Companies Craft Contracts Absent Firm Clean Energy Labor Rules - Erin Slowey, Bloomberg ($):

Many of the lucrative clean energy tax credits from President Joe Biden’s tax-and-climate law hinge on labor requirements that still lack any regulations.

The IRS and Treasury Department first released guidance on the labor requirements Nov. 29, detailing when and how to apply the rules. The guidance, though, left some unanswered questions that are complicating project and investing decisions.

The agency ‘is assisting taxpayers, developers and contractors in understanding the prevailing wage provisions of the IRA, responding to taxpayer requests for wage determination information, and continues to partner with the Department of the Treasury to provide taxpayers, contractors, subcontractors and other stakeholders with the resources necessary to take advantage of this tremendous opportunity,’ a DOL spokesperson said by email.

Treasury Issues Final Regs on Consolidated NOL Carrybacks – Chandra Wallace, Tax Notes ($):

Treasury and the IRS have finalized regulations permitting consolidated groups that acquire new members to make elections affecting the carryback periods for consolidated net operating losses, effective July 10.

The regs (T.D. 9977) finalize without substantive change the split-waiver election provisions included in proposed rules (REG-125716-18) issued three years ago, and remove the related temporary regs (T.D. 9900) effective in the interim.

Rules for Consolidated Group Net Operating Losses Released – Erin Slowey, Bloomberg ($). “The proposed rules released concurrently in 2020, implemented changes from the 2017 tax law to Section 172, for consolidated groups of companies.”

The document is here.

Mulling IRS Funding - Samantha Handler, Bloomberg ($):

With Congress back for three weeks, the fight over IRS funding is coming back to life, too.

Senate appropriators plan to release and mark up the Financial Services spending bill, which includes funding for Treasury and IRS.The Senate’s version of the Financial Services bill may be a tad less stingy than the House version, which proposed $11.2 billion for the IRS, nearly $1.1 billion below fiscal 2023 enacted levels and $2.9 billion less than the White House budget request.

Republicans control the House and Democrats control the Senate. Getting the chambers to agree on IRS funding levels will be a very heavy lift.

IRS Seeks Outside Help in Applying Big Data – Lauren Loricchio, Tax Notes ($):

The IRS has released a request for information from contractors about how they can help the agency use big data to address noncompliance.

In a July 6 draft performance work statement, the IRS Office of Research, Applied Analytics, and Statistics (RAAS) said it is looking for a contractor to help with its use of data analytics and other technology.

Debtors Say ACA Penalty Shouldn't Get Bankruptcy Priority – Vince Sullivan, Law360 Tax Authority ($):

Debtors in two Chapter 13 bankruptcy cases told a Sixth Circuit panel Monday that penalties imposed by the Internal Revenue Service for not purchasing health insurance policies should not be treated as a tax that deserves priority treatment under the Bankruptcy Code.

During oral arguments, Marcel C. Duhamel of Vorys Sater Seymour and Pease LLP, representing the debtors, said the bankruptcy court in the Northern District of Ohio made the correct decision when finding the penalties did not enjoy priority status as a tax, but that the ruling was incorrectly overturned by the bankruptcy appellate panel in the circuit.

Whistleblower Options - Samantha Handler, Bloomberg ($). “IRS Commissioner Danny Werfel reiterated in a letter to agency employees that they have the option to take their whistleblower reports directly to congressional committees.”

‘And in the event that you believe that the best course of action is not to raise issues up your IRS chain of command, but to raise the issue with an independent authority, there are a number of different options for raising concerns,’ he wrote in the letter, a copy of which was provided by the IRS.

Tax Amendments Floated for NDAA - Samantha Handler, Bloomberg ($). “The House Rules Committee meets Tuesday to consider the National Defense Reauthorization Act for 2024, including several tax-related amendments.”

One bipartisan amendment from Reps. Dan Kildee (D-Mich.), Steve Womack (R-Ark.), Derek Kilmer (D-Wash.), and Doug Lamborn (R-Colo.) would make the monthly allowance for active service members exempt from income taxes. Rep. Brian Fitzpatrick (R-Pa.) also proposed an amendment to make the first $100,000 of enlisted service members’ income tax free and have $100,000 of student loans forgiven for at least five years.

Another bipartisan amendment from Ways and Means Reps. Jimmy Panetta (D-Calif.) and Greg Steube (R-Fla.) would require the Defense Department to notify service members about the free MiliTax program and other free tax services offered by the department within the first two months of the year. The proposal also would require the department to submit a report on participation in the free tax services.

These amendments might not be germane to the bill because they are tax measures and the NDAA is a spending authorization bill. Also, if ANY tax provision gets added to the bill then ANY OTHER tax provision can be added to the bill. If lawmakers seek to add R&D expensing to the bill then other lawmakers might propose adding a Child Tax Credit expansion to the bill. And suddenly a defense authorization spending bill becomes a tax fight.

