The start of Tax Season 2023: By the numbers - Daniel Hood, Accounting Today:

By now the word has, hopefully, gotten out to clients: Refunds are smaller this year, thanks to reductions in various COVID-related relief programs.

But in terms of broad process, the season may be running a little ahead of last year, with more returns filed and processed, and more refunds issued, than at the same time in 2022. What's more, the number of professionally prepared returns is up as well.

IRS Grants Pandemic Refund Window Relief - Nathan Richman, Tax Notes ($). "The IRS issued guidance allowing taxpayers to ignore the COVID-19 pandemic filing extensions when computing the lookback periods on refund claims in response to complaints about a trap for the unwary."

IRS relaxes refund deadlines for COVID years - Eide Bailly Tax News & Views:

The IRS today announced (Notice 2023-21) a partial fix for a little-known deadline issue that threatened to foot-fault taxpayers out of tax refunds for COVID years.

Taxpayers normally have three years from the due date to claim refunds for returns with withholding that were filed without extension. For withheld taxes and estimated tax payments, however, the three-year deadline was set to expire on April 15 of the third year after filing, despite the original deadline postponements.

...

While the new guidance is helpful, it still makes refund claims for 2020 tricky. If you file the refund claim after April 15, 2023 you need to file it within three years of the original filing.

NTA Blog: Lookback Rule: The IRS Fixes the Refund Trap for the Unwary - Erin Collins, NTA Blog:

The three-year lookback period is as follows: Taxpayers who file claims for credit or refund within three years from the date the original return was filed will have their credits or refunds limited to the amounts paid within the three-year period before the filing of the claim plus the period of any extension of time for filing the original return.

Typically, the periods for filing a claim for credit or refund and the three-year lookback periods align, but the postponements of certain filing deadlines for TYs 2019 and 2020 disrupted this alignment. When taxpayers file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, the period of the extension is included in the three-year lookback period. Yet when the IRS exercises its authority under IRC § 7508A to postpone filing deadlines, such as the postponements provided during filing seasons 2020 and 2021, the period of the postponement is not included in the three-year lookback period. Thus, a postponement and an extension are not the same. Consequently, there is a mismatch between the period in which a claim for credit or refund can be filed and the three-year lookback period for those taxpayers who took advantage of the postponed filing deadlines for filing seasons 2020 and 2021.

...

Issuing Notice 2023-21 has remedied an unintended consequence of the IRS’s good deed of providing taxpayers with more time to file their 2019 and 2020 returns during the COVID-19 pandemic. This will prevent unwary taxpayers from being denied a credit or refund to which they otherwise would have been entitled. However, this relief needs to be made permanent by amending IRC § 6511(b)(2)(A) in anticipation of any future circumstances in which the IRS exercises its authority and postpones filing deadlines for all disaster relief.

Wyden Plans to Schedule Werfel Committee Vote This Week - Doug Sword, Tax Notes ($). "Wyden equivocated, though, on whether the committee vote would not only be scheduled but also take place the week of February 27. The Senate was adjourned the week of February 20 and didn’t reconvene until the evening of February 27, so Wyden hadn’t had an opportunity to sound out other committee members on scheduling."

Waiting on Werfel - Bernie Becker, Politico. "Werfel widely is expected to be confirmed by the full Senate, and two Republicans have already said they’d vote for his nomination. But how many GOP senators he’ll get in all is still up in the air."

FinCEN Alert on Nationwide Surge in Mail Theft-Related Check Fraud Schemes Targeting the U.S. Mail - Financial Crimes Enforcement Network. "Criminals have been increasingly targeting the U.S. Mail and United States Postal Service mail carriers since the COVID-19 pandemic to commit check fraud. Criminals typically steal personal checks, business checks, tax refund checks, and checks related to government assistance programs, such as Social Security payments and unemployment benefits. Following the initial theft and fraudulent negotiation of the stolen checks, criminals may continue to exploit their victims by using the personal identifiable information found in the stolen mail for future fraud schemes, such as credit card fraud or credit account fraud."

Another good reason to have your refunds direct-deposited into your bank account.

Confusion over EV tax credits stymies buyers and sellers - Jeanne Whalen, Washington Post. "Dealers say the lack of clarity has made it hard for them to promote EVs to buyers because no one is sure how long certain vehicles will qualify for the $7,500 credit — undermining a perk that was designed to accelerate the White House’s green-energy agenda."

DeSantis Takes Disney's District Keys, Appoints New Board - Lauren Berg, Law360 Tax Authority. "Florida Gov. Ron DeSantis on Monday signed a bill granting state control of The Walt Disney Co.'s once self-governing district encompassing its Orlando theme parks, legislation that came about to punish the company for its opposition to what detractors call the state's 'Don't Say Gay' law."

West Virginia Senate Advances Compromise Tax Cut Bill - Benjamin Valdez, Tax Notes.

The West Virginia Senate rapidly advanced a proposal to reduce the personal income tax and provide personal property tax rebates, signaling a long-sought compromise with House lawmakers and Gov. Jim Justice (R) on tax cuts.

The Senate approved an amended version of H.B. 2526, a House-passed personal income tax cut, on a vote of 33 to 0 February 25 after suspending rules that require a bill to be read over three consecutive days. The modified proposal would reduce each personal income tax bracket starting in tax year 2023, provide rebates for the car tax and the business inventory tax, and provide property tax credits for disabled veterans.

Colorado DOR Proposes Changes to Rule on Other State Tax Credit - Emily Hollingsworth, Tax Notes ($). "The draft rule clarifies the credit allowed to members of a partnership or S corporation for the tax imposed by another state or to a passthrough entity that files a composite return on behalf of its members, as well as the documentation to be filed with the Colorado DOR."

