Bracket Creep, End of TCJA Drive Long-Term Tax Bump, CBO Says - Doug Sword, Tax Notes ($):

Individual income tax collections amounted to an average 8 percent of GDP during the 30 years ending in 2022. But that figure, fueled by capital gains and the repayment of pandemic-deferred taxes, jumped to 10.5 percent for fiscal 2022, the highest in the 89 years the federal government has compiled the figure and the first time it crested 10 percent.

...

Two factors — real bracket creep and the expiration of the individual tax provisions of the Tax Cuts and Jobs Act at the end of 2025 — will start pushing taxes as a share of GDP upward again. The CBO’s long-term projections are based on current law, so they do not assume Republicans will succeed at making the TCJA’s provisions permanent or that a compromise will be reached with Democrats to retain lower tax rates for some brackets.

IRS sends special mailing to taxpayers in certain disaster areas - IRS:

The IRS is taking this special step to help reassure taxpayers affected by disasters that they do have extra time to file and pay their taxes. This new mailing is going to residents in California and seven other states in designated disaster areas that received a CP14 notice from the IRS in late My and June. The earlier mailings are for taxpayers who have a balance due, and they are sent out as a legal requirement. While the notice received by taxpayers says they need to pay in 21 days, these taxpayers actually have until later this year to timely pay under the disaster declaration.

Given the large reach of these disaster declarations and partner feedback, the IRS took an additional step to do a follow-up mailing to let these taxpayers know they have more time. The mailings, known as a CP14CL, will occur during the next few weeks. The letters are in English and Spanish.

ETAAC Attacks Prospect of IRS-Run Direct-Filing System - Jonathan Curry, Tax Notes ($):

The money the IRS is spending to develop a pilot version of a free, agency-run electronic tax return filing system would be better spent elsewhere, the IRS’s e-filing advisory group concluded.

...

ETAAC shared the conclusion reached by MITRE Corp. in a 2019 study on taxpayer preferences surrounding Free File and its alternatives. Fewer than 3 million taxpayers used the Free File program out of a pool of nearly 104 million eligible taxpayers in 2018, but MITRE determined that after accounting for taxpayer preferences, only about 30 million taxpayers are likely candidates for Free File. Further research by MITRE concluded that a common reason taxpayers don’t use the program is because they’re simply unaware of it.

Tax Pros Need Beefed-Up Online Accounts, IRS Told - David van den Berg, Law360 Tax Authority ($):

The Internal Revenue Service should expand online accounts for tax professionals to allow their clients to easily and securely share information with them, an advisory group for the agency said in a report released Wednesday.

The IRS should upgrade the accounts, which tax professionals can currently use to send representation authorization requests to taxpayers, to allow the professionals to get access to information in their clients' online accounts, the IRS Electronic Tax Administration Advisory Committee said in its report. Tax professionals whose representation requests are approved cannot currently access that information, the report said.

Clients share more information with preparers than they do with the IRS, but current IRS practices make it a hassle to do something as simple as verifying estimated payments that a taxpayer has on account before putting them into a return.

IRS Must Make Electronic Tax Filing Easier, Advisory Panel Says - Pavithra Rajesh, Bloomberg. "The voluntary advisory group made 26 recommendations covering several aspects of the taxpayer journey, from understanding obligations and collecting documentation to filing and receiving assistance."

Link: Electronic Tax Administration Advisory Committee Annual Report to Congress. Recommendation #1: "ETAAC recommends that Congress pass timely tax legislation and engage the IRS and appropriate stakeholders prior to passing legislation." That's just crazy talk.

La. Gov. Vetoes Phaseout Of Corp. Franchise Tax - Jaqueline McCool, Law360 Tax Authority ($). "Edwards said in his veto message that while he thought it was necessary to repeal or reform the tax, it was not the right time to do so."

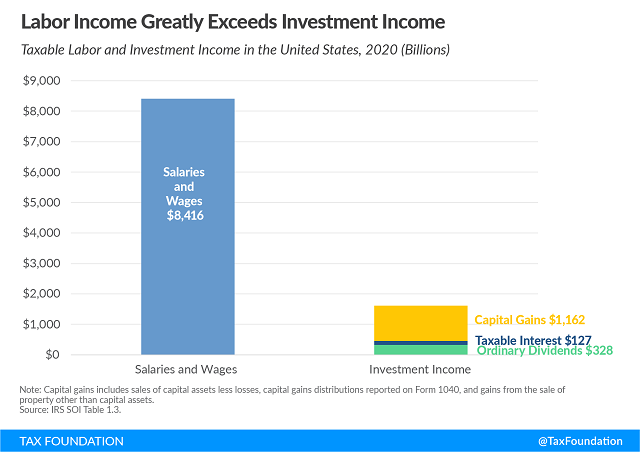

Sources of Personal Income, Tax Year 2020 - Erica York, Tax Policy Blog. "About 66 percent ($8.4 trillion) of the total income reported on Form 1040 consisted of wages and salaries, and 79 percent of all tax filers reported earning wage income."

