Why It’s Important to File Your Tax Return Timely, Even if You Can’t Pay - Erin Collins, National Taxpayer Advocate (my emphasis)::

The IRS will assess a failure-to-file penalty when a tax return is not filed by the due date or the date of a valid extension to file. A penalty of five percent of the unpaid tax is assessed each month or part of a month the return is late, up to a maximum of 25 percent. The penalty is based on the amount of tax due, minus any credit the taxpayer may receive and any payment made by the due date. In general, interest on underpayments, including any applicable penalties, accrues on the due date of the amount is owed and continues to accrue until the balance is paid in full...

Taxpayers who know they owe tax should either file the return or request an extension by April 18. Even though filing the return will not address the consequences of owing the tax, timely filing will help avoid late filing penalties. The extension will be granted if the taxpayer completes the form properly, makes a proper estimate of the tax, and files the form by the due date of the return.

Even if you don't pay what you owe, filing timely - including a return that was extended on time - reduces your penalty from 5% per month to 1/2 percent per month. If you can pay in 90% of what you owe, you only owe interest.

Never mind the myths; find filing season facts at IRS.gov - IRS:

Myth: Taxpayers don't need to report income if they didn't receive a Form 1099-K this year.

Fact: All income must be reported unless it's excluded by law. This is true whether or not taxpayers receive a Form 1099-K, or other reporting forms. It is important to report all income to avoid receiving a notice or a bill from the IRS. This includes income from:- Goods created and sold on online platforms.

- Investment income.

- Part-time or seasonal work.

- Self-employment or other business income.

- Services provided through mobile apps.

Proposed Regs Could Cast a Wider Net for Microcaptive Scrutiny - Chandra Wallace, Tax Notes ($):

The microcaptive reportable transaction regulations proposed April 10 mean a whole new set of transactions are now listed transactions — considered abusive by the IRS and subject to challenge — tax advisers warn.

The proposed regs (REG-109309-22) designate two microcaptive transaction types as “listed transactions” and one as a “transaction of interest” — categories that require disclosures to the IRS Office of Tax Shelter Analysis. But the proposal defines transactions subject to its requirements to include transactions “substantially similar to” those described in the notice.

Tax Pros Fear Opening 'Pandora's Box' By Altering Easements - Kat Lucero, Law360 Tax Authority ($). "The IRS has released guidance on amending or drafting conservation easement deeds to qualify for a safe harbor under a new enforcement law, but practitioners worry that changes to deeds could open a "Pandora's box" of potential agency scrutiny and easement disputes."

Biz Groups Oppose Minn. Worldwide Tax Reporting Bill - Sanjay Talwani, Law360 Tax Authoirty ($).

The Minnesota Chamber of Commerce and others said H.F. 2883, sponsored by Rep. Frank Hornstein, D-Minneapolis, would place the state at a competitive disadvantage. The House Taxes Committee laid the bill over for inclusion in a possible tax omnibus bill.

"This will make Minnesota an extreme tax outlier both nationally and internationally," Beth Kadoun, the Minnesota chamber's vice president for tax and fiscal policy, told the panel.

"Under the worldwide combination method, a state imposes its tax on income apportioned to that state by the corporate taxpayer and all of its affiliates, domestic or foreign, that engage in a unitary business. When a state employs a water's-edge combined reporting method, the group excludes foreign affiliates and even U.S. corporations if they conduct most of their business outside the United States." - The Tax Adviser.

R&D isn’t a bargaining chip: Congress must support American innovation - David Kautter, The Hill. "Companies can no longer immediately deduct all their research and development expenses from the income on which they are taxed. Instead, they must amortize these costs over five years (or 15 years for R&D activities abroad)."

Related: The Impact of Changes to Section 174 alert 2023/3

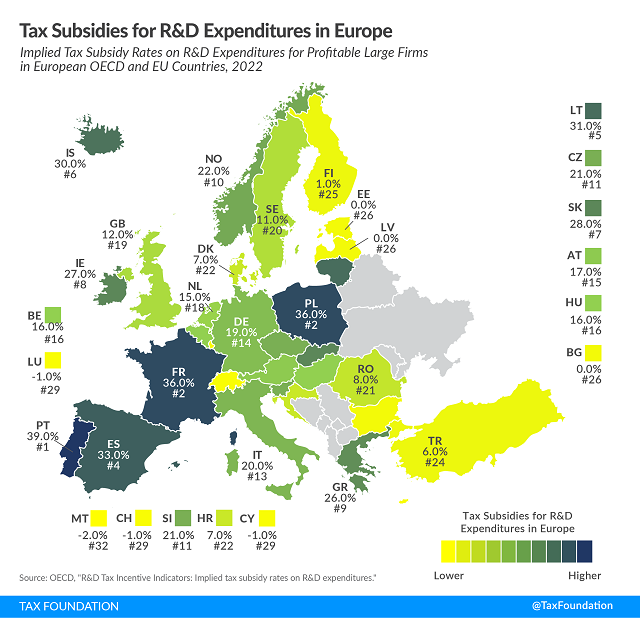

Tax Subsidies for R&D Expenditures in Europe - Cristina Enache, Tax Policy Blog. "Many countries incentivize business investment in research and development (R&D) to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives."

