As Tax Season Ends, IRS Exudes Cautious Optimism - Alexander Rifaat, Tax Notes ($). IRS Commissioner Werfel says money helped:

“The bottom line is, with the additional funding provided under the Inflation Reduction Act, the IRS made an immediate, meaningful difference to deliver the service American taxpayers deserve. On the phone, in person, and online,” Werfel said.

But the Commissioner said that the IRS juggled resources to man the phones in a way that may hurt down the road:

“There’s a trade-off. As we move money from the Inflation Reduction Act to pay for base resources, which we did in 2023 — hundreds of millions of dollars — that means we are not using money to modernize and make those adjustments and enhancements that taxpayers see when they go to their bank or engage with any other private sector entity,” Werfel said.

Tax Day: IRS Left Fewer Taxpayers on Hold This Year - Ashlea Ebeling, Wall Street Journal:

How much has customer service improved? The IRS says its representatives answered nearly nine out of 10 calls, compared with less than two out of 10 calls last year.

Though that doesn't measure how many taxpayers got the right answer, notes Taxpayer Advocate Erin Collins. And there remain issues at IRS:

Despite the improvement in answering taxpayer calls, the IRS said it is still working through a persistent backlog of tax returns with errors, amended returns and correspondence by mail. As of April 1, the IRS backlog included 1.7 million returns needing error correction or other special handling and 1.1 million unprocessed amended returns.

Tax refunds more scarce as filing deadline hits - Brian Faler, Politico. "Analysts point to a number of reasons for the shrinking payments: The expiration of pandemic-related relief, of course, but other things too, such as bracket creep, where inflation pushes up people’s tax bills."

IRS Should Prioritize Better Technology, Ex-Official Says - Lauren Loricchio, Tax Notes ($):

Speaking April 18 during a webinar hosted by the Center for Taxpayer Rights, Fred Forman, a former IRS associate commissioner of business systems modernization, said the agency should “cool the jets a little bit on overhiring or trying to ramp up the people side too much” and instead focus on sorting out the information structure side, which is “going to take some time.”

“Just hiring a bunch of auditors to me is, like, almost crazy because they will have the old systems and the old issues to deal with, and they’ll divert the people who are doing the audits,” he added.

Forman said the recently-released IRS operating plan for using its increased funding is a "step in the right direction."

Interview: Analyzing the IRS’s Inflation Reduction Act Spending Plan - David Stewart, Jonathan Curry, and Fred Goldberg Jr., Tax Notes Opinions:

I think the high end, I think the biggest challenge there is they want to hire folks who can do this, but I think they have so much to learn about compliance issues at the high end. I would not go crazy with the hiring of agents. I would spend my time doing the research to understand what I don't know, but what I do need to know to be effective. And that is both identifying issues and finding the most effective way to deal with those issues. Sometimes it's an audit, sometimes it's penalties, sometimes it's criminal enforcement.

But I think an awful lot of the time it comes to things like guidance, innovative dispute resolutions.

Fred Goldberg Jr. was IRS Commissioner from 1989 -1992.

Indiana storm victims qualify for tax relief; April 18 deadline, other dates extended to July 31 - IRS. "The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA) as a result of tornadoes, severe storms and straight-line winds that occurred on March 31 and April 1. This means that individuals and households that reside or have a business in Allen, Benton, Clinton, Grant, Howard, Johnson, Lake, Monroe, Morgan, Owen, Sullivan and White counties qualify for tax relief. Other areas added later to the disaster area will also qualify for the same relief. The current list of eligible localities is always available on the Tax Relief in Disaster Situations page on IRS.gov."

It might have been helpful if this had been announced before tax deadline day.

Bidens Paid $169,820 in Income Tax in 2022, Returns Show - Justin Sink and Laura Davison, Bloomberg ($):

President Joe Biden and First Lady Jill Biden paid $169,820 in federal and state income tax on a combined $579,514 in adjusted gross income, according to their annual tax returns.

