Werfel Drops Hint, Seeks Early End to Employee Retention Credit - Jonathan Curry, Tax Notes ($):

The IRS is all in on combating employee retention credit fraud, and one way Congress could help is by pulling the plug on the program a lot sooner, according to Commissioner Daniel Werfel.

The pandemic-era business relief program wrapped up at the end of 2021, but taxpayers can continue to file ERC claims for the refund through April 15, 2025. And that’s rapidly becoming a problem, Werfel said.

IRS Boosting Employee Credit Compliance Work, Werfel Says - David van den Berg, Law360 Tax Authority ($):

The increasing number of questionable claims for the credit follows a flood of deceptive marketing from promoters urging businesses to apply for it, Werfel said Tuesday at the IRS Nationwide Tax Forum in Atlanta, according to an agency statement containing his remarks.

"The amount of misleading marketing around this credit is staggering, and it is creating an array of problems for tax professionals and the IRS while adding risk for businesses improperly claiming the credit," Werfel said.

IRS to Share Covid Credit Fraud Fixes With Congress, Werfel Says - Lauren Vella, Bloomberg ($):

“This was not how the law was meant to work, and Congress can help with this situation,” Werfel said. “We will work with Treasury to explore legislative solutions we can share with Congress to help address fraud and error, including potentially putting an earlier ending date for businesses to claim the credit and increase IRS oversight of return preparers.”

Werfel told a group of tax professionals dealing with fall-out from aggressive ERC claims that the IRS has increased audit and criminal investigation work on these claims, both on the promoters as well as those businesses filing dubious claims.

"The further we get from the pandemic, we believe the percentage of legitimate claims coming in is declining," Werfel told attendees at the IRS Nationwide Tax Forum in Atlanta. "Instead, we continue to see more and more questionable claims coming in following the onslaught of misleading marketing from promoters pushing businesses to apply. To address this, the IRS continues to intensify our compliance work in this area."

...

There are important tips that people should be wary of involving the Employee Retention Credit. Warning signs to watch out for include:

- Unsolicited calls or advertisements mentioning an "easy application process."

Statements that the promoter or company can determine ERC eligibility within minutes.

Large upfront fees to claim the credit.- Fees based on a percentage of the refund amount of Employee Retention Credit claimed. This is a similar warning sign for average taxpayers, who should always avoid a tax preparer basing their fee on the size of the refund.

- Preparers refusing to sign the ERC return being filed by the business, exposing just the taxpayer claiming the credit to risk.

- Aggressive claims from the promoter that the business receiving the solicitation qualifies before any discussion of the group's tax situation. In reality, the Employee Retention Credit is a complex credit that requires careful review before applying.

- The IRS also sees wildly aggressive suggestions from marketers urging businesses to submit the claim because there is nothing to lose. In reality, those improperly receiving the credit could have to repay the credit – along with substantial interest and penalties.

Senators look to undo jurisdictional snag on Taiwan tax bill - Laura Weiss, Roll Call:

Lawmakers could use the tax code in unprecedented fashion to extend friendly tax treatment to Taiwanese firms operating in the U.S. and American companies doing business in Taiwan, a reflection of the island’s unique position and backing in Washington.

...

The U.S. only has unofficial relations with Taiwan so it can’t execute a formal tax treaty, and its close partnership with Taiwan has been a flashpoint in U.S.-China relations. China claims the self-governing island as its territory.

Buckle Up: IRS Corporate Letter Rulings Are on the Fast Track - Caitlin Mullaney, Tax Notes ($). The "fast track" request is available for rulings handled by the IRS associate chief counsel (corporate). From the article:

The IRS says the new fast-track program, which applies to all letter ruling requests sent beginning July 27, has two main differences from the pilot program that was established in Rev. Proc. 2022-10, 2022-6 IRB 473.

