Farmers and fishers face March 1 tax deadline - IRS:

The Internal Revenue Service today reminded businesses with income from farming or fishing that have not already made their estimated tax payments to file and pay their entire tax due on or before Wednesday, March 1, 2023.

...

Only those that have paid their estimated tax payments by Jan. 17 can file by the regular April 18 deadline and avoid estimated tax penalties. This special rule generally applies when income from farming or fishing makes up at least 2/3 of the total gross income in either the current or the preceding tax year.

The March 1 "deadline," whatever its historic merits, is archaic and unwise. Many tax software programs aren't even fully functional yet. As K-1s and late brokerage statements become more common, trying to file a business return by March 1 has become difficult, sometimes impossible - and farm returns are business returns, often very complex ones.

To qualify for skipping estimated tax payments and avoiding penalties with a March 1 filing, a taxpayer has to be a "qualifying" farmer: 2/3 of a taxpayers gross income has to be from farming. That means farmers getting K-1s from other activities have to look beyond the net income from non-farming K-1s to the K-1 "gross" income for the 2/3 test.

Qualifying farmers have a sweet estimated tax deal that can bypass the March 1 foolishness. They can pay 2/3 of the estimated tax that other taxpayers would have to pay by January 15, all in one payment.

Even if a qualifying farmer files after March 1, the return is not subject to late filing penalties, as long as it is filed by this year's April 18 deadline. The farmer just has the same estimated tax penalties a non-farmer would have under the circumstances.

Supreme Court Hands Huge Victory to Non-Willful FBAR Violators - Andrew Velarde, Tax Notes ($):

Succinctly analyzing the statutory language of the Bank Secrecy Act (BSA) and supporting government guidance, a closely divided Supreme Court delivered a momentous taxpayer victory by finding that non-willful foreign bank account reporting penalties apply per form.

The Court released its 5-4 decision in Bittner v. United States on February 28. Justice Neil M. Gorsuch authored the opinion holding that the BSA's penalty for non-willful FBAR violations applies per report. The holding could mean a difference of millions of dollars in penalties for some taxpayers.

Supreme Court: Non-willful foreign account penalties apply per-form, not per-account. - Eide Bailly Tax News & Views:

Taxpayers with foreign financial accounts aggregating $10,000 or more at any time during the year are required to file Form 114, Report of Foreign Bank and Financial Accounts, with the Financial Crimes Enforcement Network, or FinCEN.

The penalties for failing to file these reports start at severe and escalate from there. The penalty for a "non-willful" failure starts at $10,000. The penalty for a willful failure can reach half of the amount not reported.

Related: Offshore Voluntary Disclosure; Penalty Help.

Justices Reject Higher Fines For Nonwillful FBAR Violations - Dylan Moroses, Law360 Tax Authority ($). "The majority opinion also highlighted the inconsistent nature of the government's position on applying the nonwillful FBAR penalty, identifying a 2010 notice issued by the U.S. Treasury Department stating that the nonwillful failure to file an FBAR would lead to a civil penalty not to exceed $10,000."

Other coverage:

Supreme Court holds FBAR penalty is imposed per report, not per account - Martha Waggoner, Journal of Accountancy.

Supreme Court Rules In Taxpayer’s Favor On FBAR Penalties - Kelly Phillips Erb, Forbes

FBAR Non-Willful Penalty Is Per Report, Not Per Account - Russ Fox, Taxable Talk.

Supreme Court Holds in Bittner that FBAR Nonwillful Penalties are Per Form Rather Than Per Account - Jack Townsend, Federal Tax Crimes.

BREAKING! US Supreme Court — FBAR “Nonwillful” Penalty is Per Form and NOT Per Account - Virginia La Torre Jeker, Virginia - US Tax Talk.

Supreme Court Rules Against Delaware in Unclaimed Property Dispute - Andrea Muse, Tax Notes ($):

The U.S. Supreme Court has ruled against Delaware in its dispute with 30 other states over unclaimed MoneyGram agent checks and teller’s checks.

In a February 28 opinion written by Justice Ketanji Brown Jackson, the Court unanimously concluded in Delaware v. Pennsylvania and Arkansas v. Delaware that both the agent checks and the teller’s checks are sufficiently similar to money orders and should escheat under the federal Disposition of Abandoned Money Orders and Traveler’s Checks Act (FDA).

