Deadline Day. Today is an important tax season milestone: partnership and S corporation returns are due today.

It might seem that a filing deadline for returns that generally have no tax liability would be a non-event. They are really information returns that gather K-1 data their owners need to prepare their own returns, where any tax gets paid. So why does it matter?

Penalties. If a 1065 or 1120-S is filed as little as a day late, it is subject to a penalty of $220 for each K-1 that goes with the return. That penalty repeats for every additional month the return is late.

Elections. Many tax elections can only be made on a timely return. Missing an election can be expensive for partners.

States. Many states have withholding requirements for non-residents. Dozens of states have adopted pass-through entity taxes to work around the $10,000 cap on itemized deductions for state and local taxes. While each state is different, many of them require elections on a timely return.

So file or extend your pass-through return today if you haven't already. E-file if possible. You get fast confirmation, and you don't have to worry about it getting lost in the mail.

- If you must paper file, send it to the right address. If you use the U.S. Mail, spring for certified mail, return receipt requested. Get the postmark receipt, keep the original somewhere safe, and scan it where it will be backed up, so you can document that you filed on time.

- If you get to the post office too late tomorrow, you can use an authorized private delivery service. Be sure you use one of the "authorized" delivery options - for example, UPS Next Day Air works, but UPS Ground does not. Be sure to use the proper street address, as the delivery services can't use post office box addresses. Safe your shipping documents so you can prove you filed on time.

Risk Client or Penalties? Tax Pros Stuck Amid Pandemic Credit Fraud - Lauren Vella, Bloomberg ($):

Practitioners say the onslaught of inaccurate Employee Retention Credit claims prepared by third parties puts them in a tough position—either they turn away their client with a bad claim or risk filing an incorrect amended return with potential discipline from the IRS.

“Am I in a circumstance where now I’ve kind of acquiesced and did a quasi-approval of that claim?” said Tom O’Saben, director of tax content and government relations at the National Association of Tax Professionals. “Or am I going to have to tell my client, you know, I completely disagree with this?”

Beware of too-good-to-be-true claims by ERC mills on the radio or the internet.

Related: What to Know About the Employee Retention Credit

Montana Governor Signs Tax Relief Package - Emily Hollingsworth, Tax Notes ($):

Montana Gov. Greg Gianforte (R) has signed a package of bills implementing some of his promised tax relief proposals, including an increase in the state earned income tax credit, an increase in the business equipment tax exemption threshold, and individual income and property tax rebates.

...

S.B. 121, sponsored by Sen. Becky Beard (R), reduces the top marginal income tax rate from 6.5 percent to 5.9 percent and increases the state EITC from 3 percent to 10 percent of the federal credit. The tax rate change takes effect January 1, 2024, and the EITC increase is applicable to tax years beginning after December 31, 2023, according to the bill.

Mont. Taxpayers To Get Income, Property Tax Rebates - Sanjay Talwani, Law360 Tax Authority ($):

Gov. Greg Gianforte, a Republican, signed H.B. 192 and H.B. 222 into law Monday. H.B. 192 will provide taxpayers with income tax rebates equal to their 2021 liability, up to $2,500 for joint returns and $1,250 for single filers. H.B. 222 will provide a property tax rebate of $500 or the amount of taxes paid for a taxpayer's principal residence, whichever is lower.

With the signing of the bills and three others, H.B. 212, which Gianforte also signed Monday, will increase the current $300,000 business property tax exemption to $1 million. Without the passage of the other five measures, the exemption would have increased to only $500,000.

Balancing federal budget in 10 years could require 41 percent cut to programs, when excluding Social Security: CBO - Aris Foley, The Hill. "The analysis, requested by Democrats, crunches the numbers behind what achieving a balanced budget in the next 10 years would mean for federal programs."

CBO: TCJA Extension Would Deepen Cuts Needed to Balance Budget - Doug Sword, Tax Notes ($):

Every other item in the federal budget would have to be zeroed out to achieve a balanced budget in 10 years if Tax Cuts and Jobs Act provisions are extended, interest payments are made, and promises not to raise taxes or cut Medicare, Social Security, defense, or veterans’ programs are kept.

