State Tax Changes Taking Effect July 1, 2023 - Katherine Loughhead, Tax Policy Blog:

On July 1, 2023, at least 32 notable tax policy changes will take effect across 18 states, including sales tax rate reductions in New Mexico and South Dakota, a repeal of the corporate franchise (capital stock) tax in Oklahoma, the implementation of a payroll tax in Washington, and the implementation of taxes on newly legalized sales of cannabis products in Maryland and Minnesota.

Separately, across 11 states, at least 22 notable tax policy changes have been enacted or phased in this year and are retroactively effective as of January 1, 2023, including income tax reductions in Arkansas, Michigan, North Dakota, Utah, and West Virginia. Further, a few states had notable tax policy changes take effect after January 1, 2023, but before July 1, 2023.

The post provides updates for 25 states, ranging from income tax changes to cannabis tax provisions.

American States Once Awash in Cash Now Face Reversal of Fortunes - Amanda Albright and Eliyahu Kamisher, Bloomberg:

California is an extreme case of a state that relies heavily on its richest residents for its tax base. But it’s not alone: revenue in 16 other states is down this fiscal year through April, according to the Urban Institute, partly reflecting the volatility in markets and population shifts. Over in Florida and Texas — red states where levies are primarily collected through sales rather than income — it’s a different picture. While the pace of tax collections has slowed, they are among about a dozen states seeing revenue grow 5% or more this year as consumers keep spending.

...

Marc Goldwein, senior policy director for the Committee for a Responsible Federal Budget, said the dynamic reflects core differences between states’ tax bases. California and New York saw their populations shrink by about 294,000 residents in the year through July 1, 2022, while Florida and Texas added about 888,000 residents collectively, according to Census Bureau data.

State-By-State Roundup

California

California Package Includes Tax Breaks for Film, Manufacturing - Laura Mahoney, Bloomberg ($):

California lawmakers approved most of the state budget package Tuesday, including an extension of the film tax credit, after reaching agreement late Monday with Gov. Gavin Newsom on his push to include measures streamlining infrastructure projects.

Their agreement and approval of 20 bills signal the Democratic governor will sign the main budget measure lawmakers passed June 15 (S.B. 101) by his deadline of midnight Tuesday and in time for the July 1 start of the new fiscal year. The package outlines $226 billion in general fund spending, $38 billion in reserves, and a combination of deferrals, internal borrowing, and cuts to close a $32 billion deficit.

California's new budget covers $32 billion deficit while extending tax credits for film industry - Adam Beam, AP via Washington Post. "Despite the deficit, lawmakers agreed to extend tax credits for movie and television productions that film in the state. Those credits will reduce state revenues by up to $330 million per year. The big change is that those tax credits will be refundable. That means if a movie studio has credits that are worth more than what it owes in taxes, the state will pay the studio the difference in cash."

California Governor, Lawmakers Agree on Final Budget Package - Paul Jones, Tax Notes ($):

The budget agreement also includes a proposal from Newsom’s January budget and May revision to subject “incomplete non-grantor trusts” to state income tax.

“Income from an incomplete gift non-grantor trust would be included in the income of the grantor, as if the trust was a grantor trust, except when the fiduciary of a trust where 90 percent of beneficiaries are charitable organizations elects to be taxed as a resident non-grantor trust commencing in [the] 2023 taxable year,” according to the Assembly description of the agreement. “This proposal mitigates a tax strategy which allows California residents to transfer assets into [an] out-of-state incomplete non-grantor trust and potentially avoid state taxation.”

Iowa

Iowa Fuel Tax Rate Change Effective July 1, 2023 - Iowa Department of Revenue. "The fuel tax rate for Ethanol E-15 or Higher and Alcohol will increase from $0.240 to $0.245 effective July 1, 2023."

