Key Takeaways

- State taxes make Amazon vendors wish they had read the fine print.

- California judge blocks state's attempt to bypass PL 86-272 with "underground regulations."

- State revenue declines - disaster, or normalcy?

- Only five income tax states haven't passed a SALT cap workaround pass-through entity tax.

- Shohei's (maybe) California tax planning.

- Connecticut taxes Massachusetts company cars.

- Indiana goes after non-qualified option exercise.

- Iowa PTET election.

- Iowa sales tax for business computers ending.

- Massachusetts hits non-resident's stock sale.

- NY LLC owner publicity bill goes to governor.

- Ohio weed tax in limbo.

- Pennsylvania gets with the grantor trust program.

- Crowdfunding in Washington.

- Farmland preservation in Wisconsin.

- 250 years letter, lessons from the Boston Tea Party.

Welcome to this edition of our state and local tax roundup. Remember Eide Bailly for your state and local tax planning, compliance, and incentive needs.

The High Cost of Untaxed Sales - Paul Jones, Tax Notes. An excellent story about how merchants who didn't read the fine print on their agreements with Amazon ended up with surprise sales tax liability:

Some merchants that used Amazon's fulfillment service before the adoption of state marketplace facilitator laws were surprised to learn that they were exposed to thousands of dollars in sales and use tax liabilities.

Many of those third-party sellers, which include midsize independent businesses, small retailers with a few employees, and individuals who sold from their homes, only discovered the liability when states identified and pursued them for uncollected taxes.

What happened? Amazon stored vendor inventory in warehouses in states where they didn't otherwise have any presence, potentially exposing them to sales and income taxes:

Amazon’s fulfillment subsidiary moved sellers’ goods into its fulfillment centers all over the U.S. before sale, which ensured quick delivery but also created inventory nexus in those states, a concept that many sellers didn’t understand at the time. Using the FBA service created unprecedented new nexus for many businesses with no experience in complying with multistate sales and use tax obligations, and exposed them to other tax liabilities.

These tax risks were outlined in Amazon's agreements with the vendors "in a services agreement that largely protected the company and that sellers often didn’t understand or read."

The article says California and Washington have been notably eager to go after the vendors.

Calif. Judge Moots State's P.L. 86-272 Biz Tax Shield Guidance - Maria Koklanaris, Law360 Tax Authority ($):

California's guidance that disqualifies many internet activities from the protections of the 1959 federal law that insulates businesses from tax on net income when soliciting tangible personal property orders is their only connection to a state is void, a state judge ruled.

...

Instead of going through the regulation process, the FTB put out the guidance, which conforms to a Multistate Tax Commission statement, in a memo. The MTC's statement concerns how states could apply the 1959 federal law, commonly known as P.L. 86-272, in the internet age. As such, the guidance brings in a host of new activities that the law would not protect. It is advisory, not binding, even on MTC member states.

Some background:

Panelists: ACMA Challenge Could Affect of P.L. 86-272 Guidelines - Christopher Jardine, Tax Notes ($):

The American Catalog Mailers Association's (ACMA) challenge to California's guidance limiting out-of-state internet retailers’ protection under P.L. 86-272 could tamp down on states using “underground regulations” to adopt interpretations of the law, according to panelists at New York University's Institute on State and Local Taxation.

...

In February 2022 the California Franchise Tax Board issued TAM 2022-01, which is based on the Multistate Tax Commission’s August 2021 update to its P.L. 86-272 guidance. The guidance outlined a variety of fact patterns in which California believes out-of-state internet retailers that have nexus with the state lose P.L. 86-272's protections and so are required to file returns and pay state income tax...

States love to tax out-of-state businesses, as they don't vote or have in-state voting employees. Even if they bend the rules to do so, the state revenue departments have home-field advantage if it goes to state court. It didn't pay off for California here, but it may on appeal.

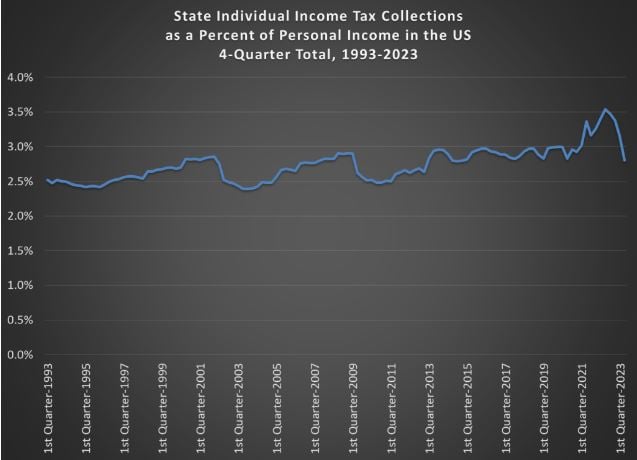

State Tax Revenue is Down a Lot in 2023 (but really just back to normal levels) - Jeremy Horpedahl, Economist Writing Every Day.

