Key Takeaways

- IRS dishes tax season guidance

- No biggie on IRS doc destruction

- R&D getting crushed

- Government shutdown fiasco; so far taxes a no-show

- AI tax scam concerns

- Commercial real estate bailout?

- What?!?!?

Tax season rapidly approaching: Get ready now to file 2023 federal income tax returns in early 2024 – IRS:

With the nation’s tax season rapidly approaching, the Internal Revenue Service reminds taxpayers there are important steps they can take now to help “get ready” to file their 2023 federal tax return.

This is the first in a series of special IRS “Get Ready” reminders to help taxpayers prepare for the upcoming tax filing season in early 2024. A little advance work now can help people have the paperwork and information ready to file their tax returns quickly and accurately. As part of this education effort, the IRS has a special page outlining items taxpayers can look into now to get ready to file their 2023 tax returns.

Here is a link to the “special page” that the IRS mentions.

Few Payers Penalized After IRS Destruction of Tax Documents - Samantha Handler, Bloomberg ($):

The IRS made the right call in destroying 30 million unprocessed 2019 paper tax documents as it faced backlogs and staffing shortages due to the Covid-19 pandemic, a government watchdog report found.

The agency’s decision to destroy the information returns was reasonable, the Treasury Inspector General for Tax Administration found in a report released Monday. The IRS didn’t have enough staff to process the paper returns in time without delaying other priorities, and processing paper-filed returns wasn’t conducive to the telework environment required by the pandemic, TIGTA said.

Plus, few were affected by it:

IRS destruction of paper returns had little impact – Michael Cohn, Accounting Today. “The Internal Revenue Service's decision to destroy around 30 million unprocessed paper information returns to reduce its backlog during the pandemic probably had little effect on taxpayers, according to a new report.”

The report is here. Plus, wow.

Digital Asset Regs Define 'Broker' Too Broadly, IRS Told – Kat Lucero, Law360 Tax Authority ($):

The IRS' proposed rules for reporting digital asset transactions offer a definition of "broker" that would inadvertently subject a wide swath of cryptocurrency industry participants to new reporting requirements, the agency was told Monday at a hearing on the proposed rulemaking.

The Internal Revenue Service's first-ever regulations on broker reporting for digital asset sales and exchanges, proposed in August, would apply to individuals and businesses not directly involved in the transactions, based on the theory that they indirectly influence the transfer of digital assets, said Lawrence Zlatkin, vice president of tax at CoinBase Global, during the teleconference hearing.

A Few Retrofits for the Proposed IRA Regs – Marie Sapirie, Tax Notes ($):

Real estate was one of the industries Congress wanted to encourage to adopt clean energy technology with the Inflation Reduction Act’s tax credits. And while the proposed regulations on transferability, elective payment, and prevailing wage and apprenticeship rules have helped answer a number of questions related to real estate, some lingering issues need to be addressed…

The real estate industry is figuring out how best to adapt some of its common commercial practices to the new energy tax credits. “There is a bit of tension between the real estate industry and the way it tends to operate and do deals and the existing guidance on tax credits that have primarily been used in the energy industry,” said Jessica Millett of Hogan Lovells.

IRS Proposes Regs For Taxes On Donor-Advised Funds – Anna Scott Farrell, Law360 Tax Authority ($). "The Internal Revenue Service proposed regulations Monday regarding the imposition of excise taxes on certain distributions from donor-advised funds, including a measure that would prevent the contributions of public charities and government organizations from triggering the tax on account holders."

S Corp Guidance From 2013 Covers Missing Shareholder Consents – Kristen Parillo, Tax Notes ($):

An IRS attorney clarified that relief provided under a 2013 IRS revenue procedure isn’t limited to curing late S corporation elections but may also be used to address missing shareholder consents.

Speaking November 13 at the American Institute of CPAs National Tax Conference, Alta Li of the IRS Office of Associate Chief Counsel (Passthroughs and Special Industries) said taxpayers can fix the problem of missing shareholder consents via Rev. Proc. 2013-30, 2013-36 IRB 169, but only if they fall within the lookback window provided under the guidance. That means the request must be made within three years and 75 days of the date the S corporation election was intended to be effective.

Shifting Tax Code Is ‘Crushing’ for Corporate R&D Viability - Caleb Harshberger, Bloomberg ($):

Companies are struggling to adjust to the impacts of recent tax code tweaks that are effectively penalizing research and development work, which in turn is leading to slashed spending or mulling operational moves overseas.

Section 174 of the tax code, as amended by the 2017 tax law, means companies would have to amortize R&D over a number of years rather than deduct them the year they went out, affecting the bottom line of businesses of all sizes, from large corporations to startups.

Misguided Tax Rules Threaten Engineering and Innovation – Chris Anderson, Flathead Beacon:

From clean air and water to safe roads and bridges, engineering and design firms across the United States spearhead the creation of cutting-edge technologies that enhance and advance our future. As the President and CEO of DJ&A, P.C., headquartered Missoula, we are proud of the work we do in civil and environmental engineering to help support communities throughout Montana and beyond.