Nonprofit hospitals under growing scrutiny over how they justify billions in tax breaks – Andy Miller and Markian Hawryluk, CNN:

The takeover by Tower Health meant the 219-bed Pottstown Hospital no longer had to pay federal and state taxes. It also no longer had to pay local property taxes, taking away more than $900,000 a year from the already underfunded Pottstown School District, school officials said.

The school system appealed Pottstown Hospital’s new nonprofit status, and earlier this year, a state court struck down the facility’s property tax break. It cited the “eye popping” compensation for multiple Tower Health executives as contrary to how Pennsylvania law defines a charity.

The court decision, which Tower Health is appealing, stunned the nonprofit hospital industry, which includes roughly 3,000 nongovernment tax-exempt hospitals nationwide.

‘The ruling sent a warning shot to all nonprofit hospitals, highlighting that their state and local tax exemptions, which are often greater than their federal income tax exemptions, can be challenged by state and local courts,’ said Ge Bai, a health policy expert at Johns Hopkins University.

Whiplash Alert:

Yesterday’s Roundup included the following article: Wisconsin’s Democratic governor guts Republican tax cut, increases school funding for 400 years

Apparently, the governor changed his mind:

For the Record: Evers reverses stance, says he's open to negotiating on middle-class tax cuts – Logan Reigstad, Naomi Kowles and Will Kenneally, Channel 3000:

In a reversal of stance, Gov. Tony Evers said he's open to negotiating with Republicans later this year after he vetoed GOP-authored tax cuts for those in Wisconsin's top two broad tax brackets earlier this week.

When Evers signed Wisconsin's biennial budget into law on Wednesday, he removed the proposed tax cuts for those in the state's top two tax brackets, which cover single filers making more than roughly $27,000 and married couples making more than roughly $37,000.

In an interview Friday airing on For the Record Sunday morning, the governor said he would consider future legislation on tax cuts for those not included under the budget but reiterated his stance that tax cuts need to be focused on middle-class Wisconsinites rather than the wealthy.

The key word in the last paragraph is "focused." A bill can be focused on one income group while also benefiting another.

For example, the Tax Relief for Middle Class Families Act of 2023 (H.R. 680) ups the SALT cap from $10,000 to $100,000. I’m guessing taxpayers earning more than middle-class wages would benefit from this bill if it were to become law.

New Jersey Tax Incentives Boost State as Hot Filmmaker Locale - Danielle Muoio Dunn, Bloomberg ($):

New Jersey is sweetening the pot for film and television production companies that set up shop in the Garden State, aiming to attract the next ‘Succession’ or movie blockbuster from states that offer their own incentives to end up on the big screen.

Gov. Phil Murphy (D) last week signed legislation that boosts the available tax credits for studios and sets aside $30 million for capital investments in production facilities. Netflix Inc. is poised to reap millions from the deal, after winning state approval in December to build a campus on a 300-acre former army base in Fort Monmouth.

Texas House and Senate reach a deal on how to cut property taxes – Karen Brooks Harper and Joshua Fechter, The Texas Tribune. “The deal would channel $12 billion to reduce the school property tax rate for homeowners and business properties, increase the homestead exemption, and create a pilot program to reduce taxes on certain residential and commercial properties. The legislation is expected to pass later this week.”

