IRS Will Offer Free Online Tax Prep for Some Taxpayers in 2024 - Richard Rubin, Wall Street Journal:

The IRS announced the pilot program Tuesday and released a pair of reports on the possibility of developing a government-run online tax-filing service that would be a new option in addition to paper forms, private software and paid tax preparers. One report included surveys finding that a majority of people who already use tax software to file their returns would likely switch to an IRS-run tool.

But the reports also identified challenges, including the need to provide customer service for taxpayers. People who file state income tax returns might find an IRS service of limited use unless it connects seamlessly with state systems.

IRS Launching Pilot of Its Own E-File Program - Alex Clearfield, Bloomberg ($):

The IRS will test a free agency-run online tax-filing tool, following a highly-anticipated report on the feasibility of such a system, IRS and Treasury Department officials said Tuesday.

Details of the pilot, including who would be eligible, are still being determined. It’s not expected to include prepopulating tax returns, IRS Commissioner Danny Werfel said. The goal is to run the pilot program during filing season next year, he said.

From the IRS report (Publication 5788, pdf):

Taxpayers balance multiple objectives when selecting a filing method, and surveys indicate cost is major factor for most. In one of scenarios covered in the MITRE survey, respondents were given a choice between a commercial product costing $80 and a free IRS option. In that scenario, 70% of taxpayers chose the IRS option. Even when the IRS option was explicitly described as offering no support for filing a state return, 59% of taxpayers preferred

the IRS option, with “filing taxes should be free” consistently cited as the top reason.The paper filer quoted above had previously used an online self-preparation product but

described their frustration with upselling tactics, as well as cost and complexity, during their interview. “I guess really it comes down to the cost. The software is not cheap. I think the minimum you’re going to pay is $70, $80 to $100 bucks, and then I have to look further into, you know, there’s different versions if you’re going to use this form or this form, and you need this. […] I can just do it on paper, and it costs me $0.”

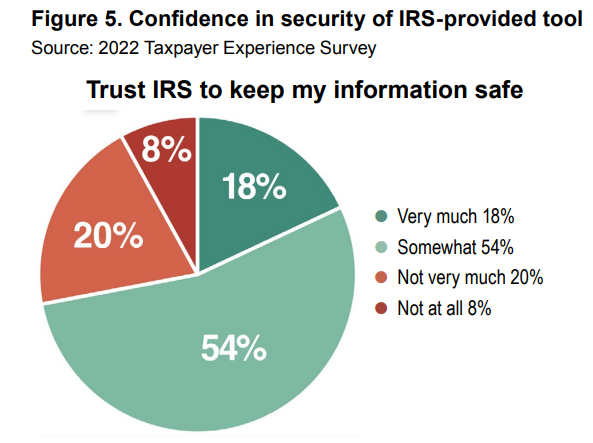

This item from the report shows one potential obstacle to free filing: only 18% of taxpayers had "very much" trust that the IRS would keep their information safe:

IRS Issues Applicable Federal Rates (AFR) for June 2023 - Bailey Finney, Eide Bailly. "The Section 382 long-term tax-exempt rate used to compute the loss carryforward limits for corporation ownership changes during June 2023 is 3.04%"

The short term rate for June 2023 is 4.43% It was 2.21% for June 2022 and 0.13% for June 2021.

IRS Scores Tax Court Victory on Treatment of Fuel Mixture Credit - Kristen Parillo, Tax Notes ($):

Growmark joins a line of court decisions addressing the treatment of section 6426 alcohol and biodiesel mixture credits. According to the IRS, the credits offset taxpayers’ section 4081 fuel excise tax liabilities, which means they must reduce their cost of goods sold or income deductions by the amount of those credits for applicable tax years.

Growmark Inc. and other fuel blenders have argued that the IRS’s position contravenes congressional intent. They contend that the credits should be treated as payments that satisfy — but don’t reduce — their fuel excise tax liability, and therefore they shouldn’t have to reduce their COGS by the amount of the section 6426 credit.

Link: 160 T.C. No. 11.

Healthcare Group’s Tax-Exempt Status Rejected by Tax Court - Caitlin Mullaney, Tax Notes ($).

In a May 16 memorandum opinion in Memorial Hermann Accountable Care Organization v. Commissioner, Chief Judge Kathleen Kerrigan held that the Memorial Hermann Accountable Care Organization (MHACO) failed to show that its activities outside of its participation with the Medicare Shared Savings Program (MSSP) served a benefit to the public as is required to qualify for section 501(c)(4) tax-exempt status.

...

The MHACO is incorporated as a nonprofit organization controlled by its sole member, the Memorial Hermann Health System, a section 501(c)(3) exempt organization. The MHACO coordinates healthcare services provided by its sister corporation of medical providers for patients enrolled in the program through either the Centers for Medicare & Medicaid Services or commercial payor health insurance plans.

Link: T.C. Memo. 2023-62

Related: Eide Bailly Exempt Organization Tax.

IRS Misses Goal For Curbing Improper Payments, TIGTA Says - Theresa Schliep, Law360 Tax Authority ($). "In the report, the watchdog said the IRS didn't meet the 10% goal laid out under the Payment Integrity Information Act of 2019. The rate at which the agency sent out incorrect earned income tax credits was 32% in the 2022 fiscal year, while the rate for the American opportunity tax credit was 36%, according to the report."

