Welcome to this edition of our state and local tax roundup. State Tax News & Views will go biweekly for awhile in honor of the wind-down of the state legislative season. Remember Eide Bailly for your state and local tax planning, compliance, and incentive needs.

Litigation May Clarify 'Look-Through' Sourcing, Attys Say - Paul Williams, Law360 Tax Authority ($):

Legal disputes between companies and state tax agencies over rules for so-called look-through sourcing, whereby receipts are sourced to a customer's customer, are increasing and could settle open questions about how the method should be applied, tax professionals said Tuesday.

...

A form of the controversy centering on where receipts should be sourced when companies have warehouses in a state but later ship their products elsewhere is percolating in Ohio and Pennsylvania, Schiller said. Ohio has a statute that sources sales of tangible personal property to "the ultimate destination," Schiller said, but added the state's tax department has taken the position in a case that a company's sales should be sourced to a third-party distribution center in Ohio instead of the location of the ultimate purchasers of the items.

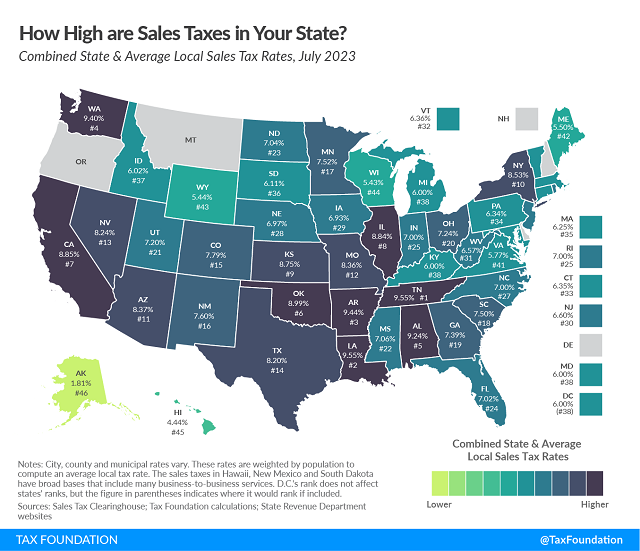

State and Local Sales Tax Rates, Midyear 2023. - Jared Walczak, Tax Policy Blog. "The five states with the highest average combined state and local sales tax rates are Tennessee (9.548 percent), Louisiana (9.547 percent), Arkansas (9.44 percent), Washington (9.40 percent), and Alabama (9.24 percent)."

State-by-State Roundup

Colorado

Colorado DOR Adopts, Repeals Miscellaneous Tax Rules - Emily Hollingsworth, Tax Notes:

In a July 14 notice the DOR announced that it took action on 31 tax rules and adopted 25 of them, following an April 6 public hearing.

...

New updates to income tax withholding reg Rule 39-22-604 include guidance on the employee withholding certificate for state tax purposes (Form DR 0004) and the penalties and interest due if the employer fails to file and remit applicable taxes. The rule also clarifies that employers that don’t receive Form DR 0004 from their employees “must calculate withholding for such employee as if the employee had filed an Internal Revenue Service Form W-4 indicating that they were a single filer.”

Colo. Tax Dept. Clarifies Eligible Wildfire Mitigation Costs - Sanjay Talwani, Law360 Tax Authority ($):

The Colorado Department of Revenue adopted rules Friday clarifying eligible expenses for the wildfire mitigation measures tax credit enacted by H.B. 1007 in 2022, as well as for the wildfire mitigation measures subtraction, which applies to mitigation efforts on private land in wildland-urban interface areas.

Under the rules, eligible costs must be actual out-of-pocket expenses incurred and paid by the landowner primarily for wildfire mitigation. Under examples in both rules, a landowner who pays a contractor for mitigation efforts such as cutting down trees has incurred an eligible expense, but a landowner who personally cuts down trees for wildfire mitigation has not.

Connecticut

Wealthy Connecticut Takes Hard Look at Tax Code Fairness - Michael Bologna, Bloomberg. "A little-noticed feature of the state’s 2024-25 biennial budget (HB 6941) requires the Department of Revenue Services to issue comprehensive reports every two years analyzing several qualities of the revenue system. The exercise will display new data about the revenue collected under a half-dozen state tax programs, but it will also offer critical insights on two important fronts: the tax code’s impact on different socioeconomic groups, and the billions of tax dollars that go uncollected each year due to noncompliance—the so-called 'tax gap.'"

Illinois

Governor Pritzker Waives Penalties, Interest for Taxpayers Affected by Severe Weather - Illinois Department of Revenue:

Gov. JB Pritzker announces that individuals and businesses devastated by the severe weather and tornadoes on June 29th through July 4th may request waivers of penalties and interest on state taxes if they cannot file their returns or make payments on time.

The counties covered by the Disaster Proclamation include: Coles, Cook, Edgar, Hancock, McDonough, Morgan, Sangamon, and Washington.

Illinois DOR Proposes Raft of Updates to Sales Tax Rules - Benjamin Valdez, Tax Notes ($). "The department also proposes to implement various sales tax exemptions, including one for machinery and equipment used primarily in graphic arts production. Under the state's 2017 budget bill, such equipment is exempt from the sales tax beginning July 1, 2017; the rules would conform to that change. Also, sales of tangible personal property to or by certain financial institutions would be exempt from the tax if the purchaser is exempt from use tax under federal law, retroactive to January 4, 2019."

