While many eligible employers claimed and have already received the ERC, some third parties continue to widely advertise their services targeting taxpayers who may not be eligible for the ERC. Unfortunately, these advertisements, along with the increased prevalence of websites touting how easy it is to qualify for the ERC, lend an air of legitimacy to abusive claims for refund.

Tax professionals have reported receiving undue pressure from clients to participate and claim the ERC, even when the tax professional believes the client is not entitled to the credit. The IRS encourages the tax professional community to continue to advise clients not to file ERC claims when the tax professional believes they do not qualify.

There is no penalty exemption available for "my friend's tax guy said it was fine."

Third party promoters of the ERC often don't accurately explain eligibility for and computation of the credit. They may make broad arguments suggesting that all employers are eligible without evaluating an employer's individual circumstances. For example, only recovery startup businesses are eligible for the ERC in the fourth quarter of 2021, but these third-party promoters fail to explain this limitation. In addition, some third parties do not inform employers that they cannot claim the ERC on wages that were reported as payroll costs in obtaining Paycheck Protection Program loan forgiveness.

Details, details. But sometimes the results are worse than IRS penalties and interest:

Additionally, some of these advertisements exist solely to collect the taxpayer's personally identifiable information in exchange for false promises. The scammers then use the information to conduct identity theft.

Be careful out there.

IRS Amps Up Enforcement on Employee Retention Credit Claims - Lauren Loricchio, Tax Notes ($). "The ERC schemes are being promoted in internet and radio advertisements by third parties — sometimes referred to as ERC mills — that charge upfront fees and lure taxpayers who aren’t really eligible for the credit with promises of big refunds."

Upcoming R&D Guidance to Address Costs, IRS Official Says - Erin Slowey, Bloomberg ($):

The 2017 tax law required companies starting in 2022 to amortize their R&D costs over a five-year period. The IRS and Treasury released initial guidance in December detailing how companies can comply with the expense change.

Upcoming guidance “is really focused on what does an endpoint look like, what types of costs are we talking about,” said Scott Vance, associate chief counsel for the IRS’s Income Tax and Accounting Division. He was speaking at a Tax Executives Institute conference in Washington.

The IRS is “actively” working on guidance, Vance said, adding, "I would love for this to be out before year-end, again not guaranteeing that, just from a personal standpoint.”

"I would love for this to be out before year-end..." This law was enacted more than five years ago. People are getting shocked and battered by K-1s reporting 2022 taxable income way in excess of cash income right now as a result - and you "would love" to give them some guidance by the end of this year.

I would love that too, brother.

Related: The Impact of Changes to Section 174

How’s the support looking on research? - Bernie Becker, Politico. "But those efforts have become much more complicated because the push to reverse the research amortization requirement has become wrapped up with the debate over whether to expand the Child Tax Credit."

House Tax Chair Wants Child Credit With Work Provision - Asha Glover, Law360 Tax Authority ($):

Senate Republicans also have floated ideas about how to permanently expand the child tax credit. During a budget hearing last week, Sen. Steve Daines, R-Mont., suggested that lawmakers look toward eliminating the state and local tax deduction in exchange for making the ARPA's expanded child tax credit permanent.

It is unclear whether the Biden administration would support eliminating the deduction in exchange for a permanent $3,600 child tax credit. U.S. Treasury Secretary Janet Yellen told senators the administration will be open to working with lawmakers on how to make the provision permanent, but said those discussions won't likely happen until 2025.

The Impact of the Estate of Cecil Tax Court Ruling on Tax Affecting for Valuation Purposes - Travis Lance and Devin Hecht, Eide Bailly. "Taxpayers’ failure to adequately disclose gifts on gift tax returns allows the IRS the opportunity to re-value gifts (potentially many years after the fact). Once again, valuation experts and tax professionals can aid taxpayers with preparing valuation reports and advise taxpayers on the adequate disclosure requirements."