Link: Report Number: 2023-40-032

CBO Rescores Cost of TCJA Extensions at $3.5 Trillion - Cady Stanton, Tax Notes ($). "The CBO calculated in a March report that to balance the federal budget while extending the TCJA provisions, making interest payments, and achieving promises not to raise taxes or cut Medicare, Social Security, defense, or veterans’ programs, every other item in the federal budget would have to be zeroed out."

IRS Agent Says Team Removed From Hunter Biden Probe - David van den Berg, Law360 Tax Authority ($):

An IRS criminal supervisory special agent and his entire investigative team were dropped from an ongoing investigation of a high-profile subject — widely reported to be President Joe Biden's son Hunter Biden — according to a letter the agent's counsel sent lawmakers.

The Internal Revenue Service agent learned Monday that the U.S. Department of Justice had requested the removal of the team, according to the letter from Tristan Leavitt, president of Empower Oversight, and Mark D. Lytle of Nixon Peabody LLP.

IRS announces high-deductible health plan, HSA & HRA inflation bumps for 2024 - Kay Bell, Don't Mess With Taxes. "For 2024, you can contribute up to $4,150 to an HSA if you have individual HDHP coverage. That's up from this year's $3,850 maximum HSA contribution."

Work From Home And Other Benefits May Be At Risk After Covid Emergency Declaration Ends - Kelly Phillips Erb, Forbes. "Now that the emergency declaration has ended, there’s a dilemma for employers: cease Covid-19 related payments, accept that they might be taxable, or determine whether they might otherwise be deductible under another section."

Tax Court Dismisses Petition Filed Electronically Five Minutes Past Midnight - Parker Tax Pro Library. "The Tax Court dismissed for lack of jurisdiction an electronically filed Tax Court petition which was filed on the due date at 11:05 p.m. in the central time zone. The court held that a document that is electronically filed with the Tax Court is filed when it is received by the court as determined in reference to where the court is located (i.e., Washington, D.C.), and because the taxpayers electronically filed the petition after the due date in the eastern time zone, the petition was untimely."

Minnesota Looks to Raise Taxes despite Projected $17.6 Billion Budgetary Surplus - Timothy Vermeer, Tax Policy Blog. "The Senate no longer seems willing to support mandatory worldwide combined reporting, a welcome development. However, several other uncompetitive proposals remain under consideration: the addition of Global Low-Taxed Intangible Income (GILTI) to the corporate tax base, a fifth marginal tax bracket that would add a full percentage point to the individual income tax rate, and a surtax on capital gains income. Each would have a significant negative impact on the state’s economy if enacted individually, but, when implemented together, the negative effects would be compounded."

16th Anniversary of the 21st Century Taxation Blog - Annette Nellen, 21st Century Taxation. "There are many inequities in our tax system such as special tax deductions, exclusions and exemptions that provide a larger benefit to higher income taxpayers relative to others. Examples include the mortgage interest deduction, exclusion of gains that exist at death, and the exclusion of employer-provided health insurance subsidies."

Alternative Tax Thinker Trying The Puerto Rico Gambit - Peter Reilly, Forbes. "The conventional term for someone like Brian Swanson is tax protester, which Wikipedia defines as someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. In 1998 Congress forbade IRS from designating people 'illegal tax protesters', but that does not prevent others including the courts from throwing the term around. Still I don't like it, so what I am going to call Brian Swanson is an alternative tax thinker."

Or, one could call them "people who lose all their tax cases."

Former police department lieutenant sentenced for failing to report more than $1.3 million in income from his security business - IRS (defendant name omitted):

U.S. District Judge Deborah L. Boardman sentenced Defendant, of Dunkirk, Maryland, today to 16 months in federal prison, followed by two years of supervised release, for a tax evasion charge. Defendant is a former Lieutenant with the Prince George's County Police Department and owned and operated EFI, a private company. Judge Boardman also ordered Defendant to pay restitution in the full amount of the loss, $367,765.

...

According to his plea agreement and other court documents, from approximately December 26, 1995 to April 26, 2021, Defendant was a member of the Prince George's County Police Department (PGPD). Members of the PGPD were allowed to work part-time outside employment in addition to their full-time duties, known as Secondary Law Enforcement Employment (SLEE). According to the plea agreement and court documents, from 2014 to 2021, Defendant used EFI and employed off-duty law enforcement officers to provide security services to apartment complexes and other businesses, primarily in Prince George's and Montgomery Counties, to manage and operate his SLEE business.

Defendant admitted that he underreported a total of more than $1.3 million of EFI income on his 2014 through 2019 individual income tax returns. During that time frame, Defendant deposited checks payable to EFI into personal bank accounts or non-EFI bank accounts over which Defendant had signature authority. Defendant also created false business expenses to lower his tax due by writing checks to relatives and friends for purported services performed; and used business funds to purchase a boat, a car, and other items for his personal use. This underreported income resulted in a total tax loss to the government of $367,765.

Further, Defendant admitted that on April 22, 2021, as federal agents announced their presence at his front door to execute a search warrant on his residence, Defendant initiated the erasure and resetting of his cellphone. Defendant then opened the front door to his residence and law enforcement recovered the phone in the master bedroom.

The gentleman enforced laws for a living while moonlighting at lawbreaking. An example of the amazing adaptability of the human mind.

I'll stalk them in the produce section. Today is National Mushroom Hunting Day!

Make a habit of sustained success.