To continue to meet unprecedented challenges with novel solutions, it’s critical that engineering companies like ours engage in research and development (R&D) to find innovative ways to approach problems old and new. However, a recent change to our tax code is stifling this commitment to R&D and threatening the industry’s collective development to the detriment of our communities.

This tax change, which took effect in 2022, requires businesses to deduct R&D expenses over five years instead of when they occur, leading to devastating tax consequences. This revision in the tax code puts immense financial strain on small engineering firms that innovate while they serve the public.

Somewhat related:

Navigating Changes to the R&D Audit Process - Rich Bernstein, Tax Notes ($). “Relying on the success of your research and development efforts to justify a research credit rather than upgrading your research credit study is getting risky. The IRS’s method of evaluating the research credit has undergone significant changes in the past two years, arising from its attempt to force R&D auditors to use uniform audit methods nationwide.”

Regarding whether the Federal government will suffer a partial shutdown at the end of the week. The current answer is maybe not:

Senate leaders give green light to Johnson stopgap funds plan – David Lerman, Aidan Quigley and Paul Krawzak, Roll Call:

Senate leaders of both parties sent encouraging signals Monday for Speaker Mike Johnson’s two-step stopgap funding measure to avoid a partial government shutdown at week’s end…

The bill by the Louisiana Republican would extend current funding in two phases. Funding for agencies covered by the Military Construction-VA, Agriculture, Energy-Water and Transportation-HUD bills would be extended to Jan. 19, and the agencies covered by the other eight annual appropriations bills would be extended a little longer, to Feb. 2.

IRS funding is in February group.

The House must first approve the measure, which will require Democratic support. The chamber is expected to vote on the measure later today.

The House package does not include taxes, like the ones mentioned above. If the House and Senate approve the spending measure, which would fund the Federal government into next year, it might make it hard to pass tax legislation by year end.

Stopgap funds bill leaves plenty of post-Thanksgiving leftovers – Roll Call:

The House GOP-drafted stopgap funding measure would remove pressure for final decisions on this year’s appropriations bills until early in 2024…

The length of Johnson’s stopgap bill complicates a bipartisan push to get a tax package done by the end of this year because it would mean no broad spending measure to attach it to, according to multiple sources tracking the effort.

Instead, lawmakers could add a potential tax deal to a must-pass bill also left out of the CR: FAA reauthorization, which would already be a revenue measure because it renews federal aviation taxes.

They could also attempt to pass a standalone tax package rooted in a bipartisan, widely supported bill to extend friendly tax treatment to Taiwan, according to some former aides.

Congress Concerned About AI Tax Scam Threats, Staffer Says – Asha Glover, Law360 Tax Authority ($):

Lawmakers from both parties are concerned about the potential security threats artificial intelligence could pose to tax administration, but the Internal Revenue Service has begun taking steps to protect taxpayers from nefarious actors, a senior Senate Finance Committee staffer said Monday.

A chief concern among lawmakers is how AI can be used for tax scams, said Eric LoPresti, a senior attorney on the Senate Finance Committee's tax team. He spoke at a conference hosted by the American Institute of Certified Public Accountants and the Chartered Institute of Management Accountants, held in Washington, D.C., and online.

Tax Credits Could Mitigate Surge In Office Vacancies – Stephen Cooper, Law360 Tax Authority ($):

Amid a surge in commercial office vacancies due to higher interest rates and the ongoing remote work trend, the White House and Congress are exploring ways to use traditional tax incentives, such as credits for affordable housing and renewable energy, as potential solutions to help prevent harm to the market.

Lawmakers, real estate professionals and tax experts are beginning to express concerns about the adverse effects of more vacant commercial properties on the economic well-being of cities and suburbs and the resulting drop in tax revenue needed to provide essential services to residents. However, Congress has not yet prioritized this issue with the same urgency as the residential real estate market crash of 2008.

