Tax Cuts High on GOP Agenda as House Looks to Revive Business Breaks - Richard Rubin, Wall Street Journal:

Republicans hope to push a bill through the House Ways and Means Committee as soon as this month that would revive expired business tax breaks, congressional aides said. They may also include significant tax cuts for individuals, and the committee chairman on Tuesday endorsed a bill that would increase the standard deduction.

The GOP bill likely won’t become law, but it could be the first step toward bipartisan negotiations this year. And it would set the stage for a larger tax-cut package Republicans are expected to push in 2025, when Trump-era breaks for individuals are scheduled to expire.

Bipartisan Call in Congress for R&D Expensing - Jay Heflin, Eide Bailly:

Political partisanship taints nearly everything on Capitol Hill, but not when it comes to R&D expensing.

Representatives Ron Estes (R-Kan.) and John Larson (D-Conn.), both members of the tax-writing House Ways and Means Committee, introduced legislation that, if enacted, would permit R&D costs to be expensed.

The “American Innovation and R&D Competitiveness Act of 2023” (H.R. 2673) was introduced on April 18, 2023. Since its introduction, nearly every member from both parties on the House Ways and Means Committee support it. There is also bipartisan support from non-committee members. Nearly 100 House lawmakers support this bill. That support is “evenly split between Republicans and Democrats,” according to Estes.

The bill’s text is here.

Largely Bipartisan Markup of Tax Bills Slated for Ways & Means - Doug Sword, Tax Notes ($):

But the big bill Smith has foreshadowed for months isn’t ready yet. “Very soon,” Smith said when asked about the timing on a bill purported to restore at least some of the business tax breaks reduced last year and this year by provisions in the Tax Cuts and Jobs Act.

Besides the “Big Three” business tax breaks — research and development expensing, bonus depreciation, and net interest expensing — Smith has said he’s open to enhancing child tax credits so long as work requirements are included. He also favors tax relief for low- and moderate-income households.

IRS Formally Proposes Flagging Of Malta Retirement Funds - Kat Lucero, Law360 Tax Authority ($):

The IRS unveiled proposed rules Tuesday that would require disclosure of certain tax-free Maltese retirement accounts following recent attempts to regulate what it said were abusive pension plans that took advantage of the U.S.-Malta tax treaty.

...

The U.S. and Malta agreed in December 2021 that investment arrangements that allowed noncash contributions and did not limit contributions to funds from employment or self-employment would not be considered retirement plans under the two countries' 2008 tax treaty. Earlier in 2021, the IRS placed Maltese pension plans on its "Dirty Dozen" list of abusive tax shelters, along with syndicated conservation easements and abusive micro-captive arrangements.

Hawaii Governor Approves SALT Cap Workaround - Paul Jones, Tax Notes ($):

The legislation was approved by lawmakers at the end of the 2023 session. As with all such workarounds, the law is designed to help passthrough business owners skirt the federal Tax Cuts and Jobs Act’s $10,000 limit on the SALT deduction. Starting with the 2023 tax year, a partnership or S corporation can elect to pay a state tax on its owners' pre-distribution income that’s taxable by Hawaii at a rate equal to the highest individual income tax rate. The passthrough income of an entity’s corporate owners is excluded.

Owners of an electing entity would be provided a credit against their Hawaii income tax liability in an amount equal to their pro rata amount of the entity-level tax paid on their income. Residents can claim a credit against a “substantially similar” tax paid to another state to ensure owners using a passthrough workaround in another state aren’t double taxed.

All Tesla Model 3 Cars Now Qualify for $7,500 EV Tax Credit - Keith Laing, Bloomberg. "The change, announced in an update on a government website detailing vehicle eligibility Tuesday, brings the total number of EV models eligible for the full tax credits to 22, including some from General Motors Co., Ford Motor Co. and Volkswagen AG."

Taxpayer Advocate: IRS’s Phone Service Turnaround Came at a Cost - Jonathan Curry, Tax Notes ($):

But to achieve those phone service numbers, the agency had to sacrifice other metrics. IRS employees who answer phone calls also process paperwork, including mail correspondence and amended tax returns.

“If you’re answering the phone 85, 90 percent of the time, guess what percentage of paper you’re working on? Very little, if not none,” Collins said. So while the IRS did a superb job of answering calls, it’s now back to tackling a major backlog of paper correspondence and amended returns, similar to where it was a year ago, she added.

Congressmen push for crypto reporting regs to close Tax Gap - Kay Bell, Don't Mess With Taxes. "In the virtual asset world, as in all other areas of taxable transactions, the lack of third-party data leads to less tax compliance."