Both amounts represented a decrease from the previous year, in which the first family made $610,702 in 2021 and paid $183,925 in taxes. The decline was in part because of increased charitable giving — the Bidens donated slightly more than $20,000 last year — and in part because of falling income from their S-corporations, entities that they have used to run the income from their book deals.

Links: President's 2022 returns; Vice-President's 2022 returns.

Tax Analysis has a free-to-view collection of presidential tax returns, including the 1932 return for FDR.

Climate credits, IRS funds snarl GOP debt limit talks - Lindsey McPherson, Laura Weiss, and Aidan Quigley, Roll Call:

If a repeal of clean energy credits is included, thus opening the package to tax provisions, other GOP priorities could also be contenders. Republicans have been pressing for the revival of several business tax breaks that lapsed or phase down under their 2017 tax law.

Those include bringing back upfront expensing for all research and development costs and preserving a full and immediate deduction for the cost of buying equipment, machinery and other assets. Rep. Vern Buchanan, R-Fla., said he’d like to see those provisions addressed if the package has a tax title, arguing that it would help the U.S. keep up with other countries incentivizing R&D.

Lots of ifs and coulds have to happen for any tax provisions to move.

The Potential Federal Income Tax Liability of Foreign Digital Nomads - Doron Narotzki and Vered Kuperberg, Tax Notes ($):

Unfortunately, the IRC provides very little guidance for what level or type of activity will constitute a USTB and simply defines the term as “the performance of personal services within the United States at any time within the taxable year.” And while it seems clear that passive investment activity will not be considered engaging in a USTB, under the IRC it is unclear what will be.

USTB = United States Trade or Business.

Related: Eide Bailly Global Mobility Services.

US Expatriations Halved In 1st Quarter, IRS Says - Emlyn Cameron, Law360 Tax Authority ($). "The number of people losing or renouncing their U.S. citizenship dropped to 536 in the period of January through March, from more than 1,000 in the fourth quarter of last year, the IRS said in a list of those choosing to expatriate."

More details at International Tax Blog.

World’s First Carbon Import Tax Approved by EU Lawmakers - Matthew Dalton and Amrith Ramkumar, Wall Street Journal:

The European Union’s parliament approved legislation to tax imports based on the greenhouse gases emitted to make them, clearing the final hurdle before the plan becomes law and enshrines climate regulation in the rules of global trade for the first time.

...

Governments and lawmakers in other countries are already under pressure to follow suit. The U.K. is debating whether to introduce a carbon border tax, while Democrats in Congress proposed legislation to create one. Bipartisan support for the idea is growing in the U.S., said Kevin Dempsey, president of the American Iron and Steel Institute, which represents companies such as Nucor Corp. and ArcelorMittal SA.

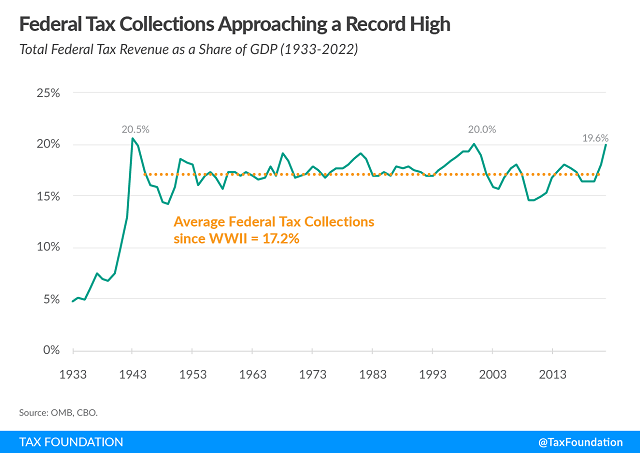

Testimony: The Costs and Complexity of the Federal Tax Code Demand Reform - William McBride, Tax Policy Blog. "Only two other years in U.S. history saw federal tax collections as a share of GDP exceed the FY 2022 level, both during World War II: in 1943, federal tax collections reached 20.5 percent of GDP before falling to 19.9 percent in 1944. FY 2022 tax collections exceeded the post-war average of 17.2 percent of GDP by 2.4 percentage points."

