Key Takeaways

- ERC Repayment Plan is a thing

- Analysis of tax bills past

- Big 3, Big $

- Future Tax Plans

- Coming State Tax Changes

- FinCEN and BOI

- Whistle blowing for free

The Tax News & Views Roundup will be on hiatus after today until December 27th. For those who are celebrating the upcoming holiday, we wish you happy holidays. To those who are not celebrating, we wish you a great weekend and a perfect beginning to your week.

IRS Launches Employee Retention Credit Disclosure Program – Asha Glover, Law360 Tax Authority ($):

Businesses that believe they received employee retention credits they weren't entitled to will be required to repay only 80% of the claim if they are accepted into a voluntary disclosure program launched Thursday by the Internal Revenue Service.

Employers who are accepted into the program won't be required to reimburse any interest the IRS paid on their erroneous employee retention credit, IRS Commissioner Daniel Werfel told reporters during a call Thursday. Those who are unable to repay 80% of the credit may be considered for an installment agreement, but they will be required to pay penalties and interest when entering into that agreement, the IRS said in a statement.

Why only repay 80%?

IRS Launches ERC Voluntary Disclosure Program – Lauren Loricchio, Tax Notes ($):

IRS Commissioner Daniel Werfel told reporters December 21 that the IRS understands “that there are many employers eager to correct their error but remain concerned about their ability to pay back the portion of the credit that has been lost to the promoters that brought them into this mess.”

Under the program, businesses that opt in can keep 20 percent of the credit they claimed in case they paid a contingency fee to a promoter. Businesses that participate won’t be charged interest or penalties on the credits they repay, unless they can’t pay 80 percent of the credit at the time they sign their closing agreement, in which case they will have to pay the penalties and interest associated with entering into an installment agreement.

As part of an ongoing initiative aimed at combating dubious Employee Retention Credit (ERC) claims, the Internal Revenue Service today launched a new Voluntary Disclosure Program to help businesses who want to pay back the money they received after filing ERC claims in error.

The new disclosure program, which has been in the works for several months, is part of a larger effort at the IRS to stop aggressive marketing around ERC that misled some employers into filing claims. The special disclosure program runs through March 22, 2024, and the IRS added provisions allowing repayment of 80% of the claim received.

Eligibility could be an issue:

ERC voluntary disclosure program requiring 80% claim payback launched - Martha Waggoner, Tax Adviser:

Not all businesses are eligible for the program. Those that are ineligible include employers under criminal investigation, those under an IRS employment tax examination for the tax period for which they are applying to the program, and those that have received an IRS notice and demand for repayment of all or part of the ERC.

Also ineligible for the program are businesses for which the IRS has received information from a third party that the taxpayer is not in compliance or for which the IRS has acquired information directly related to the noncompliance from an enforcement action.

Good question:

IRS Launches Voluntary ERC Repayment Program with March 22, 2024 deadline – Joe Kristan, Eide Bailly:

Tonya Rule, an Eide Bailly partner who has shepherded many successful ERC claims through the process, wonders whether the program will be effective in reaching taxpayers who have made bad ERC claims. "They think they qualify because the ERC mill told them they qualify, so why would they pay it back?"

IRS Issues Proposed Rules on Clean Hydrogen Production - Erin Slowey, Bloomberg ($):

The IRS and Treasury Department released highly anticipated proposed rules Friday for the tax credit for clean hydrogen production.

The Democrats’ Inflation Reduction Act created a tax credit for hydrogen producers—paying as much as $3 per kilogram of clean hydrogen produced over 10 years.

The document is here.

JCT Issues Blue Book After Several Delays – Kristen Parillo, Tax Notes ($):

The Joint Committee on Taxation has released its long-awaited blue book addressing all tax provisions passed during the 117th Congress, a busy period that included enactment of the corporate alternative minimum tax and the stock buyback excise tax.

After several months of delay, the December 21 release of the blue book (JCS-1-23) fulfilled the JCT’s goal of getting it out before the end of 2023. Jared Hermann, legislation counsel for the JCT, said in September that it was taking longer than usual to prepare the book because of the breadth of tax legislation passed during the 117th Congress.

The document is here.

Speaking of Congress and taxes, lawmakers left D.C. without addressing tax concerns (R&D expensing, expanding the 163(j) interest deduction, upping Bonus Depreciation to 100%, and enlarging the Child Tax Credit). The true cost of these provisions might have had a hand in lawmakers not doing anything about them.