State tax revenue is down a lot since last year. The latest comparable data from Census’s QTAX survey is for the 2nd quarter of 2023, and it shows a massive hit: state tax revenue was down 14% from the same quarter in 2022, which is about $66 billion. Almost all of that decline is from income tax revenue, specifically individual income tax revenue which is down over 30% (almost $60 billion). General sales taxes, the other workhorse of state budgets, is essentially flat over the year.

That’s a huge revenue decline! So, what’s going on? In some states, there has been an attempt to blame recent tax cuts. It’s not a bad place to start, since half of US states have reduced income taxes in the past 3 years, mostly reducing top marginal tax rates. But that can’t be the full explanation, since almost every state saw a reduction in revenue: just 3 states had individual income tax revenue increases (Louisiana, Mississippi, and New Hampshire) from 2022q2 to 2023q2, and they were among the half of states that reduced rates!

States Have Rushed To Enact Pass-Through Taxes, Pros Say - Maria Koklanaris, Law360 Tax Authority ($):

Under such arrangements, owners of pass-through businesses may receive a federal tax deduction and either a state tax credit or an exclusion. In November 2020, the Department of the Treasury and the Internal Revenue Service indicated via a notice that they found such taxes acceptable and said they would issue guidance, although that guidance has still not materialized. A few states had adopted entity-level taxes before the agencies' notice, but after it, the number skyrocketed, the panelists said. They spoke at New York University's Institute on State and Local Taxation, a conference held in New York and online.

The article says Delaware, Maine, North Dakota, Pennsylvania, and Vermont have yet to enact these taxes, designed to work around the $10,000 cap on itemized deductions for state and local taxes.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround.

State-By-State Roundup

California

Shohei Ohtani Signed a $700 Million Contract. He’s Only Getting Paid $2 Million a Year. - Lindsey Adler and Richard Rubin, Wall Street Journal:

Ohtani will take home just $2 million per season over the 10-year span of his contract, which was made official Monday night. In an unprecedented structure, Ohtani will defer $68 million per season until the end of his contract, meaning the Dodgers will pay him $680 million between 2034 and 2043. By the time Ohtani receives his final paycheck from the team, he will be 49 years old.

...

The deferrals will result in tax benefits for Ohtani himself, according to a person familiar with his negotiations. During the first 10 years, he will be subject to state income taxes on his annual $2 million salary in California and other states where the Dodgers play. But by the time he starts receiving the $68 million payments, he may be able to avoid state income taxes by living someplace like Florida without an income tax, or by moving back to Japan.

There's always a tax angle. Tax planning is easier if you don't need 97% of your salary right away, and your employer is willing to work something out.

Connecticut

Conn. Justices Uphold Tax On Out-Of-State Company Cars - Law360 Tax Authority. "The Connecticut Supreme Court on Wednesday upheld a tax charged on a Massachusetts construction company's vehicles parked overnight at the owner's home in the Nutmeg State, reasoning that the levy doesn't lead to unconstitutional double taxation because each jurisdiction is collecting revenue on the cars for a different reason."

Link: ALICO, LLC, ET AL. v. TOWN OF SOMERS ET AL.

Indiana

Indiana DOR: Taxpayer's Exercise of Nonqualified Stock Options Subject to Tax - Emily Hollingsworth, Tax Notes ($). "The taxpayer had lived in Indiana and worked for an Indiana-based employer until moving out of state in early 2018. In late 2022 the taxpayer filed a part-year or full-year nonresident individual income tax return form for 2021 and claimed an $83,138 refund of income tax withheld by his former Indiana employer. The DOR reviewed the filing and the Form W-2 statement submitted by the former employer, adjusted the filing, and refunded the taxpayer $45."

Link: 01-20231335.ODR

Iowa

2023 Pass-Through Entity Tax (PTET) Election form now available on GovConnectIowa - Iowa Department of Revenue e-mail:

This PTET election form will only record the entity’s PTET election. The electing entity’s PTET liability will be computed on the Iowa income tax return (IA 1065 or IA 1120S).

PTET election due date for Tax Year 2023 or later. An Iowa PTET election must be made by the due date of the entity’s Iowa income tax return, including extensions. Late elections are subject to rejection by the Department.

Pass-through entities are encouraged to create a GovConnectIowa logon and gain access to their tax accounts. For more information on gaining access to your accounts, visit our GovConnectIowa Help Page.

