Superfund Taxes Get Supersized Guidance Package - Mary Katherine Browne, Tax Notes ($):

On March 27 the IRS released long-awaited proposed regulations (REG-105954-22) on the excise taxes imposed on chemicals and hazardous substances. The taxes were resurrected after a 26-year slumber by the Infrastructure Investment and Jobs Act and went into effect in July 2022.

...

The proposed regs specify that the tax in section 4661 attaches during the first sale or use of a taxable chemical by a manufacturer, producer, or importer. In the case of transactions involving a foreign manufacturer, the tax doesn’t attach to the foreign manufacturer’s sale of a taxable chemical to an importer, but to the importer's first sale or use of the chemical in question.

IRS Superfund Rules Seek Input On How To Weigh Chemicals - Kat Lucero, Law360 Tax Authority ($):

The levy, which took effect in July, applies at a specified rate per ton of chemicals sold or used that the federal government deems hazardous under Internal Revenue Code Section 4661. The rate ranges from 44 cents for potassium hydroxide to $9.74 for acetylene, and also applies to imported substances that contain the taxable chemicals.

The IRS proposed rules asked for alternative methods to weigh the chemicals, saying they should be specific and not falsely reduce the tax base.

IRS Superfund Rules Clarify Taxation of Certain Chemicals - Lauren Vella and Erin Slowey, Bloomberg. "The new regulations from the IRS come after the agency released its FAQ and list of taxable rates for substances last June, leaving tax professionals with outstanding questions on definitions, exemptions, and calculations."

A major red flag or bad sign is when the tax preparer is unwilling to sign the dotted line. Avoid these "ghost" preparers, who will prepare a tax return but refuse to sign or include their IRS Preparer Tax Identification Number (PTIN) as required by law.

Not signing the return could mean the preparer may be looking to make a quick profit by promising a big refund or charging fees based on the size of the refund. This leaves the taxpayer vulnerable and on the hook for any misinformation on the return. Taxpayers should never sign a blank or incomplete return.

IRS Watchdog Urges Improvements in Reporting Tax Gap Estimates - Lauren Loricchio, Tax Notes ($):

The report explains that the gross tax gap is made up of three categories: the underreporting tax gap, the underpayment gap, and the nonfiling gap.

The underreporting tax gap, which accounts for most of the gross tax gap, doesn’t include excise taxes or the income taxes of estates and trusts. It also doesn’t account for some corporate income tax filers; unrelated business income tax from the Form 990-T; individual income tax filers who are considered “international” based on their filing addresses or attached forms and schedules; or employment taxes of household and agricultural employers, according to the report.

Watchdog Urges IRS to Make Improvements to Tax Gap Estimates - Naomi Jagoda, Bloomberg ($): "The IRS’s most recent tax gap estimates, released last October, found an average annual gross tax gap of $496 billion from 2014 to 2016, and also projected an average annual gross tax gap of $540 billion from 2017 through 2019. Members of Congress have expressed keen interest in tax-gap estimates, and the Biden administration is aiming to use some of the $80 billion the IRS received in the tax-and-climate law to reduce the gap."

Link: TIGTA report.

White House’s EV tax credit implementation in the spotlight - Laura Weiss, Roll Call:

The article cites Senator Joe Manchin as saying the standards aren't stringent enough.Sen. Debbie Stabenow, a Michigan Democrat whose constituents include major U.S. automakers, said Thursday that the Biden administration is doing the right thing by moving ahead with targeted trade deals for mineral sourcing. She added that it would be difficult for the agreements to go through Congress.

Even with the administration's efforts, Stabenow predicted the electric vehicle credits won't be very useful in the coming years due to the stringency of sourcing mandates.

"Once [Treasury's guidance] comes out, we will see any use of the credit in the next couple of years severely reduced," she said. "I'm not sure anyone would qualify for the credit."

GOP ups the pressure on global tax deal - Bernie Becker, Politico. "Ten House GOP tax writers floated the idea on Friday of erasing U.S. funding for the Organization for Economic Cooperation and Development, the Paris-based group that helped develop the global tax deal."

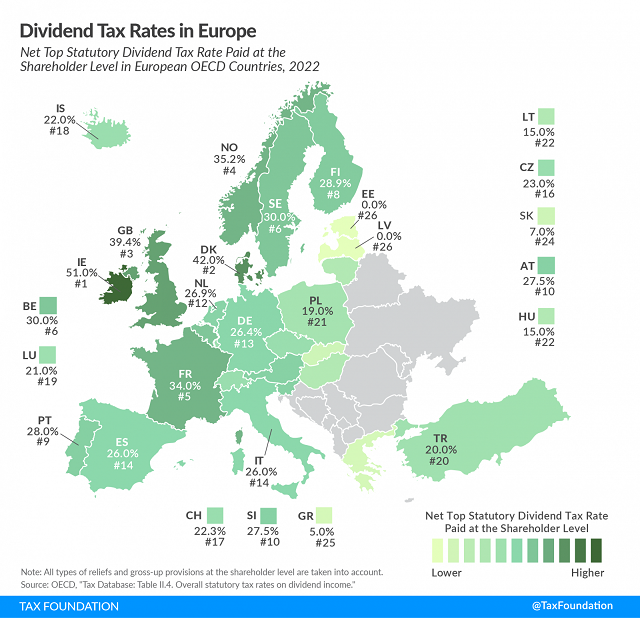

Dividend Tax Rates in Europe - Cristina Enache, Tax Policy Blog:

Ireland has the highest top dividend tax rate among European OECD countries at 51 percent. Denmark and the United Kingdom follow, at 42 percent and 39.4 percent, respectively.