The first is that fast-track processing won’t be granted if the letter ruling request includes a closing agreement regarding an issue under any associate office. The revenue procedure notes that letter ruling requests that include a closing agreement will still be eligible for expedited handling under the standard process.

The second difference is that a taxpayer isn’t required to demonstrate a business need for fast-track processing unless they are requesting a ruling in less than 12 weeks. The IRS clarifies that a statement providing one or more of the taxpayer’s reasons for requesting fast-track processing is still required.

This will make it more practical to get IRS blessing on corporate transactions, such as spin-offs, as part of the transaction process.

Link: Rev. Proc. 2023-26

IRS Urges States to Join Direct-File Pilot - Lauren Loricchio, Tax Notes ($). "In a July 26 letter to Sharonne R. Bonardi and Peter Barca of the Federation of Tax Administrators, IRS Commissioner Daniel Werfel said that in the coming weeks, the direct-file pilot team wants to partner with the FTA to update state tax administrators on the IRS’s plans for “state tax integration and pilot strategy.”

The ability to process state returns at the same time as federal returns is a major challenge to IRS attempts to implement its own free-filing internet platform.

New Income Exemption for Wisconsin Financial Institutions - Paul Sirek, Eide Bailly. alerts 2023/7 "Financial institutions with tax years beginning after December 31, 2022, are eligible for the exemption. Income in 2023 from interest, fees, and penalties earned from business and agricultural loans of $5 million and less are exempt from state income tax."

Iowa releases proposed rules for farm capital gain exclusion. The Iowa Department of Revenue yesterday released proposed rules to cover the revised limited exclusion for farm capital gains that takes effect in 2023. The Department also issued rules covering a new exclusion for certain income from farm land leases by retired farmers. Some key takeaways from the proposal:

-The exclusion is available for farmers selling farm real estate held for 10 years if the farmer "materially participated" under the Sec. 469 passive loss rules for 10 years in the farming activity.

- While the federal passive loss rules include no special provisions for crop-share leases, the proposed Iowa rules contain rules that make it possible for crop-share landlords to qualify for the exclusion when their participation doesn't meet IRS standards.

The state also issued rules for a new limited exclusion for employee-held stock.

Links:

Iowa proposed rules for farm gains and farm tenancy

Iowa proposed rules on employer stock sales.

Faith groups urged to take advantage of new climate-related tax credits - Kay Bell, Don't Mess With Taxes. "Now the Biden Administration's energy chief is reminding faith-based groups that they, too, could be eligible for the Inflation Reduction Act tax credits."

IRS Continues To Focus On Fraudulent Employee Retention Credit Claims - Kelly Phillips Erb, Forbes. "As you can imagine, the appeal of $26,000 per employee is considerable—for legitimate businesses and scammers. Taxpayers and tax professionals alike have noted an uptick in aggressive promotions—I get several calls and emails each day, including one on Tuesday advising, 'Our records indicate that you have not yet filed for the ertc employee retention refund.'"

Latest IRS Guidance Demonstrates the Limited Basis for Claiming the ERC under a Supply Chain Disruption Theory - Cody Edwards and Charles Telk, Iowa Tax Cafe. "In short, the GLAM’s primary takeaways are that ERC claims from supply chain-based suspensions of operations have the same requirements as any other partial suspension claim. An applicable governmental order must have caused the supplier to suspend its business operations, and that suspension must have caused the employer claiming the credit to suspend its business operations."

Stone Mining Company’s Donation Deduction For Land Sold To Town Disallowed - Peter Reilly, Forbes. "It ends up not being that complicated. When you take a deduction for a bargain saleyou have to consider everything that you received not just the cash. In figuring the deduction Holdings did not put a valuation on the zoning change that it received that was an integral part of the settlement. They argued that they were entitled to the change and would have won on the litigation, but that did not wash."

