Biden, McCarthy Appoint Teams to Negotiate on Debt Ceiling - Alexander Rifaat, Tax Notes ($). "Both President Biden and House Speaker Kevin McCarthy, R-Calif., struck a cautiously optimistic tone regarding debt ceiling discussions as each side has appointed teams to hash out differences over tax and spending priorities."

Senators fight over source of US deficit as default looms - Tobias Burns, The Hill:

Republicans are currently seeking to make many of the tax cuts in the 2017 Tax Cuts and Jobs Act permanent, including business-specific cuts relating to interest deductibility and bonus depreciation.

Democrats, on the other hand, have been aiming for major expansions of pricey spending programs that include the earned income tax credit and the child tax credit, which lifted millions of children out of poverty during the pandemic.

Our Jay Heflin will have a report on the latest in D.C. doings later today here at ebtaxblog.com.

Ore. County Voters Appear To Sink Gains Tax For Eviction Aid - Sanjay Talwani, Law360 Tax Authority ($). "The county just before midnight Tuesday said Ballot Measure 26-238, which would have imposed a local 0.75% tax on capital gains to fund a program to provide free legal and financial assistance to tenants facing eviction, had only received about 18% of the vote, with more than 125,000 ballots cast."

Newsom Approves Tax Exemption for Forgiven Student Loans - Paul Jones, Tax Notes. "A.B. 111, which Gov. Gavin Newsom (D) signed May 15, will conform to federal law to 'exclude from an individual’s gross income the amount of certain student loans discharged, in whole or in part, after December 31, 2020, and before January 1, 2026.' The legislation provides similar relief for forgiven community college fees and federal grants provided to support students pursuing post-secondary education."

When Helping Hurts: How IRS Customer Service Focus Might Backfire - Jonathan Curry, Tax Notes ($):

The IRS’s strategic plan envisions a new, customer-service-oriented agency that makes sure taxpayers get all the credits and deductions they’re eligible for, but a recent inspector general report spotlights the risk that comes from being too helpful.

...

TIGTA’s report gives a hypothetical example of the IRS notifying a nonfiler with two children and earned income that she might be eligible for the earned income tax credit, so the taxpayer files a return and gets a refund. But when that taxpayer’s return is reviewed, it turns out those two children spent most of their time living with grandparents, so the IRS now has to deny that claim and claw back the refund, which likely was already spent.

IRS Issues Health Savings Account (HSA) limits for 2024 - Bailey Finney, Eide Bailly. "Health Savings Accounts are IRA-like accounts designed to accumulate funds for coverage of out-of-pocket health costs. Qualifying contributions generate an 'above-the-line' deduction on 1040s, with no phaseouts for high-income filers."

Gulfstream Founder's Heirs Liable for Unpaid Taxes, Ninth Circuit Says - Mary Katherine Browne, Tax Notes ($). "The heirs to a multimillion-dollar estate were liable for unpaid taxes regardless of whether they received estate property on the date of death of the decedent or after, an appeals court held."

From the opinion summary:

Allen Paulson died with an estate valued at nearly $200 million, most of which was placed in a living trust. The estate was distributed among Paulson's heirs over the years. When the estate filed its tax return, it also paid a portion of its tax liability, and elected to pay the remaining balance in installments with a fifteen-year plan under 26 U.S.C. §6166. After the estate missed some payments, the Internal Revenue Service terminated the §6166 election and issued a notice of final determination under 26 U.S.C. §7479. The IRS then recorded notices of federal tax liens against the estate.

...

The panel held that §6324(a)(2) imposes personal liability for unpaid estate taxes on the categories of persons listed in the statute who have or receive estate property, either on the date of the decedent's death or at any time thereafter (as opposed to only on the date of death), subject to the applicable statute of limitations.

An ugly result for the heirs. As important as estate planning is, estate administration also matters.

Related: Eide Bailly Wealth Transition Services.

The Challenges of Untangling the Tax Code’s Related Party Rules - Carolyn Linkov, Eide Bailly via Bloomberg:

Consider this doozy: Under ERC rules, one or more employers is considered a single (aggregated) employer if they’re considered members of the same controlled group within the meaning of Section 52(a). But Section 52(a) itself doesn’t define the term controlled group; instead, it embeds the Section 1563(a) definition of that term.

...

And that’s just the beginning. For ERC aggregation purposes, Section 52(b) and Sections 414(m) and (o) also must be considered. That means that you began your odyssey in the ERC provision—Section 3134(d)—and ended it in Section 1563(a)(1), with stops along the way in each of Sections 52(a) and (b) and Sections 414(m) and (o).

More than 1M tax returns flagged for potential identity fraud: IRS - Jared Gans, The Hill. "An interim report on the 2023 tax filing season that the IRS composed last week and publicly released Tuesday states that the agency identified almost 1.1 million returns that need to have additional review because of identity theft filters, as of March 2. The IRS confirmed 12,617 returns to be fraudulent, preventing $105.3 million in refunds from being distributed"

Five Challenges Facing the IRS’s Direct E-File Pilot Program - Naomi Jagoda and Chris Cioffi, Bloomberg ($).

The IRS will need to figure out how a pilot program will coordinate with states, so that taxpayers are able to easily file both their federal and state returns.

...

Former National Taxpayer Advocate Nina Olson, now executive director of the Center for Taxpayer Rights, said that perhaps the IRS could do a pilot with one or two states. She said an issue around integration with states is getting taxpayers’ consent to have their federal tax information disclosed on their state tax return."

What parents need to know about 529 college savings plans - Michelle Singletary, Washington Post:

...

This means the cost of college still primarily falls on parents and students. Saving will be the key to avoiding decades of debt.

