Key Takeaways

- More states ditch transaction counts for sales volume for nexus thresholds.

- NY, other states consider public beneficial ownership data.

- Colorado approves several tax relief measures.

- Minnesota Supreme Court says Revenue Department can change rules without telling anyone.

- Mississippi Gov rejects unfavorable revenue estimates.

- Montana legislatures urge special session.

- Nebraska consumption tax referendum pushed.

- New Hampshire school case may threaten investment income tax elimination.

- New York weed business deductions

- Philadelphia denial of out-of-state tax credit upheld.

- Wisconsin tax cut veto

- Punch cards.

Welcome to this edition of our state and local tax roundup. Remember Eide Bailly for your state and local tax planning, compliance, and incentive needs.

Policymakers Must Weigh the Revenue, Distributional, and Economic Trade-Offs of SALT Deduction Cap Design Options - Garrett Watson, Tax Policy Blog:

Since 2021, congressional policymakers within both parties have considered a wide range of ideas for increasing the SALT deduction cap. For example, the Build Back Better Act introduced in September 2021 proposed increasing the SALT deduction from $10,000 to $80,000. Later that year, Sen. Bernie Sanders (I-VT) floated an idea to increase the SALT cap for taxpayers earning under $400,000. More recently, Rep. Jim Jordan (R-OH) reportedly supported increasing the cap to $20,000 for single filers ($40,000 joint) as part of his bid to become Speaker of the House. While the designs differ, all these proposals would reduce federal revenue, make the tax code more regressive, and lower marginal income tax rates.

...

The revenue consequences of these decisions are large. For example, eliminating the SALT deduction altogether would raise about $2 trillion over 10 years. If the $10,000 cap was made permanent, it would raise about $1.2 trillion from 2026 to 2033. If Congress enacts rules to end state-level SALT cap workarounds, a permanent $10,000 cap would instead raise nearly $1.4 trillion, an 18 percent increase in revenue over 10 years. (This estimate, while uncertain due to limitations in state-level workaround revenue data, is consistent with other estimates on how workarounds impact SALT cap revenue.) A compromise option that would make permanent a more generous version of the cap compared to current law by increasing the amount to $15,000 single ($30,000 joint) would raise $564 billion over 10 years after losing revenue under the current law baseline in 2024 and 2025.

Something big will happen in 2026. We just don't know what yet.

State-by-State Roundup

California

California Sees $68 Billion Deficit on Revenue Plunge - Maxwell Adler and Eliyahu Kamisher, Bloomberg ($):

The projected deficit, which is double the size of last year’s shortfall and the largest in the state’s history, comes after an “unprecedented” downward revision to estimated tax receipts, the state’s Legislative Analyst’s Office said in a report released Thursday. The LAO, as the agency is commonly known, said tax receipts last year fell $26 billion short of earlier estimates and forecast a cumulative $155 billion deficit through 2028.

...

The budget crunch is tied to the state’s wealthiest residents, who contribute half of California’s personal income tax revenue. The aftermath of a 2022 stock market downturn and high interest rates has hit top earners hard, echoing challenges faced during historical market downturns. Because of that reliance on its richest people, California’s economy, which is considered the fifth largest in the world, is sensitive to extreme booms and busts.

Calif. Regs Clarify 'Net Income Tax' For Out-Of-State Biz - Zak Kostro, Law360 Tax Authority ($). "Under the law, the payment of tax to another state generally is eligible for a credit only when the other state's tax is a net income tax, according to the proposed rulemaking notice, whereas a tax imposed on "items other than net income" is not considered a net income tax for purposes of the credit."

Link: 18 CA Code of Regs 18001-2

Georgia

Georgia Will Accelerate Individual Income Tax Cut in 2024 - Matthew Pertz, Tax Notes ($). "Georgia Gov. Brian Kemp (R) announced that the state's 2024 income tax rate will be reduced to 5.39 percent, a full 0.1 percentage point lower than originally scheduled."

Georgia Governor Wants to Fast-Track Income Tax Reduction Plan - Angélica Serrano-Román, Bloomberg ($). "The new proposal aims to amend last year’s income tax cut law (HB 1437), which called for reductions of 10 basis points in the income tax rate, starting in tax year 2025, until the rate reaches 4.99%. Under Kemp’s plan, these cuts will begin in tax year 2024, lowering the rate to 5.39% instead of the previously planned 5.49%. The tax rate for 2023 stands at 5.75%."

