IRS performance improves through tax season - Roger Russell, Accounting Today:

The IRS continued to improve its filing season performance in March, according to the National Conference of CPA Practitioners.

-The average answer time and level of service have vastly improved to over an 80% level of service.

-Taxpayers are able to respond to notices online and the IRS has been receiving their responses. Online payment plans have been successful with over 11,000 agreements secured in the first month.

-New voice bots are rolling out in Collections and callback features continue to be expanded.

-The IRS has begun scanning and digitizing more forms, including Form 941, and adding returns to Error Resolution, with errors reduced and handled quickly.

Yellen Confirms IRS Spending Plan Will Be Out This Week - Alexander Rifaat, Tax Notes ($):

During an April 4 swearing-in ceremony for new IRS Commissioner Daniel Werfel, Yellen said Treasury will release its plan — which will detail how the agency intends to spend the extra funds it received in the Inflation Reduction Act (IRA, P.L. 117-169) — later in the week of April 3. The plan originally was due in February.

The extra funds are already having an effect on this year’s filing season, Yellen said, noting that the IRS has met its target of hiring 5,000 additional customer service agents, has achieved an 80 to 90 percent level of service in phone assistance, and has “worked through more inventory in the previous 12 months than during any one-year period in history.”

Of course, that was possible only because they piled up more inventory than ever before.

IRS Expected to Plan for Use of Data, Technology in Enforcement - Lauren Loricchio, Tax Notes ($):

In June 2021 testimony before the House Ways and Means Select Revenue Measures and Oversight subcommittees, Nina Olson of the Center for Taxpayer Rights said that data and artificial intelligence can help improve the detection of noncompliance, but that “human intervention must be retained, and these systems must adhere to basic principles of human dignity and privacy.”

Olson, who was the national taxpayer advocate from 2001 through 2019, said there are “lessons to be learned from other countries’ experiments with data use and artificial intelligence systems to identify fraud in welfare and tax credits.” For instance, a debt recovery system in Australia known as “Robodebt” that used an automated data matching technique was scrapped after it wrongfully issued debt notices to welfare recipients.

New IRS leader promises faster, easier tax filing process - Fatima Hussein, Associated Press via The Hill. "While the administration has showcased the boosting employee ranks with 5,000 new workers and investments in new technology, a March Treasury Inspector General for Tax Administration report on the 2022 tax season states that the 'ongoing backlogs of tax returns and other account work continued to challenge the IRS during the 2022 Filing Season.'"

Government Watchdog Finds When It Comes To Answering Phones And Assisting Taxpayers, IRS Still Has Work To Do - Kelly Phillips Erb, Forbes. "The IRS still needs to pick up the phone: As of September 24, 2022, taxpayers made 148.9 million total attempts and 118.6 million net attempts to contact the IRS by calling the various customer service toll-free telephone assistance lines. The IRS reports that 29 million calls were answered with automation, and telephone assistors answered 8.8 million calls. That works out to a 14% level of service—down from 2021. The average speed of answer was 31 minutes, longer than in 2020."

IRS Provides Clarity on Energy Communities for Credit Increases - Mary Katherine Browne, Tax Notes ($):

The Inflation Reduction Act (P.L. 117-169) increases credit amounts if specific requirements pertaining to energy communities are met. Under section 45(b)(11), developers that locate projects in historical energy communities are entitled to a 10 percent increase for the production tax credit and the investment tax credit, provided that prevailing wage and apprenticeship requirements are met for the investment credit.

Energy communities under the statute are brownfield sites, metropolitan areas or metropolitan statistical areas with high fossil fuel industry employment or tax revenue but higher-than-average unemployment rates, and census tracts near closed coal mines or coal-fired power plants.

Biden Administration assists Tribal Nations claim IRA Benefits - Jay Heflin, Eide Bailly. "Tribes that do not pay income taxes can take advantage of these credit through Direct Pay. This means that Tribal communities can benefit from income tax credits even if they do not owe federal income taxes."

Exempt Orgs Get 3 Months To Comply With E-Filing Change - Emlyn Cameron, Law360 Tax Authority ($). "In Revenue Procedure 2023-12, the IRS said it has changed the rules for submitting Form 8940, with electronic submission becoming the exclusive method effective Tuesday. However, the agency said it will accept paper forms postmarked through July 3, granting those submitting such forms a 90-day transition window."