Extra RMD money could make a good 529 plan gift - Kay Bell, Don't Mess With Taxes. "Even better, 529 plan earnings grow tax-deferred at federal and most state levels. The money can be withdrawn tax-free to pay qualified educational expenses. Some states also offer a state tax deduction for 529 plan contributions."

AI-Generated Tax Scams Can Look A Lot Like They Came From The IRS - Kelly Phillips Erb, Forbes. "How good could an AI-generated letter possibly be? I decided to test it out myself. I asked ChatGPT to 'Write a letter from IRS advising a taxpayer that they need to pay their taxes immediately with a gift card.'"

FEIE for Digital Nomads and Remote Workers - Kasia Strzelczyk, 1040 Abroad. "The good news is that U.S. expats may qualify for certain provisions like the Foreign Earned Income Exclusion (FEIE), Foreign Housing Exclusion or Deduction, and Foreign Tax Credit to mitigate the risk of double taxation. However, these provisions come with specific requirements and are not automatically granted."

US Tax Treatment: Stock Options from Your Foreign Employer - Virginia La Torre Jeker - US tax Talk. "Stock options are increasingly becoming an important element of the international executive’s compensation package. There are wonderful opportunities to be had with stock options, but there are also tax traps involved especially in the international context."

Related: Eide Bailly Global Mobility Services.

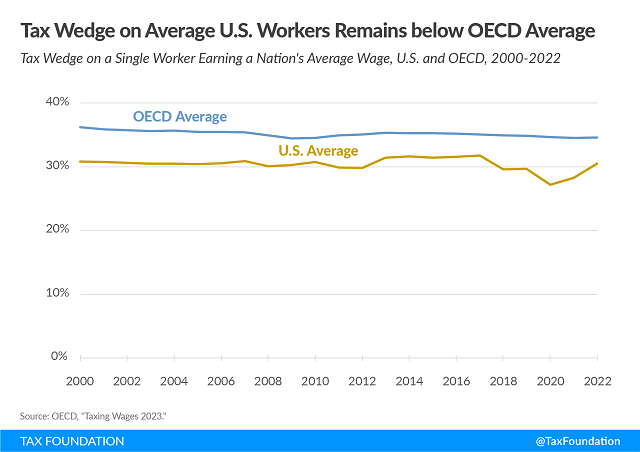

The U.S. Tax Burden on Labor Remains below the OECD Average - Alex Mengden and Daniel Bunn, Tax Policy Blog. "Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes."

Auntie's mad. A family drama played out in the 11th Circuit Court of Appeals. Tax Notes ($) summarizes the case: "The Eleventh Circuit affirmed a district court decision that granted an individual a $5,000 judgment under section 7434 and issued a preliminary injunction against the individual’s aunt after the aunt and her tax business filed false Forms 1099-MISC reporting income for the individual, finding that the aunt waived her defense regarding jurisdiction."

The tax law relies on third-party reporting of income. It's hard to imagine the tax system functioning without W-2 and 1099 filings. But the tax law also frowns on 1099s issued out of spite.

Without getting into all of the grim details, the aunt, who ran a tax preparation service, had a dispute involving the care of the niece's mother. Somehow this involved a dispute over jewelry held by the niece, leading to the aunt sending this e-mail, as reported in the 11th Circuit Opinion:

As I stated you have until Sept. 28th to return. If I don't receive them back . . . it simply means you received something of value that you refused to return. You will be assessed the appraisal value of each piece x 3. It [sic] called damages/fraud, so play your games with someone else. When IRS come knocking at the door for the taxes including Georgia Dept of Revenue let's see how far you get with playing your games! . . . If you want to continue sending your emails I will bill you at my billable rate and forward to you my Invoice. Pay it or not pay it. If you elect to not pay it you will also receive a 1099-Misc. for my labor!

The aunt ended up issuing a 1099-MISC for $320,660 reporting "other income" to the niece, followed by a second one reporting $29,470. The niece struck back with a federal lawsuit against the aunt. A U.S. District court imposed an injunction against the aunt and awarded $5,000 under Internal Revenue Code Sec. 7434, "which provides for civil damages for fraudulent filing of information returns."

The 11th Circuit upheld the injunction and award.

The Moral? By all means file information returns when you actually are required to. Don't file them because you are mad.

Accounting manager for Everett, Washington, company pleads guilty to embezzling more than $2.5 million from employer - IRS (defendant name omitted):

Defendant, an Accounting Manager at an Everett-based manufacturing company, stole more than $2.5 million from her employer by transferring funds to accounts Defendant set up in the names of fake companies and then routing the funds to her own bank accounts. Defendant faces up to 20 years in prison when sentenced by U.S. District Judge Ricardo S. Martinez on August 11, 2023.

According to the plea agreement, in April 2013, Defendant set up an account with payment processor Square that used a display name that made it appear it was an account of a commercial shipping company. Between 2014 and 2019, Defendant secretly paid $1,695,591 to that account and then transferred the money to her own bank accounts. She made false entries in the company books to conceal the theft.

...

Defendant is also charged with making a false tax return for failing to report the more than $2.5 million in income she embezzled. For example, for the tax year 2019, Defendant represented that her income was $38,022, but failed to report the $615,392 in income she received that year from her embezzlement. In all, Defendant failed to pay $590,850 that she owed in taxes.

I guess that just leaving embezzlement income off your 1040 is a sort of tax planning, but not embezzling is a much better way to go.

Related: Eide Bailly Forensic Accounting.

Meet Chonkosaurus. Today we take a break from our usual diet of obscure holidays to honor Chonkosaurus, a giant turtle living its best life in the Chicago River. If you are ever tempted to swim there, you'll have company.

Make a habit of sustained success.