Inflation tops tax worries, according to one survey - Kay Bell, Don't Mess With Taxes. "WalletHub's 2023 tax survey found that as far as the actual task of completing returns, 49 percent of us would rather server on a jury; 36 percent would prefer to talk to their kids about sex; and 26 percent said they would miss a connecting flight if it meant not having to mess with their taxes."

Lesson From The Tax Court: The Actual Payment Doctrine - Bryan Camp, TaxProf Blog. "To take a deduction the taxpayer must make an actual payment. There is no such thing as constructive payment. In Edwin L. Gage and Elain R. Gage v. Commissioner, T.C. Memo. 2023-47 (Apr. 12, 2023) (Judge Holmes), the taxpayers purchased a cashier’s check in December 2012 to settle a lawsuit and gave it to their attorney. They took a 162 deduction for 2012, even though their attorney did not deliver the cashier's check to the opposing party until March 2013. In holding that they could not deduct that payment in 2012, Judge Holmes explains why their commitment to pay and their actual purchase of a cashier’s check did not amount to making an actual payment in 2012."

If You Have To Repay Compensation, Will IRS Refund The Taxes? - Robert Wood, Forbes. "In general, the IRS doesn't allow you to undo a prior transaction as if it never occurred. Rescission is sometimes possible where everything occurs (including the giveback) in the same tax year. In most cases, the giveback happens in a later tax year. Usually you can't just amend your prior year tax return either. Amending a prior tax return is generally allowed only to correct a mistake."

Used Car Seller’s Bonus Payments Do Not Constitute A Separate Trade or Business - Leslie Book, Procedurally Taxing. "I suspect that during the years that the TCJA suspends the deduction of MIDs, people like Schmerling, who have W-2 income and 1099 income may try to allocate expenses that are arguably related to both to the W-2 income and the 1099 income toward the 1099 income."

MIDs = miscellaneous itemized deductions.

Orange County woman sentenced to over 5 years in prison for embezzling over $3 million from two Anaheim companies that employed her - IRS (Defendant name omitted):

An Orange County woman who embezzled more than $3 million from two companies while she worked as their financial controller, cheated on her taxes, and fraudulently obtained a COVID-relief business loan was sentenced today to 63 months in federal prison.

Defendant, of Dana Point, was sentenced by United States District Judge Cormac J. Carney, who also ordered her to pay $4,192,470 in restitution.

In February 2019, Defendant told executives their companies did not have funds to meet payroll obligations and failed to inform the executives that she had been embezzling from the companies. Several months later, while the companies were the subject of an IRS enforcement action because of unpaid payroll taxes, Defendant falsely told the executives that she did not pay the quarterly payroll taxes because she instead had used those funds to pay employees.

Once Defendant transferred the funds to her accounts, she used the stolen money on personal expenses, withdrew a large amount in cash, wired a significant amount to a family member-owned bank account in Mexico and made other transfers of the illicitly obtained funds to family and friends.

Just in case $4 million wasn't enough: "In her plea agreement, Defendant admitted to submitting a false and fraudulent Paycheck Protection Program (PPP) loan application for $20,569."

Shocking that she didn't report the embezzlement on her 1040.

Beyoncé Challenges $3M In Taxes, Penalties Imposed By IRS - David van Berg, Law360 Tax Authority ($):

The petition filed Monday said the IRS wrongly determined Beyoncé failed to report royalty income in 2018 and improperly claimed a host of tax deductions in 2018 and 2019. The petition asserted she properly reported several tax deductions, including the qualified business income deduction for both years and deductions for legal and professional services in 2018 and management fees in 2019.

According to an IRS deficiency notice included with the petition, the agency asserted Beyoncé owed more than $805,000 in taxes for 2018 and $1.4 million for 2019. The agency also imposed accuracy-related penalties for understatement of tax totaling more than $161,000 for 2018 and more than $288,000 for 2019, according to the notice. The IRS also claimed Beyoncé owed interest estimated at about $264,000 for the two years, according to an IRS exam document.

Nice problem for a musician to have.

How can we combine these? It's both National Garlic Day and National Banana Day!

Make a habit of sustained success.