Biden: Expect Tax Increases in Budget Proposal - Alexander Rifaat, Tax Notes ($). "'I want to make it clear: I’m going to raise some taxes,' Biden said."

Congress, of course, has a say in that.

Standard Deduction 2022-2023: How Much Is It and Should I Take It? - Laura Saunders, Wall Street Journal. "When to claim the standard deduction: When it is greater than your total itemized deductions listed on Schedule A. These are typically for mortgage interest, charitable donations, state and local taxes, and eligible medical expenses."

Tax Pros Say Challenges Remain Following IRS’s S Corp Guidance - Lauren Vella, Bloomberg. "Under the new guidance, a small business corporation and its shareholders can now redeem their S corporation status without a PLR if they change the bad language in their operating agreement. However, if the business has a bad operating agreement as well as disproportionate distributions, according to the guidance, the taxpayer will still need to request a PLR."

Democrats Work on Repairing Roth Snafu in Retirement Bill - Doug Sword, Tax Notes ($). "House Ways and Means Committee ranking member Richard E. Neal, D-Mass., told Tax Notes that he has discussed options with Treasury Secretary Janet Yellen to address the legislative glitch that may inadvertently bar all catch-up retirement contributions beginning in 2024."

Where's your tax refund? Use IRS online tracker to find out - Kay Bell, Don't Mess With Taxes. "If you, however, got your 1040 to the Internal Revenue Service early this year and are still waiting on your refund, here are some tips on tracking it down using the IRS' Where's My Refund? online tool."

Taxes, Scholarships, And A College Freshman: No Such Thing As Free Money - Renu Zaretsky, TaxVox. "IRS rules state that a scholarship or grant is tax-free under two conditions. The recipient needs to be pursuing a degree from a qualified educational institution, and funds need to be used on qualified tuition and related expenses (QTRE), namely tuition, fees, and required books, supplies, and equipment. However, that money will be taxable if used for 'room and board, travel, and optional equipment.'"

IRS Extends Tax Deadlines To Oct. 16 For Taxpayers In California, Alabama And Georgia Disaster Areas - Robert Wood, Forbes. "The current list of eligible localities and other details for each disaster are always available on the disaster relief page on IRS.gov."

What to Know if You’ve Been Affected By a Federally-Declared Disaster and the Recent Additional Time Provided For Parts of Alabama, California and Georgia - Erin Collins, NTA Blog. "When taxpayers need more time beyond the postponed filing deadline, they can of course file for an extension, but might be surprised to learn that they cannot file for this extension electronically, in certain circumstances. For example, taxpayers will only be able to file an extension electronically on or before the statutory date on which the return is due because limitations of the IRS’s current systems don’t allow for the electronic filing of extensions beyond the statutory filing deadline."

The Tax Consequences of Being Paid to Go On a Date (Reprise) - Jim Maule, Mauled Again. According to all the reports, Jane Fonda, who is worth roughly $200 million, agreed to go on a date with an Austrian 'tycoon,' accompanying him to the Vienna Opera ball 'because he offered to ‘pay me quite a bit of money.’'

IRS-CI enlists the public’s assistance in slamming the next scam - IRS:

Phishing scams are still prevalent. If you receive an unsolicited email, don't enter your personal information or click links. Scammers have become much more sophisticated, and emails and texts may look legitimate.

Charity fraud takes place when an organization falsely claims to be a nonprofit organization or misappropriates funds intended for a charity. Before you donate, ensure an organization is legitimate. Verify an organization's tax exemption status before you donate goods, services or money.

Fraudsters prey on U.S. taxpayers who may owe a debt to the IRS. Be wary of advertisers who say they can settle your tax debt for pennies on the dollar. If you have a debt to the IRS, reach out to the IRS directly to determine your options.

Be super careful.

