No Basis Bump for Grantor Trust Assets, IRS Rules - Kristen Parillo, Tax Notes ($):

The IRS has confirmed in new guidance that property transferred to an irrevocable grantor trust before death doesn’t get a basis step-up if that property isn’t included in the decedent’s gross estate.

...

Some tax professionals and scholars have argued that assets in an irrevocable grantor trust qualify for a step-up in basis when the grantor dies, even if the assets aren’t in the decedent’s gross estate. Under this theory, the termination of an irrevocable trust at the death of the grantor should be treated as a bequest or devise under section 1014(b)(1). The IRS, lawmakers, and many in the tax community position have sharply criticized that position as an abuse of section 1014(a)(1).

IRS: No inclusion in estate means no step of basis in assets held in irrevocable grantor trust - Eide Bailly Tax News & Views:

The new ruling does not come as a surprise to Ava Archibald of Eide Bailly's Wealth Transition Services practice:

"Nothing really surprising here as that is how the majority of estate planners in the country have treated those transactions. There are only a few more aggressive planners that have taken the opinion that you are able to step up assets at death that were transferred during life by a completed gift to an irrevocable grantor trust."

Phishing is a term given to emails or text messages designed to get users to provide personal information, either directly or by clicking on a link or attachment. Spearphishing is a tailored phishing attempt to a specific organization or business.

The IRS is warning tax professionals about spearphishing because there is greater potential for harm if the tax preparer has a data breach. A successful spearphishing attack can ultimately steal client data and the tax preparer's identity, allowing the thief to file fraudulent returns.

...

The IRS wants to warn businesses about another specific spearphishing scam that targets employees in payroll or accounting departments. These employees might get an email that looks like it comes from an official source requesting W-2s for all employees. The payroll department might accidentally reply with these important documents, which would provide scammers with W-2 data on employees that can be used to commit fraud.

The IRS recommends using a two-person review process when receiving these types of requests for W-2s. The IRS also recommends any requests for payroll be submitted through an official process, like the employer's Human Resources portal.

Be careful, especially with texts and e-mails.

Manchin Threatens to Fight Treasury Over EV Tax Credit Rules - Gabrielle Coppola and Keith Laing, Bloomberg:

Since preliminary guidance was released in December, lobbyists have been seeking to tweak the rules around how much content carmakers and their suppliers will need to source domestically. The broader the rules, the more they’d be able to rely on foreign supply chains.

...

Specifically, the law says vehicles can qualify for the full $7,500 tax credit if at least half of their battery components are made in North America, and if 40% of the value of raw materials in the battery are extracted from or processed domestically or in countries with US free-trade agreements.

Punchbowl News has more:

Manchin sought to bolster U.S. EV manufacturers and supply chains by limiting the IRA’s full tax credits to North American companies. But with China controlling much of the world’s EV production – including batteries and the materials used to build them — Manchin is worried that the Biden administration will fail to use the Treasury guidance as leverage to force more EV production to the United States.

Yet carmakers fear that EV sales will suffer if the Treasury Department sharply limits who gets the tax credits, even if that means Chinese companies benefit. And the Biden administration wants emission reductions from wider EV use. There’s also grumbling that Manchin’s efforts in drafting this portion of the IRA language was flawed.

Mississippi Enacts Changes to SALT Cap Workaround Law - Matthew Pertz, Tax Notes ($):

Mississippi Gov. Tate Reeves (R) has approved legislation aimed at correcting oversights in the state’s passthrough entity (PTE) workaround to the federal cap on the state and local tax deduction.

...

One concern with the original PTE election law is the order of operations for applying credits. As written, it could be interpreted that the owner-level credit for taxes paid as an entity would be calculated on the amount of taxes paid after entity-level credits, essentially nullifying tax perks earned by the business. H.B. 1668 clarifies that entity owners will receive the full benefit of electing to be taxed as a PTE.

How Many Calls Has the IRS Answered? It Depends - Lauren Loricchio, Tax Notes ($):

Treasury and IRS officials have reported that the IRS has met — and at points even exceeded — that lofty goal. Treasury spokeswoman Ashley Schapitl told Tax Notes March 21 that the agency’s LOS was 86 percent for the filing season at that point.

But that measurement was called into question during a March 22 Senate Appropriations Committee hearing when Sen. Susan M. Collins, R-Maine, challenged Yellen’s depiction of improved customer service on IRS phone lines, pointing to information she said her office had received from the Treasury Inspector General for Tax Administration that said TIGTA calculated that the IRS had answered only 52 percent of calls this filing season through March 4.

Five last-minute tax tips before the April 18 deadline - Michelle Singletary, Washington Post: "File your return even if you can’t pay to avoid the penalty for failing to file. It will save you money. There is a failure-to-file penalty, which is 5 percent of the unpaid taxes for each month or part of a month that your tax return is late. Ordinarily, the penalty won’t exceed 25 percent of your unpaid taxes."

6 family-friendly tax credits - Kay Bell, Don't Mess With Taxes. "Tax credits reduce your tax liability dollar-for-dollar."

IRS Warns On W-2 Scams Making The Rounds On Social Media - Kelly Phillips Erb, Forbes. "Scam artists encourage taxpayers to make up numbers showing large amounts income and related withholding. Then, the scammers suggest, simply electronically file a bogus tax return to snag a large refund due to the amount of fake withholding."