Deducting Residual (Excess) Soil Fertility – Does the Concept Apply to Pasture/Rangeland? - Roger McEowen, I Tax School. "When farmland is acquired, an allocation of value can be made to depreciable items. In certain parts of the country, a depreciable item might be residual fertilizer supply. If it can be established with appropriate data, a tax benefit is available. It’s important, however, to follow the IRS guidelines. As applied to grazing land, however, the deduction is quite likely to be so small as to not justify the cost of the soil sampling and the associated tax work to claim the deduction."

Employee Retention Credit Schemes Are Symptoms Of A Dysfunctional Tax System - Peter Reilly, Forbes. "The current batch of scamsters is just another instance of the seemingly irresistible impulse to use the Tax Code as the Swiss Army Knife of social policy while refusing to be serious about funding IRS enforcement."

IRS Can Offset COVID-19 Tax Credits Against Liabilities of Third-Party Payors - Parker Tax Pro Library. "In an email, the Chief Counsel's Office advised that the IRS may offset certain COVID-19 employment tax credits (for example, the employee retention credit (ERC)) to any existing tax liabilities of a Professional Employer Organization (PEO) that pays wages to individuals as part of the services provided to a client employer under a service agreement, even though the credits are attributable to wages paid to a client employer's employees."

Be careful in choosing a PEO.

Lesson From The Tax Court: Temporary vs. Indefinite Commutes - Bryan Camp, TaxProf Blog. "It is not surprising that folks with really long drive commutes might think they should be able to deduct their commuting costs, especially if they are at a job where continued employment may be uncertain. To them, their work seems temporary because they know it might end at any time. But in Joseph Michael Ledbetter and Ashley Jones Ledbetter v. Commissioner, T.C. Summ. Op. 2023-19 (May 25, 2023) (Judge Paris), we learn that just because work might end at any time does not make it temporary. It makes it indefinite. And while travel to a temporary work location outside the area where the taxpayer lives may be deductible, travel to an indefinite work location is not."

Boyle and Baldwin Spell Penalty Trouble - Leslie Book, Procedurally Taxing. "This case serves as a warning that boards and officers must keep close watch over tax matters; even longtime employees who have acted appropriately for years may experience personal and professional issues that can lead to sizable and unexpected sanctions."

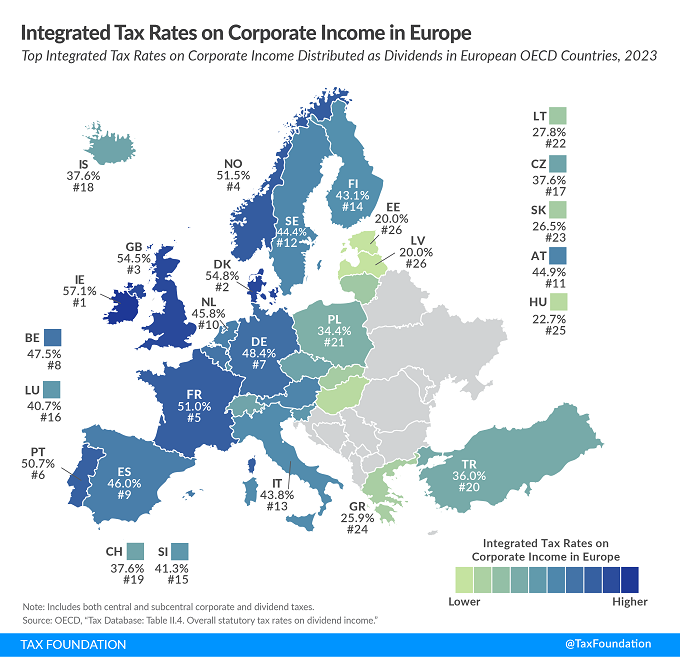

Integrated Tax Rates on Corporate Income in Europe - Cristina Enache, Tax Policy Blog:

In most European OECD countries, corporate income is taxed twice—once at the entity level and once at the shareholder level. Before shareholders pay taxes, the business first faces corporate income tax on its profits...

As an example, suppose that an Italian corporation earns $100 in profit. It must pay corporate income tax of $24, which leaves the corporation with $76 in after-tax profits. If the corporation distributes those earnings as a dividend, the income is taxed again at the individual level at a top dividend rate of 26 percent, resulting in $19.76 in dividend taxes. Thus, the final after-tax income is $56.24, implying that the $100 in original corporate profits faces an integrated tax rate on corporate income of 43.76 percent. (The same calculation can be done for corporate income realized as capital gains.)

The comparable US rate, excluding state taxes, is 47.47%. When state taxes are considered, the integrated rate often exceeds 50%.