New Mexico Legislature Approves Omnibus Tax Bill - Paul Jones, Tax Notes ($):

New Mexico lawmakers have approved a tax omnibus bill that would provide one-time tax rebates, phase in a reduction to the gross receipts tax rate, reduce income taxes on lower earners, and transition the state to a single-sales-factor apportionment regime.

...

The bill would reduce taxes on lower levels of income by altering rates and adjusting brackets. For example, the rate for a single filer's income up to $5,500 would be reduced from 1.7 percent to 1.5 percent. The brackets for the remaining tax rates would be adjusted so that instead of paying 3.2 percent on income between $5,500 and $11,000, a single filer would pay that rate on income between $5,500 and $16,500; instead of paying 4.7 percent on income between $11,000 and $16,000, the filer will pay 4.3 percent on income between $16,500 and $33,500; and instead of paying 4.9 percent on income between $16,000 and $210,000, the filer would pay only 4.7 percent on income between $33,500 and $66,500, among other changes to the rates.

Major New Mexico Tax Package Cuts Too Deeply, Warns Governor - Laura Mahoney, Bloomberg ($):

Luján Grisham said the annual cost represents one-tenth of New Mexico’s annual budget, setting up the possibility of future, painful cuts because the state’s reliance on the oil industry makes its revenue volatile.

“Put simply: this tax package cuts too deep, too quickly,” the governor said in a Thursday news release before the final bill reached her desk. “I’m with the Legislature: let’s deliver bold, meaningful tax reform—but let’s also protect our future by making responsible choices today.”

Minn. Tax Court Nixes Tax Break After Sale Of Inherited Parcel - Sanjay Talwani, Law360 Tax Authority ($):

The estate of a deceased Minnesota man owes additional state estate tax on inherited property that was sold outside an heir's family because the sale disqualified the parcel from an exemption to the tax, the state tax court said.

In a judgment issued Thursday, the Minnesota Tax Court, Regular Division, upheld an order by the state Department of Revenue that removed the qualified farm property estate tax exemption from one of four inherited parcels. The court agreed with the department that the sale of one of the parcels to a party outside the family of that heir within three years of the man's death in 2019 disqualified that property from receiving the exemption.

Iowa Senate Bill Would Cut Individual, Corp. Income Taxes - Zak Kostro, Law360 Tax Authority ($). "The state Senate's Ways and Means Committee introduced S.F. 552 Thursday and approved the measure by a 12-5 vote. The legislation would lower individual income tax rates for married joint filers in the 2025 tax year to 4% on the first $12,000 of income and to 4.4% on income above that amount, according to a bill explanation. Under current law, Iowa imposes a graduated individual income tax with rates ranging from 4.4% to 6%, according to the state Department of Revenue's website."

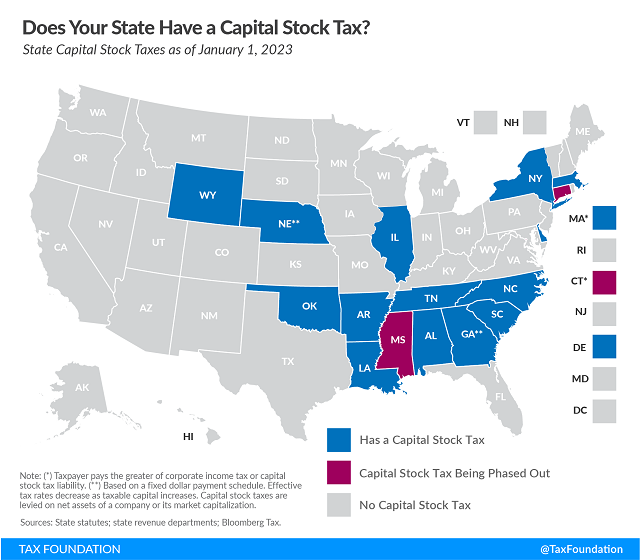

Does Your State Levy a Capital Stock Tax? - Janelle Fritts, Tax Foundation. "Unlike corporate income taxes, which are levied on a business’s net income (or profit), state capital stock taxes are imposed on a business’s net worth (or accumulated wealth). As such, the tax tends to penalize investment and requires businesses to pay regardless of whether they make a profit in a given year, or ever."

