Key Takeaways

- The tax advantages of deferring 97% of your salary.

- "The IRS is struggling to catch fraudulent ERC claims as they come in."

- All bug five income-tax states have pass-through tax SALT cap workarounds.

- IRC proposes foreign tax credit rules for OECD minimum taxes.

- IRS looking for AI operations platform.

- Malta criminal investigation walked back?

- House GOP gunning for IRS guns.

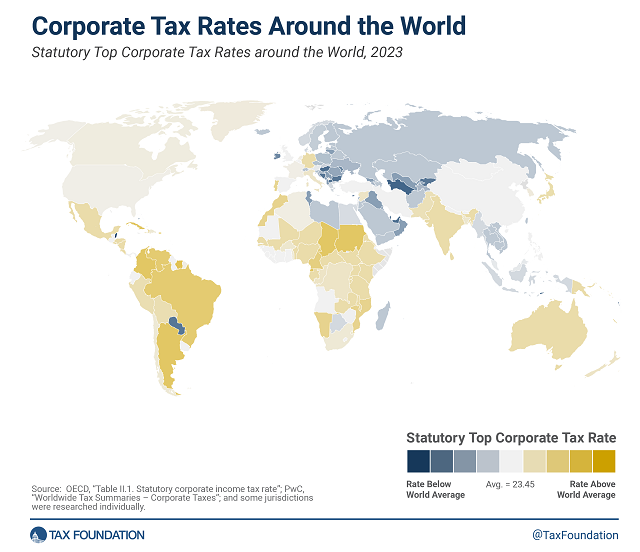

- Worldwide corporate tax rates.

- Student athletes, NIL deals, and taxes.

- IRS top-10 criminal cases.

- Romance scammer nets big bucks, faces big house time.

- Gingerbread House Day.

Shohei Ohtani Signed a $700 Million Contract. He’s Only Getting Paid $2 Million a Year. - Lindsey Adler and Richard Rubin, Wall Street Journal:

Ohtani will take home just $2 million per season over the 10-year span of his contract, which was made official Monday night. In an unprecedented structure, Ohtani will defer $68 million per season until the end of his contract, meaning the Dodgers will pay him $680 million between 2034 and 2043. By the time Ohtani receives his final paycheck from the team, he will be 49 years old.

...

The deferrals will result in tax benefits for Ohtani himself, according to a person familiar with his negotiations. During the first 10 years, he will be subject to state income taxes on his annual $2 million salary in California and other states where the Dodgers play. But by the time he starts receiving the $68 million payments, he may be able to avoid state income taxes by living someplace like Florida without an income tax, or by moving back to Japan.

There's always a tax angle. Tax planning is easier if you don't need 97% of your salary right away, and your employer is willing to work something out.

Tax Pros Are Reading Further and Further Into ERC Moratorium - Nathan Richman, Tax Notes ($):

The IRS’s moratorium on processing new ERC claims says three things, according to Daniel N. Price of the Law Offices of Daniel N. Price PLLC.

First, the unprecedented halt in processing shows that for all its data analytical might, the IRS is struggling to catch fraudulent ERC claims as they come in — as it attempts now with stolen identity tax returns — rather than on audit, Price said December 9 at a conference in Las Vegas sponsored by the American Bar Association Section of Taxation.

Second, the moratorium implies the IRS has no better ideas for dealing with the bad claims, and third, it represents a departure from the agency’s core mission by halting good and bad claims together, Price said.

"All it's data analytical might" paints a picture of a more technically advanced IRS than may actually exist.

States Have Rushed To Enact Pass-Through Taxes, Pros Say - Maria Koklanaris, Law360 Tax Authority ($):

Under such arrangements, owners of pass-through businesses may receive a federal tax deduction and either a state tax credit or an exclusion. In November 2020, the Department of the Treasury and the Internal Revenue Service indicated via a notice that they found such taxes acceptable and said they would issue guidance, although that guidance has still not materialized. A few states had adopted entity-level taxes before the agencies' notice, but after it, the number skyrocketed, the panelists said. They spoke at New York University's Institute on State and Local Taxation, a conference held in New York and online.

The article says Delaware, Maine, North Dakota, Pennsylvania, and Vermont have yet to enact these taxes, designed to work around the $10,000 cap on itemized deductions for state and local taxes.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround.

IRS Details Meshing of Foreign Tax Credit, OECD Minimum Tax - Michael Rapoport, Bloomberg ($):

Under Monday’s guidance, qualified domestic minimum top-up taxes, or QDMTTs—one of the key types of taxes expected to be imposed under the new minimum tax regime—will generally qualify for the foreign tax credit. QDMTTs are a version of the minimum tax that a country will apply within its own borders, thus bringing companies paying less than 15% up to the minimum level.

Taxes imposed under Pillar Two’s income inclusion rule, or IIR, would generally not be eligible for the foreign tax credit, however. Under the IIR, the country where a company is headquartered would bring the company’s rate up to 15%—so if it were creditable, it would amount to allowing the foreign tax credit to be used for taxes already being paid to the US.

Related: Eide Bailly International Business Structuring.

IRS Looks to Procure AI Operations Platform - Lauren Loricchio, Tax Notes ($). "While the RFI doesn’t provide many hints about how the IRS is using AI, the agency announced in September that it had used AI to identify 75 partnerships for audit. The agency also stated in a July 6 performance work statement that 'supervised and unsupervised algorithms have various applications across the IRS,' including in the Criminal Investigation, Large Business and International, and Small Business/Self-Employed divisions."

Wealthy Targets of IRS Malta Probe Get Letters Walking It Back - Michael Bologna, Bloomberg ($).

The IRS has rescinded some criminal summonses from its crackdown on Malta pension plans, raising questions about whether the agency is backing off or retooling its aggressive campaign targeting the offshore tax schemes.