Potential Tax Deal Could Cost $830 Billion – Committee for a Responsible Federal Budget:

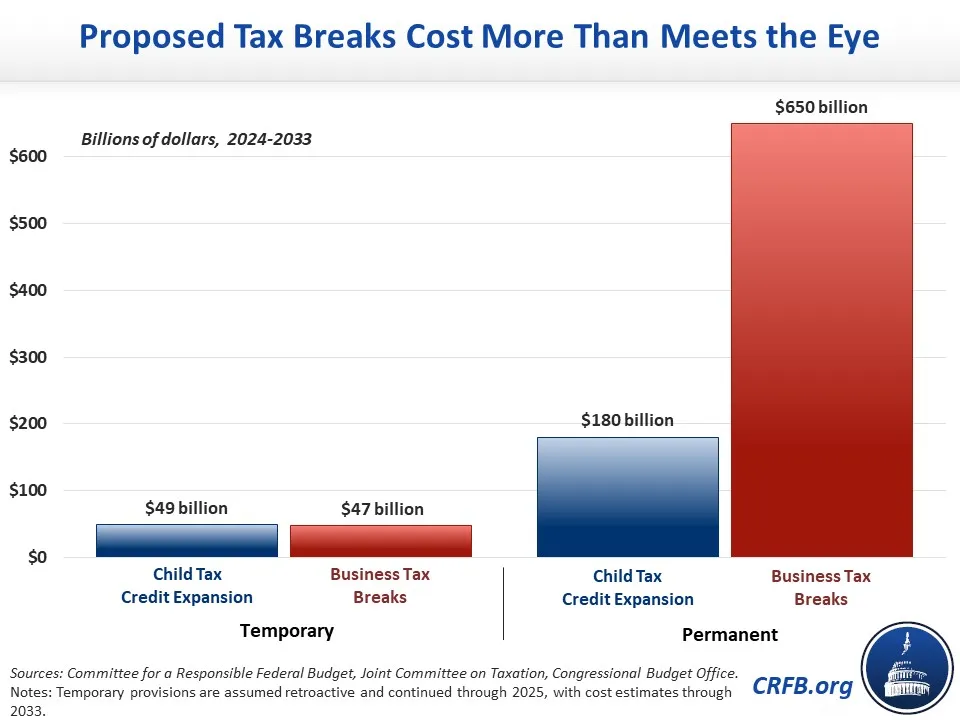

As Congress nears important policy deadlines, some lawmakers view the deadlines as opportunities to enact costly tax cuts. Policymakers are reportedly negotiating an expansion of the Child Tax Credit (CTC) in exchange for the revival of three business tax breaks that have adjusted or are phasing out under the Tax Cuts and Jobs Act (TCJA). While the costs of these policies are expected to total about $100 billion as written, we estimate the policies under consideration would cost $830 billion through 2033 if arbitrary sunsets are removed and the policies are made permanent. Nearly four-fifths of this cost would be for business tax breaks, and about one-fifth for the expanded child tax credit.

How 2023 set the stage for major tax fights to come in the new year - Laura Weiss, Punchbowl News ($):

We’ll just say it — 2023 wasn’t a great year for tax policy. But there’s hope for all you tax lovers out there.

The groundwork that lawmakers laid this year, along with some big deadlines on the horizon, could make 2024 a busy period in tax land. What happens in the new year will set up landmark legislative efforts to address a pile of tax policies that expire after 2025.

Recent Recap:

Capitol Hill Recap: Tax Bill Put on Ice – Jay Heflin, Eide Bailly:

Congressional tax lawmakers and staff have repeatedly said in closed-door meetings (i.e., no press allowed) that the focus in 2024 will be on examining the expiring TCJA (Tax Cuts and Jobs Act) tax reform provisions and decide what stays and what goes.

Offsets will likely be a big part of the TCJA discussion and could include a new form of taxation. Then, in 2025, Congress would vote on the tax legislation. That’s the current plan.

Of course, plans change, especially in Congress, which is nothing if not inconsistent.

House Panel Wants To Question Werfel Over 1099-K Delay – Jared Serre, Law 360 Tax Authority ($). “The House Ways and Means Committee called on IRS Commissioner Daniel Werfel on Thursday to testify regarding the agency's delay in implementing new Form 1099-K reporting thresholds for third-party payment platforms.”

State Tax Changes Taking Effect January 1, 2024 – Manish Bhatt and Benjamin Jaros, Tax Foundation:

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both). Generally, state tax changes take effect either at the start of the calendar year (January 1) or the fiscal year (July 1 for most states), with rate changes for major taxes typically implemented effective January 1—either prospectively, as in these cases, or retroactively, as may happen under legislation enacted in the new year.

The past several years have seen a wave of significant tax reforms, including rate reductions and tax cuts, as states emerged from the pandemic with revenue surpluses and stared down inflation. Whether and how this trend continues is yet to be seen, but evidence from the past three years indicates that many states understand and value the importance of creating and maintaining a stable, pro-growth, and competitive tax code.