Kansas

Kansas DOR Details Tax Exclusion for Separately Stated Delivery Charges - Emily Hollingsworth, Tax Notes ($). "According to Notice 23-02, issued June 22, legislation signed in 2022 (H.B. 2136) amended K.S.A. section 79-3602 to change the state’s definition of sales price to exclude separately stated delivery charges. “Prior to the amendment, delivery charges were included in the sales or selling price charged to a customer as part of the gross receipts from the sale of tangible personal property or enumerated services, and so were subject to” the 6.5 percent state sales tax, the notice said."

Louisiana

La. To Drop Corporate Tax 'Throwout' Rule - Maria Koklanaris, Law360 Tax Authority ($):

A bill signed by Louisiana's governor repeals the state's so-called throwout rule for corporate income tax apportionment purposes, removing a requirement for companies to exclude, or throw out, receipts from sales made into states where the company isn't taxable.

...

Although now only Maine employs a throwout rule — West Virginia used to impose one as well but eliminated its rule before Louisiana did, in a 2021 law — several states have a similar rule called a throwback rule. That rule sources so-called nowhere sales, those sales made into a state where the state lacks authority to tax the seller, to the numerator of the sales factor of the state where a sale originated. Arkansas enacted a law this year that will phase out its throwback rule by 2030.

Link: H.B. 631

La. Gov. Vetoes Phaseout Of Corp. Franchise Tax - Jaqueline McCool, Law360 Tax Authority ($). "Edwards said in his veto message that while he thought it was necessary to repeal or reform the tax, it was not the right time to do so."

La. Exempts Certain REITs From Corporate Franchise Tax - David Holtzman, Law360 Tax Authority ($). "The governor approved S.B. 9 on Tuesday, the same day he vetoed legislation that would have phased out the corporate franchise tax over a four-year period. Louisiana is one of 18 states that have such a tax on companies, according to LegalZoom. The tax is typically calculated as a percentage of a company's capital stock, net worth or the book value of its property."

La. Extends Tax Deadlines Due To Weather, Power Outages - Jared Serre, Law360 Tax Authority ($):

Taxpayers with sales, excise, severance or withholding tax returns or payments due between June 14 and July 15 now have until July 20 to pay, according to a bulletin published Friday. Any late returns or payments that have begun accruing interest before June 14 are not eligible for the assistance.

Taxpayers in 21 parishes will receive the automatic extension: Bienville, Bossier, Caddo, Caldwell, Claiborne, DeSoto, East Carroll, Franklin, Jackson, Lincoln, Madison, Morehouse, Natchitoches, Ouachita, Red River, Richland, Tensas, Union, Webster, West Carroll and Winn.

Minnesota

Distributor Exceeded P.L. 86-272 Protection, Minnesota Court Finds - Andrea Muse, Tax Notes ($):

In Uline Inc. v. Commissioner of Revenue, the Minnesota Tax Court determined that the distributor’s practice of having its sales representatives obtain information concerning its competitor’s products and business practices served a business purpose independent from the solicitation of orders and is not protected by P.L. 86-272. The opinion, dated June 23, was signed June 26.

Uline Inc. is an S corporation headquartered in Wisconsin that distributes industrial and packaging products. The company sold its Minnesota distribution center in September 2013 and had no physical office, distribution center, or place of business in the state in tax years 2014 and 2015. Uline’s Minnesota sales representatives submitted orders to its distribution facility in Wisconsin for acceptance, and the products were then shipped to Minnesota customers using common carriers.

Minn. Tax Court Says Biz Maintained Enough Contacts For Tax - Maria Koklanaris, Law360 Tax Authority ($):

Of the activities conducted by Uline employees in Minnesota — which included customer visits, documenting those visits in at least two ways, attending job fairs and occasionally personally picking up customer items to be returned — the tax court examined two that could have defeated the protections of P.L. 86-272.

Those two were the preparation of a document called "market news notes" and the occasional personal pickup of customers' items for return...

Preparing the market news notes, for which Uline maintained company guidelines, involved market research that included obtaining information about the company's competitors, Judge Wendy S. Tien wrote for the tax court.