Iowa

Iowa extends deadline for 2022 PTET elections - Iowa Department of Revenue

The Department has extended the deadline to make a Pass-Through Entity Tax (PTET) election for tax year 2022 from January 2, 2024 to April 30, 2024. As a result, a tax year 2022 PTET election must be made by the later of the following dates:

-April 30, 2024, or

-The due date for filing the 2022 IA 1065 or 2022 IA 1120S, including extensions.

April 30 is also the deadline for filing 2023 returns.

The Department of Revenue notes that owners of partnerships and S corporations will be unable to claim PTET credits until the entity pays them. Deductions at the entity level are probably unavailable until the year in which a PTET election is made, and in many cases, until the tax is paid.

Michigan

Michigan Court: Solo Audit Doesn't Extend Unitary Group’s Return Deadline - Christopher Jardine, Tax Notes ($):

The statute of limitations for a unitary business group (UBG) was not extended by the audit of one of the group's individual businesses, the Michigan Court of Appeals found.

In a November 30 decision in Soave v. Department of Treasury, the Michigan Court of Appeals affirmed a court of claims decision finding that the audit of the individual business did not extend the statute of limitations for the filing of the UBG’s tax returns under the since-repealed Michigan Business Tax Act, and therefore the returns filed by the business and the UBG for tax years 2008 and 2009 were untimely.

Minnesota

Minnesota DOR: Taxpayer Rebates Are Taxable at the Federal Level - Emily Hollingsworth, Tax Notes ($):

Ryan Brown, media coordinator with the DOR, told Tax Notes on December 6 that the IRS determined that the state’s rebate payments are taxable at the federal level. He said the IRS "stuck with [its] original guidance," referring to Notice 2023-56 on the federal taxation of state refunds and payments, which was issued in August.

Noting that the payments won’t be subject to state income tax, Brown said that the DOR "will be sending Form 1099-MISC to all rebate recipients for them to use when filing their federal individual income tax return in 2024."

Minnesota Golf Course Timely Challenged $2.6 Million Tax Bill - Perry Cooper, Bloomberg ($). "Hollydale Land LLC’s challenge was timely because Hennepin County’s reclassification of the property after the sale prompted a different deadline for suing than applies to typical property tax assessment appeals, Judge Jane N. Bowman ruled Friday, denying the county’s motion to dismiss the suit."

New Jersey

New Jersey Deer Are a Problem. Might an Income Tax Break Help? - Danielle Muoio Dunn, Bloomberg ($). "Even though the state has liberal deer-hunting regulations, access to private land for hunting is challenging, the Fish & Wildlife agency has said. A possible solution? A bipartisan bill, S. 4113, making residents eligible for income tax credits for opening land to hunting in areas with a 'high number of wildlife incidents.'"

Tax credits - is there anything they cant do?

New York

New York City Reenacts Biotech Tax Credit - Emily Hollingsworth, Tax Notes ($). "The bill, approved by the New York City Council November 15, takes effect immediately. The tax credit will be retroactively available to eligible biotechnology companies for tax years beginning on or after January 1, 2023, and before January 1, 2026."

Link: Int. No. 1070A

Washington

Wash. To Provide Biz Tax Break For Newspaper Publishers - Zak Kostro, Law360 Tax Authority ($). "Businesses primarily engaged in the printing or publishing of newspapers or eligible digital content will be exempt from Washington state's business and occupation tax starting Jan. 1, the state Department of Revenue said."

Wisconsin

Wis. Expands Tax Breaks For Farmland Preservation - Michael Nunes, Law360 Tax Authority ($). "A.B. 133, which Democratic Gov. Tony Evers signed Wednesday, increases the tax credit available to property in a farmland preservation zoning district to $12.50per acre from $10 per acre. It also expands the eligibility for farmland preservation tax credits to include land subject to an agricultural conservation easement purchased by the state Department of Agriculture, Trade and Consumer Protection."

Wisconsin Law Criminalizes Possession of Sales Tax ‘Zappers’ - Michael Bologna, Bloomberg ($):

Wisconsin Gov. Tony Evers (D) signed legislation Wednesday imposing criminal penalties for the possession, sale, or manufacture of “zappers,” software applications used by some retailers and restaurants to evade sales and income taxes.