Tax(relief)achusetts - Lisa Kashinsky, Politico. "Healey surprised Democrats on and off Beacon Hill by pitching an expansive tax-relief package that surpasses former Gov. Charlie Baker’s in scope and in cost. She's calling for a $3 million estate-tax threshold, up from the $2 million marker floated last year. And she's reviving a part of Baker's plan that lawmakers nixed: taxing short-term capital gains at 5 percent rather than 12 percent."

WSJ Tax Guide 2023 - Wall Street Journal. "During the pandemic, Congress allowed taxpayers who don’t itemize their deductions on Schedule A to deduct up to $300 in cash donations for 2020 and $600 for 2021. About 47 million filers, nearly one-third of the total, used this donation deduction in 2021. Now it is gone, and these taxpayers will get no charitable break for 2022 or future years unless lawmakers restore it, as charities are pushing for."

Oct. 16 is new tax deadline for residents in California, Alabama & Georgia disaster areas - Kay Bell, Don't Mess With Taxes:

Previously, IRS granted a tax extension until May 15, instead of this year's April 18 Tax Day, for individuals and owners of businesses in much of California hit by storms that produced mudslides and flooding. The same mid-May delay was granted to Alabama and Georgia residents and business owners who last month endured severed storms and tornadoes.

Now these taxpayers have five extra months — again, until Oct. 16 — to meet various tax filing and payment deadlines, including those for most calendar-year 2022 individual and business returns.

The IRS guidance is here.

What to Do About Missing or Incorrect Forms W-2 and Forms 1099 - Parker Tax Pro Library. "While the receipt of Forms W-2 and Forms 1099 by the end of January are key for taxpayers wishing to get a jump on preparing their tax returns, knowing what to do if those documents are not received or incorrect is also important."

Cryptic Territory – An Update on Digital Assets and Tax Implications - Kris Korban, I Tax School. "Regardless of whether a taxpayer is involved with digital assets or not, every individual filer must answer the question on the front of Form 1040, U.S. Individual Income Tax Return, whether they received or sold a digital asset in the taxable year."

Deducting Residual (Excess) Soil Fertility – Does the Concept Apply to Pasture/Rangeland? (An Addendum) - Roger McEowen, Agricultural Law and Taxation Blog. "The marketing material of the agronomic firms that I have seen that are in the business of measuring soil fertility makes a broad statement that I.R.C. §180 applies to grazing land. While true on its face, pasture grass is not the same as cropland when it comes to nutrients. While the concept applies equally, the application does not."

Failure to File Information Returns For Foreign Trust Keeps Statute Of Limitations Open For Individual’s Income Tax - Leslie Book, Procedurally Taxing. "I suspect that Fairbank would be ok with that uncertainty, and while the SOL rules are meant to provide a date certain, it is hard to see why the IRS should have additional time to assess if it has elsewhere received all the information it would have received on a specific form. That issue awaits resolution in another case, however."

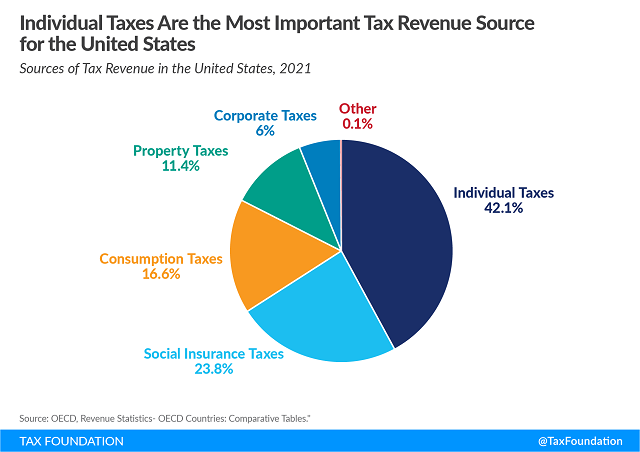

Sources of U.S. Tax Revenue by Tax Type - Daniel Bunn and Cecilia Perez Weigel, Tax Policy Blog. "Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised. This is especially important as the economic recovery from the pandemic continues."

The Big Picture in International Taxes - Alex Parker, Things of Caesar. "Don’t get me wrong–the international tax system is in a state of profound chaos right now. The rules are constantly changing and evolving, and many are wondering if the fundamental cornerstones put in place 100 years ago will withstand. And the global economy continues to transform and create new business models that flummox the traditional tax rules."

Dutch tax ruling: 3 employees working from home are not a PE - Leonard Wagenaar, Leonard's Tax Posts. "The Dutch tax authorities issued a ruling (https://lnkd.in/ezuRyJrV) that a foreign EU company did not have a Dutch permanent establishment (PE) for having three employees who worked fully remote from their home offices in the Netherlands, as the home offices are not ‘at the disposal’ of the employer. This is a sensible and practical outcome."

Related: Eide Bailly Global Mobility Services.

Tax Defier Who Bragged About Spanking IRS Convicted On Ten Counts - Peter Reilly, Forbes:

For what it is worth 2:21-cr-20355 is the docket number of the case. The transcript of the trial will not be available on my budget till May 1, but from Judge Lawson's summary things did not get better.

Mr. Lavigne appears to subscribe to the concept that he has two aspects or identities, one which he labels as a “person” or “corporate entity,” and the other as his “flesh and blood’ form. One spells his name with upper case letters. The other adds spurious and meaningless punctuation to his name. Although Mr. Lavigne puts special significance on these alternative nomenclature forms, these are ineffectual in law and are meaningless paper masks. They have no force or meaning in law, other than that they indicate an intention on Mr. Lavigne’s part to evade his lawful obligations and the authority of the Court and other branches of government.

Yeah, that doesn't work.

But I snore. Today is National Public Sleeping Day!

Make a habit of sustained success.