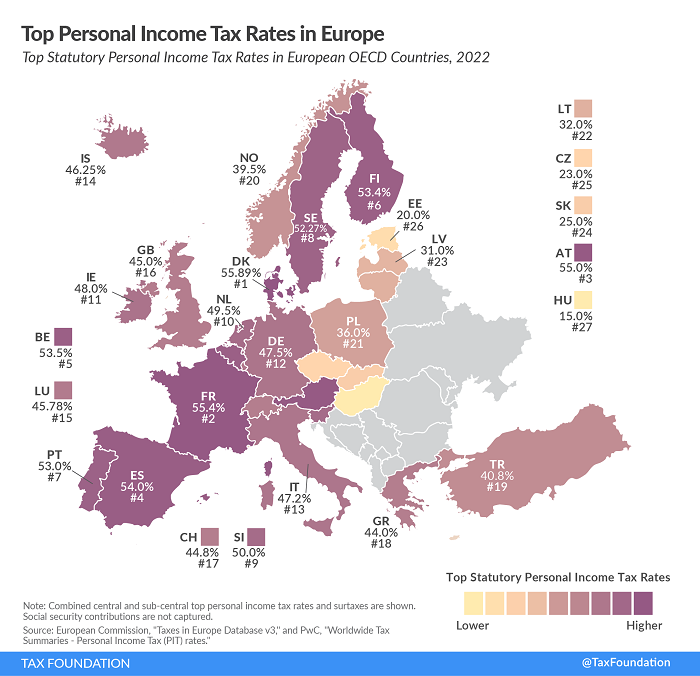

Top Personal Income Tax Rates in Europe - Christina Enache, Tax Policy Blog. "Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) had the highest top statutory personal income tax rates in Europe among OECD countries in 2022. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) had the lowest top statutory personal income top rates in Europe."

That top rate in Denmark kicks in at about US$82,000.

Wealthy People Can’t Pay for All Biden Wants - Allison Schrager, Bloomberg ($). "It just isn’t realistic to expect the rich to pay for it all. My colleague Brian Riedl at the Manhattan Institute estimates that if we eliminate the cap and add in every other proposed tax on high earners, including high wealth taxes (assuming they are collectable — which is optimistic ), we end up with tax brackets for even moderately high earners above 70%. And it’s still not enough to pay for everything, because it will only bring in $10 trillion in new revenue, well short of the $18.8 trillion we need for current commitments."

How Alex Murdaugh Opened The Door For Convictions On Financial And Tax Crime Charges - Kelly Phillips Erb, Forbes. "But this much is clear: his testimony, including his admissions that he stole money, is likely to hurt him in any future trials on 99 other state counts pending against him for financial crimes, including embezzlement, money laundering and evading taxes —on nearly $7 million that he allegedly stole."

I don't want to get paid today, but how about a tax-free advance? Getting paid is nice, but paychecks are taxable. That's such a hassle.

Loans, on the other hand, are tax free. So how about we just make all my paychecks due on the day I quit, and you just advance me the money as loans on that giant final payroll?

That's a great idea, but it doesn't actually work, as the Tax Court illustrated this week. Judge Buch sets the stage (taxpayer name omitted):

Mr. Taxpayer's evidence regarding the wire transfers from Cambodia was unreliable and often conflicting. He testified that he was borrowing money from GLG and that the transfers represented advances of income from GLG. At times, he referred to the advances as a salary — for example, he testified that “the incoming wires that I sent over to my personal bank account here in California . . . [were] to take care of the family. . . . I took some of my salaries to help pay for my expenses here.” And at other times, he referred to the advances as part loan, part salary.

That didn't work (my emphasis):

The Taxpayers argue that most of the deposits are not taxable because they are proceeds from a loan from GLG to Mr. Taxpayer. A loan is not taxable income when received because the taxpayer has an obligation to repay it. By comparison, an advance for future services is taxable in the year it is received. Whether an advance is a bona fide loan is a question of fact that turns on whether the borrower and lender intended to make and enforce monetary repayment at the time the advance was made. Id. To answer this question, we consider various objective factors that are indicative of subjective intent... We find no evidence that the Taxpayers intended to repay the advances at the time they were made, so they were not loans. The loan agreements are unenlightening as to intent at the time the advances were made because they do not indicate when Mr. Taxpayer executed them... Finally, other than Mr. Taxpayer's testimony, which we do not find credible, there is no evidence that he made any repayments.

The moral? That doesn't work.

Oink. Today is National Pig Day! Here in Iowa, that's a big deal. About 3.2 million humans share Iowa with an estimated 23 million hogs and pigs.

Make a habit of sustained success.