Crypto Bankruptcies Leave Taxpayers in Limbo in Filing Season - Lauren Vella, Bloomberg ($):

Investors who lost money on now-bankrupt crypto exchanges are stuck in limbo this filing season, tax practitioners say, unable to claim losses on digital assets with little recourse for obtaining relief.

...

Investors do have the option to sell their tokens that have declined in value and harvest a loss, barring limitations with respect to those losses. However, for those who hold on to their coins, the federal government indicated that a steep decline in value does not constitute a loss under Section 165.

The most important thing investors can do is make sure they maintain good records of their cost basis and purchase dates.

Fair Tax Would Be ‘Too High’ to Work, Economist Says - Doug Sword, Tax Notes ($):

There hasn’t been a new study of what a national sales tax rate would need to be to replace the federal tax system since 2005, when William Gale estimated it would need to be at least 44 percent on a tax-exclusive basis, the Tax Foundation’s Erica York said February 16 on an Urban-Brookings Tax Policy Center webcast.

And Gale’s estimate doesn’t take into account the tax avoidance and evasion that such a high rate would attract or the near certainty that Congress would exclude a raft of items, like groceries, from a national sales tax bill, York said.

“If you add in some really reasonable evasion and avoidance assumptions, like say a 15 percent or 20 percent avoidance rate, then the necessary tax-exclusive rate climbs up to the 50 percent range, which is very, very high and leads to even more evasion and avoidance issues,” York said.

Business Groups Urge Oregon Lawmakers to End Throwback Rule - Paul Jones, Tax Notes ($):

The bill, H.B. 2546, was debated in the House Committee on Revenue on February 14. It proposes to end Oregon's practice of sourcing to the state sales that an in-state manufacturer makes into another state but that the destination state can’t tax — typically because of P.L. 86-272. The throwback rule causes those sales to increase the seller’s Oregon apportionment factor and thus its state income tax burden, even though Oregon otherwise uses destination sourcing for sales of goods.

The state’s throwback policy “punishes in-state manufacturers” and is counterproductive to Oregon's attempt to incentivize manufacturing in the state by using destination sourcing and single-sales-factor apportionment, said Scott Bruun of Oregon Business and Industry.

Watch for our new state tax roundup on Fridays through the spring legislative season. It's not too late to read the most recent edition.

Crumbs in a Blender - Alex Parker, Things of Caesar:

The main problem is that GILTI is too far off from the OECD model for an income inclusion rule, the central tax of Pillar Two. Both are taxes applied by a country on the low-taxed foreign income of the parent companies based in its jurisdiction. Both use a substance-based carveout based on factors like tangible assets and payroll, to target the tax on intangible income. That’s the income most likely used in tax avoidance, because it’s highly mobile and based on intangible assets like IP that are hard to price.

But GILTI is applied at a 10.5% rate, while Pillar Two is at 15%. GILTI aggregates all of a company’s foreign income, including from high-tax jurisdictions, while Pillar Two applies jurisdiction-by-jurisdiction. And their definitions of income are dramatically different, as GILTI doesn’t allow taxpayers to carry forward net operating losses or unused foreign tax credits.

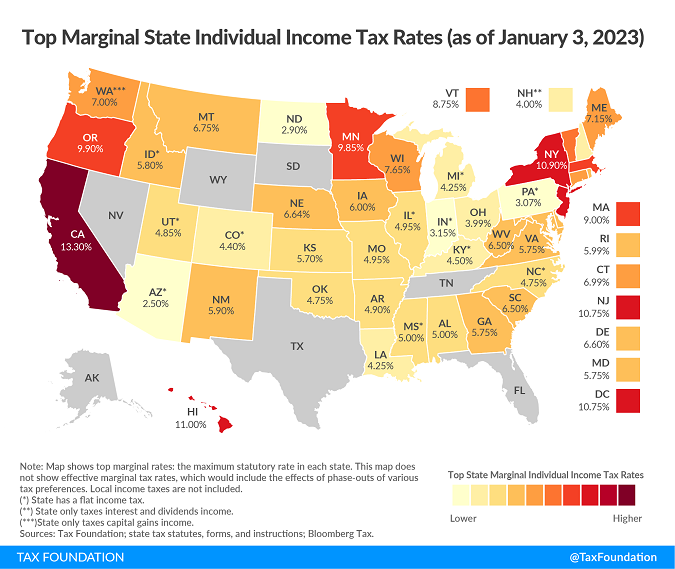

State Individual Income Tax Rates and Brackets for 2023 - Timothy Vermeer, Tax Policy Blog. "Of those states taxing wages, eleven have single-rate tax structures, with one rate applying to all taxable income. Conversely, 30 states and the District of Columbia levy graduated-rate income taxes, with the number of brackets varying widely by state. Kansas, for example, is one of several states imposing a three-bracket income tax system. At the other end of the spectrum, Hawaii has 12 brackets. Top marginal rates range from Arizona’s 2.5 percent to California’s 13.3 percent."

