IRS Achieves Ambitious Phone Service Goal, Advocate Service Says - Lauren Loricchio, Tax Notes ($):

Speaking February 11 during the American Bar Association Section of Taxation meeting, Laura Baek of the IRS Taxpayer Advocate Service said the IRS has met the goal set by Treasury Secretary Janet Yellen in September 2022.

The target has been viewed as ambitious, considering that the agency answered only 11 percent of calls in fiscal 2021, and 13 percent of calls in fiscal 2022.

But increasing the level of phone service means the IRS has to pull employees away from processing correspondence, Baek said. “The IRS has this balancing act with the phones and correspondence — we’ll see how that works,” she added.

IRS Won’t Challenge Passthrough Deduction for Cannabis Operators - Wesley Elmore, Tax Notes:

The IRS has decided not to automatically challenge cannabis business owners’ claims for the section 199A deduction for qualified business income.

Speaking February 10 at an American Bar Association Section of Taxation meeting, Luke Ortner of the IRS Office of Chief Counsel (Small Business/Self-Employed) confirmed that decision, but he explained that when calculating the factors for determining whether a taxpayer is eligible for the deduction, section 280E still comes into play.

When the IRS makes a "decision" like this, it would be helpful if they would maybe put it in writing and post it to their web site, rather than just tell the bar association tax meeting.

New $10 Billion Program for Energy Subsidies Set for Rollout by Treasury Department - Richard Rubin, Wall Street Journal:

The Treasury Department said Monday the government will begin taking applications May 31 for the first $4 billion of the advanced energy program, which is a 30% investment tax credit. It will be available for projects including manufacturing fuel-cell components, adding carbon-capture equipment to existing facilities or processing critical minerals.

...

Unlike more open-ended tax credits where projects qualify for federal subsidies if they meet specified criteria, the tax credits under the advance energy program are capped and awarded through applications, which are vetted by the Treasury and Energy departments.

Va. Legislators OK Changes To Pass-Through Entity Tax - Jaqueline McCool, Law360 Tax Authority ($):

The requirement that a pass-through entity be entirely owned by a person or person eligible to be the shareholder of an S corporation would be removed, according to the bill's fiscal note.

Introduced by Del. Joseph P. McNamara, R-Roanoke, the bill was passed unanimously by the House of Delegates on Jan. 31. The bill now awaits Republican Gov. Glenn Youngkin's signature.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround.

Final word: (Most) state payments not taxable - Bernie Becker, Politico:

The IRS made it official on Friday evening — it won’t be taxing most direct payments that states sent out during 2022.

...

What else could they do? On a practical level, it likely would have been hard for the IRS to suddenly rule that those payments were taxable, even if agency officials truly believed they should be.

Indian government raids BBC offices in wake of documentary critical of Modi - Gerry Shih, Karishma Mehrotra, and Anant Gupta, Washington Post. "Indian tax authorities raided the BBC’s offices and seized its journalists’ phones in a stunning — and apparently retaliatory — move Tuesday against the British broadcaster weeks after it aired a polarizing documentary examining Indian Prime Minister Narendra Modi’s rise and his handling of a deadly 2002 riot."

It's things like this that make people touchy about perceived political bias at the IRS or in state agencies.

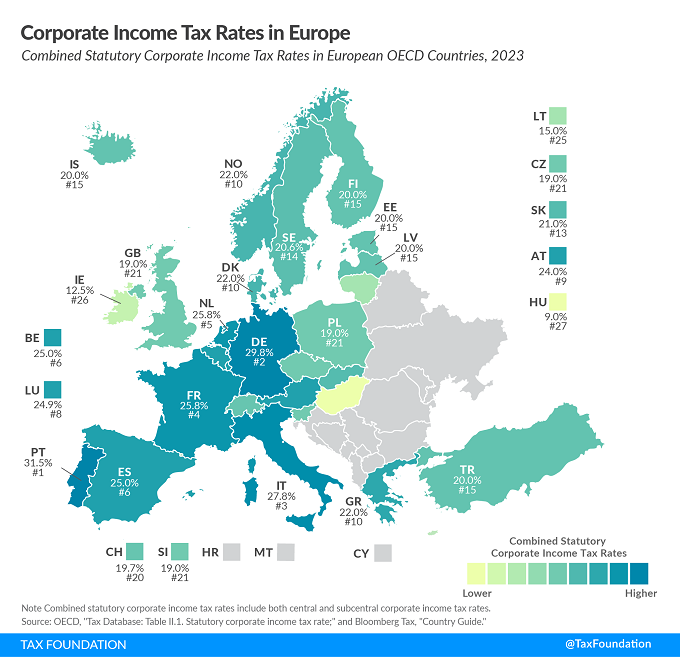

2023 Corporate Income Tax Rates in Europe - Sean Bray, Tax Policy Blog. "Taking into account central and subcentral taxes, Portugal has the highest statutory corporate income tax rate among European OECD countries, at 31.5 percent. Germany and Italy follow, at 29.8 percent and 27.8 percent, respectively. Hungary (9 percent), Ireland (12.5 percent), and Lithuania (15 percent) have the lowest corporate income tax rates."

The US federal rate is 21%. The highest U.S. state rate for 2023 is New Jersey's 11.5%, for a combined rate of 30.085%, taking into account the deductibility of state taxes on the federal return. That puts the US on the higher end of corporate rates internationally.

Don’t Let A Scammer Steal Your Happily-Ever-After This Valentine’s Day - Kelly Phillips Erb, Forbes. "While some romance scammers use dating apps like Bumble and OkCupid to target those looking for love, most start with unexpected direct messages on social media. In fact, 40% of people who reported being victims of a romance scam last year said the contact began on social media, compared to 19% from a dating website or app. Of those who signaled that the fraud started on social media, 29% began on Instagram, and 28% got started on Facebook—about 40% of those conversations then moved to other apps like WhatsApp, Google Chat, or Telegram."