P.L. 86-272 is a 1959 statute enacted to limit the reach of state income taxes. It prohibits states from taxing a business whose only activity is selling goods into the state from another state, and whose sales representatives have very limited duties in the selling state. This case illustrates how easy it is for businesses to overstep those limits and become subject to tax in a destination state.

Minnesota DOR Updates Guidance on Estate Tax Recapture Provision - Emily Hollingsworth, Tax Notes ($).

Minnesota law allows qualified heirs who inherit small business or farm property to claim a deduction for the property for estate tax purposes.

...

According to the guidance, qualified heirs are subject to the tax if, within three years of the decedent’s death, they:

-dispose of any interest in qualified property, and the interest isn’t disposed to a family member;

-aren’t involved in the operations of the trade or business “on a standard, continual, and significant basis” for the inherited small business; or

-don’t maintain the 2a agricultural land classification for the inherited farm property, statutorily defined in M.S. 273.13, subdivision 23, as homestead or non-homestead land that “consists of parcels of property, or portions thereof that are agricultural land and buildings.

Link: Qualified Small Business and Farm Property Deduction

Related: Eide Bailly Wealth Transition Services.

New Hampshire

New Hampshire Accelerates Interest and Dividends Tax Phaseout - Benjamin Valdez, Tax Notes ($):

Sununu signed H.B. 2, a fiscal 2024 and 2025 budget appropriations bill, on June 20. Under the bill, the interest and dividends tax will be eliminated for tax years starting after December 31, 2024, speeding up by two years an ongoing phaseout enacted under the last biennial budget.

The tax is currently levied at 3 percent — down from 5 percent — on the gross interest and dividends of residents, fiduciaries, and some partnerships that exceed $2,400 annually. Under the previous phaseout, the tax was set to be eliminated for tax years beginning after December 31, 2026.

New York

New York Updates Payroll Mobility Tax Guidance to Highlight Rate Increase - Emily Hollingsworth, Tax Notes ($). "The MCTMT applies to employers required to withhold New York state income tax from wages and that have payroll expenses for covered employees in the metropolitan commuter transportation district (MCTD) that exceed $312,500 in any calendar quarter."

Link: Metropolitan commuter transportation mobility tax

Oregon

Ore. Lawmakers Vote To Extend Pass-Through Biz Tax Credit - Jaqueline McCool, Law360 Tax Authrity ($):

Oregon would extend its pass-through business alternative income tax credit and related personal income tax credit by two years under a bill passed by state lawmakers and headed to the governor

H.B. 2083, which the Senate passed Saturday by a vote of 25-0, with five absent, would extend the sunset date for the credits from Jan. 1, 2024, to Jan. 1, 2026.

Ore. Lawmakers OK Expanded Special Assessment For Farms - Zak Kostro, Law360 Tax Authority ($). "Specifically, the bill would add "in-stream water leasing" as another activity that would prevent farmland from being disqualified from special assessment for property tax purposes under a state program enacted in 1967, the summary and a revenue impact statement said. The bill would provide that specially assessed irrigated farmland would not face additional taxes if the owner has an active in-stream lease for water rights belonging to the land and the land is used for accepted farming practices, according to fiscal and government impact statements on the legislation."

Link: H.B. 2971.

Oregon Legislature Approves New Semiconductor R&D Credit - Paul Jones, Tax Notes ($). "For taxpayers whose credit amount exceeds their tax liability, the portion of the excess that’s refundable would vary based on the size of their workforce, prioritizing refunds for smaller businesses. It would be 75 percent refundable for businesses with less than 150 employees; 50 percent for those with at least 150 and less than 500 employees; and 25 percent for those with at least 500 and less than 3,000 employees. Any nonrefundable amount of the credit could be carried forward for five years."

Ore. Lawmakers OK Exclusions From Corporate Activity Tax - Jared Serre, Law360 Tax Authority ($). "H.B. 2073, approved by a 19-6 vote Saturday in the state Senate, would exclude commodities that are sold to processors for out-of-state sale from the state's corporate activity tax. The tax is assessed at a rate of $250 plus 0.57% of commercial activity in Oregon that exceeds $1 million, according to the state Department of Revenue."