That’s according to a new Congressional Budget Office analysis released March 14 that was requested by Senate Finance Committee Chair Ron Wyden, D-Ore., and Senate Budget Committee Chair Sheldon Whitehouse, D-R.I.

Tax Court Grants Partial Deferral for Canadian Retirement Accounts - Michael Smith, Tax Notes ($). "Canadian retirement plans are included as U.S. income as the plan earnings accrue but are treated as income for Canadian tax purposes only when a distribution is made. Generally, the Canada-U.S. tax treaty allows a taxpayer to make an election to defer U.S. tax liability until a distribution is made, to match the tax treatment in Canada."

Related: Eide Bailly Global Mobility Services.

Filing For A Tax Extension Shows Smarts, Not Desperation - Kelly Phillips Erb, Forbes. "Plus, contrary to popular belief, filing for an extension isn’t an audit trigger—and it tends to result in faster processing times than filing now and fixing any issues later."

IRS still accepts checks, but has rules about paper payments - Kay Bell, Don't Mess With Taxes. "Include your info: Show your correct name, address, Social Security number, daytime phone number, and the tax year and form number (for most of us this time of year, that's Form 1040) on the front of your check or money order. If you are filing a joint return, enter the Social Security number shown first on your tax return."

Don’t believe these 5 tax myths. Here’s what you need to know before you file this year’s return - Sharon Epperson, CNBC. "Myth: If you go to a tax preparer and there are mistakes on your return, they will be liable."

Luck of the Irish? The IRS has rules in place to ensure its cut - National Association of Tax Professionals. "As St. Patrick’s Day approaches, many may be dreaming of finding a pot of gold at the end of a rainbow. While finding treasure may seem like a stroke of luck, it’s important to know there are rules surrounding the discovery of valuable items. In particular, the IRS has guidelines for what you need to do should you come across a treasure trove, with or without a small, mythical character."

Tax Court Sustains IRS WBO Denial of Whistleblower Claim for Award Based on All OVDI Collected Proceeds - Jack Townsend, Federal Tax Procedure. "As best I understand, Shands claimed that, based on information he gave federal agents related to the arrest and cooperation of one Renzo Gadola, a misbehaving Swiss banker (misbehaving is perhaps redundant), the IRS created the OVDI program and collected proceeds from many taxpayers, most or even all of whom were unknown to Shands. In his claim letter dated 6/6/12, Shands was unable to name those taxpayers but said he was nevertheless entitled to the § 7623(b) award based on collected proceeds from those taxpayers entering OVDI."

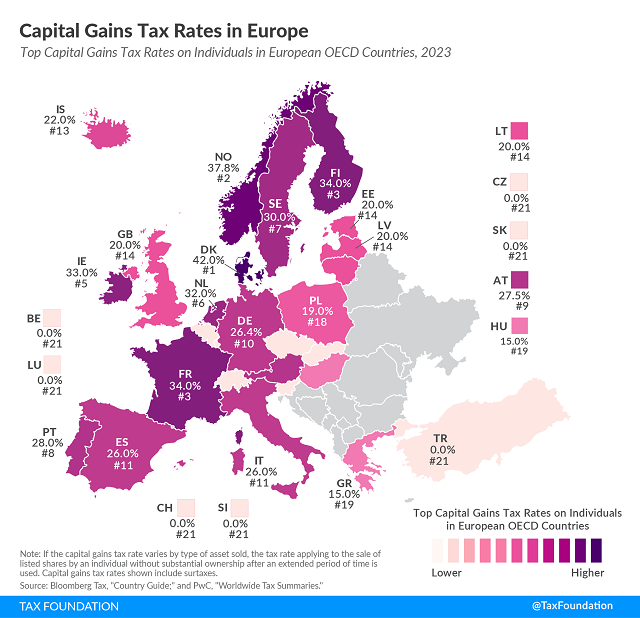

Capital Gains Tax Rates in Europe - Christina Enache, Tax Policy Blog:

Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. Norway levies the second-highest top capital gains tax at 37.8 percent. Finland and France follow, at 34 percent each.

A number of European countries do not levy capital gains taxes on the sale of long-held shares. These include Belgium, the Czech Republic, Luxembourg, Slovakia, Slovenia, Switzerland, and Turkey. Of the countries that do levy a capital gains tax, Greece and Hungary have the lowest rates, at 15 percent.