...

The withdrawal letters come one month after Bloomberg Tax published a broad examination of the marketing of Malta pension plans by a small group of wealth advisers and law firms. The tax schemes assert ambiguous language in a tax treaty with the tiny Mediterranean island nation of Malta and permit millionaires and billionaires to park assets in secretive retirement accounts without the limitations and tax consequences embedded in domestic IRAs.

The Malta retirement scheme has made the IRS "Dirty Dozen" list of list of "the worst tax scams."

House GOP Takes Shot at IRS’s Guns - Jonathan Curry and Doug Sword, Tax Notes ($). "Contrary to rumors of the IRS unleashing 87,000 gun-toting auditors on the nation’s taxpaying public, all guns in the IRS’s possession are held by CI’s roughly 2,100 special agents, who are categorized and trained as federal law enforcement officers. The lone exception, according to the GAO’s report, was the small IRS police force."

Corporate Tax Rates around the World, 2023 - Cristina Enache, Tax Foundation:

Thirteen countries changed their statutory corporate income tax rates in 2023. Six countries increased their top corporate rates: Morocco (31 percent to 32 percent), United Arab Emirates (0 percent to 9 percent), Sri Lanka (24 percent to 30 percent), Turkey (23 percent to 25 percent), Belarus (18 percent to 20 percent) and the United Kingdom (19 percent to 25 percent). In 2023, the United Arab Emirates introduced a federal corporate tax of 9 percent on taxable income above AED 375,000 (USD 102,000). However, the new corporate income tax will not apply to the extraction of natural resources as these activities are already subject to taxation in the Emirates.[4]

Seven countries across four continents—Guinea, South Africa, Bangladesh, the Republic of Korea, Austria, Aruba, and Saint Vincent and the Grenadines—reduced their corporate tax rates in 2023. The tax rate reductions ranged from just 1 percentage point in Austria, the Republic of Korea, and South Africa, to 10 percentage points in Guinea.

Student-Athletes Involved in Name Image Likeness (NIL) Agreements Should Be Aware of Their Tax Obligations - Erin Collins, NTA Blog. "TAS [Taxpayer Advocate Service} has developed and published educational tax resources for student-athletes on our NIL Get Help page to highlight general information, including federal tax reporting, federal tax withholding, estimated tax payment, and return filing requirements associated with NIL income."

3 welcome, and tax-advantaged, holiday gifts - Kay Bell, Don't Mess With Taxes. "1. Open a Roth IRA for a young worker. This is a great way to help out a young relative or friend's child whom you consider family. The young person already is showing financial initiative by getting a job. Here you can help them save tax-free for retirement decades away so that they still have access to all their earnings."

Proposed Regs Address 401(k) Plans for Long-Term Part-Time Employees - Parker Tax Pro Library. "The IRS issued proposed regulations that amend the rules applicable to plans that include cash or deferred arrangements under Code Sec. 401(k) to provide guidance with respect to long-term, part-time employees."

Reasonable Compensation in the New Year - Tom Gorczynksi, Tom Talkes Taxes. "S corporation owners should have reasonable compensation planning as part of their overall tax planning every year, and this year especially due to COVID-19. Many S corporation owners receive poor advice in this area, leading to either very low salaries (where they reduce Social Security benefits and risk recharacterization of distributions as wages) or extremely high salaries (where they overpay payroll taxes)."

IRS Criminal Investigation Counts Down Agency’s Top 10 Cases For 2023 - Kelly Phillips Erb, Forbes. "1. Five Individuals Sentenced To Prison For Billion Dollar Biofuel Tax Fraud Scheme... The basis of the scheme was to create the appearance of biodiesel production and sale to claim tax credits from the IRS. The IRS ultimately paid out more than $511 million in credits to Washakie Renewable Energy ("Washakie"), a Utah biodiesel company owned by Jacob and Isaiah Kingston."

Hunter Biden Criminal Tax Charges Contain Universal Tax Lessons - Robert Wood, Forbes. "Report your income, and always file. You must file a tax return each year with the IRS if your income is over the requisite level. Don’t forget, and don’t be late either, even if you can’t pay what you owe. File anyway, and you can work out payments later. The statute of limitations on audit—usually three years and sometimes six years—can’t even begin to run until you file your return. So file, and remember, the U.S. taxes all income wherever you earn it."

What’s $68 Billion and 1.1% Among Friends? - Russ Fox, Taxable Talk. "That’s the big issue in California: runaway spending. What has the state legislature’s response been: Let’s increase tax rates! Beginning in January, California’s top rate rises to 14.4% (from 13.3%); those in the middle class will see the rate rise from 9.3% to 10.4%. This doesn’t sound like much, but if a family earns $100,000 a year they can save $1,100 by residing in no-tax Nevada "

Romance scammer convicted at trial of money laundering, wire fraud conspiracies - IRS:

According to evidence presented at trial, the fraudsters assumed fake names and trolled dating sites like Match.com and Zoosk, searching for targets.

Once the fraudsters had ingratiated themselves to their often divorced or widowed victims with promises of long-term commitment, the fraudsters concocted elaborate stories about why they needed financial assistance. A common story was that the fraudster had to travel overseas for work and was unable to access a bank account. To solve a work-related crisis or pay for urgent medical treatment for a family member, the fraudster asked the victims to send money to cover the expenses, promising to repay them in the near future. The trusting victims sent thousands of dollars to bank accounts opened by the defendant and her coconspirators in the Northern District of Texas. The defendant then distributed the fraudulent proceeds to coconspirators and claimed a cut for herself.

When Grandpa gets a new online girlfriend, it might be good to get to know her better.

Be sure to obtain proper permits and check local zoning rules. It's Gingerbread House Day!

Make a habit of sustained success.