Washington

Washington DOR: Personalized Products Subject to Manufacturing B&O Tax - Cameron Browne, Tax Notes ($). "In Determination No. 18-0191, the DOR’s Administrative Review and Hearings Division ruled that a limited liability company's personalized pet products sold online are subject to the manufacturing B&O tax because the personalization process constitutes manufacturing. However, the DOR determined that the taxpayer's sales of non-personalized products are not subject to the manufacturing B&O tax. The decision was published June 16."

Tax Policy Corner

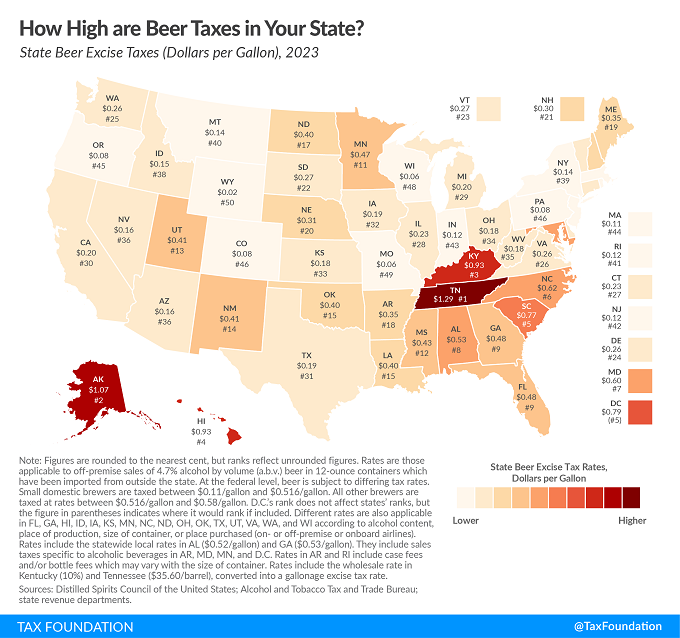

How High are Beer Taxes in Your State? - Benjamin Jaros and Adam Hoffer, Tax Policy Blog. "One might expect the price of beer to be driven primarily by the price of grain or hops. However, according to the Beer Institute, “Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.” A report in 2005 found that all the different layers of taxation on production and distribution make up about 40 percent of the retail price for beer."

Tax History Corner

We all know that taxes were somehow a trigger for the Declaration of Independence, which we will celebrate July 4 (well, our firm also is taking off the July 3 and July 5; it's too much tax for just one day off). One of the grievances listed in the declaration was "For imposing Taxes on us without our Consent."

There were two primary sets of taxes that riled the colonists. One was The Stamp Tax Act of 1765, which (via History.com):

...was the first internal tax levied directly on American colonists by the British Parliament. The act, which imposed a tax on all paper documents in the colonies, came at a time when the British Empire was deep in debt from the Seven Years' War (1756-63) and looking to its North American colonies as a revenue source.

Arguing that only their own representative assemblies could tax them, the colonists insisted that the act was unconstitutional, and they resorted to mob violence to intimidate stamp collectors into resigning. Parliament passed the Stamp Act on March 22, 1765 and repealed it in 1766, but issued a Declaratory Act at the same time to reaffirm its authority to pass any colonial legislation it saw fit.

Then came the Townshend Acts. These, per Wikipedia, were "a series of British acts of Parliament passed during 1767 and 1768 introducing a series of taxes and regulations to fund administration of the British colonies in America." They included taxes on glass, lead, paint, paper, and tea - leading eventually to the famous Boston Tea Party in December 1773.

One of the long lasting consequences: "Tea drinking declined during and after the Revolution, resulting in a shift to coffee as the preferred hot drink."

So as you linger over your coffee over the Independence Day break, remember the rowdy Bostonians who inadvertently helped create our coffee culture as a tax protest.

Make a habit of sustained success.