Pro-Tax Progressive Wins Chicago Mayor Race After Long-Shot Bid - Isis Almeida, Bloomberg:

Johnson plans a $4 per employee tax on large companies that have at least half of their operation in Chicago. He’s also proposing a $1 or $2 tax per securities-trading contract, a plan that would likely need state approval and is fiercely opposed by the city’s exchange giants CME Group and Cboe.

He also wants to increase revenue by raising taxes on hotels, implementing a levy on airlines that pollute the city’s air and increasing fees on the sale of high-end properties. He pledged, however, to freeze property taxes, which are largely used to plug the city’s pension hole but have been pushing Chicagoans out of the city.

That would be an excellent way to get the commodities industry to move to the suburbs.

Kentucky Enacts Barrel Tax Phaseout, Corrects SALT Cap Workaround - Matthew Pertz, Tax Notes ($). "The bill also makes corrections to Kentucky’s passthrough entity (PTE) tax enacted under H.B. 360 as a workaround to the federal cap on the state and local tax deduction. As enacted, the credit is worth 100 percent of the tax paid by a PTE on behalf of its owners. H.B. 5 clarifies that the election must be made annually and that the credit is refundable."

Tax reminders from Trump's NY criminal charges - Kay Bell, Don't Mess With Taxes. "As far as business records and taxes, there's Time to track your 2023 tax deductible business miles, The importance of good, and separate, business records, and How ordinary & necessary expenses become tax deductions. "Suffering sticker shock from huge property tax reassessments? Here's how you can protest - Lee Rood, Des Moines Register. "In Polk County, at the center of the Midwest's fast-growing major metro, homeowners are receiving jaw-dropping increases, from $32,700 on the east side to $60,000 in Windsor Heights, $100,000 in Beaverdale and even more in Salisbury Oaks."

Bozo Tax Tip #8: Use a Foreign Trust to Avoid Taxes! - Russ Fox, Taxable Talk. "But I’m smarter than the IRS, and they’ll never catch my trust set up in Luxembourg, Liechtenstein, or the Isle of Man. Well, you will spend thousands to set up your trust, and if the IRS does catch on–and in these days where governments are exchanging tax information, this can (and does) happen–your foreign trust will have served only one purpose: It will have enriched the promoters who set it up."

Venmo, The $600 Threshold, And You: What’s An (Honest) Taxpayer To Do? - Renu Zaretsky, TaxVox. "As of 2021, about 16 percent of Americans had earned money through an online gig work platform. While contract labor is not new, the growth of online and app-based gig work has caused new tax headaches for everyone from the IRS to people who use third-party payment platforms like Venmo and PayPal, Uber drivers, and Airbnb hosts."

IRS Provides Guidance on Treatment of Nonfungible Tokens as Collectibles - Parker Tax Pro Library. "The notice also describes how the IRS intends to determine whether an NFT constitutes a collectible under Code Sec. 408(m).."

Third Circuit Upholds Tax Court In Large Dollar Horse Hobby Loss Opinion - Peter Reilly, Forbes. "In approving the IRS denial of the over $3,000.000 in losses on Bluestone Farms LLC (85% owned by Skolnick), Judge Lauber indicated that he had weighed the sixth of nine regulatory factors - history of income and losses - very heavily in making his determination that Bluestone was not an activity carried on with an intent to make a profit. From 1998 to 2013, losses had totaled over $11,000,000."

Gwyneth Paltrow’s $1 Ski Trial Win Has A Strange Tax Twist - Robert Wood, Forbes. "That means if Paltrow is awarded $1 plus say $75,000 in legal fees (just to pick a low number), Paltrow has $75,001 in income. But can’t she just turn around and deduct the $75,000 in fees on her taxes? After all, the money is going to the lawyers. Yet that does not necessarily mean that Paltrow gets a tax deduction. It turns out the tax treatment of legal fees is strangely complex, and many plaintiffs end up paying legal fees they cannot deduct."

Owners of Canadian vacation property face May 1 tax deadline - Eide Bailly Tax News & Views. "Canada has a new 1% annual Underused Housing Tax on the ownership of vacant or underused housing in Canada."