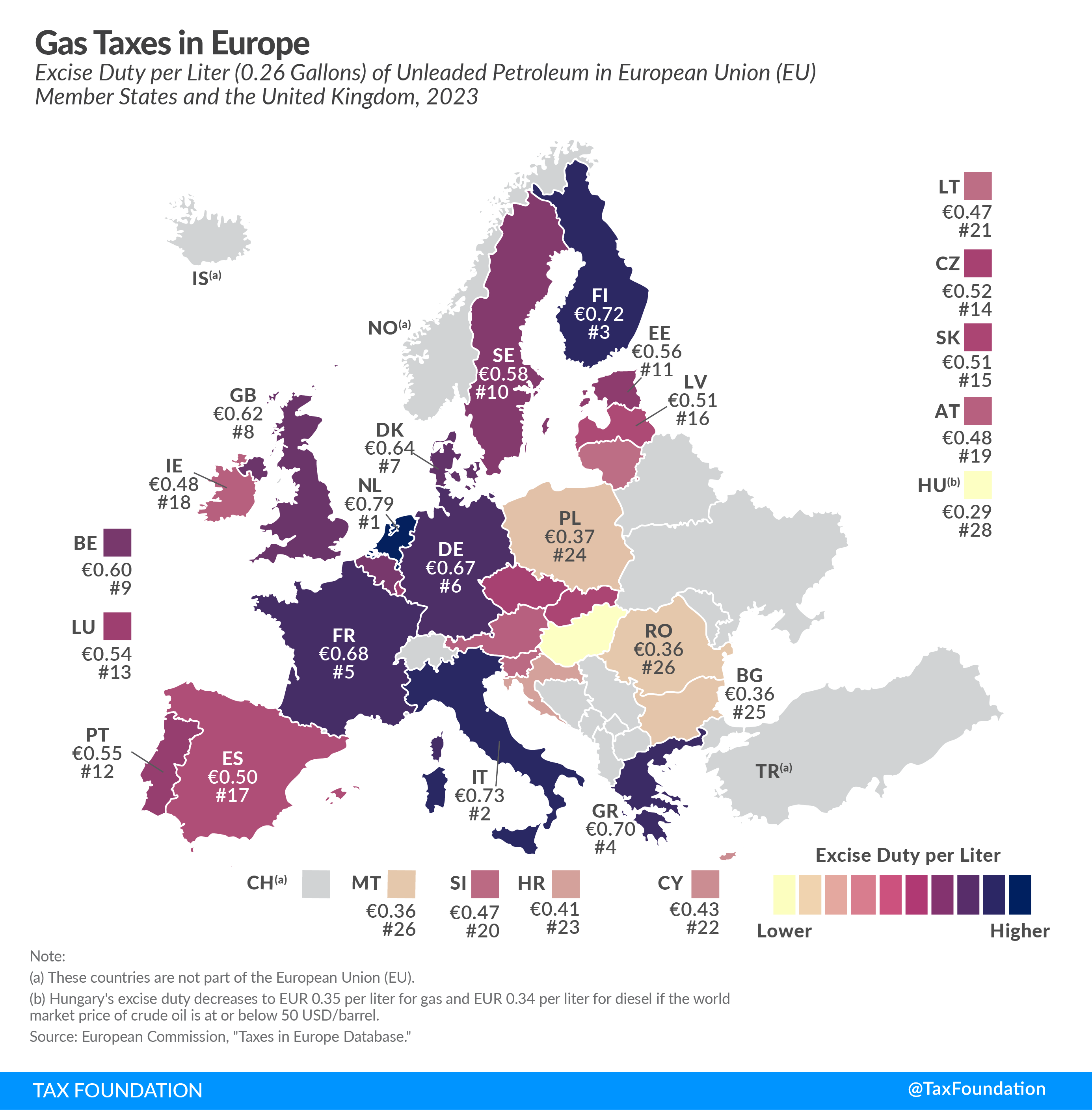

Diesel and Gas Taxes in Europe – Adam Hoffer, Tax Foundation:

In response to a year of extreme energy price increases in 2022, many European countries offered partial relief through temporary fuel tax reductions. In 2023, European gas and diesel taxes have mostly returned to the rates in place before the Russia-Ukraine war. The European Union (EU) requires Member States to levy a minimum excise duty of €0.36 per liter ($1.55 per gallon) on petrol (gasoline).

Today’s map shows that only Bulgaria, Hungary, Romania, Malta, and Poland stick to the minimum rate, while all other EU countries levy higher excise duties on gas. The lowest gas tax is in Hungary, at €0.29 per liter ($1.21 per gallon), as the Hungarian rate is set in its domestic currency, the forint, resulting in an average rate slightly below the EU minimum after exchange rate fluctuations. The next lowest rates after exchange rates are Bulgaria, Malta, and Romania, each at €0.36 per liter ($1.48 per gallon).

From the “Whoopsie” file:

Staffers Find $352 Million Mistake In Minnesota’s New Tax Law - Kelly Phillips Erb, Forbes:

This headline is about the One Minnesota Budget that was signed into law last May. The budget provides rebate checks to 2.5 million Minnesotans and child tax credits for lower income earners. The money going to taxpayers will be based on 2024 tax returns.

However, inflation adjustments were not considered, which is a bad thing. It means that taxpayers will receive less than intended:

[T]he average state married-filing-jointly taxpayer would lose out on over $1,000 in deductions and would pay $210 more, while the average single taxpayer would pay an extra $110. The mistake would affect over three-quarters of all taxpayers—about 2.3 million Minnesotans. A small percentage—7%—of taxpayers would not have been affected.

That adds up to a $352 Million mistake, which can be fixed:

Tax returns for the 2024 tax year won’t be filed until 2025, giving the state a year and some change to fix the problem. The head of the Minnesota Revenue Department, Paul Marquart, whose staff caught the error, promised to make a fix.

Udderly Amazing! It’s Cow Appreciation Day! Bovines be happen’! Order chicken for dinner and not steak!

Make a habit of sustained success.