Iowa

Iowa issues guidance on retroactive pass-through entity tax. - Eide Bailly:

The guidance answers a number of open questions on the new tax, enacted by HF 352 during the 2023 Iowa Legislature. The Iowa PTET is designed as a workaround for the $10,000 limitation on the federal itemized deduction for state and local taxes enacted in the 2017 Tax Cuts and Jobs Act.

...

The guidance provides that the election must be made for 2022 by the later of the due date of the entity return or December 31, 2023. The election for 2023 and later will be due no later than the due date of the entity return.

Entities electing the Iowa PTET will generate tax credits that owners can claim on their Iowa returns. For 2022, the guidance provides that "The electing pass-through entity will report each owner’s PTET credit on a separate letter. After an electing pass-through entity files its 2022 PTET form in GovConnectIowa, the Department will make available in GovConnectIowa a letter template that will be used by the electing pass-through entity to report PTET credits to its owners."

Louisiana

Louisiana Governor's Veto of Franchise Tax Phaseout Prevails - Matthew Pertz, Tax Notes ($):

The Louisiana Legislature declined to address Democratic Gov. John Bel Edwards's veto of legislation that would have phased out the state franchise tax.

...

The governor said in his June 27 veto letter that although he wants to reform the franchise tax, the effects of Allain's 2021 reforms won't be known until the end of this year or early 2024. It would be "unwise to create a second franchise tax reduction trigger at this time," Edwards wrote.

“There is little doubt among tax experts that this tax is antiquated and should be structurally reformed or repealed,” the governor continued, adding that "the phaseout and ultimate elimination of the franchise tax will require future policymakers to reconcile the inherent reduction to the corporate income tax due to the portability of these hundreds of millions of available tax credits.”

Massachusetts

Massachusetts Sales Tax Holiday August 12, 2023 to August 13, 2023 - Sarah Weintraub, Eide Bailly. "Businesses that make retail sales are required to participate in the 2023 Sales Tax Holiday that runs from August 12, 2023 to August 12, 2023. Online retailers making sales to MA customers are also required to participate in the holiday. Unfortunately, business purchases will still be taxable."

Link: Sales Tax Holiday Frequently Asked Questions.

Oregon

Oregon Governor Signs Semiconductor Incentives Bill - Paul Jones, Tax Notes ($). "Gov. Tina Kotek (D) signed H.B. 2009 July 18. The bill allows semiconductor companies to take an R&D tax credit equal to 15 percent of qualifying research expenses in the state, with up to $4 million in credits per qualifying taxpayer annually. If a credit exceeds a taxpayer's personal or corporate income tax liability, the amount of the excess that's refundable depends on the size of the company: 75 percent for those with less than 150 qualifying employees, 50 percent for those with between 150 and 500 employees, and 25 percent for those with between 500 and 3,000 employees. The nonrefundable credit amount can be carried forward for five years."

Ore. Allows Disclosure Of Taxpayer Info For Fraud Detection - Zak Kostro, Law360 Tax Authority ($). "S.B. 205, which Democratic Gov. Tina Kotek signed Thursday, allows the Oregon Department of Revenue to disclose specified taxpayer information to Employment Department employees for the purpose of determining whether identity theft or fraud has been committed, according to a bill summary. Such information may include a person's individual taxpayer identification number; name, address and date of birth; employer's name, employer identification number and wages paid; self-employment income and source; and other tax return information as defined by state law and "at the discretion of the director of the Department of Revenue, on a case-by-case basis," according to the bill."

Oregon City Adopts Payroll Tax to Fill Budget Gap - Benjamin Valdez, Tax Notes ($). "The council voted July 10 to approve Ordinance Bill No. 12-23, with Mayor Chris Hoy joining the favorable votes. The bill creates the “Safe Salem” payroll tax, which will be levied at 0.814 percent on employee wages and net self-employment earnings, beginning no later than July 1, 2024. Minimum-wage employees will be exempt from the tax."

Vermont

Vermont Extends Filing Deadlines for Taxpayers Affected by Flooding - Benjamin Valdez, Tax Notes ($):

Vermont Gov. Phil Scott (R) has extended several tax deadlines until November 15 for taxpayers affected by recent catastrophic flooding.

Scott on July 19 announced that tax filing and payment deadlines occurring between July 7 and November 15 are extended to November 15 for taxpayers affected by the recent wave of severe flooding. The extension applies to corporate and business income taxes, sales and use taxes, estimated personal income tax payments due September 15, and extended 2022 tax returns, according to the release.

Tax Policy Corner

New Jersey and You, Perfect Together - David Brunori, Law360 Tax Authority ($):

On the less good side, the state is switching from the Joyce method to the Finnigan method for combined reporting purposes. The Finnigan method usually raises more revenue, which it will in New Jersey. Under Finnigan, if one member of the combined report is taxable, then all are taxable. Other than being a money grab, there does not seem to be a policy rationale behind this method.

Significantly, the state will adopt its sales tax economic nexus thresholds for its income tax. The thresholds are 200 or more transactions or receipts of more than $100,000. This is good and bad.

I like bright-line thresholds. You and the departments of revenue know where you stand. Meet the threshold, and the state has taxing jurisdiction. But the thresholds, particularly the gross receipts, are way too low. It does not take much to meet the threshold, and a lot of smaller companies will now have economic nexus. I would make the threshold $1 million.

Tax History Corner

The first manned lunar landing was 54 years ago this week. A few comparative numbers show that the U.S. tax system that the astronauts had to face in 1969 is from another world:

Of course, that was before the at-risk rules, passive loss rules, and a host of other base-broadeners that resulted in a much narrower tax base than we have today. Also, the entire computing power of the IRS was less than what you may be wearing on your wrist.

Make a habit of sustained success.