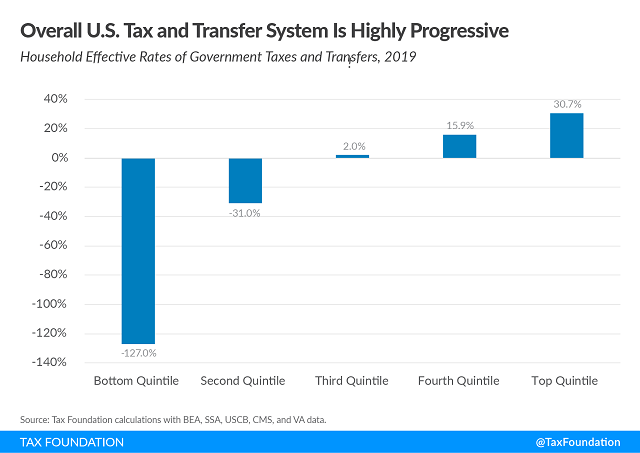

America’s Progressive Tax and Transfer System: Federal, State, and Local Tax and Transfer Distributions - Timothy Vermeer, Alex Durante, Erica York, and Jared Walczak, Tax Policy Blog:

The top quintile funded 90.1 percent, or $1.6 trillion, of all government transfers in 2019. For each dollar of taxes paid, the top quintile received $0.11 in gross government transfers.

Government transfers account for 59 percent of the bottom quintile’s comprehensive income. For each dollar of taxes paid by the bottom quintile, they received $6.17 in gross government transfers.

Analysis: A Surprise Accusation Bolsters a Risky Case Against Trump - Charlie Savage, New York Times:

“Pundits have been speculating that Trump would be charged with lying about the hush money payments to illegally affect an election, and that theory rests on controversial legal issues and could be hard to prove,” said Rebecca Roiphe, a New York Law School professor and former state prosecutor.

“It turns out the indictment also includes a claim that Trump falsified records to commit a state tax crime,” she continued. “That’s a much simpler charge that avoids the potential pitfalls.”

Tax Court Rejects Rental Real Estate Side Hustle Loss Deduction - Caitlin Mullaney, Tax Notes ($). "The Tax Court rejected a couple’s argument that they were entitled to a rental real estate loss deduction of over $62,000 for their side hustle rental real estate business."

This case highlights the difficulties higher-income taxpayers face when trying to deduct real estate rental losses. The "passive loss" rules enacted in 1986 to shut down that era's tax shelters treat rental real estate as automatically "passive." That means they are only deductible against other passive income, or upon a taxable sale.

There are two narrow exclusions. The first, enacted as part of the 1986 tax law, allows "active" real estate owners to deduct up to $25,000 in real estate rental losses - but the allowance phases out starting at adjusted gross income of $100,000, and phases out completely at $150,000 AGI.

The second, enacted in 1993, applies only to "taxpayers in real property business." To qualify, a taxpayer has to meet two stiff tests:

- that taxpayer has to work more than 750 hours of services during the taxable year in real property trades or businesses in which the taxpayer materially participates, and

-more than one-half of the personal services performed in trades or businesses by the taxpayer during such taxable year are performed in real property trades or businesses in which the taxpayer materially participates.

The first prong alone is a steep climb, but there are taxpayers who have full-time jobs and can get to 750 hours on their rentals. It's the second prong - "more than one-half of the personal services performed" in the rental side hustle - that's the killer. And so it is in this case. From the opinion by Tax Court Special Trial Judge Leyden:

Both petitioners were full-time employees. However, neither petitioner has provided the number of hours he or she performed as an employee. Assuming without finding that petitioners also performed personal services with respect to their rental real estate activities, petitioners cannot prove that more than one-half of either petitioner's total personal services performed in trades and businesses were performed on their rental real estate activities during that year. See I.R.C. §469(c)(7)(B). Consequently, petitioners have failed to sustain their burden to prove either petitioner meets the description of a real estate professional under section 469(c)(7)(B).

IRS wins.

The moral? Unless you have either a real estate main job or a very non-demanding one, it's nearly impossible to be "non-passive" in rental real estate.

Chicago style. Whether or not their favored candidate won the election yesterday, all Chicagoans can celebrate National Deep Dish Pizza Day today!

Make a habit of sustained success.