Some state refund recipients should amend their federal tax returns - Kay Bell, Don't Mess With Taxes. "The affected taxpayers live in Alaska, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Maine, Massachusetts, New Jersey, New Mexico, New York, Oregon, Pennsylvania, Rhode Island, South Carolina, and Virginia. You can read about the IRS decision in my post State relief payments issued in 2022 are federally tax free."

Bozo Tax Tip #3: We Don’t Need No Stinkin’ Basis - Russ Fox, Taxable Talk. "If there’s one issue in tax that tax professionals have trouble explaining to clients it’s basis. Your basis in an entity is, generally, the total of your investment in an entity plus income it generated less any distributions from it. If you’re an investor in a business, you can only take losses up to the amount of your basis. Sounds simple, right?"

Trust Language Doomed Estate's Deduction for Transfer of CRAT Interest to Charity - Parker Tax Pro Library. "The Tax Court held that an estate was not entitled to a deduction under Code Sec. 2055(a) for the transfer of a remainder interest in a trust to a charitable organization because the trust instrument did not provide that a "sum certain" was to be paid at least annually to the income beneficiaries of the trust and therefore, the trust was not a charitable remainder annuity trust (CRAT). The court also found that an amendment to the trust did not qualify for the exception for judicial reformations because the amendment was executed beyond the 90-day period following the due date for the estate tax return and was instituted by the co-trustees alone, rather than by a court."

Taxpayer Loses $3 Million Deduction Over Sale That Was “Practically Certain To Occur” - Kelly Phillips Erb, Forbes:

His advisers told him he needed to make the gift before the sale to avoid any "anticipatory assignment of income." This is a doctrine that’s been around for awhile and was famously memorialized in Lucas v. Earl, 281 U.S. 111 (1930). It stands for the idea that income is taxed to the person who has the right to receive it. I can’t simply sign my paycheck away to someone else, for example, and claim that the tax doesn’t apply to me.

In this case, Scott was reluctant to "pull the trigger" and wanted to delay the donation as much as possible.

The result was unfavorable.

Relief for Expats Owning Foreign Corporations in US Tax Court - 1040Abroad. "Failure to file certain international information returns, such as Forms 5471 and 5472, may impact the limitations period on a taxpayer’s return, and this case does not change that rule. U.S. expats who own businesses in foreign countries should be aware of the requirements for filing Form 5471 and consult with a tax professional to ensure compliance with all applicable tax laws."

Why is April 15th the extension filing deadline? - Brett Hersh, Overnight Accountant. "But, if we accept the premise that Congress cared about voters and changed the due date from March to April 15th due to increased complexity, why has the date remained the same for 60+ years?"

NIL Madness: Should College Sports Revenue Be Tax Exempt? - Robert Goulder and Mitchell Franklin, Tax Notes Opinions. "I don't have scientific data to support this, but I think you can make a reasonable assumption which one of the two reasons or why students are transferring schools, and the academic classroom experience probably in most cases is not the primary reason."

Transforming the Internal Revenue Service - Joseph Bishop-Henchman, Cato Institute. "The IRS commissioner, Treasury secretary, and lawmakers should set a 2023 filing season goal to have all IRS forms available for digital filing. For those who still file by paper, all tax returns should have barcodes when they are printed or else be compatible with optical scan technology when they are processed. The IRS should utilize existing technology, not wait for future technologies to be invented. The IRS now has the financial resources to cover purchase costs needed to digitize tax filing and processing, and this change would likely save the agency more than $1 billion in labor costs over the next decade."

Cotton Candy and $864 in Sex Toys: Influencers Go Big on Tax Write-Offs - Sarah Needleman, Wall Street Journal. "Outside Las Vegas, 43-year-old YouTube creator Thomas Jackson, who makes videos about cars and various antics, once live-streamed himself lobbing sex toys at a building." Naturally, he claimed a write off. "'Nobody asked me any questions about it,' he says."

If you make money doing silly things on the internet, silly things may be ordinary and necessary expenses. But just because you haven't been audited doesn't mean the deductions necessarily work. If you want to deduct clothes or household items, forget it.

Four Tax Preparers Enter Guilty Plea For Conspiracy - Rebekah Barton, TaxBuzz. "Whether your taxes for the 2022 tax year have already been filed or you filed for an extension, it is crucial to choose a reputable tax professional to work with you."

Albemarle man pleads guilty to filing false tax return - IRS (Defendant name omitted). "The investigation revealed that during the years 2017-2021, Defendant routinely directed... customers to make checks payable to him, instead of to the business. Defendant would, in turn, cash those checks or deposit the checks into a personal bank account instead of the Defendant Fence business checking account. As part of his scheme, Defendant would conceal those checks from his tax return preparer, which resulted in a tax loss of over $200,000."

The IRS has had 110 years to figure that one out.

Like every other workday. It's Deskfast Day!

Make a habit of sustained success.