States, and Uncle Sam, looking into mileage fees to cover fuel tax losses - Kay Bell, Don't Mess With Taxes. "Newer autos get much better fuel efficiency, meaning less fill-ups. Plus, more electric vehicles (EVs) are hitting the country's roads. U.S. Bureau of Labor Statistics data shows that electric car sales in the United States went from just 0.1 percent of total vehicle sales in 2011 to 4.6 percent in 2021."

Lesson From The Tax Court: How To Calculate Insolvency For The §108 Exclusion - Bryan Camp, TaxProf Blog. "Today’s lesson involves the insolvency exclusion in §108(a). To qualify for that, one has to be (duh) insolvent! Insolvency is tested at the time of the discharge. Section 108(d)(3) defines insolvency as 'the excess of liabilities over the fair market value of assets.' But nothing in the statutes or regulations defines the term 'liabilities.'"

US Recipients of Gifts or Inheritance from a Former American: The Importance of Record-Keeping to Avoid Transfer Tax Liability - Virginia La Torre Jeker, US Tax Talk. "Expatriates may unknowingly subject US recipients of gifts or bequests to transfer tax obligations."

French Family Vineyards Imperiled by Historic Inheritance Taxes - Shaun Courtney, Bloomberg ($). "When an estate operator dies in France an average inheritance tax now amounts to more than five years’ worth of a winery’s pure profit, the General Union of the Champagne Winemakers estimates."

Cutting IRS Resources and Punishing Honest Taxpayers - Eugene Steuerle, TaxVox. "President Biden set his own sound bite policy by promising that the tax agency would not increase audit rates for households earning less than $400,000 per year. This guideline is quite awkward, as cheating occurs at all levels of income. It’s also hard to know off of a tax return the true income of someone who underreports income."

Man Sentenced To 82 Months In Prison For Scheme That Defrauded Elderly Victims - Kelly Phillips Erb, Forbes. "Over more than five years, the fraudsters used the lists to send personalized letters to elderly victims. While posing as bank employees, the fraudsters falsely claimed the victims were entitled to a $26.7 million inheritance left in a Spanish bank by an individual who died in a car accident and shared their last name. Other times, the letters said the individual died in the 2004 Madrid train bombings. Of course, that was all a lie."

The latest Hunter Biden controversy, explained - Niall Stanage, The Hill:

The Hunter Biden saga has taken a new twist with the emergence of an Internal Revenue Service (IRS) whistleblower, Gary Shapley.

...

Shapley alleges that there was serious interference in the investigation of Hunter Biden that began in late 2018.

This interference, he alleges, blunted the force of that investigation, left key questions unanswered and, at crucial moments, gave the younger Biden’s team advance warning of what was about to happen.

Ex-CEO Guilty On 44 Counts In $34M PPP Loan Fraud Scheme - Anna Scott Farrell, Law360 Tax Authority ($). "The former head of a California reentry home that claimed to help homeless veterans and men coming out of prison was convicted on all 44 counts for a wide-ranging scheme to try to steal $34 million from the Paycheck Protection Program."

From the IRS press release (defendant name omitted; my emphasis):

Additional evidence demonstrated that in April and June of 2020, Defendant engaged in a second scheme to defraud lenders participating in the PPP lending plan authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act was designed to provide emergency financial assistance to the millions of Americans who were suffering from the economic effects caused by the COVID-19 pandemic. Pursuant to the CARES Act, the SBA managed the PPP lending plan. Trial evidence established Defendant submitted multiple loan applications on behalf of All Hands on Deck to lenders that were false and misleading. For example, the applications substantially overstated the number and payroll of All Hands on Deck employees—while Defendant's loan applications stated All Hands on Deck had approximately 73 to 81 employees, the business had, in fact, perhaps other than himself, no salaried employees.

Defendant was also convicted of offenses related to the submission of multiple fraudulent loan applications in the name of other companies. The evidence demonstrated Defendant hastily revived two dormant companies, and then submitted loan applications from the PPP lending plan for the bogus businesses. To carry out this scheme to defraud, Defendant used, without legal authority, the names and identities of two persons living in his residential reentry facility. Defendant falsely represented that the residents were "CEO"s of companies with hundreds of employees with million-dollar payrolls.

In all, the evidence at trial showed that Defendant submitted a total of 16 fraudulent loan applications to the PPP lending plan seeking approximately $34,655,437 in PPP loans.

It won't be long before we start seeing similar items substituting "ERC" for "PPP."

How does working qualify as a holiday? Anyway, it's National Work From Home Day. It's also International Mud Day, if that helps.

Make a habit of sustained success.