House GOP Anti-P2 bill - Leonard Wagenaar, Leonard's Tax Posts. "The tax increase is unlikely to see the light of day, but it is of course possible that it may resurface in 2025, though likely in significantly reworked form. Two years is a long time in international tax these days, so not too many people would be concerned about the 2025 plans for now. But it seems that even when you set out to create a retaliatory, extraterritorial and discriminatory measure, it is quite difficult to make it sufficiently well targeted to ensure you are discriminating who you want to discriminate."

Casual Poker Players Can't Deduct Losses, Tax Court Says - Anna Scott Farrell, Law360 Tax Authority ($). "A Nevada accountant and her husband who lost money playing video poker in 2018 cannot use the losses to offset nearly $20,000 in unreported winnings because they are not professional gamblers, the U.S. Tax Court said in a decision released Tuesday."

Tax Court Special Trial Judge Choi's opinion shows where the "we're pros" argument went wrong for the taxpayers (real names omitted below; emphasis mine):

They play only video poker machines with the best odds of winning. When playing, they employ a strategy they developed in 2016. The strategy was based on statistical information about video poker. Both Petitioners have extensive knowledge of video poker. Based on the foregoing, Petitioners consider themselves professional gamblers.

Petitioners did not keep their own written record of their gambling activity for tax year 2019. Instead, they relied on casinos electronic records, which track a gambler's activity so long as the gambler uses their player card while gambling. Petitioners always used their player cards when gambling because of the benefits they received from using them such as free play and increased points for playing.

Petitioner Wife is an accountant. She prepared Petitioners' 2019 tax return. She initially included the gambling winnings from the Form W-2G in the return, but later decided not to include the winnings when she noticed that doing so increased the amount of tax due from Petitioners, which she believed to be in error. It was her understanding that because Petitioners had a net gambling loss, the gambling winnings reported in the Forms W-2G were not taxable.

Not quite a correct understanding. You have to report the winnings as income; unless you are a "professional," losses are itemized deductions, which are useless if they don't exceed the standard deduction.

Petitioners did not personally keep track of their gambling activity in 2019 choosing, instead, to rely on third-party information from casinos, even though they further acknowledge that the casinos record may be incomplete, as only jackpot winnings, not smaller winnings, are reported. Petitioners also did not keep a separate bank account to manage gambling winnings and expenses, but used their personal account, which is further evidence of the casual nature of their gambling.

Further, in previous years, Petitioners reported gambling losses on Schedule A as would a casual gambler, as they began to do for taxable year 2019. According to Petitioners, they did not know then that their gambling activity could be reported as business activity. But as evidenced by the Schedule C Ms. Mercier prepared for Mr. Mercier's appliance repair business, Petitioners were aware that business activities were to be reported on Schedule C.

Nevertheless, Petitioners did not attempt to offset their gambling winnings with their gambling losses on Schedule C until after receiving Respondent's Notice of Deficiency for taxable year 2019.

The Moral? As in so much in tax, recordkeeping matters a lot. Also, if you want business deductions, don't wait for the audit to start to start reporting on Schedule C.

Keswick man sentenced to prison for failing to pay payroll taxes, making false statements on PPP loan applications - IRS (Defendant name omitted):

A Keswick man was sentenced to 18 months in federal prison for failing to pay over $700,000 in employment taxes for his business, and for making a false statement for purposes of obtaining a Paycheck Protection Program (PPP) loan for the business.

According to court documents, during the years 2014 through 2020, Defendant was a co-owner of TCS Fabricating, Inc. and, during that time, failed to pay $703,615.69 in employment taxes to the IRS. This included the failure to pay taxes that he had collected from TCS's employees through withholding, as well as matching contributions to Social Security and Medicare. In 2020 and 2021, Defendant obtained two PPP loans on behalf of TCS in the total amount of $237,379. The PPP loan applications misrepresented that TCS had paid its payroll tax obligations.

Defendant will be required to pay TCS's unpaid payroll tax obligations, together with interest and penalties. He also will be required to pay restitution of $237,379 to the United States Small Business Administration. Following Defendant's release from prison, he will be required to serve two years of supervised release.

Keswick is a town with 242 residents - well, 241 for 18 months or so - in Southeast Iowa.

This case illustrates two points. First, not paying employment taxes over to the IRS is a terrible idea. They notice that, you'll have to pay with interest and penalties eventually, and it can quickly escalate into a criminal problem.

Second, claiming excess government Covid benefits works fine, until the day it doesn't. Keep that in mind next time you get a call from an outfit assuring you that you really really qualify for employee retention credits.

Related: What to Know About the Employee Retention Credit.

Rewind. It's National VCR Day!

Make a habit of sustained success.