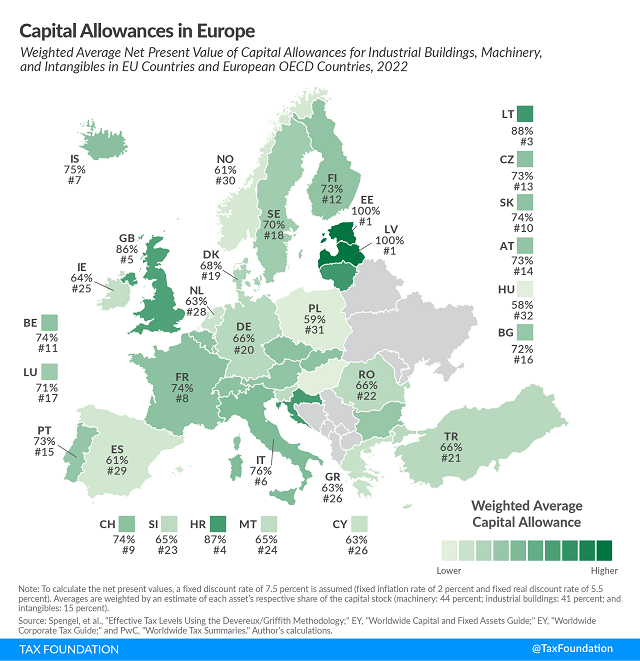

Capital Allowances in Europe - Cristina Enache, Tax Policy Blog. "Businesses determine their profits by subtracting costs (such as wages, raw materials, and equipment) from revenue. However, in most jurisdictions, capital investments are not seen as regular costs that can be subtracted from revenue in the year of acquisition. Instead, depreciation schedules specify the life span of an asset, which determines the number of years over which an asset must be written off...However, in most cases, these depreciation schedules do not consider the time value of money (a normal return plus inflation)."

Wittgenstein’s tax laws - Leonard Wagenaar, Leonard's Tax Posts. "Anyone who can drive manual transmission knows that connecting moving gears requires finesse. Rather than having their facts get crushed by moving gears, taxpayers and tax advisers can seek to carefully align their facts into a position that just works better. This is tax planning and it has a bad name, but it is essential for any law to work as intended."

Hunter Biden’s Courtroom Reversal Extends His Legal Limbo, Political Exposure - Sadie Gurman and Annie Linskey, Wall Street Journal:

In an extraordinary courtroom drama, the judge expressed concerns about a proposed plea deal under which the younger Biden would have likely served no time in prison in exchange for a guilty plea on two tax charges, and avoided a gun charge by agreeing to remain drug-free and never own a firearm again.

Instead of the carefully choreographed way most plea deals roll out, U.S. District Judge Maryellen Noreika refused to approve either the tax or the gun agreement, saying they contained “atypical provisions” and needed further study. And Justice Department lawyers left open the possibility that the president’s son could face additional charges, including related to his foreign lobbying, prompting a disagreement with defense attorneys.

Judge puts Hunter Biden’s plea deal on hold, questioning its details - Glenn Thrush, Michael S. Schmidt and Chris Cameron, New York Times. "After moments of high drama in which the deal appeared headed toward collapse, the judge, Maryellen Noreika of the Federal District Court in Wilmington, Del., sent the two sides back to try to work out modifications that would address her concerns and salvage the basic contours of the agreement."

Snohomish County tax preparer pleads guilty to assisting in the preparation of false tax returns - IRS (defendant name omitted). "According to records filed in the case, since at least 2012, Defendant operated a tax preparation business called Affordable Income Tax LLC. As a tax preparer he intentionally exaggerated deductions for his clients: unreimbursed employee expenses, charitable deductions, and payments for "other taxes." Between 2016 and 2019 Defendant submitted exaggerated deductions on more than 79 tax returns for 29 different clients. In total the fake deductions led to a tax loss of $212,395."

His clients appreciated their big refunds, until the IRS called wanting them back.

I'm on it. It's National Sleepy Head Day!

Make a habit of sustained success.