What You Need To Know About Taxes If You Sold Your Home In 2022 -- Or Plan To Sell in 2023 - Kelly Phillips Erb, Forbes. "Some taxpayers believe that any profit on the sale of a home is taxable—but that's not true. There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale."

How to get your tax withholding just right - Kay Bell, Don't Mess With Taxes. "IRS data show that most taxpayers, around 70 percent each year, choose to use the unofficial bank of the Internal Revenue Service as a savings account. They intentionally overwithhold income tax from their paychecks so that they will get a refund when they file."

IRS Advises That 2022 State Relief Payments Should Not Be Reported as Income - Parker Tax Pro Library. - Parker Tax Pro Library. "Specifically, the IRS determined it will not challenge the taxability of payments related to general welfare and disaster relief."

How Do I Report State Tax Rebates? - John Richman, I Tax School. "For most states, the IRS’s guidance describes these payments as relating to 'general welfare and disaster relief,' adding that because filing season had already started, it wanted to bring clarity to the issue of whether these payments were subject to federal tax. Described in these terms, the payments from states would not be subject to tax, according to this February 10 notice."

Deducting Residual (Excess) Soil Fertility - Roger McEowen, Agricultural Law and Taxation Blog. "So, how can a taxpayer establish the presence and extent of residual fertilizer supply and that it is actually being exhausted? For starters, if farmland has an actual excess soil fertility base it will normally bring a price premium upon sale."

Determining qualifying dependents and the tax implications - National Association of Tax Professionals. "For most individual taxpayers, determining who qualifies as a dependent of a taxpayer is a straightforward proposition. However, the question can quickly get complicated in a number of situations tax pros see regularly."

Lesson From The Tax Court: The Limited Review Of Passport Revocation Certifications - Bryan Camp, TaxProf Blog. "The idea behind §7345 is simple. If you owe taxes and the government threatens to take your passport, you are more likely to pay up. But its operation is complex. It requires the IRS to first certify to the State Department that a taxpayer has a 'seriously delinquent tax debt.'"

The US-Japan Tax Treaty: A Comprehensive Guide - 1040 Abroad. "The crucial advantage offered by this agreement is the elimination of double taxation."

What is the inflation adjustment for taxes in 2023? - Robert McClelland, TaxVox. "Inflation last year reached its highest level in the United States since 1981. As a result, the IRS announced the largest inflation adjustment for individual taxes in decades: 7.1 percent for tax year 2023."

More Tax Guidance Needed on Alternative Financial Statement Income - Carrie Brandon Elliot, Tax Notes Opinions. "Including unrealized gains in AFSI would create liquidity problems because the taxpayer has not sold the investments. This will lessen incentives to invest and could negatively affect capital markets and the economy."

ChatGPT and the Tax Law - Annette Nellen, 21st Century Taxation. "We all know tax rules are complex. Can artificial intelligence such as used in ChatGPT address tax matters? I gave it a try today while listening to some colleagues deliver an online chat about the abilities and limitations of ChatGPT. I tried two prompts with it which I summarize below with some commentary. Spoiler alert - the 2nd prompt led to a completely wrong answer!"

ChatGPT isn't up to being a tax advisor - yet. But I think future, better versions of ChatGPT or similar AI programs will be incorporated in tax software in the coming years, greatly improving off-the-shelf tax apps.

Duluth nail salon proprietors charged with tax fraud conspiracy - IRS (Defendant names omitted). "From at least 2016 through at least October 2020, the defendants unlawfully conspired with each other and others to defraud the Internal Revenue Service by reporting on their individual income tax returns only the credit card sales, or including a false, nominal amount of cash sales, from their Q Nails and Crystal Nails salons. The defendants also falsely claimed to reside at two different addresses and agreed to divide their three children—with whom they jointly resided—as dependents in order to fraudulently claim head of household status on both of their individual income tax returns."

Cases like this always make me wonder what attracted IRS attention. Was it a cash-discount sign in the salon? Bragging? Or maybe a visit from the IRS secret shopper program? In any case, it's better to just pay the taxes.

It's Mardi Gras! That means it's also National Pancake Day! Extra butter, please.

Make a habit of sustained success.