Mississippi Counties Impacted by Tornadoes Have Until July 31st to File - Russ Fox, Taxable Talk. "The IRS announced this morning that four Mississippi counties impacted by tornadoes have until July 31st to file. The extension, for Carroll, Humphreys, Monroe, and Sharkey counties, covers all tax forms and estimated tax payments due between now and July 30th for both business and individual returns. I would expect the Mississippi Department of Revenue to similarly extend their deadlines for impacted taxpayers."

Woman Sentenced to Federal Prison For Preparing False Tax Returns For Clients - Rebekah Barton, Tax Buzz. "Between January 2015 and a known date of June 2018, White prepared and submitted numerous IRS Form 1040 returns with fraudulent information. For example, she routinely filled out false Schedule C documents, citing profits and losses from fictitious businesses."

Court OKs IRS Bid For Bank Docs Of Kan. Senator's Church - Theresa Schliep, Law360 Tax Authority ($):

God's Storehouse — founded by Kansas state Sen. Rick Kloos, R-Berryton, and Pennie Kloos — failed to show that the IRS wasn't acting in good faith when it issued the summons, while the IRS has met its initial burden to prove that it pursued the summons in good faith, Judge Crabtree said.

...

The IRS is probing the tax-exempt status of God's Storehouse, which comprises a thrift store and coffee shop. Kloos founded the organization in 2009 with his wife, Pennie, and opted to self-declare it as a church rather than file a tax-exempt application, according to the order.

IRS agent Kesroy Henry had alerted God's Storehouse that he was concerned the organization was running a thrift store and not a church, that the coffee shop might owe unrelated business income tax and that employment taxes might be owed on wages paid to Rick Kloos, who worked as a pastor at God's Storehouse, according to the order.

Owner of Covina employment staffing company sentenced to 2 years in federal prison for not paying over payroll taxes to IRS - IRS (Defendant name omitted):

From March 2016 to March 2020, Defendant operated B&S Staffing, a Covina-based staffing service business. From mid-2017 until the end of 2019, B&S accrued large unpaid employment tax liabilities, failed to make timely employment tax deposits, and repeatedly failed to timely file quarterly employment tax returns with the IRS.

...

Defendant used B&S funds for the down payment and monthly mortgage payments on his purchase of a home, but kept the property titled in the name of another person to conceal Defendant's ownership of the property. Defendant also directed payments from the corporate bank accounts of B&S to pay for personal expenses, including a portion of his daughter's college tuition, and funding for Defendant's other business interests, including a failed construction business and a failed restaurant.

Bad strategy. After two years in prison, the defendant can get to work on paying the "approximately $2,791,783 in unpaid employment taxes" he ran up.

Tax Court Doesn’t Buy Salesman’s Arguments in Civil Fraud Case - Mary Katherine Browne, Tax Notes ($). "The Tax Court dismissed a real estate salesman’s assertion that an IRS bank deposit analysis was excessive in estimating that he underreported his income by millions of dollars."

The opinion is a cautionary tale in poor tax recordkeeping and worse management of an IRS exam. From the Tax Notes story (I omit the taxpayer's name):

The IRS began examining Taxpayer’s returns in 2008. Over the course of the examination, he was uncooperative and adversarial. He changed his phone number without informing the government, didn’t provide necessary documentation, and handed over documents the IRS suspected were false. His wife wasn’t involved in the examination process.

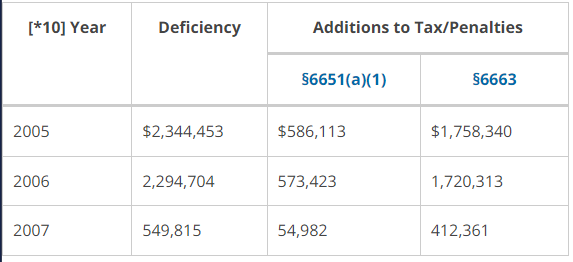

The IRS performed a bank deposit analysis and determined that Taxpayer had severely underreported his income. It concluded that Taxpayer had taxable income of $6.7 million, $6.6 million, and $1.6 million for tax years 2005, 2006, and 2007, respectively.

Tax Court Judge Buch explains how an IRS bank deposit analysis works:

The bank deposits method assumes that all money deposited into a taxpayer's account is taxable income unless the taxpayer can show that the deposits are not taxable or were previously reported. However, the Commissioner must account for any nontaxable source or deductible expense of which he has knowledge.

The examination results were unfavorable:

The "Section 6663 penalty" is the IRS civil fraud penalty of 75% of the underpayment, which is universally considered a bad thing.

Bottom line, from Judge Buch:

Mr. Taxpayer failed to prove any error in any of the Commissioner's determinations beyond the concessions already made by the Commissioner. The Commissioner proved by clear and convincing evidence that those underpayments were attributable to fraud. Ms. Taxpayer is entitled to innocent spouse relief under section 6015 for 2007. Accordingly, Mr. Taxpayer is solely liable for an income tax deficiency, a section 6651(a)(1) addition to tax, and a section 6663 penalty for each year in issue.

The Moral? Keep good records, and don't expect a good result if the IRS rebuilds your taxable income from scratch.

It's Opening Day for those who observe. If baseball isn't your thing, well, it's also National Pencil Day!

Make a habit of sustained success.