Here’s What Happens at the IRS After You File Your Taxes - Ashlea Ebeling, Wall Street Journal. "In cases where the IRS needs to reach out to taxpayers by letter to ask for additional information, such as a schedule for itemized deductions, resolution can take more than 120 days. Responding promptly can speed up your refund."

April 1 is RMD deadline for some. No fooling. - Kay Bell, Don't Mess With Taxes. "But if you celebrated your 72nd birthday last year, and didn't take your first RMD by Dec. 31, 2022, you must withdraw the specified amount by April 1. That's less than two weeks away."

Husband Who Paid Wife’s Taxes Finds it’s Not Easy to Sue For a Tax Refund - Maryilyn Ames, Procedurally Taxing. "One of my professors in law school was fond of explaining unusual results in court opinions with the statement that bad facts make bad law. The Court of Appeals for the Federal Circuit illustrated this principle in the recent case of Roman v. United States, which if not totally bad law is possibly unnecessary and at the least is undeveloped in terms of its application within the structure of the tax system."

Ninth Circuit: Partnership Did Not File Return by Faxing It to IRS Agent - Parker Tax Pro Library. "As a result, the Ninth Circuit concluded that the three-year statute of limitations never began to run, and therefore, the IRS's Final Partnership Administrative Adjustment disallowing the partnership's losses was timely."

Section 911 Housing Cost Amounts Updated for 2023 - International Tax Blog. "Code §911(a) allows a qualified individual to elect to exclude from gross income an 'Exclusion Amount' related to foreign earned income and a 'Housing Cost Amount.' The Exclusion Amount for 2023 is $120,000."

All the Tax in China - Alex Parker, Things of Caesar. "U.S. critics say that the 15% global minimum tax will be a windfall for China. That may come as a surprise to the Chinese."

Don’t Be Fooled: The Carbon-Import Tax Is Just a Tariff - Robert Goulder, Tax Notes Opinions. "Because the special tax would apply only to specified imports, it would need to be administered by U.S. customs officials, not the IRS. Functionally, it’s no different from a tariff."

Oscar Winner’s Sci-Fi Tale Evokes Real Immigrant Tax Dilemmas - Caitlin Mullaney, Tax Notes ($):

Not only did Academy Award winner Everything Everywhere All at Once engage movie audiences with its multiverse fantasy, but it also helped put a spotlight on the unique issues that immigrants may face when navigating the tax system.

Tax professionals say the film, starring Michelle Yeoh as a Chinese-American laundromat owner being audited by the IRS, reminded them of the representation gaps and language barriers that burden many immigrants who have limited options for assistance.

The tax system is hard enough for those of us who work with it for a living. I can only imagine what it looks like to someone coming into it cold from another country.

Chauvin, who killed George Floyd, pleads guilty in tax case - Steve Karnowski and Trisha Ahmed, AP via Washington Post:

The former Minneapolis police officer convicted in the 2020 killing of George Floyd pleaded guilty Friday to two tax evasion counts, admitting that he didn’t file Minnesota income taxes for two years due to “financial concerns.”

...

Shortly after Floyd’s killing, Chauvin and his then-wife were charged with multiple counts for allegedly underreporting their income to the state of Minnesota and failing to file Minnesota tax returns. The complaints alleged that from 2014 to 2019, the Chauvins underreported their joint income by $464,433.

The article says Chauvin was sentenced to 13 months on the tax charges, but was given credit for time served. He is serving 22 1/2 years on state murder and manslaughter charges and 21 years on federal civil rights charges, per the article.

Remind me again. Maybe over tea. Today is Memory Day, "The day celebrates the human memory and all that it can achieve." It's also Tea for Two Tuesday.

Make a habit of sustained success.