Republican Tax Bill Will Come Quickly After Debt Ceiling Solution - Cady Stanton and Doug Sword, Tax Notes ($):

House Republicans are well on the way to finishing a 2023 tax package — including addressing some 2017 business tax provisions — and plan to introduce the legislation as soon as possible once the looming debt ceiling is resolved.

Republicans working on the package have “buttoned it up pretty tight,” House Ways and Means Committee member Kevin Hern, R-Okla., told Tax Notes May 23, and the bill will likely include the “Big Three” provisions weakened by the Tax Cuts and Jobs Act that Republicans have unsuccessfully tried to roll back: research and development expensing, bonus depreciation, and net interest expensing.

As our Jay Heflin has noted, Democrats have been unwilling to move a tax bill that omits an enhanced child tax credit, so the prospects for this bill in the Senate, where Democrats hold a majority, seem bleak. In any case, first, the debt ceiling has to be solved. There is plenty of coverage in other places on those negotiations. Taxes, though, have come up:

Democrats fume that White House isn’t demanding tax hikes in debt fight - Mike Lillis, The Hill. "While President Biden has repeatedly called for tax hikes on wealthy Americans to accompany the talks, he’s stopped short of demanding such provisions as part of a final deal. And there’s been no sign the White House officials on the front lines of the negotiations are threatening GOP leaders with red lines on the issue."

GOP’s cut to IRS funding in debt limit plan would backfire - Brian Faler, Politico. "Republicans’ proposal to rescind $71 billion in IRS funding pushed through by Democrats last year would cut projected tax receipts by $191 billion over the next decade, the nonpartisan Congressional Budget Office estimates."

Tax Increases Enter Debt Ceiling Debate - Jay Heflin, Eide Bailly. "House Republicans approved their debt-ceiling bill on April 26th. In a normal world, this piece of legislation would be considered to increase taxes. It reduces or eliminates tax deductions or credits, which would increase a taxpayer’s tax bill. Ergo, a tax increase."

Republicans train their sights on the IRS Commissioner - Benjamin Guggenheim, Politico:

IRS Commissioner Danny Werfel has only been at the helm of the agency since March, but Republicans are already starting to question his credibility and alluding to a procedural measure that could make Werfel’s stewardship of the IRS quite difficult going forward.

Here’s what you need to know: Last week Ways and Means Chair Jason Smith (R-Mo.) requested an urgent briefing with Werfel to discuss IRS whistleblower allegations that the entire investigative team on the Hunter Biden tax probe had been removed by the Department of Justice.

Tax Pact Board Says States Should Nix Transaction Threshold - Paul Williams, Law360 Tax Authority:

The Streamlined Sales Tax Governing Board approved a recommendation Tuesday urging states that participate in the tax simplification compact it oversees not to include a transaction threshold in their economic nexus standards for remote sellers.

...

In approving the change, the board essentially altered the agreement to say that it would prefer that states just impose a monetary threshold, such as the $100,000 figure that most states employ, for remote sellers. However, the recommendation is nonbinding on the 24 states that participate in the agreement, as the participants are encouraged, but not required, to follow the compact's best practices.

10 states still have a threshold that sales tax collection responsibility after, say, 200 transactions, no matter how small the dollar amount involved.

IRS Watchdog: Taxpayer Experience Office Isn’t Working as Planned - Lauren Loricchio, Tax Notes ($):

The IRS outlined its taxpayer experience strategy and its plans to create a Taxpayer Experience Office in a report to Congress in January 2021, in accordance with 2019’s Taxpayer First Act. When the office first opened in March 2022, the IRS said it would “focus on all aspects of taxpayer transactions with the IRS across the service, compliance, and other program areas and coordinate with all IRS business units and the Taxpayer Advocate Service to improve taxpayer service.”

But in a report released May 23, TIGTA said that the office has been having trouble hiring staff, which has curtailed its ability to fulfill its mission. According to the report, management in the office said it had a limited ability to hire staff until the fiscal 2022 budget was passed in March 2022, and that by February 2023, the office was still not fully staffed.

From the report:

As of February 2023, the TXO has not functioned as intended. The IRS created the TXO to work closely with its peers across the agency and to be the strategic function with connections to the other business units; however, the TXO still has not established the necessary contacts across the agency to form these connections. As a result, the business units continue to implement the planned capabilities without coordination and feedback. In addition, the IRS has not provided external stakeholders and decision makers with information about the effectiveness of the business units’ efforts and the IRS’s progress towards improving the overall taxpayer experience.

Link: TIGTA report.

The Ins and Outs of the New and Revised Clean Energy Tax Credits - Jamie Garcia de Paredes, Eide Bailly via Bloomberg. "The Inflation Reduction Act modified several clean energy initiatives, expanding Section 48C of the tax code dealing with advanced energy project credit and introducing advanced manufacturing production credits in Section 45X. This article will detail the differences between them and how tax professionals can advise their clients how best to apply each of these credits."

Summer's arrival heralds sales tax holidays in FL & TX - Kay Bell, Don't Mess With Taxes. "Beginning Saturday, May 27, and running through Monday, May 29, Lone Star State shoppers won't have to pay state and local sales taxes that usually apply to purchases of energy- and water-saving products."

