IRS Enforcement Revamp Starts Slowly Despite Getting Bulk of Funds - Doug Sword, Tax Notes ($):

An agencywide overhaul will require a lot of planning, particularly in enforcement for which recruiting top talent, hiring, and training are harder and longer processes, said Jorge E. Castro, a counselor to IRS commissioners from 2010 to 2013.

...

David Kautter, who was acting IRS commissioner and Treasury assistant secretary for tax policy during the Trump administration, agreed that beefing up enforcement muscle is perhaps the toughest task facing the agency.

It's not like you can hire 20 new examiners and have them do the work of the 20-year person who's retiring.

AICPA Calls on IRS to Tweak S Corp Foot-Fault Guidance - Kristen Parillo, Tax Notes:

That would open the door to easier S corporation restoration to taxpayers who accidentally made disproportionated distributions - for example, by failing to true up distributions to offset state withholding on a non-resident shareholder.Section 3.06 addresses S corporation elections that were inadvertently invalidated or terminated solely because of the adoption of one or more nonidentical governing provisions. The misstep happens to many limited liability companies that file S corporation elections without removing partnership tax provisions from their LLC operating agreements (or other governing provisions) that violate the single-class-of-stock rule for S corporation status — that is, they don’t confer identical rights to distribution and liquidation proceeds.

...

The AICPA’s letter recommends that the IRS modify section 3.06(2)(b)(ii) to provide that only disproportionate distributions made under a nonidentical governing provision disqualify a corporation from relief under section 3.06.

Link: AICPA letter.

Beware of Surprises When Fixing Partnership Data on Tax Forms - Todd Laney, Eide Bailly, via Bloomberg. "The Bipartisan Budget Act of 2015 changed the way partnerships and partners handle corrections to partnership related items as of Dec. 31, 2017. If a partnership subject to the BBA corrects a previously filed return, the regime prohibits partnerships from issuing amended Schedules K-1 to their partners. Instead, a partnership must file an administrative adjustment request."

Ford Says Most of Its EVs Will See Tax Credits Halved - Brett Ferguson, Tax Notes ($). "Of Ford’s six electric or plug-in hybrid models, only its F-150 Lightning pickup truck and Lincoln Aviator Grand Touring plug-in hybrid are expected to qualify for the full credit, the company said April 5. The company’s Mustang Mach-E and E-Transit full EVs and Escape plug-in hybrid and Lincoln Corsair Grand Touring are expected to be limited to a $3,750 credit."

Top Tax Mistakes to Avoid If You Make More Than $100,000 in US - Jo Constantz, Bloomberg. "1. Not maxing out retirement accounts. Many high-earning individuals don’t take full advantage of retirement plans, according to Jamie Lima, founder and president of Woodson Wealth Management. Not doing so means missing out on tax-deferred growth and matching contributions from employers, Lima said."

PEO Is Responsible for Filing for Employee Retention Credit - IRS, Via Tax Notes ($). "When an employer uses a PEO to pay its employment taxes and satisfy its employment tax return filing obligations, the PEO is the taxpayer before the IRS. The PEO reports the wages, employment taxes, and credits on behalf of all its employer clients. If there is a refund owed to the PEO after applying the PEO's total credit amount for all clients to the PEO's total aggregate tax liability reported for all clients, the IRS will release the refund directly to the PEO. The IRS uses this process because the PEO deposits, pays, and reports the employment taxes under its own employer identification number (EIN) against which the PEO is claiming the ERC. How the PEO distributes the refund amounts to its clients is a contractual matter between the PEO and its clients."

Link INFO 2023-0001

Related: Benefit from the Employee Retention Credit

IRS Finalizes Dirty Dozen Tax Scams Of 2023 - Kelly Phillips Erb, Forbes. "Taxpayers should be aware of aggressive pitches from scammers who promote large refunds related to the Employee Retention Credit, or ERC. ERC mills made the list following what the IRS calls 'blatant attempts by promoters to con ineligible people to claim the credit.' The IRS specifically highlighted schemes from promoters blasting radio and internet ads touting ERC refunds. These promotions can be based on inaccurate information related to eligibility for and computation of the credit."

Bozo Tax Tip #7: Withhold, but Don’t Remit, Your Employment Taxes! - Russ Fox, Taxable Talk. "The above strategy is likely one of two quick and easy ways to get on the road to ClubFed. The IRS doesn’t like it when trust fund taxes don’t make it to the government. The penalties are substantial. The liability goes to the owners (and check signers) of the business. IRS Criminal Investigation will investigate this. Don’t do this!"

50 IRS TACs open Saturday, April 8, for walk-in tax help - Kay Bell, Don't Mess With Taxes. "These facilities usually are open only on weekdays, and taxpayers must make appointments to receive services. But this weekend, for the third Saturday this year, taxpayers can simply walk into the designated centers between 9 a.m. and 4 p.m. local time for in-person help."

US Property Taxes Rose Twice as Fast Last Year Than in 2021 - Alex Tanzi, Bloomberg. "Even after the gains, single-family-home property taxes remain much lower in the Sun Belt than in the Northeast, according to a report released by real estate data firm Attom on Thursday."