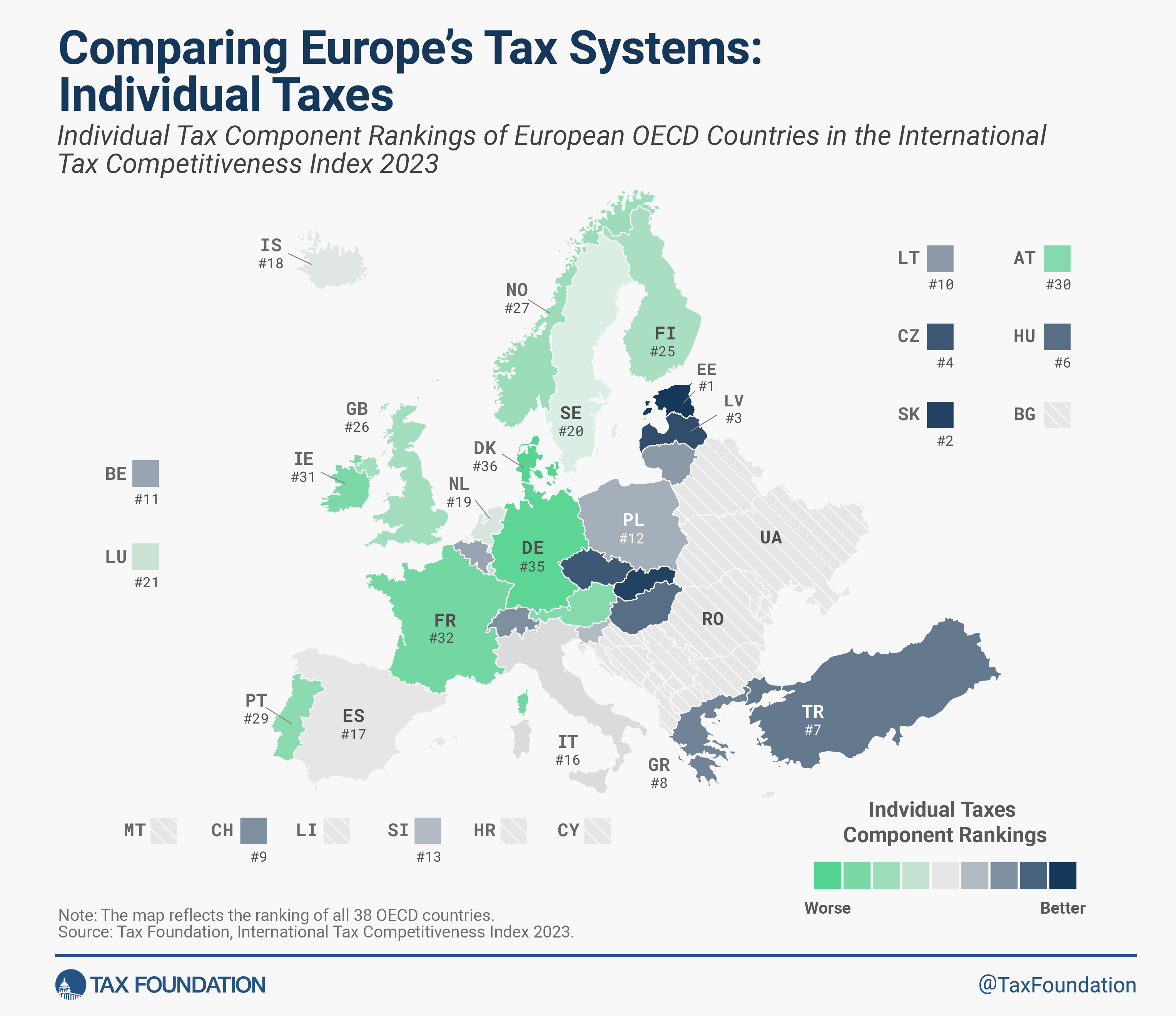

Comparing Europe’s Tax Systems: Individual Taxes – Alex Mengden, Tax Foundation:

The recently published International Tax Competitiveness Index (ITCI) 2023 compares how well OECD countries promote sustainable economic growth and investment through competitive, neutral tax systems. This article examines how European OECD countries rank on individual taxes, continuing our series on the ITCI’s component rankings.

The ITCI’s individual tax component scores OECD countries on their top marginal individual income tax rates and thresholds, how complex the income tax is, and the tax rates levied on income from capital gains and dividends.

Lawmakers Urge Treasury to Extend Temporary Relief From FTC Regs – Tax Notes ($). "Eight members of the U.S. House of Representatives have asked Treasury to extend temporary relief (Notice 2023-55) for determining whether a foreign tax is eligible for a foreign tax credit under sections 901 and 903."

From the “What?!?!?” file:

The history of the proposed Alaska bill that was to levy a $50 tax on single women – David Reamer, Anchorage Daily News:

In 1949, the future honorable Gov. William A. Egan (1914-1984), then the humble Territorial Rep. Bill Egan, introduced a bill into the Legislature. “Braving the snarls of spinsters,” as the anonymous Associated Press scribe wrote, Egan called for a tax of $50 on every single woman in Alaska. His stated intent was to “further the institution of matrimony, relieve the housing shortage and levy a special tax on the privilege of being single.”

More specifically, House Bill 108 was a head tax on every unmarried woman between 18 and 50 who was also gainfully employed. The tax was either a flat $50 or 10% of the woman’s federal income tax, whichever was higher. Thus introduced, the bill was referred to the Ways and Means Committee.

First off, outrageous. Single men didn't have to pay? And imagine a woman getting married to avoid paying a tax. Romance!

It’s National Seat Belt Day! I remember when seat belts were largely ignored. In fact, I used to clean cars at a car dealership and one of my responsibilities was pushing seatbelts into the seats so they couldn’t be seen. My, times have changed – for a really good reason.

Make a habit of sustained success.