Taxpayers wanting to ensure 2023 deductions for 2023 Iowa PTET elections may want to make the election by year-end. It appears that the only way to do so is via GovConnectIowa.

Sales and Use Tax Exemption for Purchases of Computers and Computer Peripherals by Certain Entities Ends on December 31, 2023 - Iowa Department of Revenue. "Section 41 of 2022 Iowa Acts, Senate File 2367 strikes the exemption, effective Jan 1, 2024. Therefore, starting January 1, 2024, the purchase of computers and computer peripherals by insurance companies, financial institutions, or commercial enterprises for use in processing or the storage of data or information is subject to Iowa sales and use tax."

Massachusetts

Massachusetts ATB Affirms Income Tax on Nonresident’s Stock Sale - Cameron Browne, Tax Notes ($). "In Welch v. Commissioner of Revenue, the ATB affirmed a $335,969 income tax assessment (including penalties and interest) against a nonresident taxpayer, finding that his gains from the stock sale are sourced to Massachusetts. The opinion, dated November 29, was released December 8."

New York

NY Bill to Unveil Owners Behind LLCs Sent to Governor’s Desk - Danielle Muoio Dunn, Bloomberg ($).

Gov. Kathy Hochul (D) will soon decide whether to make New York the first state to publicly identify the owners behind limited liability companies...

The bill would require LLCs to list their beneficial owners and other identifying information, such as their business street address. The information would be available on a public searchable database, though entities with “significant privacy interests” could apply for a waiver to not appear in it. Those who fail to comply for more than two years would be subject to a $250 penalty and shown as “delinquent” on state records.

This is a broader requirement for LLCs than the federal beneficial ownership rules that take effect next year.

Ohio

Ohio Marijuana Program Details, Tax Rate, Await Lawmaker Action - Angélica Serrano-Román, Bloomberg ($). "Ohio’s House of Representatives adjourned this week without acting on an overhaul of the state’s recreational marijuana law, leaving voter-approved legalization in place but with uncertainty about particulars, including the tax rate when retail sales begin sometime next year."

Pennsylvania

Pa. Lawmakers OK Fed. Conformity For Tax On Grantor Trusts - Zak Kostro, Law360 Tax Authority ($):

Pennsylvania would align with federal tax law by allowing income received by a resident or nonresident trust from in-state sources to be taxable to the grantor of the trust under a bill passed by state lawmakers and headed to Democratic Gov. Josh Shapiro.

...

Under current law, Pennsylvania imposes state personal income tax on grantor trusts based on the same rules as for irrevocable trusts, the fiscal note said, unless the grantor trust is a "wholly irrevocable trust." This means that a grantor trust's beneficiaries are taxed on income that is distributed or credited to them, according to the fiscal note, and the grantor is taxable on the remainder.

The article says Pennsylvania has been the only state that has not followed federal rules taxing grantor trust rules to the grantor. It appears that this change will take effect for 2024, so Pennsylvania's weird old rules apply for one more filing season.

Link: S.B. 815

Washington

Crowdfunding - Washington Department of Revenue:

I am an individual using crowdfunding to raise money for a personal project. Do I need to register with the Department of Revenue (DOR)?

If your annual gross income (funding amount before the host fee is deducted) from crowdfunding is more than $12,000, or you are required to collect sales tax on a reward, then you must register with the department. For more registration information, including additional nexus thresholds, see Apply for a business license.

Wisconsin

Wisconsin Enacts Tax Info Sharing, Farmland Preservation Credit Bills - Paul Jones, Tax Notes ($). "Wisconsin Gov. Tony Evers (D) has approved bills that allow taxpayer information to be shared under specific conditions, increase a tax break for farmland preservation, and provide subsidies for improvements to the Milwaukee Brewers' stadium."

Tax History Corner

What’s the Tea? 250 Years since the Boston Tea Party - Erica York, Tax Policy Blog:

After a few relatively quiet years on the tax front, Parliament passed the Tea Act in 1773 to reduce import taxes on British tea. Why? To give the British East India Company monopoly privileges to sell tea directly to the colonies. (Prior to the Tea Act, the Navigation Acts required nearly all colonial imports and exports to first be artificially routed through Great Britain, which added extra costs.) At the time, nearly two-thirds of the tea imported into the colonies was smuggled to avoid paying taxes. Colonial merchants thrived while the East India Company struggled.

The Tea Act lowered the price of legally imported tea to prop up Britain’s sales—at the expense of colonial merchants.

...

Thus, the Boston Tea Party itself was instigated by a tax decrease. But the broader shift toward higher taxes, particularly internal taxes without representation, that began at the end of the French and Indian War provoked increasing colonial resentment and resistance.

An early application of the timeless law of unintended consequences.

Make a habit of sustained success.