State Income Tax Rate Changes (Top Marginal Rates, 2023 and 2024)

| State | Personal Income Taxes | Corporate Income Taxes | ||

|---|---|---|---|---|

| 2023 | 2024 | 2023 | 2024 | |

| Arkansas | 4.90% | 4.40% | 5.30% | 4.80% |

| California | 13.30% | 14.40% | ||

| Georgia | 5.75% | 5.49% | ||

| Indiana | 3.15% | 3.05% | ||

| Iowa | 6% | 5.70% | 8.40% | 7.10% |

| Kentucky | 4.50% | 4.00% | ||

| Kansas | 4% | 3.50% | ||

| Michigan | 4.05% | 4.25% | ||

| Mississippi | 5% | 4.70% | ||

| Montana | 6.75% | 5.90% | ||

| Nebraska | 6.64% | 5.84% | 7.25% | 5.84% |

| New Hampshire* | 4.00% | 3.00% | ||

| New Jersey | 11.50% | 9% | ||

| North Carolina | 4.75% | 4.50% | ||

| Ohio | 3.99% | 3.50% | ||

| Pennsylvania | 8.99% | 8.49% | ||

| South Carolina | 6.50% | 6.40% | ||

States Seek to Extend Tax Codes Beyond ‘Water’s Edge’ in 2024 - Michael Bologna, Bloomberg ($):

A half-dozen states next year may pursue legislation aimed at collecting taxes from multinational corporations that use accounting techniques to shift their earnings offshore.

Most states’ corporate tax rules stop at the “water’s edge,” but a push for mandatory worldwide combined reporting could allow revenue agencies to collect taxes based on global income attributable to their particular jurisdiction.

FinCEN Finalizes Access Rule for Beneficial Ownership Reporting – Kiarra Strocko, Tax Notes ($):

Treasury’s Financial Crimes Enforcement Network has finalized a rule implementing access and safeguard provisions related to beneficial ownership information (BOI) reporting, ensuring that authorized recipients can effectively use the information, subject to confidentiality requirements.

The final rule (RIN 1506-AB59), published December 21, expands on the purposes for which financial institutions may use BOI, streamlines access requirements for law enforcement agencies, and makes other clarifications and technical revisions. FinCEN said the final rule “reflects FinCEN’s commitment to creating a highly useful database for authorized BOI recipients while protecting this sensitive information from unauthorized disclosure.”

FinCEN Issues Final Rule Regarding Access to Beneficial Ownership Information – FinCEN.

[T]he U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) took another major step in support of U.S. Government efforts to crack down on illicit finance and enhance corporate transparency by issuing a final rule that establishes the framework for access to and protection of beneficial ownership information (BOI). Issued pursuant to the bipartisan Corporate Transparency Act (CTA), this final rule prescribes the circumstances under which BOI reported in compliance with FinCEN’s September 30, 2022 final BOI Reporting Rule may be disclosed to Federal agencies; state, local, tribal, and foreign governments; and financial institutions, and how it must be protected. FinCEN will also issue today two interagency statements to give banks and non-bank financial institutions guidance on the interplay between the final rule and FinCEN’s existing Customer Due Diligence Rule.

A big year for the BSA – Zachary Warmbrodt, Politico Morning Money:

[House Financial Services Chair Patrick] McHenry is calling on the administration to delay the reporting requirement’s Jan. 1 launch, in part because “millions of small business owners remain unaware of their beneficial ownership reporting obligations.” Dozens of other House and Senate Republicans have also called for a delay.

Treasury is well aware of the daunting public awareness challenge before it. A FinCEN official told MM that one of the agency’s main priorities is educating business owners and that critical to that effort will be a “robust public outreach campaign.” The official acknowledged that many business owners have never heard of FinCEN.

[T]he OECD/G20 Inclusive Framework on BEPS (Inclusive Framework) released further technical guidance to assist governments with implementation of the global minimum tax under Pillar Two and a statement on the timeline of the Multilateral Convention (MLC) under Pillar One.

The Agreed Administrative Guidance for the Pillar Two GloBE Rules (December 2023) released today supplements the Commentary to the Global Anti-Base Erosion Model Rules in order to clarify their application, including guidance on the application of the Transitional Country-by-Country Reporting Safe Harbour and a mechanism for allocating taxes arising in a Blended Controlled Foreign Corporation (CFC) Tax Regime when some of the jurisdictions the MNE operates in are eligible for the safe harbour.

Corporate AMT Draft Form, Instructions Debut at IRS – Chandra Wallace, Tax Notes ($):

The seven-page form includes separate parts for determining applicable corporation status — that is, whether a corporation or corporate group is subject to the tax — and calculating the tax, with subsections addressing adjustments to financial statement income, foreign tax credits, and foreign-parented multinational groups.

The draft instructions include worksheets for determining the pro rata shares of income and loss attributable to controlled foreign corporations — a matter addressed in the IRS’s most recent interim guidance on the corporate AMT (Notice 2024-10, 2024-2 IRB 1), released December 15.

From the “None For You” file:

IRS Whistleblower's Info No Big Deal, Tax Court Says – Jared Serre, Law360 Tax Authority ($):

The contributions that an Internal Revenue Service whistleblower made to the pursuit of three nonfilers do not warrant a reward, the U.S. Tax Court ruled Thursday.

Although the IRS routinely sought the assistance of the unnamed whistleblower while investigating employees of her former company, the record did not indicate that any of the information was used in the prosecution of the three individuals, Tax Court Judge Emin Toro wrote in an opinion.

Happy National Date Nut Bread Day! Toast it, add butter, and eat with coffee. Magnificent!

Make a habit of sustained success.