Reporting Super Bowl and other gambling winnings on IRS Schedule 1 - Kay Bell, Don't Mess With Taxes. "If you were part of this new betting record and cashed in, enjoy your added dough. Remember, though, that Uncle Sam gets to share in your good luck."

IRS Issues Annual Vehicle Depreciation and Lease Inclusion Amounts for 2023 - Parker Tax Pro Library. "The IRS issued its annual guidance providing (1) tables of limitations on depreciation deductions for owners of passenger automobiles (which includes trucks and vans) first placed in service by the taxpayer during calendar year 2023; and (2) a table of amounts that must be included in income by lessees of passenger automobiles first leased by the taxpayer during calendar year 2023."

IRS Regulations Lowest in 24 Years - International Tax Blog. "...the number of pages published in 2022 was the lowest it has been since 1997. In 1997, the IRS published 1,071 pages in the Federal Register, and in 2022 the IRS published 1,097 pages."

Unscrupulous Return Preparers Draw Attention At The ABA Tax Section Midyear Meeting - Leslie Book, Procedurally Taxing. "Among the tax community the almost universal support for mandatory continuing education and licensing for unenrolled preparers is met by IFJ’s claim that the IRS’s licensing, testing and education regime would have put some mom and pop preparers out of business or resulted in higher taxpayer preparation costs. IFJ also was skeptical that the regime would have an impact on improving the quality and accuracy of the returns."

"IFJ" stands for the Institute For Justice, an organization that has fought increased IRS control over preparers.

The Zahawi Affair: How A Tax Blogger Took Down A Chancellor - Robert Goulder, Forbes. This story tells how a blogger bought down a UK party chairman:

What happened next is a delicate matter. Neidle was contacted by lawyers from the U.K. firm Osbourne Clarke, which represented Zahawi. They urged him to retract commentary on his blog relating to accusations that Zahawi lied about his taxes, saying that those remarks crossed the line of propriety.

Neidle did the smart thing, requesting that Zahawi’s lawyers present their demands for retraction in written form, which they did. Neidle received their back-off letter and soon published it on his blog for all to see. Zahawi’s lawyers wanted the letter be kept confidential. You have to love the gumption: You must keep quiet about our efforts to keep you quiet about our client.

The story explains how much more unfriendly UK free speech rules are to bloggers and reporting in general, and how an intrepid tax blogger prevailed anyway. It also highlights the phenomenon of "Strategic Lawsuits Against Public Participation," which is how rich and powerful people who don't like unfriendly reporting use the expense of lawsuits to silence reporters and critics. In the U.S., some states are better than others.

Old Blog Posts Can Be Used As Evidence, Tax Court Says - Anna Scott Farrell, Law360 Tax Authority ($). "A California woman's blog posts were justifiably used by the IRS during her trial challenging her overdue tax bill, the U.S. Tax Court said Monday, rejecting the woman's argument that the posts were inadmissible because they weren't newly discovered evidence."

The case is an "innocent spouse" case, where a taxpayer who filed a joint return is looking to avoid taxes and/or penalties related to misreporting by a spouse. To prevail, taxpayers must demonstrate that, in the words of Tax Court Judge Toro, "taking into account all of the facts and circumstances, it is inequitable to hold that spouse liable..." These cases typically turn on specific facts, such as how much financial information the not-so-innocent spouse shared with the others, whether there was an abusive relationship, whether the would-be innocent was unsophisticated financially, and whether it should have been obvious that income wasn't being reported.

The taxpayer and her husband filed returns for 2012-2014, but didn't pay all the tax shown on the returns. The taxpayer claimed innocent spouse status, which the IRS denied. Once the case reached Tax Court, the IRS asked to use taxpayers old blog posts. From the Tax Court Opinion (taxpayer name omitted, my emphasis):

Because both parties wanted the Court to consider testimony and other evidence that was not part of the administrative record, we tried the case in San Francisco on April 4, 2022. At the trial, the Commissioner proposed to introduce into evidence Exhibit 13–R, consisting of a series of posts from Ms. Taxpayer's personal blog. The first post included in the Exhibit is dated November 2, 2016, and the final post is dated January 5, 2022. The contents of the posts are relevant because they reflect information about Ms. Taxpayer's assets, lifestyle, and business, as well as her relationship with Mr. Taxpayer. Ms. Taxpayer discussed the blog during her direct testimony, and, although the Commissioner did not directly question Ms. Taxpayer about specific blog posts during cross-examination, some of the Commissioner's cross-examination questions relied on matters addressed in the blog posts.

The Tax Court, in an opinion reviewed by the full court, ruled that the old blog posts are "newly discovered" under the tax law, and the IRS could use them in the case.

Tax Court maven Lew Taishoff weighs in with Bloggers First: "Judge Buch (in a concurring opinion) points out with vivid illustrations how an innocent blogger-spouse can be sandbagged. If she blogs about how the nonrequestor beat her up, but doesn’t put in the blogposts, they can’t be 'newly discovered' on the Tax Court trial de novo. On the other hand, an abused spouse, terrified by the abuser, may post all kinds of wonderful stuff that IRS can use to sink him or her."

The Moral? Anything you blog can and maybe will be used against you in Tax Court, so blog discreetly. Same goes for any social media content you generate.

Happy Valentines Day! It's also National Donor Day: "By donating organs such as corneas, tissue, marrow, platelets and blood; you create a living legacy of your generosity with the ultimate gift of love."

Make a habit of sustained success.