Plan to Avoid Gain on Sale of Company by Donating Shares to Charity Goes Awry - Parker Tax Pro Library. "The Tax Court held that a taxpayer who contributed shares of stock in a closely held corporation to a charitable organization near-contemporaneously with the selling of those shares to a third party realized and recognized gain under the anticipatory assignment of income doctrine. The court also found that the taxpayer was not entitled to a charitable deduction for the donated shares because he failed to attach a qualified appraisal to his tax return."

Ordinary and Necessary Expenses - I tax School (Video). "This presentation includes a high-level discussion of basic principles governing the deductibility of expenses. It also discusses some nuances of deducting interest and tracking these deductions so a small business owner can report them accurately on a tax return."

Expatriation, Form 8854 & Fair Market Valuation of Assets – Which Date is Used? - Virginia La Torre Jeker, US Tax Talk. "The tax regime applies only to so-called 'covered expatriates' (CE)... A CE is subject to the 'exit tax' or 'mark-to-market' (MTM) regime which generally means that all property owned by the CE worldwide is treated as sold for its fair market value on the day before the expatriation date."

Related: Eide Bailly Global Mobility Services.

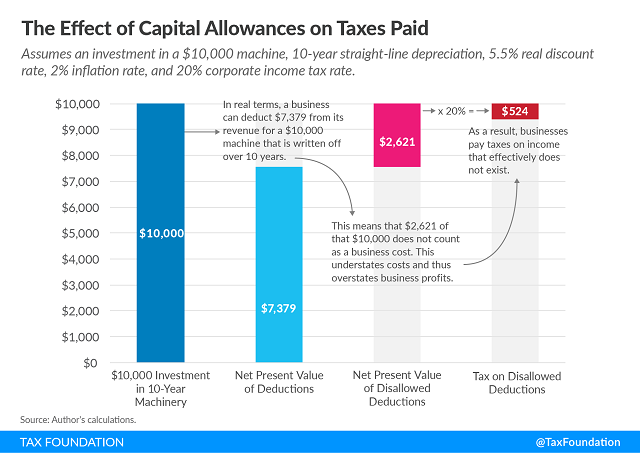

Capital Cost Recovery across the OECD - Cristina Enache, Tax Policy Blog. "Besides pursuing policies of full expensing for capital investments, it is also important to make capital allowance provisions permanent. Permanency implies certainty, which is an essential factor for long-term investment decisions. For instance, the temporary Canadian and U.S. expensing and accelerated depreciation provisions are likely to spur economic growth in the short term. Their long-term effects, however, would be much higher if the changes were made permanent."

Interview: ChatGPT Takes on Tax - David Stewart and Caitlin Mullaney, Tax Notes Opinions. "I was overall very impressed. I felt that it did really well on the overarching policy-related questions. And then when it came to the technical questions, I appreciated that it directed the asker to seek help from an actual expert, which I was kind of nervous about. But I really enjoyed that and I was overall kind of nervous about my job in the future."

‘Pearl’ Cryptocurrency Creator Pleads Guilty to Tax Crimes - Aysha Bagchi, Bloomberg ($). "Amir Bruno Elmaani entered the guilty pleas Wednesday at the US District Court for the Southern District of New York. The federal government alleged Elmaani committed the crimes as part of broader misconduct—including failing to report income he earned by minting new cryptocurrency “Pearl” tokens for his personal use, despite telling investors the number of tokens was fixed."

Crypto Mogul, Accused Of Tax Evasion, Cops To False Return - Theresa Schliep, Law360 Tax Authority ($). "Prices for Pearl tokens tanked when word got out that Elmaani had been creating new tokens despite his statements to the contrary, the information said. He made millions from his cryptocurrency activities, but didn't comply with his obligations to report the income to the IRS, according to the information."

Surprise man sentenced to four years in prison for false claims to the IRS - IRS (Defendant name removed:

Defendant, of Surprise, Arizona, was sentenced last week by United States District Judge Michael T. Liburdi to four years in prison. Defendant was convicted on January 11, 2023, of 17 counts including conspiracy, false claims to the IRS, and transactional money laundering.

In 2018 and 2019, Defendant submitted seven false tax returns to the Internal Revenue Service (IRS), claiming over $3 million in owed refunds. The IRS processed one of these returns that resulted in an unwarranted $600,000 refund to Defendant. The IRS later advised him that the return was fraudulent, and that Defendant needed to return the money. Defendant failed to do so; instead, he purchased two luxury vehicles and a home, among other expenditures.

His co-defendant... pleaded guilty and was sentenced to time served followed by 12 months of supervised release for her role in the offense. Both defendants were ordered to pay almost $600,000 in restitution. They also were ordered to forfeit their interests in a Surprise home, an Audi A7, and a Porsche Panamera.

Not really surprising.

Go ahead and jump. Today is Jump Over Things Day, for those of you who found Walk Around Things Day earlier this week an inadequate challenge.

Make a habit of sustained success.