The top U.S. capital gain rate is 23.8%. Taking state taxes into account, the highest US rate is 37.1% (California). Under the Biden budget proposal, the top federal capital gain rate would rise to 43.4% - 56.7% for Californians.

State Revenue Forecasts Look Bleak as Revenue Boom Subsides - Lucy Dadayan, TaxVox. "There is also significant variation across the states. California and New York are reporting large declines in overall revenues, whereas many states are still reporting growth in nominal terms – albeit much weaker compared to the prior two years."

Can the SVB crisis be solved in the longer run? - Tyler Cowen, Marginal Revolution. "Once depositors are allowed to take losses, both individuals and institutions will adjust their deposit behavior, and they probably would do so relatively quickly. Smaller banks would receive many fewer deposits, and the giant 'too big to fail' banks, such as JP Morgan, would receive many more deposits. Many people know that if depositors at an institution such as JP Morgan were allowed to take losses above 250k, the economy would come crashing down. The federal government would in some manner intervene – whether we like it or not – and depositors at the biggest banks would be protected."

Can Nikki Haley Save Us From Presidential Tax Crooks? - Joseph Thorndike, Tax Notes Opinions. "There might still be a chance for some brave Republican to rescue the tradition of voluntary disclosure. It’s not clear that Nikki Haley will be that courageous figure. It could certainly be any of the other Republicans who find the gumption to challenge Trump for the nomination (if any actually emerge). But here are four reasons to vest some hope in Haley."

What Does It Mean When Former Judge Kroupa Shows Up as Senior Judge Kroupa in the Tax Court’s Report to Congress - Keith Fogg, Procedurally Taxing. "Former/senior Judge Kroupa receives a pension despite her conviction for a tax crime in one of the most sensational acts committed by a Tax Court judge during its 99-year history"

Illinois attorney found guilty of embezzlement, bankruptcy fraud, and tax fraud - IRS (Defendant name omitted):

Evidence at trial revealed that Defendant... was a close associate of... the former President of Washington Federal Bank for Savings ("WFBS"), a small bank in Chicago's Bridgeport neighborhood which was closed in December 2017 after the Office of the Comptroller of the Currency determined that the bank was insolvent and had at least $66 million in nonperforming loans. Defendant served a key role in the embezzlement scheme, specifically diverting from the bank more than $8 million, plus property which was rightly the collateral of the bank for other loans...

After the collapse of WFBS, the Federal Deposit Insurance Corporation attempted to collect on the money and properties that Defendant obtained as part of the embezzlement scheme. To avoid losing the assets, Defendant filed a fraudulent bankruptcy case, in which he attempted to concealed numerous assets. To substantiate the financial claims made within his bankruptcy filings, and avoid paying taxes, Defendant filed false corporate returns in 2014 and 2015, and false personal returns in 2015, 2016, and 2017. Defendant failed to file returns in 2013 and 2014.

Don't do that.

I hope they didn't give them bank account numbers or prepaid gift cards. Newark, New Jersey Was Duped Into Becoming A Sister City For A Fake Country.

Miles beyond. A taxpayer ran into a little problem trying to convince the Tax Court that he should be allowed to claim some mileage expenses. From a Tax Court opinion issued yesterday (Taxpayer name omitted, emphasis added):

At trial and on brief, respondent noted the multiple inconsistencies with Mr. Taxpayer's mileage log rendering it unreliable. To discredit the mileage log and refute the starting mileage of 50,000, respondent offered copies of Mr. Taxpayer's Texas vehicle inspection reports dated October 20, 2017, and November 15, 2018, providing the odometer readings for his vehicle of 182,291 and 204,107, respectively. According to the inspection reports between October 20, 2017, and November 15, 2018, 21,816 miles were driven on the vehicle, far less than the driven miles shown on the mileage log. Mr. Taxpayer failed to explain or refute the inconsistencies.

Three lessons. First, round mileage numbers are suspicious. Second, beware of the possibility of third party mileage verification. Finally, if you have more business miles than actual miles, check your math.

Not only is today a filing deadline, it is True Confessions Day. Coincidence, I think.

Make a habit of sustained success.