The broad tax administration bill (SB 268), recommended by the Department of Revenue, also includes new authorities to boost the department’s regulation and enforcement of tax laws governing alcohol, tobacco, and the lottery. In a statement, Evers said the effort to modernize state tax laws in the face of new products and tax evasion methods “remains a priority for the safety of consumers, producers, and Wisconsin as a whole.”

Wis. OKs Tax Breaks Meant To Keep MLB Team In Milwaukee - Michael Nunes, Law360 Tax Authority ($):

A.B. 438 was signed into law Tuesday by Democratic Gov. Tony Evers. The law expands a sales tax exemption for building materials to include purchases to improve, repair and maintain American Family Field, which is operated by the Southeast Wisconsin Professional Baseball Park District.

The law also exempts sales of tangible personal property and services to the stadium, according to a report by the Joint Survey Committee on Tax Exemptions. A.B. 438, along with another law signed by the governor Tuesday allocating $411 million to renovate the stadium, are part of a package meant to entice the Major League Baseball team to stay in Milwaukee.

Tax Policy Corner

Personal Property De Minimis Exemptions Slash Compliance Burdens at Trivial Cost - Jared Walczak, Tax Foundation:

All policy choices involve trade-offs—but occasionally, the ratio of costs and benefits is shockingly lopsided. Adopting a de minimis exemption for tangible personal property (TPP) taxes is just such a policy: one which massively reduces compliance and administrative burdens at trivial cost. Taxes on TPP (business machinery, equipment, fixtures, and supplies) are a small but still meaningful part of the property tax base in most states. However, the vast majority of revenue comes from extremely few businesses, while small and medium-sized businesses absorb substantial compliance costs—and local governments face substantial administrative burdens—to remit a few dollars in taxes.

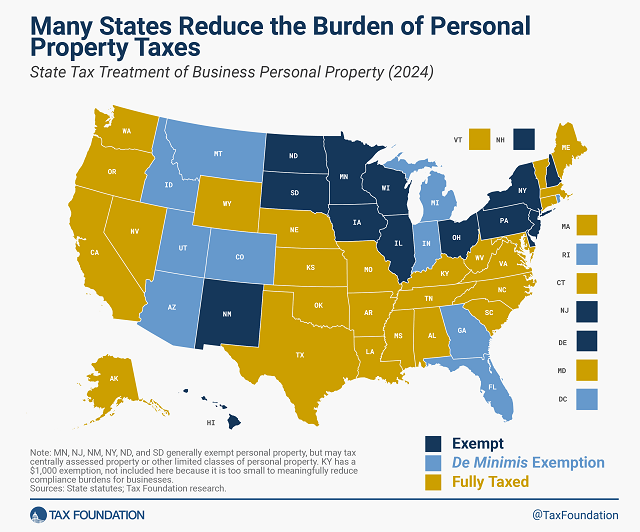

Adopting an exemption for modest amounts of TPP costs governments extremely little, with substantial benefits to taxpayers and tax administrators. Unsurprisingly, such thresholds are catching on in red and blue states alike. Twenty-four states and the District of Columbia either broadly exempt TPP from taxation (14 states) or provide an exemption for small businesses with little tangible property (10 states and the District of Columbia

Tax History Corner

Iowa's star turn in corporate income taxation. Once upon a time, taxable income was generally apportioned among states based equally on sales, property and payroll. Iowa changed all that.

A 2005 Tax Foundation piece explains:

In 2005 at least 8 states considered adoption of single-sales apportionment formulas. This legislation is popular with state lawmakers as a means to boost in-state investment, since the formula allows companies to invest in physical plants, machinery and labor without increasing their corporate tax burden. If a company has 10 percent of its sales in, say, Iowa, it will pay tax on 10 percent of its income in Iowa.

As I wrote last week, however, the Commerce Clause requires a state to fairly apportion income. Does single-sales factor apportionment meet this requirement? The Supreme Court answered ‘yes’ in the case of Moorman Manufacturing Company v. Bair.

For years, Iowa justified its highest-in-the-nation corporation income tax rate on the grounds, basically, that "yes, but we have single-factor apportionment." Now that 32 states have adopted single factor (Massachusetts just this year), that argument carries less weight.

Make a habit of sustained success.