, according to prosecutors. On one type of tax form, Haynes claimed more in sick and family leave wage credits than the total amount of wages reported paid, for each respective quarter, according to filings in the case....

He charged each of the clients a fee of up to 15% of the tax refunds they received, and he had many clients pay him in cash, prosecutors said Monday.

The folks behind ads you see and calls you get telling you that you for sure qualify for Employee Retention Credits aren't there to get you money.

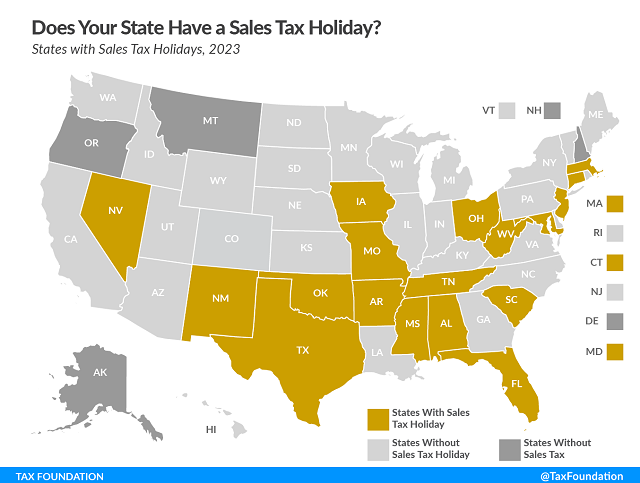

Does Your State Have a Sales Tax Holiday? - Manish Bhatt, Tax Policy Blog. "Proponents argue that sales tax holidays promote economic growth. They posit that individuals will purchase more of the exempted goods than they would have in the absence of the holiday, and that they will also increase their consumption of nonexempt goods. However, the evidence (including a 2017 study by Federal Reserve researchers) shows that, instead of increasing purchases, consumers simply shift the timing of purchases they were already going to make."

5 tax moves to make this August - Kay Bell, Don't Mess With Taxes. "4. Get part-time work documents in order. Documentation also is key if instead of needing constant oversight, the young people had a summer job, or two or more. This time-honored rite of passage offers good lessons on responsibility and money management. It also could have tax implications, five of which are discussed in my post on tax considerations for young workers and their parents."

Lesson From The Tax Court: An Object Lesson On Adequate Business Records - Bryan Camp, TaxProf Blog. "Bottom Line: Failure to keep adequate business records may trigger a bank deposits audit, the results of which will always put the taxpayer into a hole of having to prove a negative: that each deposit was not income. But that’s a hole of the taxpayer’s own making."

Unshocking News from the IRS: Staking Income Is Taxable - Russ Fox, Taxable Talk. "In what shouldn’t be a surprise to anyone, the IRS announced yesterday in Revenue Ruling 2023-14 that staking income, when received, is taxable income based on the fair market value when constructively received. This should be a surprise to no one–if you receive something with a value it’s an accession to wealth and that’s the definition of income."

IRS Rules Staking Rewards Are Taxable When Received - Amber Gray Fenner, Forbes. "For those who follow the taxation of digital assets the position taken in IRS Revenue Ruling 2023-14 comes as no surprise."

Tax Court Rejects Charitable Deduction for Purported Bargain Sale of Land - Parker Tax Pro Library. "The court found that the taxpayers failed to establish the value of all consideration the S corporation received as part of the purported bargain sale because they did not take into account the value of the reversion of the zoning designation, which in the court's view was an integral part of the sale transaction."

Can CPAs Prepare Your Taxes For A Percent Of Your Tax Savings? - Robert Wood, Forbes. "The IRS doesn’t permit your annual tax returns to be done on contingency. It turns out that tax advice or representation for contingent fees is the exception, not the norm."

Taxing Remote Workers: “Convenience,” Conflict, And The Courts - Renu Zaretsky, TaxVox. "When your commute to work takes place within the confines of your home, where should you pay income taxes? The answer is complicated. For remote workers, it could mean more work when filing their taxes. State and local budgets can pay a price, too."

OECD Agreement on Amount B Tax Deal Remains Elusive - Ryan Finley, Tax Notes Opinions ($). "The idea is that a mechanical system for assigning fixed operating margins to relatively stripped-down wholesale distribution subsidiaries could yield a reliable measure of an arm’s-length return, but without any of the compliance or enforcement costs associated with the bespoke transactional net margin method (or in U.S. parlance, comparable profits method) analyses performed today. In that sense, amount B wouldn’t so much displace the arm’s-length principle as establish a more practical way to apply it."

The Case Against the Child Tax Credit - Adam Michel and Vanessa Brown Calder, Liberty Taxed. "The CTC is a costly transfer program for taxpayers with kids who do not need government handouts and who do not meaningfully change their fertility decisions in response to larger payments. As an anti‐poverty program, the CTC is poorly targeted, and without income requirements, regular no‐strings‐attached payments from Washington are counterproductive for the most vulnerable families."

New Jersey owner of auto repair shop sentenced to prison for filing a false corporate tax return - IRS (Defendant name omitted):

A New Jersey man was sentenced today to one year and one day in prison for filing a false corporate income tax return with the IRS.

According to court documents and statements made in court, Defendant, of Edison, New Jersey, owned and operated Buses and Trucks, Inc., an automotive repair business located in Linden, New Jersey. In 2011, Defendant used business funds to pay for personal items, including gambling on horse races. Defendant concealed this diversion of business income by not disclosing it to his return preparer, thus causing the preparation and filing of a false corporate tax return. Furthermore, Defendant did not pay employment taxes in the amount of $291,600 based on an unreported cash payroll.

In addition to the term of imprisonment, U.S. District Judge Stanley R. Chesler ordered Defendant to serve one year of supervised release and to pay approximately $87,926 in restitution to the United States.

"Unreported cash payroll." When you pay in cash to avoid taxes, you instantly create a bunch of potential whistleblowers.

Watch the lines. It's National Coloring Book Day!

Make a habit of sustained success.