Estonia and Latvia are the only European countries covered that do not levy a tax on dividend income. This is due to their cash-flow-based corporate tax system. Instead of levying a dividend tax, Estonia and Latvia impose a corporate income tax of 20 percent when a business distributes its profits to shareholders.

The current top dividend rate in the U.S., excluding state taxes, is 23.8%. The Biden budget proposal would increase this to 44.8%.

RMD age increase and wrong notices create tax confusion for some retirement account owners - Kay Bell, Don't Mess With Taxes:

If you turned 72 last year and didn't take your first required minimum distribution (RMD) by Dec. 31, 2022, you have a few days to take the mandatory withdrawal.

April 1 is your deadline to take out the specified amount from your tax-deferred retirement savings account(s).

This year, however, is the last one for the age 72 RMD trigger.

IRS Gives New York Storm Victims Extension To May 15, Tax Relief - Robert Wood, Forbes. "The tax relief postpones various tax filing and payment deadlines that occurred starting on Dec. 23, 2022. As a result, affected individuals and businesses will have until May 15, 2023, to file returns and pay any taxes that were originally due during this period."

The Necessity & Benefit of Filing a Tax Return Extension - Brett Hersh, Overnight Accountant. "Elimination of the Late Filing Penalty."

Extension Requests and Other Filings Didn't Constitute an Informal Refund Claim - Parker Tax Pro Library. "A district court held that it lacked jurisdiction over a couple's action for a refund because they failed to file a timely formal refund claim and neither a letter to the IRS from their CPA nor their Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, qualified as a valid informal refund claim."

Activision Blizzard CEO Bobby Kotick's Taxable Income For 2001 Gets A $35 Million Boost - Peter Reilly, Forbes. "A day may come when the fallout from the tax shelter scandal at the turn of millennium is no more. But it is not this day."

Seeking a Discharge of the Federal Tax Lien - Keith Fogg, Procedurally Taxing. "The factual background for the request for relief does not arise with great frequency but comes up often enough and always makes me feel bad for the spouse stuck with the tax liability of their ex-spouse because ex-spouse’s unpaid taxes have caused a lien to arise and attach to property now owned by the non-liable spouse who thought they had extricated themselves from their former partner’s financial shortcomings."

Nice Try, Clothing Donation Category. The tax law allows taxpayers to deduct the fair market value of many non-cash contributions. Taxpayers commonly take small deductions for donations of used clothing and other household items.

The tax law requires property donations in excess of $5,000 to have a qualified appraisal, or the deduction becomes zero. As qualified appraisals for household junk are scarce on the round, most taxpayers round down their claims to meet the $5,000.

A creative taxpayer took another approach that came up short in Tax Court yesterday. The taxpayer claimed $13,852 in donations to goodwill and $11,594 in donations to the Salvation Army - separated accross 173 separate trips. The taxpayer deducted the full amount on the basis that each donation was well under the $5,000 appraisal trigger. Tax Court Judge Ashford explains why that doesn't work (my emphasis):

Petitioner, however, misapprehends the applicable law... Pursuant to section 170(f)(11)(F) and Treasury Regulation § 1.170A-13(c)(1)(i), all the clothing donations must be aggregated. The aggregate of these donations is $25,446 (i.e., $13,852 (the total amount of the clothing donations to Goodwill) plus $11,594 (the total amount of the clothing donations to the Salvation Army)), which is over five times the $5,000 threshold and thus necessitates that they be appraised. Since there was no such appraisal, petitioner is not entitled to the deductions claimed on his 2017 Schedule A for noncash charitable gifts of clothing to Goodwill and the Salvation Army.

The Moral: If you claim a $5,000+ donation for household items without a qualified appraisal, your deduction becomes zero - no matter how many drop-offs you make.

Disgorgement Isn’t Off the Table in Promoter Suit, Court Says - Kristen Parillo, Tax Notes ($). "A business owner accused of promoting an abusive scheme involving charitable remainder annuity trusts (CRATs) failed to convince a federal judge that the tax code doesn’t authorize courts to order disgorgement in injunction cases."

The case involves CRAT schemes similar to one we covered in September (bottom of post). In that case, an Indiana farmer hired a CRAT promoter "after seeing an advertisement in a farming magazine." The farmer donated his crops to a newly formed trust, which sold them without reporting any gain, and which distributed proceeds as an annuity to the farmer without reporting any tax on the crop sales. The Tax Court held that there was no deductible contribution to the "charitable" trust, that the grain sales were sales of zero-basis crops, and that the annuity distributions were taxable.

The government's complaint seeking an injunction against the promoter includes an ad placed by the CRAT promoter in High Plains/Midwest AG Journal, reproduced here without the promoter's contact information:

As the Indiana farmer learned, this stuff doesn't work. While CRATs are legitimate estate and gift planning tools, they are not a tax miracle. As we said in September, "There is no tax fairy waiting in the pages of a farming magazine to wave a wand to wipe out your taxes. Get an independent opinion before you try a tax scheme that magically makes your income disappear."

Mixed messages. Today is American Diabetes Alert Day. By unfortunate coincidence, it is also National Black Forest Cake Day.

Make a habit of sustained success.