IRS submits report to Congress, plans a 2024 limited Direct File Tax Return Prep pilot - Mark Friedlich, Wolters Kluwer Tax & Accounting. "It is unclear if Direct File would coordinate with state and local income tax returns. Failure to do so would force taxpayers to essentially do their income tax returns twice – once using the IRS system and another with existing private company software."

New Bipartisan Legislation Could Help Frustrated 1099 Online Sellers - Rebekah Barton, TaxBuzz. "Now, newly introduced bipartisan legislation is giving resellers hope. According to a press release, U.S. Senators Sherrod Brown (D-OH) and Bill Cassidy, M.D. (R-LA), introduced the Red Tape Reduction Act last Thursday. The bill proposes altering the reporting threshold from $600 to $10,000, meaning fewer sellers and small businesses would receive tax forms from PayPal and other platforms."

Retiring in Paradise Has Its Financial Problems. Make These Moves First. - Anne Tergesen, Wall Street Journal. "Your income is subject to U.S. income tax regardless of where you live. If you don’t file a U.S. tax return, you could face penalties and interest, and even criminal prosecution."

Related: Eide Bailly Global Mobility Services.

M&A Tax’s unwritten detection risk rule - Leonard Wagenaar, Leonard's Tax Posts. "If something is plain wrong and indefensible, no one is getting away with saying ‘but the tax authorities are never going to find out’, as that would be fraud. Even honest mistakes can turn into fraud if they are not corrected once people realised that it was wrong. And no one wants to be complicit in tax fraud."

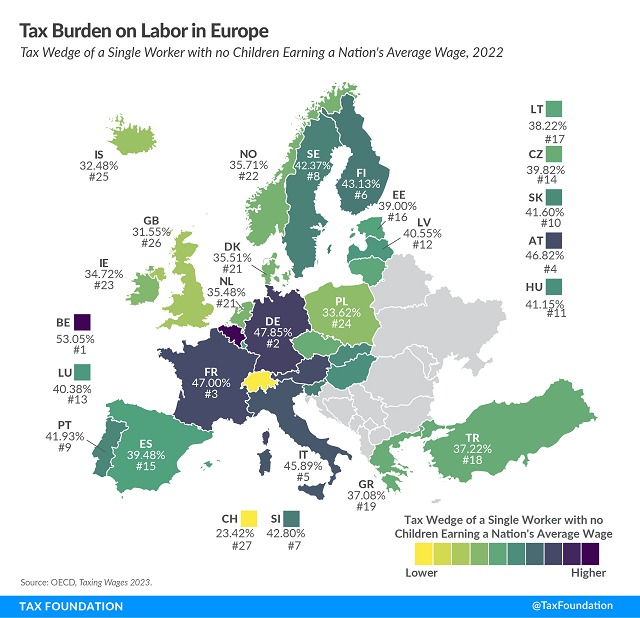

Tax Burden on Labor in Europe - Cristina Enache, Tax Policy Blog. The piece discusses the "tax wedge" - "This so-called tax burden on labor reflects the difference between an employer’s total cost of an employee and the employee’s net disposable income."

For reference, the comparable U.S. number to those on the map is 30.5%.

Hearing Remarks: Protecting American Families from Higher Taxes - Adam Michel, Liberty Taxed. "Every other large modern welfare state funds its programs with high taxes on the poor and middle class. Advocates of more government spending need to be honest with the American people. Big government requires significantly higher taxes on everyone, not just the rich."

Watertown Father and Son Sentenced to Prison for Decade-Long Lottery and Tax Fraud Scheme - US Department of Justice (Defendant names omitted, emphasis added):

A father and son were sentenced today in federal court in Boston for orchestrating an elaborate “ten-percenting” scheme involving dozens of convenience stores across Massachusetts. The defendants unlawfully claimed more than 14,000 winning lottery tickets, laundered over $20 million in proceeds, and then lied on their tax returns. The result was more than $6 million in federal tax loss. As a direct result of this case, the Massachusetts State Lottery Commission is in the process of revoking or suspending the licenses of more than 40 of its lottery agents.

Father, 63, and Son, 29, both of Watertown, were sentenced by U.S. District Court Judge Nathaniel M. Gorton to five years and 50 months in prison, respectively, in addition to orders of restitution in the amount of $6,082,578 and forfeiture of their profits from the scheme. In December 2022, Defendants were convicted by a federal jury of one count of conspiracy to defraud the Internal Revenue Service, one count of conspiracy to commit money laundering and one count each of filing a false tax return.

...

Between 2011 and 2020, the defendants purchased winning lottery tickets from individuals across Massachusetts who wanted to sell their winning tickets for a cash discount instead of claiming their prizes from the Massachusetts State Lottery Commission. This allowed the real winners to avoid identification by the Commission, which is legally required to identify lottery winners and withhold any outstanding taxes, back taxes and child support payments before paying out prizes. The defendants recruited and paid the owners of dozens of convenience stores to facilitate the transactions. After purchasing tickets from the lottery winners at a discount, using the convenience stores as go-betweens, the defendants lied to the Commission, claiming the full amount of the prize money as their own. The defendants then further profited by reporting the winnings on their income tax returns and claiming equivalent fake gambling losses as an offset, thereby avoiding federal income taxes and receiving fraudulent tax refunds.

Some criminals pretty much catch themselves. If the lottery didn't notice something, the IRS surely was going to.

Sometimes it's just too hard to choose. It's National Asparagus Day and National Escargot Day.

Make a habit of sustained success.